Middle East & Africa Seed Market Size (2023-2030)

Sow the Future: Mastering the Middle East & Africa Seed Market Landscape!

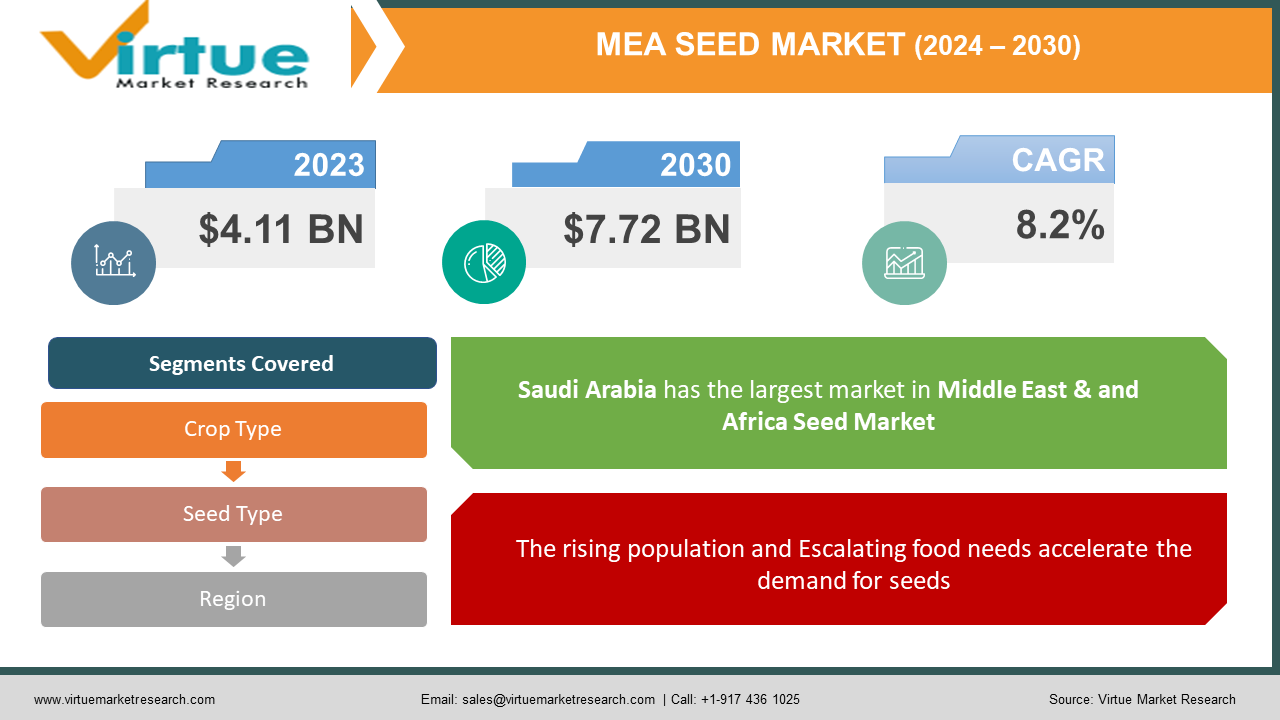

Middle East & Africa Seed Market is estimated to be worth USD 4.11 Billion in 2022 and is projected to reach a value of USD 7.72 Billion by 2030, growing at a CAGR of 8.2% during the forecast period 2023-2030.

Seeds are the fundamental units of agriculture and serve as the foundation for crop production. Across the Middle East & Africa region, a sophisticated composition of agro-climatic conditions drives the need for seeds to meet the demands of staple and cash crops. The seed market plays a significant role in ensuring food security, enhancing crop yields, and strengthening resilience against adverse climatic conditions.

The Middle East & Africa Seed Market has immense potential as a catalyst for agricultural transformation. Technological innovations in seed development, along with sustainable farming practices, are crucial for achieving food security, adapting to climate change, and expanding economic growth across the region. Stakeholders must collaborate to address challenges and harness opportunities, ensuring a resilient agricultural future for all.

Middle East & Africa Seed Market Drivers:

The rising population and Escalating food needs accelerate the demand for seeds in the Middle East & and African Seed markets.

The region's increasing population is driving a surge in agricultural productivity, resulting in heightened demand for superior seeds to meet the escalating need for food. A direct consequence of this population growth is the increased demand for food, which places immense strain on current agricultural systems. This driver is compelling agricultural systems to enhance productivity to ensure food security.

Urbanization and changing dietary patterns are driving the need for seeds in the Middle East & and African seed markets.

As urbanization accelerates, dietary preferences and consumption patterns are changing among consumers. Increased urban populations demand a diverse range of foods, including fruits, vegetables, and processed products. This shift drives the need for a broader selection of seed varieties to cater to new crop demands, expanding the seed market in the region.

Middle East & Africa Seed Market Challenges:

Climate Variability and Water Scarcity pose challenges to the Middle East & Africa Seed market.

The Middle East & and Africa region has a dry, arid, and semi-arid climate, along with limited rainfall. In such an environment, traditional crops face difficulties in achieving desired yields due to insufficient water availability. These factors raise the need for the development of seed varieties that can endure drought conditions and optimize water usage. Research and development on drought-tolerant and water-efficient seed varieties is crucial to ensure agricultural sustainability in adverse climatic conditions.

Research and Development Deficits could hinder the growth of this market.

Growth in the agricultural sector heavily relies on research and development, including improved seed varieties. Inadequate and insufficient investments in agricultural R&D have become a hindrance in unlocking the full potential of the seed market in this region. Lack of R&D funding can lead to limited localized seed varieties that are used by the farmers and adapt to the unique climatic and soil conditions. Insufficient R&D investments also hinder the pace of technological advancements in the agricultural sector, preventing the adoption of cutting-edge farming practices and seed technologies.

COVID-19 Impact on the Middle East & Africa Seed Market:

The COVID-19 pandemic had a notable impact on the agriculture industry, including the Middle East & and Africa Seed market. International and domestic movement restrictions disrupted the trade and distribution of seeds. This affected the on-time availability of seeds during crucial planting seasons, leading to delayed crop cycles. The pandemic caused shifts in consumer preferences and behavior. Increased focus on self-sufficiency and home gardening led to higher demand for seeds among households. Lockdowns and social distancing measures accelerated the adoption of digital platforms for seed procurement. E-commerce channels became important for farmers and consumers to access seeds, expanding online seed sales. Labor shortages posed great challenges during planting and harvesting seasons. Travel restrictions and lockdowns disrupted agricultural research activities, affecting the development of new seed varieties and innovations.

Economic uncertainties caused by the pandemic led to financial constraints for both farmers and seed companies. Farmers had limited resources for purchasing seeds, while seed

companies faced challenges in research investments and production. Changes in consumer demand due to the closure of restaurants and disruptions in supply chains led to shifts in crop demand. Seed companies needed to adjust their offerings to cater to changing preferences.

Middle East & Africa Seed Market Recent Developments:

- In July 2023, Casterra AG Ltd, announced an additional $2.2 Million of purchase orders to supply castor seeds to new African territories, which will be used to grow castor to produce oil, which will be later used to produce biofuels, to meet the growing demands for biofuels.

- In Feb 2023, GDM, a plant genetics company applied for registration of 13 soy plant varieties in South Africa, after the country approved the use of a new GMO seed technology, aiming to expand their genetically modified seed business in soybeans farming in South Africa.

MIDDLE EAST & AFRICA SEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Crop type, Seed Type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Middle East & Africa, Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of MEA |

|

Key Companies Profiled |

Bayer AG, Syngenta AG, SeedCo Limited, East-West Seed, Advanta Seeds, PANNAR Seed, Kenya Seed Company, Monsanto Company, May Seed, Seed World Group |

Middle East & Africa Seed Market Segmentation:

Middle East & Africa Seed Market Segmentation: By Crop Type

- Cereals

- Oilseed

- Fruit and Vegetable

- Forage

- Others

Cereal crop seeds are for crops like wheat, maize, rice, barley, and sorghum. These crops are fundamental staples in the region's diet and are largely cultivated to meet the demand for basic food items among consumers. Oilseed crops are oil-rich crops like sunflower, soybean, and canola and provide edible oils that are used for cooking and food processing. Fruit and Vegetable crops encompass a wide range of crops such as tomatoes, cucumbers, peppers, melons, and various fruits. Fruit and vegetable cultivation is gaining popularity. Forage crop seeds are used for cultivating fodder crops to feed livestock. Other crop seeds include seeds for crops like pulses, spices, medicinal plants, and specialty crops.

The largest segment in the Middle East & and Africa Seed Market is the Cereal crop seeds. Cereal crops form a significant part of the daily diet for everyone in the region and these grains are staples in households. The fastest-growing segment is the Fruit and Vegetable crop seeds. With rapid urbanization and changing dietary patterns arises the demand among consumers for fresh produce, hence, the cultivation of fruits and vegetables is on the rise.

Middle East & Africa Seed Market Segmentation: By Seed Type

- Conventional Seeds

- Genetically Modified Seeds

- Hybrid Seeds

Conventional seeds are created by selecting and crossbreeding plants with desirable traits to produce improved seed varieties and play a significant role in seed development. Genetically modified seeds involve the insertion of specific genes into plants to get desired traits such as pest resistance, disease tolerance, and better yield potential. Hybrid seeds result from crossbreeding two different parent plants to create a new generation with improved characteristics. Hybrid seeds exhibit higher yields and other desirable traits.

Among these segments, the largest is the Conventional Seeds segment. Conventional seeds have been used traditionally for a long time and cater to a broad spectrum of crops. The fastest-growing segment is Genetically Modified seeds. Advancements in biotechnology and the need to address agricultural challenges will drive increased adoption of GM Seeds.

Middle East & Africa Seed Market Segmentation: By Region

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia which is known for its arid climatic conditions, is a significant player in the Middle East & and Africa Seed Market, with a focus on agricultural modernization and the adoption of advanced technologies driving the demand for innovative and drought-tolerant seed varieties.

Qatar is investing in agricultural research and development to enhance local production. This drives the demand for specialized seeds that can thrive in desert environments. Israel's advanced irrigation techniques and precision agriculture practices necessitate high-quality seeds that align with these modern methods. South Africa has a diverse agricultural landscape and is a key player in the seed market. The country has various agroecological zones demanding for a wide range of seed varieties. As one of the most populous countries in Africa, Nigeria's agricultural sector is crucial for food security. The demand for seeds spans multiple crops, and efforts to modernize agriculture drive the need for improved and adaptable seed varieties. Kenya is a hub for agricultural innovation and technology adoption in East Africa. The country's dynamic agribusiness sector fosters the demand for seeds that cater to diverse agroclimatic zones and market demands. Egypt remains a vital player in the region's seed market. The country's agricultural productivity and focus on export-oriented crops drive demand for a variety of seeds. The rest of MEA includes other countries within the Middle East & and Africa region each contributing to the overall market dynamics.

The largest country within this segment is South Africa because of the diverse agricultural landscape, advanced farming practices, and established seed industry, this country plays a central role in molding regional seed demand and supply. The fastest-growing country is Kenya due to its innovative ecosystem, expanding agribusiness sector, and emphasis on modern agricultural practices contributing to a rapidly evolving seed market.

Middle East & Africa Seed Market Key Players:

- Bayer AG

- Syngenta AG

- SeedCo Limited

- East-West Seed

- Advanta Seeds

- PANNAR Seed

- Kenya Seed Company

- Monsanto Company

- May Seed

- Seed World Group

Chapter 1. Middle East & Africa Seed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Seed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Seed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Seed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Seed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Seed Market– By Crop Type

6.1. Introduction/Key Findings

6.2. Cereals

6.3. Oilseed

6.4. Fruit and Vegetable

6.5. Forage

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Crop Type

6.8. Absolute $ Opportunity Analysis By Crop Type, 2023-2030

Chapter 7. Middle East & Africa Seed Market– By Seed Type

7.1. Introduction/Key Findings

7.2. Conventional Seeds

7.3. Genetically Modified Seeds

7.4. Hybrid Seeds

7.5. Y-O-Y Growth trend Analysis By Seed Type

7.6. Absolute $ Opportunity Analysis By Seed Type, 2023-2030

Chapter 8. Middle East & Africa Seed Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Crop Type

8.1.3. By Seed Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East & Africa Seed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bayer AG

9.2. Syngenta AG

9.3. SeedCo Limited

9.4. East-West Seed

9.5. Advanta Seeds

9.6. PANNAR Seed

9.7. Kenya Seed Company

9.8. Monsanto Company

9.9. May Seed

9.10. Seed World Group

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Middle East & Africa Seed Market is estimated to be worth USD 4.11 Billion in 2022 and is projected to reach a value of USD 7.72 Billion by 2030, growing at a CAGR of 8.2% during the forecast period 2023-2030

The Middle East & Africa Seed Market Drivers are the Rising population, Escalating food needs, Urbanization, and changing dietary patterns

Based on the Product type, the Middle East & Africa Seed Market is segmented into Conventional seeds, Genetically Modified seeds, and Hybrid seeds

South Africa is the most dominating in the Middle East & Africa Seed Market

Bayer AG, Syngenta AG, SeedCo Limited, East-West Seed, Advanta Seeds, and PANNAR Seed are a few of the leading players in the Middle East & Africa Seed Market.