Latin America Processed Meat Market Size (2024-2030)

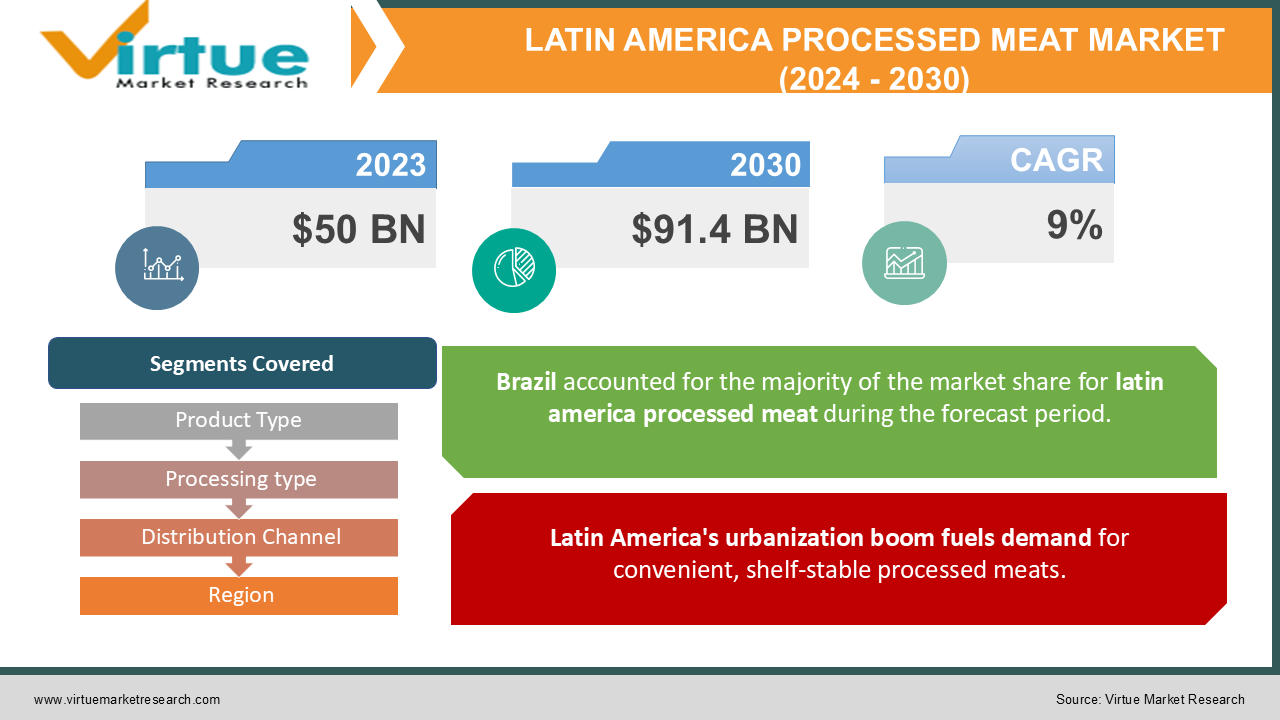

The Latin America Processed Meat Market was valued at USD 50 billion in 2023 and is projected to reach a market size of USD 91.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9%.

The Latin American processed meat market thrives on the convenience it offers to a growing urban population. As disposable incomes rise and people juggle busy lifestyles, the demand for quick and easy meal solutions like processed meats increases. This market is fragmented, with established global players competing alongside regional companies. However, a growing health consciousness is leading to a rise in demand for healthier alternatives.

Key Market Insights:

As people have more money to spend, processed meats, often seen as time-saving solutions, become more attractive. This is reflected in a Compound Annual Growth Rate (CAGR) estimated to be around 9% for the 2024-2030 period.

However, the market is not without its challenges. Consumers are becoming increasingly health-conscious and aware of the potential health risks associated with processed meat consumption. This has led to a surge in demand for healthier alternatives, such as plant-based proteins. In response to this shift in consumer preference, manufacturers are reformulating their products. We are seeing a rise in processed meats with lower sodium content (around 9% CAGR) and fewer artificial ingredients. Additionally, there's a growing focus on organic or natural varieties to cater to the health-conscious consumer.

Latin America Processed Meat Market Drivers:

Latin America's urbanization boom fuels demand for convenient, shelf-stable processed meats.

Latin America is experiencing a rapid urbanization surge, with a growing number of people migrating to cities. This urban shift leads to a significant increase in demand for convenient and shelf-stable food options. Busy city dwellers with limited time and resources for elaborate meal preparation find processed meats highly appealing. The convenience factor of processed meats, often pre-cooked or ready-to-cook, perfectly aligns with the fast-paced nature of urban life.

Rising disposable incomes in the region allow consumers to spend more on convenient processed meats.

Economic growth across Latin America is leading to a rise in disposable incomes. This translates to consumers having more money to spend on convenient food options. Processed meats are often perceived as a time-saving advantage, and with increased spending power, consumers are more likely to indulge in their convenience. This shift in consumer habits, driven by rising disposable incomes, is a major driver for the processed meat market.

The fast pace of modern life creates a strong preference for quick and easy meals, perfectly addressed by processed meats.

The modern world is characterized by a fast-paced lifestyle, with people juggling work, family, and social commitments. This creates a strong preference for quick and easy meal solutions. Processed meats cater perfectly to this need, offering consumers convenience and ease. They come in various forms like pre-cooked sausages, frozen hamburger patties, or sliced luncheon meats, all requiring minimal preparation time, making them ideal for busy individuals and families seeking quick and convenient meal options.

The rise of plant-based alternatives pushes processed meat innovation towards healthier options.

While not strictly a growth driver, the rise of plant-based alternatives is having a significant impact on the processed meat market. The growing popularity of plant-based proteins is pushing processed meat manufacturers to innovate and adapt. This has led to a wider variety of processed meats with healthier attributes, catering to a more health-conscious consumer base. Manufacturers are reformulating products with lower sodium content, and fewer artificial ingredients, and offering organic or natural options to stay competitive in the evolving protein landscape.

Latin America Processed Meat Market Restraints and Challenges:

The Latin American processed meat market, while experiencing growth, faces several challenges. A major hurdle is the growing public awareness of the potential health risks linked to processed meats, such as heart disease and cancer. This is leading consumers to actively seek healthier alternatives. Additionally, government regulations may become stricter, limiting the use of additives, preservatives, or sodium content in processed meats. This can affect the taste, shelf life, and affordability of these products, impacting their appeal.

The market also faces significant competition from the burgeoning plant-based protein sector. Tofu, tempeh, and seitan are gaining popularity due to their perceived health benefits and environmental friendliness, attracting consumers seeking a more sustainable and healthier lifestyle. Economic factors like inflation and currency fluctuations can further restrain the market. As disposable income shrinks, processed meats, often seen as a convenience rather than a necessity, might be the first to be sacrificed by budget-conscious consumers. Finally, concerns about the environmental impact of large-scale livestock production, including deforestation and water usage, could negatively impact consumer perception of processed meats. This might push them towards more sustainable protein sources, further challenging the processed meat industry's dominance.

Latin America Processed Meat Market Opportunities:

The Latin American processed meat market presents exciting opportunities for growth through innovation and adaptation. A key area lies in developing healthier options. Manufacturers can cater to health-conscious consumers who still value convenience by offering processed meats with lower sodium, reduced artificial ingredients, and organic or natural varieties. Additionally, there's a growing market for premiumization and convenience. Consumers are willing to pay more for high-quality, convenient options. Companies can capitalize on this by offering unique flavors, ethnic ingredients, or single-serve packaging formats. Furthermore, targeting specific demographics with tailored products creates new opportunities. This could involve low-fat or low-carb options for health-conscious individuals, high-protein varieties for fitness enthusiasts, or ready-to-heat meals for busy families. The rise of e-commerce also presents a chance to expand reach and distribution. Offering online ordering and delivery services caters to consumers who prefer the convenience of shopping from home. Finally, with growing environmental concerns, sustainability initiatives offer a way to improve brand image and attract eco-conscious consumers. Companies can implement sustainable practices like sourcing from ethically raised livestock or using recyclable packaging materials. By embracing these opportunities, the Latin American processed meat market can adapt and thrive in the evolving food landscape.

LATIN AMERICA PROCESSED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|||

|

Market Size Available |

2023 - 2030 |

|||

|

Base Year |

2023 |

|||

|

Forecast Period |

2024 - 2030 |

|||

|

CAGR |

9% |

|||

|

Segments Covered |

By Product Type, Processing type, Distribution Channel and Region |

|||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|||

|

Regional Scope |

|

|||

|

Key Companies Profiled |

BRF S.A., JBS S.A., Tyson Foods, Cargill, Smithfield Foods, WH Group, Marfrig, Grupo Bimbo, Grupo Herdez, San Fernando |

Latin America Processed Meat Market Segmentation:

Latin America Processed Meat Market Segmentation: By Product Type:

- Poultry

- Beef

- Pork

- Lamb

- Other Meat Types

The dominant segment in the Latin American processed meat market by product type is likely pork. The popularity of processed pork items like ham, bacon, and sausages is driven by breakfast and lunch consumption habits. However, the fastest-growing segment is expected to be poultry. This is due to the rising demand for protein-rich chicken products and convenience options across Latin America.

Latin America Processed Meat Market Segmentation: By Processing Type:

- Chilled

- Frozen

- Canned

The most dominant segment in the Latin American processed meat market by Processing Type is likely 'Chilled', due to a higher preference for fresh meats. However, the fastest-growing segment is projected to be 'Frozen', driven by the increasing demand for convenient food options and longer shelf life. This trend aligns with the busy lifestyles of urban populations.

Latin America Processed Meat Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Grocery Stores

- Specialty Retailers

- Online Channels

- Other Channels

Supermarkets and hypermarkets are expected to remain the dominant distribution channel for processed meats in Latin America due to their wide product variety and brand selection. However, online channels are witnessing the fastest growth, driven by the increasing popularity of e-commerce and the convenience of home delivery. This trend is likely to continue as more consumers adopt online shopping habits.

Latin America Processed Meat Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil: Reigning supreme in the region, Brazil boasts the largest processed meat market. This dominance stems from its high production and consumption of beef. Convenience and affordability are key drivers, with sausages, hamburgers, and other processed beef options enjoying high demand. However, Brazil's market might face challenges in the future due to factors like potential shifts towards healthier alternatives.

Argentina: Known for its rich culinary tradition, Argentina holds a special place in the processed meat scene. Here, the focus is on quality, with a strong demand for cured meats and handcrafted sausages. However, stricter regulations on production and economic instability could pose hurdles for the Argentinian processed meat industry in the coming years.

Colombia: Colombia's processed meat market is experiencing a growth spurt fueled by a burgeoning economy and rising disposable incomes. Chicken and pork are popular choices, and consumers are increasingly receptive to healthier options. This creates an exciting opportunity for manufacturers to develop processed meats with lower sodium content or organic ingredients, catering to the evolving preferences of Colombian consumers.

COVID-19 Impact Analysis on the Latin America Processed Meat Market:

The COVID-19 pandemic left its mark on the Latin American processed meat market, presenting both challenges and opportunities. Lockdowns and travel restrictions disrupted the flow of ingredients and livestock, causing temporary shortages and price fluctuations. Initial panic buying saw a surge in demand for shelf-stable processed meats. However, as the pandemic progressed, health concerns may have led to a decline in consumption due to the perceived health risks associated with processed meats. Additionally, the closure of restaurants and hotels significantly impacted demand for products typically used in the food service sector.

Looking beyond the immediate disruptions, the pandemic also triggered some long-term trends. The rise of e-commerce platforms for grocery shopping, including processed meats, is expected to continue, offering a new avenue for market growth. Heightened awareness of health and well-being might lead to increased demand for processed meats perceived as high in protein and beneficial for immunity. However, this could also push consumers towards healthier options with lower sodium and fewer artificial ingredients. Finally, growing concerns about sustainability may influence consumer choices towards plant-based alternatives or processed meats sourced from sustainable farms.

Latest Trends/ Developments:

The Latin American processed meat market is transforming. Consumers are demanding cleaner options, with "clean label" processed meats featuring shorter ingredient lists and free from artificial additives gaining traction. Organic and grass-fed varieties are also finding favor. However, plant-based alternatives continue to disrupt the market, pushing manufacturers to innovate with hybrid meat-plant protein products for flexitarian consumers. Health remains a top priority, with a growing focus on protein content and its perceived benefit for immunity. Manufacturers are highlighting protein content and potentially exploring ways to fortify products with immune-supporting nutrients. E-commerce is booming, offering convenience and wider selection through online grocery shopping and the emergence of direct-to-consumer sales models. Finally, sustainability concerns are rising. Consumers are increasingly interested in ethical sourcing practices and traceability throughout the supply chain. This is pushing manufacturers towards farms with strong animal welfare and sustainable production methods. Regional variations also exist. Brazil might focus on premiumization and convenience, while Argentina prioritizes artisanal and locally sourced options. By adapting to these trends and developing innovative products that cater to evolving consumer needs and regional preferences, processed meat companies in Latin America can ensure their continued success in this dynamic food landscape.

Key Players:

- BRF S.A.

- JBS S.A.

- Tyson Foods

- Cargill

- Smithfield Foods

- WH Group

- Marfrig

- Grupo Bimbo

- Grupo Herdez

- San Fernando

Chapter 1. Latin America processed Meat Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America processed Meat Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America processed Meat Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America processed Meat Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America processed Meat Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America processed Meat Market– By Product Type

6.1. Introduction/Key Findings

6.2. Poultry

6.3. Beef

6.4. Pork

6.5. Lamb

6.6. Other Meat Types

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Latin America processed Meat Market– By Processing Type

7.1. Introduction/Key Findings

7.2 Chilled

7.3. Frozen

7.4. Canned

7.5. Y-O-Y Growth trend Analysis By Processing Type

7.6. Absolute $ Opportunity Analysis By Processing Type , 2024-2030

Chapter 8. Latin America processed Meat Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3. Grocery Stores

8.4. Specialty Retailers

8.5. Online Channels

8.6. Other Channels

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Latin America processed Meat Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Product Type

9.1.3. By Distribution Channel

9.1.4. By Processing Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America processed Meat Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BRF S.A.

10.2. JBS S.A.

10.3. Tyson Foods

10.4. Cargill

10.5. Smithfield Foods

10.6. WH Group

10.7. Marfrig

10.8. Grupo Bimbo

10.9. Grupo Herdez

10.10. San Fernando

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Processed Meat Market was valued at USD 50 billion in 2023 and is projected to reach a market size of USD 91.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9%.

Urbanization Boom and the Convenience Factor, Rising Disposable Incomes and Changing Consumer Habits, Preference for Convenience and Busy Lifestyles in a Time-Crunched World, The Evolving Protein Landscape and Innovation.

Poultry, Beef, Pork, Lamb, Other Meat Types

Brazil reigns supreme in the Latin American processed meat market, boasting the largest production and consumption, particularly for beef options. This dominance is driven by factors like affordability and convenience.

. BRF S.A., JBS S.A., Tyson Foods, Cargill, Smithfield Foods, WH Group, Marfrig, Grupo Bimbo, Grupo Herdez, San Fernando