Latin America Seed Market Size (2024-2030)

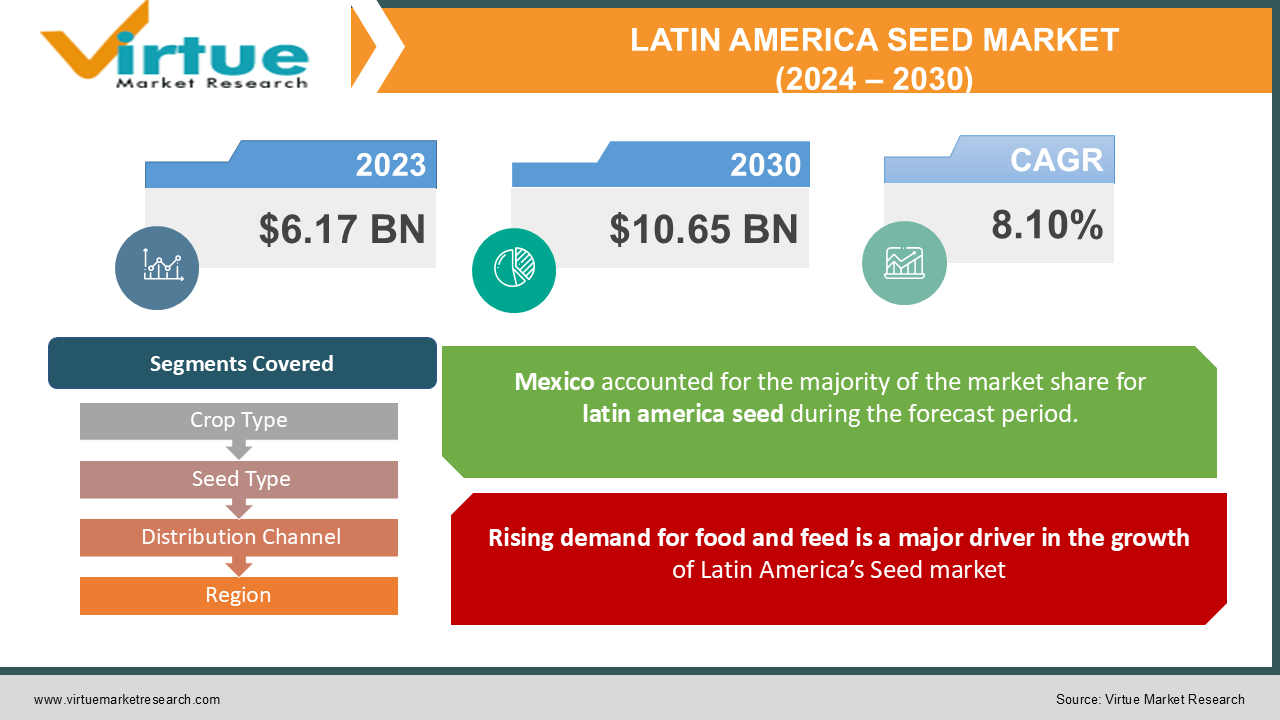

Latin America Seed Market is estimated to be worth USD 6.17 Billion in 2023 and is projected to reach a value of USD 10.65 Billion by 2030, growing at a CAGR of 8.10% during the forecast period 2024-2030.

Latin America Seed Market is a diverse and significant sector that plays an important role in the food production and economy of the region. This region has rich biodiversity and varied climates, making it an excellent location for seed production and distribution. Various crops like soybeans, maize, rice, and wheat are grown there along with ornamental plants, fruits, and vegetables. Agriculture is a major factor contributing to the growth of Latina America’s economy. Several well-established countries in Latin America like Brazil, Mexico, Chile, and Argentina play a crucial role in seed production and export.

Genetically modified crops, particularly soybeans and maize, are widely adopted in Latin American countries, particularly in Brazil and Argentina, which are major producers of GM crops globally. This adoption of GM technology has brought challenges as well as opportunities, as each country in Latin America has its guidelines, regulations, and policies for the seed industry. These factors play an important role in influencing the seed market. Consistent efforts in research and innovation are made to develop new and improved seed varieties that are beneficial for crop production.

Latin America Seed Market Drivers:

Rising demand for food and feed is a major driver in the growth of Latin America’s Seed market

Increased demand for food and animal feed has been observed as the population increases and dietary preferences change. Better-quality seeds and higher agricultural productivity are needed to fulfill the growing requirements for crops like wheat, maize, and soybeans. Improved and high-quality seeds play a vital role in elevating agricultural productivity which gives resistance to pests and diseases, higher yield, better tolerance, and nutritional content. This increases the need for better-quality seeds in the seed market.

Adoption of GM crops and Crop diversification are significant drivers in the seed market of Latin America

A major driver in the seed market of the Latin America region is the adoption of Genetically Modified (GM) crops which provide better resistance capabilities to pests, insects, and chemicals, along with increased yield. Several GM crops like insect-resistant maize and herbicide-resistant soybeans have already been developed. Farmers in this region look for such genetically modified seeds to enhance productivity, increasing the demand in the seed market. Similarly, diversification in crops has also seen rising interest to meet market demands. New varieties of seeds are being developed by seed companies in response to this demand.

Climate resilience and Adaptation increase demand for seeds in Latin America

Agriculture in Latin America is impacted by climate change which drives the demand for seeds that are more tolerant to changing climatic conditions, such as heat, drought, cold and new diseases. Many seed companies are making an effort to develop such seed varieties which can thrive in challenging environments.

Latin America Seed Market Challenges:

Climate Change and Adaptation a challenge for Latin America’s seed market

Climate changes bring challenges for farmers in the selection and adaptation of seeds. These factors affect the yield of crops and make them less resilient, leading to an overall decrease in the growth of the seed market. Substantial research and investment are required to develop seed varieties that are tolerant to changing climatic conditions.

Smallholder farmer access could hinder the growth of the overall seed market in Latin America

Many small-scale farmers in this region face restraints in accessing quality and improved seeds along with hybrid varieties. These farmers have limited access to markets, credit, and information which hinders their ability to adopt modern seed technology, and ultimately decreases the growth in the seed market.

COVID-19 Impact on Latin America Seed Market:

The COVID-19 pandemic had a notable impact on the agriculture and seed market of the Latin America region. Disruptions in supply chains for seeds due to lockdowns and travel restrictions affected the production, distribution, and availability of seeds for farmers. Labor availability for seed production and packaging was also affected. Along with this, disruptions in international in domestic trade impacted the supply of seeds between various countries, leading to shortage and reduced variety availability.

Restrictions were posed on research activities and trials due to the pandemic which delayed the development of new seed varieties. Farmers faced economic challenges which made them unable to invest in high-quality seeds and tools. Changes in consumer behavior and market demand impacted the demand for specific crops and seed varieties.

Latest Developments in Latin America Seed Market:

- In June 2022, “Arunas RZ” which is a new variety of tropicalized lettuce was launched.

- In May 2022, Corteva enhanced its business by expanding sunflower seed operations in Europe. It invested USD 14.1 Million in the Afumati production facility, in Romania, to address the rising demand for top-notch sunflower seeds.

- In April 2022, a new center for sustainable agriculture was opened aiming to spread knowledge on various technologies and innovations in agriculture.

LATIN AMERICA SEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.10% |

|

Segments Covered |

By Crop Type, Seed Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, Rest of Latin America |

|

Key Companies Profiled |

Bayer Crop Science, Syngenta, Corteva Agriscience (formerly DowDuPont), Advanta Seeds (UPL Limited), AgReliant Genetics, Limagrain, Nidera Semillas (part of Syngenta), Bejo Zaden, Pioneer (part of Corteva Agriscience), Seminis (part of Bayer Crop Science) |

Latin America Seed Market Segmentation:

Latin America Seed Market Segmentation: By Crop Type

- Cereals

- Oilseeds

- Fruits and Vegetables

- Forage and Pasture

- Others

Cereals are staple crops mainly including crops like maize, rice, and wheat which are consumed widely and these crops cater to both commercial and smallholder farmers. Genetically modified varieties like herbicide-tolerant maize and soybeans are developed and adopted by farmers. Oilseed crops are rich in oil content and are mainly used in cooking and food processing. Soybean is an excellent oilseed crop in Latin America widely grown in Brazil and Argentina. The fruits and vegetables segment includes crops that cater to human nutrition and culinary uses. Consumer preference and urban population affect the market of these crops significantly. Forage and pasture crops are essential for livestock production which provides feed for sheep, cattle, and other animals. This seed market segment demands high-quality forage with better nutritional content and yield. Other crops include specialty crops like cotton, sugarcane, quinoa, chia, etc, which find uses in industries.

Cereals are the largest segment by crop type, as these crops are staple food and fundamental crops for human consumption, and also find wide use in animal feed and industries. Fruits and Vegetables are the fastest-growing segments. These crops are essential for human nutrition and factors like rising export opportunities and nutrition awareness are also responsible for the fast growth of this segment.

Latin America Seed Market Segmentation: By Seed Type

- Conventional

- Genetically Modified

- Hybrid

- Others

Conventional seeds are mainly traditional seed varieties that are naturally selected or bred over time. Many small farmers continue to depend on conventional seeds only, as these are mostly adapted to specific local environments. Genetically Modified (GM) seeds are modified through biotechnology for incorporation of specific desired traits like resistance to pests, chemicals, and diseases. GM seeds have great potential to enhance yield and productivity. Hybrid seeds are created by crossbreeding two parent varieties which produce offspring with desired traits. Crops like maize, vegetables, and rice are commonly grown using hybrid seeds. Other types of seeds include organic seeds, open-pollinated varieties, treated seeds, and specialty seeds.

Conventional seeds are the largest contributor to the seed market of Latin America. Many farmers, particularly small farmers, still rely on conventional seeds as these seeds are cost-effective and farmers are more familiar with these. Genetically Modified seeds are the fastest growing in this market because of enhanced productivity, reduced input costs, and export demand.

Latin America Seed Market Segmentation: By Distribution Channel

- Direct Sales

- Agro-Dealers and Retailers

- E-Commerce Platforms

- Others

In Direct Sales, seed companies sell products directly to farmers through various ways like field representatives, exhibitions, and company-owned stores. Agro-dealers and retailers have a variety of seed types and brands, offering a wide range of choices to farmers. E-Commerce platforms provide the facility to purchase seeds online, which makes it convenient for farmers along with a wide range of products. Farmers can also see product details, reviews, and comparison tools on online platforms. Other distribution channels include government programs, extension services, farmer groups, NGOs, wholesalers, and seed banks.

The largest segment is Agro-Dealers and retailers segment. These retailers and agricultural supply stores play a significant role in distributing seeds to farmers, as these provide convenience, wide reach, expertise and support, options for bulk purchase, and market information as well to farmers. The fastest growing segment is E-commerce platforms due to the rise in digitization. E-commerce and online platforms provide convenience, time savings, technology adoption, and doorstep delivery to farmers along with other perks.

Latin America Seed Market Segmentation: By Region

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Mexico has a diverse agricultural landscape with a wide range of crops like maize, fruits, vegetables, and beans. Maize is mainly cultivated in Mexico because it holds economic and cultural significance. Brazil is a major producer of soybeans, maize, coffee, and sugarcane and is mainly known for its extensive adoption of GM crops. It is also the largest contributor to the seed market of Latin America, due to its large agricultural area and significant production of maize and soybeans which are major exported crops. Argentina is also a significant player in the seed market producing cereal and oilseed crops, like soybeans, maize, sunflower, and wheat. Chile’s seed market consists mainly of vegetable and fruit crops like wine grapes, along with staple crops. High-quality fruit and vegetable seeds are used for domestic as well as export. The rest of Latin America includes countries like Colombia, Peru, Ecuador, etc., where various crops and seed types are cultivated.

Latin America Seed Market Key Players:

- Bayer Crop Science

- Syngenta

- Corteva Agriscience (formerly DowDuPont)

- Advanta Seeds (UPL Limited)

- AgReliant Genetics

- Limagrain

- Nidera Semillas (part of Syngenta)

- Bejo Zaden

- Pioneer (part of Corteva Agriscience)

- Seminis (part of Bayer Crop Science)

Chapter 1. Latin America Seed Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Seed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Latin America Seed Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Latin America Seed Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Latin America Seed Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Seed Market - By Crop Type

6.1 Cereals

6.2. Oilseeds

6.3. Fruits and Vegetables

6.4. Forage and Pasture

6.5. Others

Chapter 7. Latin America Seed Market - By Seed Type

7.1. Conventional

7.2. Genetically Modified

7.3. Hybrid

7.4. Others

Chapter 8. Latin America Seed Market - By Distribution Channel

8.1. Direct Sales

8.2. Agro-Dealers and Retailers

8.3. E-Commerce Platforms

8.4. Others

Chapter 9. Latin America Seed Market – By Region

9.1. Mexico

9.2. Brazil

9.3. Argentina

9.4. Chile

9.5. Rest of Latin America

Chapter 10. Latin America Seed Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Bayer Crop Science

10.2. Syngenta

10.3. Corteva Agriscience (formerly DowDuPont)

10.4. Advanta Seeds (UPL Limited)

10.5. AgReliant Genetics

10.6. Limagrain

10.7. Nidera Semillas (part of Syngenta)

10.8. Bejo Zaden

10.9. Pioneer (part of Corteva Agriscience)

10.10. Seminis (part of Bayer Crop Science)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Latin America Seed Market is estimated to be worth USD 6.17 Billion in 2023 and is projected to reach a value of USD 10.65 Billion by 2030, growing at a CAGR of 8.10% during the forecast period 2024-2030.

The Latin America Seed Market Drivers are the Rising demand for food and feed and the adoption of GM crops and crop diversification

Based on the seed type, the Latin America Seed market is segmented into Conventional, Genetically modified, Hybrid, and Others

. Brazil holds the largest share of the Latin America Seed Market

Bayer Crop Science, Syngenta, and Corteva Agriscience., are a few of the leading players in the Latin America Seed Market