Europe Power Tools Market Size (2024-2030)

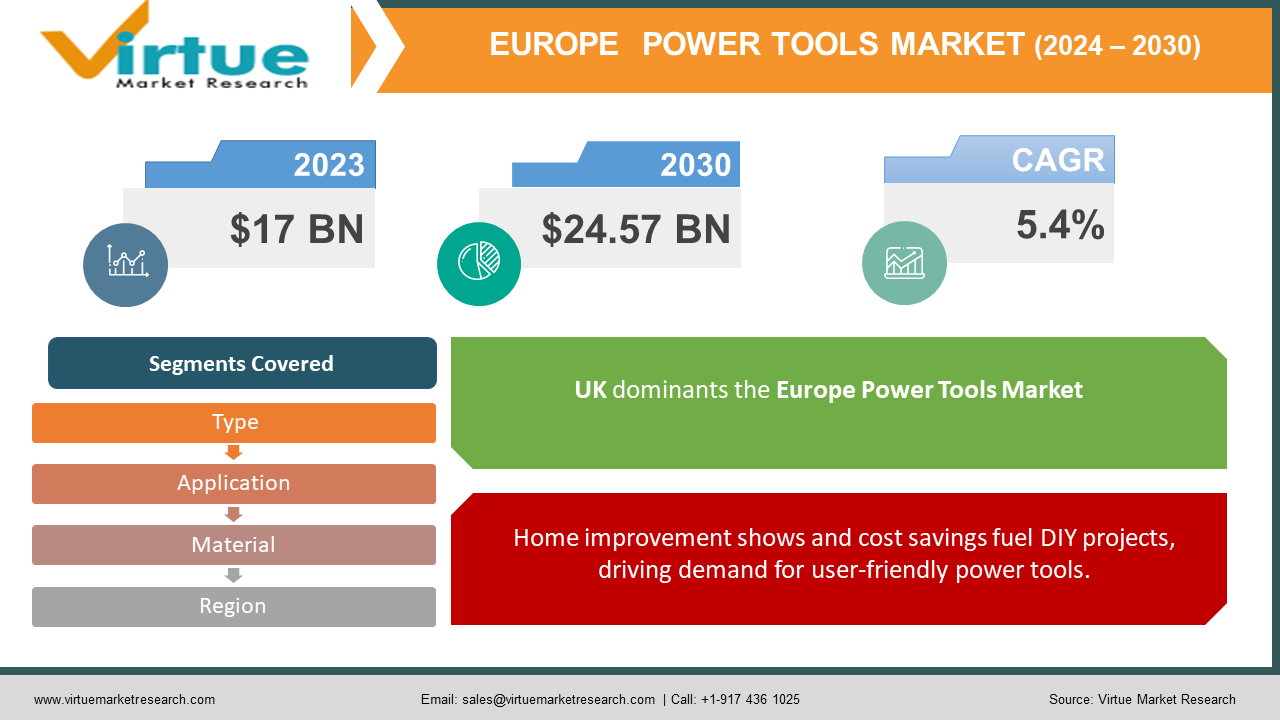

The Europe Power Tools Market was valued at USD 17 billion in 2023 and is projected to reach a market size of USD 24.57 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.4%.

The European power tools market is poised for continued growth, fueled by several key factors. The increasing popularity of DIY projects, driven by home improvement shows and rising contractor costs, is leading more homeowners to invest in power tools. Additionally, the growth of the professional construction sector due to urbanization and infrastructure development is boosting demand for these tools. Finally, the convenience and functionality of cordless and connected power tools, which offer features like portability, tracking, and monitoring, are attracting both professional and DIY users. This, coupled with the continued innovation of established brands like Bosch and Stanley Black & Decker, paints a positive outlook for the European power tools market in the coming years.

Key Market Insights:

The European power tools market is experiencing exciting growth, driven by a surge in DIY projects and a booming construction sector. Homeowners, empowered by online tutorials and a desire for cost-savings, are increasingly tackling home improvement tasks themselves, which fuels demand for user-friendly power tools. Additionally, the professional construction industry is experiencing growth due to factors like urbanization and infrastructure development, further propelling the market forward.

This growth is accompanied by a shift towards sustainable and user-friendly tools. As environmental concerns rise, the construction sector is increasingly favoring electric power tools due to their lower operating costs and reduced emissions. Manufacturers are also prioritizing user experience by integrating smart features like app-connected tool tracking and efficient power management, while also focusing on ergonomics and safety through improved tool design and advanced safety features.

Looking ahead, the European power tools market is expected to see further consolidation among major players, particularly in the face of growing competition within the segment of cordless and connected tools. This segment, offering features like portability and advanced functionalities, is attracting both professional and DIY users, making it a key battleground for market share in the coming years.

Europe Power Tools Market Drivers:

Home improvement shows and cost savings fuel DIY projects, driving demand for user-friendly power tools.

This trend is fueled by the growing popularity of home improvement shows and online tutorials, making DIY projects more accessible for the average homeowner. Additionally, the rising cost of hiring professional contractors incentivizes individuals to tackle tasks themselves, leading to a demand for user-friendly and versatile power tools.

Urbanization, infrastructure development, and rising construction investment propel the need for professional-grade power tools.

Urbanization and infrastructure development are driving the need for new housing, commercial spaces, and improved infrastructure across Europe. This, coupled with rising investments in construction, necessitates robust and reliable power tools to meet the demands of complex projects within the professional construction sector.

Convenience, ease of use, and advanced features make cordless and connected power tools increasingly popular.

Convenience, ease of use, and advanced functionalities are fueling the popularity of cordless and connected power tools. These tools offer greater mobility, user-friendly designs, and features like tool tracking and software updates, appealing to both professional and DIY users. This trend is driving innovation in the market, with manufacturers constantly developing new and advanced cordless and connected tools.

Environmental concerns and safety regulations drive the use of sustainable and safe power tools.

Environmental concerns are leading the construction sector towards electric power tools due to their lower emissions and operating costs. Additionally, stricter regulations and growing safety awareness are prompting manufacturers to prioritize user safety by designing power tools with improved ergonomics and advanced safety features. This focus on sustainability and safety will continue to shape the future of the European power tools market.

The Europe Power Tools Market Restraints and Challenges:

The European power tools market, while experiencing growth, also faces certain restraints and challenges that could hinder its full potential. One concern is the fluctuation in raw material prices. Power tools rely on various materials like steel, plastic, and electronics, and significant price fluctuations in these materials can disrupt production costs and impact profit margins for manufacturers. Additionally, the market faces intense competition, particularly in the segment of low-cost, entry-level tools. This competition can lead to price wars and potentially hinder innovation as manufacturers prioritize cost-cutting measures over investment in research and development.

Furthermore, the availability of skilled labour can pose a challenge, especially in the professional construction sector. As the demand for skilled construction workers outpaces the supply, it can lead to difficulties in finding qualified individuals to operate and maintain advanced power tools. Lastly, regulatory compliance can be a hurdle for manufacturers, as they need to adhere to strict safety and environmental regulations across various European countries. Navigating these complex regulations can add to production costs and slow down the development and launch of new tools.

Despite these challenges, the European power tools market is expected to exhibit continued growth due to the drivers and ongoing advancements in technology. Manufacturers are constantly innovating to address these challenges, such as adopting sustainable practices to mitigate the impact of fluctuating raw material prices and developing user-friendly tools to address the skilled labor shortage. As the market evolves, addressing these restraints and challenges will be crucial for sustained growth and fostering a healthy, innovative European power tools market.

The Europe Power Tools Market Opportunities:

Beyond the current drivers, the European power tools market holds promising opportunities for further expansion and innovation. Firstly, emerging Eastern European economies present fertile ground for market growth, offering potential for increased demand through tailored tools at appropriate price points. Secondly, the continued advancement of cordless and connected technology opens doors for even more sophisticated functionalities, like real-time monitoring, remote diagnostics, and integration with construction management software. Additionally, the rise of the sharing economy creates an opportunity for rental and subscription models catering to individuals with occasional needs or limited storage space, potentially broadening the market reach. Furthermore, focusing on niche markets like tools for women or individuals with specific needs, along with a commitment to sustainable materials and production processes, can attract environmentally conscious consumers and cater to a wider range of users. Finally, leveraging the growing popularity of e-commerce and omnichannel marketing allows manufacturers to reach new audiences and provide a seamless customer experience through a combination of online and offline sales channels. By seizing these opportunities and addressing existing challenges, the European power tools market is well-positioned for continued growth and innovation.

EUROPE POWER TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Application, material, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, France, Italy, UK, Spain, Rest of Europe |

|

Key Companies Profiled |

Robert Bosch, Stanley Black & Decker, Hilt, Atlas, Copco, Makita, Festool, Husqvarna, Alfred Kärcher |

The Europe Power Tools Market Segmentation:

Europe Power Tools Market Segmentation: By Type:

- Drilling & fastening tools.

- Material removal tools

- Sawing & cutting tools.

- Demolition tools

- Other tools

The most dominant segment in the European power tools market by type is drilling and fastening tools, encompassing drills, screwdrivers, and impact drivers. This segment's widespread use in both professional and DIY applications fuel its dominance. Meanwhile, the cordless and connected tools segment is experiencing the fastest growth due to the increasing preference for convenience, ease of use, and advanced features like tool tracking and monitoring. These functionalities are attracting both professional and DIY users, making cordless and connected tools a key battleground for market share in the coming years.

Europe Power Tools Market Segmentation: By Application:

- DIY (Do-It-Yourself)

- Industrial (Professional)

While the industrial (professional) segment remains the dominant force in the European power tools market due to its established presence in various industries, the DIY (Do-It-Yourself) segment is experiencing the fastest growth. This surge is attributed to the rising popularity of home improvement shows and online tutorials, alongside the increasing cost of hiring professional contractors, which incentivizes homeowners to tackle projects themselves. This trend is expected to continue, fuelled by the growing demand for user-friendly and versatile power tools suitable for various DIY applications.

Europe Power Tools Market Segmentation: By Material:

- Metal

- Wood

- Concrete

- Others

While specific data on dominance and growth rates can vary depending on the source, industry reports generally suggest that wood is the most dominant segment within the European power tools market by material sector. This dominance can be attributed to the widespread use of wood in construction and home improvement projects. On the other hand, the metal segment is expected to be the fastest-growing segment, driven by factors like increasing demand from the automotive and manufacturing sectors.

Europe Power Tools Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK is a mature yet significant market for power tools, driven by a sizeable construction sector and a growing DIY culture. The market is expected to see steady growth due to factors like continued urbanization, infrastructure development, and increasing adoption of cordless and connected tools.

Germany: Germany is the largest and most established market for power tools in Europe, boasting a strong presence of leading manufacturers and a highly skilled workforce. The market is expected to maintain its leading position due to its robust infrastructure, focus on innovation, and high demand from various professional industries.

France: The French power tools market is experiencing moderate growth, driven by ongoing construction activity and renovation projects. However, the market faces challenges like intense competition and a price-sensitive consumer base.

COVID-19 Impact Analysis on the Europe Power Tools Market:

The COVID-19 pandemic undeniably impacted the European power tools market, causing initial disruptions. Lockdowns and travel restrictions hindered production and supply chains, leading to component shortages and delays. Additionally, the decline in construction activity due to project postponements and social distancing measures reduced demand for professional-grade tools. Disruptions in the retail landscape, with store closures and limitations on in-person shopping, further impacted sales, particularly for DIY users. However, the pandemic also presented some positive shifts. Increased focus on home improvement during lockdowns led to a surge in demand for user-friendly DIY power tools for repairs and renovations. The rise of e-commerce offered a safe and convenient alternative for consumers to purchase tools during lockdowns, benefiting online platforms. Additionally, manufacturers adapted by focusing on innovation, developing tools with improved hygiene features and even remote-control functionalities. While the pandemic initially caused a negative impact, the European power tools market has shown signs of recovery, particularly in the DIY segment, as consumer behavior adjusts to the evolving landscape. The long-term impact remains to be seen, but the pandemic likely accelerated the trend towards online shopping and the adoption of innovative power tools in the European market.

Latest Trends/ Developments:

The European power tools market is brimming with exciting developments, shaping its future with innovation and a focus on sustainability. Artificial intelligence (AI) is making inroads, with applications like smart tool tracking, predictive maintenance, and even augmented reality overlays to enhance user experience and efficiency. Additionally, sustainability is at the forefront, with manufacturers increasingly adopting battery-powered tools, exploring eco-friendly materials, and implementing circular economy initiatives like battery recycling. Niche and specialized tools are gaining popularity, catering to specific user groups and emphasizing ergonomics for improved comfort and safety. The retail landscape is evolving as well, with manufacturers exploring direct-to-consumer channels and omnichannel marketing strategies to reach a wider audience and provide a seamless customer journey. Finally, advancements in 3D printing hold immense potential for on-demand customization of parts and accessories, along with the development of lightweight and robust tool components. By embracing these trends, focusing on sustainability, and catering to evolving user needs, the European power tools market is well-positioned for continued growth and innovation in the years to come.

Key Players:

- Robert Bosch

- Stanley Black & Decker

- Hilti

- Atlas Copco

- Makita

- Festool

- Husqvarna

- Alfred Kärcher

Chapter 1. Europe Power Tools Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Power Tools – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Power Tools Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Power Tools - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Power Tools Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Power Tools Market– By Type

6.1. Introduction/Key Findings

6.2. Drilling & fastening tools.

6.3. Material removal tools

6.4. Sawing & cutting tools.

6.5. Demolition tools

6.6. Other tools

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Power Tools Market– By Application

7.1. Introduction/Key Findings

7.2 DIY (Do-It-Yourself)

7.3. Industrial (Professional)

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Power Tools Market– By Material

8.1. Introduction/Key Findings

8.2. Metal

8.3. Wood

8.4. Concrete

8.5. Others

8.6. Y-O-Y Growth trend Analysis Material

8.7. Absolute $ Opportunity Analysis Material , 2024-2030

Chapter 9. Europe Power Tools Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Application

9.1.4. By Material

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Power Tools Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Robert Bosch

10.2. Stanley Black & Decker

10.3. Hilti

10.4. Atlas Copco

10.5. Makita

10.6. Festool

10.7. Husqvarna

10.8. Alfred Kärcher

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Power Tools Market was valued at USD 17 billion in 2023 and is projected to reach a market size of USD 24.57 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.4%.

Rise of DIY projects, expanding professional construction sector, growing demand for cordless and connected power tools, Focus on sustainability and safety.

Drilling & fastening tools, Material removal tools, Sawing & cutting tools, Demolition tools, other tools

While regional performances can vary, Germany is generally considered the most dominant region in the European power tools market due to its strong manufacturing base, established industry presence, and high demand from various sectors

Robert Bosch, Stanley Black & Decker, Hilti, Atlas Copco, Makita, Festool, Husqvarna, Alfred Kärcher