Asia Pacific Processed Meat Market Size (2023-2030)

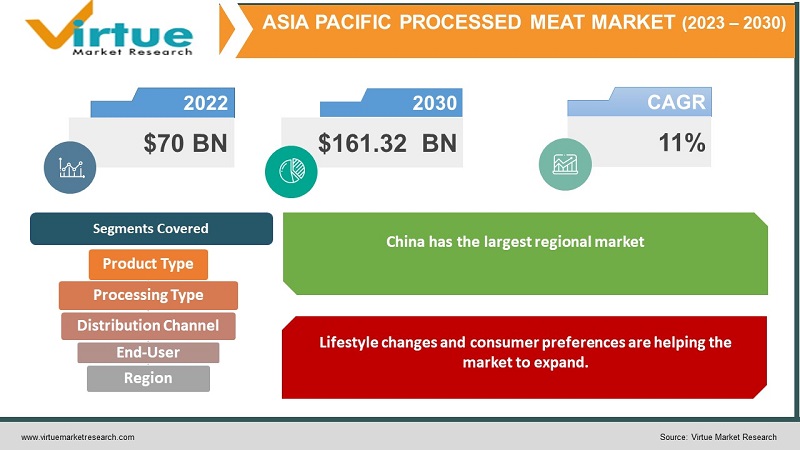

The Asia Pacific Processed Meat Market was valued at USD 70 billion and is projected to reach a market size of USD 161.32 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 11%.

Asia Pacific Processed Meat has seen substantial growth over the years. In the past, many regions consumed meat helping to generate significant amounts of revenue. Presently, with a greater number of restaurants, hotels, fast food chains, and other online ordering apps, this market is seeing tremendous growth. Shortly, with diverse culinary applications and other technological advancements, this market is set to see a lucrative development. During the forecast period, this market is set to see a notable growth.

Key Market Insights:

In the Processed Meat market, volume is expected to amount to 8.48bn kg by 2028 in Asia Pacific with a volume growth of 2.4% in 2024.

As per a report in February 2023, China’s meat industry expanded to become the world’s largest, accounting for 20 percent of global sales.

A report on a 17-year-long study of 8,000 human subjects reveals that people who eat processed meat are 38% more likely to develop diabetes. To tackle this, R&D activities regarding preservatives and healthier choices are being carried out.

Asia Pacific Processed Meat Market Drivers:

Lifestyle changes and consumer preferences are helping the market to expand.

Over the years, urbanization and rising income have played a huge role in causing a shift in the way of living. Significant progress has been made to improve the economy and create new job opportunities. Dual income is the new norm. This is associated with hectic schedules, leaving no time for individuals to cook. Easy and ready-to-eat options have become a go-to option. Apart from this, bachelors and people who are unable to cook find these choices to be convenient. A lot of time is saved allowing people to carry out their other day-to-day activities. This reason plays a crucial role in contributing to the market growth.

Associated advantages are helping in boosting the growth rate.

Through various procedures which include fermentation, salting, curing, etc., the meat products are modified. This helps to enhance the shelf life, create a better texture, improve the consistency, and improve the taste. They are preserved in airtight cans, bottles, and other jars. This protects them from any sort of bacterial contamination and any other dust particles. Process meat products include bacon, sausages, meatballs, beef, ham, and many more. These benefits make them an attractive choice to be purchased helping the market to enlarge.

Asia Pacific Processed Meat Market Restraints and Challenges:

Health concerns and the growing popularity of veganism are the major hindrances that the market is currently experiencing.

Processed meat has been linked with various number of diseases. It contains high amounts of saturated fats and other salts causing variations in blood pressure as well as compromising cardiovascular health. Few studies have shown the risk of cancer due to the prevalence of carcinogens. There are many chemicals and preservatives which are used leading to toxic effects in the human systems. Furthermore, it has been linked to diabetes, unhealthy weight gain, and an unhealthy lifestyle. Secondly, plant-based foods can cause losses in the market. After the pandemic, there has been an increase in the number of people who are adapting towards vegan-based foods to avoid the harsh cruelties faced by the animal breeding industry. To support this, there has been an increase in the number of food places and other chains that offer these food products.

Asia Pacific Processed Meat Market Opportunities:

Emerging restaurants, hotels, and other fast-food chains are aiding the progress. Besides, online retail has been providing the market with an ample number of opportunities. Due to E-Commerce, there is a wider range of available options. Other than this, culinary applications are being explored to create innovative and taste products to attract a broader consumer base. Globalization of operations has been helping the market to expand and thereby earn more revenue. Furthermore, there are ongoing wellness trends for a healthy lifestyle. To align with this, healthier options are being created. Along with this, many sustainable brands are being developed. They use plant-based products without actually using meat. One of the popular brands in this category is Imagine Meats. They have a very similar taste to meat but are made from plant-based alternatives.

ASIA PACIFIC PROCESSED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Product Type, Processing Type, Distribution Channel , ENd User,and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan |

|

Key Companies Profiled |

BRF S.A., CP Foods (Charoen Pokphand Foods), Zhejiang Yurun Food, Ajinomoto Co., Inc., JBS Foods, Ajinomoto Co., Inc., Sime Darby Foods, Hormel Foods, Majestic Meat, Cargill |

Asia Pacific Processed Meat Market Segmentation:

Asia Pacific Processed Meat Market Segmentation: By Product Type:

- Poultry

- Beef

- Lamb

- Pork

Based on product type, the poultry segment is the largest in the market. This is because of the taste, availability, demand, and the products like eggs which are obtained. They are a great source of protein, vitamins, minerals, and nutrients like zinc, iron, iodine, and other fatty acids. They are estimated to hold a share of around 43%. Pork is one of the fastest-growing segments in countries like Japan South Korea, and China. Pork is rich in vitamins like B12 and B6, as selenium, has a lot of iron helping the RBC and immune system, and provides strength for developing babies. The beef segment is also showing quick growth owing exceptional source of proteins, which helps in muscle growth, and is rich in iron.

Asia Pacific Processed Meat Market Segmentation: By Processing Type

- Chilled

- Frozen

- Canned

Based on processing type, the frozen segment is the largest in the market. This is due to freshness, ease of storage and transportation, lesser microbe contamination, longer shelf life, preference, demand, convenience, and availability. They are estimated to hold a share of around 66%. The chilled segment is the fastest growing owing to the lesser use of preservatives, flavor, smoothness, rising demand, and quality.

Asia Pacific Processed Meat Market Segmentation: By Distribution Channel:

- Supermarket/Hypermarket

- Convenience Stores

- Specialty Retailers

- Online Stores

- Others

Based on the distribution channel, the supermarket/hypermarket category is the largest in the market holding a share exceeding 60%. This is because of face-to-face interaction, inspection of quality, trust, access, bargaining, and convenience. Online stores are the fastest growing owing to shopping from the comfort of a house, a wider range of options, the presence of local and international products, enhanced customer experience, user-friendly features, availability, and promos.

Asia Pacific Processed Meat Market Segmentation: By End User

- Commercial

- Residential

Based on end users, the commercial segment is the most dominant holding a share exceeding 73%. This is because of the increase in the number of food chains, online retail, innovations, creativity, culinary flavors, demand, changing lifestyles, and global expansion. The commercial segment is the fastest growing due to health and wellness trends, increased interest in cooking, homemade order opportunities, and consumption preference.

Asia Pacific Processed Meat Market Segmentation: Regional Analysis:

- China

- India

- Japan

- Rest of Asia Pacific

Based on region, China has the largest regional market holding a rough share of 37%. This is because of meat consumption, the presence of key companies, industrial grinding equipment advancements, demand, the economy, the greater population of the workforce, import-export trading, and the population. India is the fastest growing owing to a rising workforce, emerging players, technological advancements, increasing incorporation of meat-based diets, several people, online retail enlargement, and an opening of a greater number of food chains. This region holds a total share of around 20%.

COVID-19 Impact Analysis on the Asia Pacific Processed Meat Market:

The outbreak of the virus hurt the market. Lockdowns, social isolation, and movement restrictions were the new normal. This caused a lot of disruptions in supply chain, transportation, and logistics. Import-export activities were affected by this. Moreover, most of the companies and manufacturing units were closed. This caused an economic downfall. Furthermore, the pandemic highlighted the importance of having good health and a sustainable lifestyle. Meats were often associated with many health disorders and other animal flu. During the Covid-19 pandemic, there was a huge surge in interest globally towards veganism, with Google reporting a 47% increase in vegan-related searches in 2020. All these took a toll on the market. However, post-pandemic, the market started to pick up with the relaxation of guidelines and protocols causing the opening of restaurants and other food chains. Besides, online food shipping helped the market to generate profits.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance existing technologies and find new ones. This has also led to greater enlargement.

Consumers are leaning towards purchasing clean-label food. This has the list of all ingredients that are used enabling transparency. Furthermore, this creates no room for any possible allergens or other toxic chemicals that might be present. This initiative is expected to flourish in the market.

Key Players:

- BRF S.A.

- CP Foods (Charoen Pokphand Foods)

- Zhejiang Yurun Food

- Ajinomoto Co., Inc.

- JBS Foods

- Ajinomoto Co., Inc.

- Sime Darby Foods

- Hormel Foods

- Majestic Meat

- Cargill

In March 2022, leading food and biotechnology company Ajinomoto partnered with cultivated meat company SuperMeat. As part of the partnership, Ajinomoto Co. would invest in SuperMeat as one of its corporate venture capital projects. The venture would work to tackle ongoing food and health issues in the world by combining SuperMeat's technologies and expertise in cultivated meat, with Ajinomoto Co.'s proprietary R&D technologies in the biotechnology field and fermentation.

In June 2020, in a strategic expansion into the growing food technology sector, Messe Frankfurt New Era Business Media Ltd and VNU Asia Pacific, announced a partnership to jointly organize ‘Meat Pro Asia’.

Chapter 1. Asia Pacific Processed Meat Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Processed Meat Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Processed Meat Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Processed Meat Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Asia Pacific Processed Meat Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Processed Meat Market– By Product Type

6.1. Introduction/Key Findings

6.2. Poultry

6.3. Beef

6.4. Lamb

6.5. Pork

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Asia Pacific Processed Meat Market– By Processing Type

7.1. Introduction/Key Findings

7.2. Chilled

7.3. Frozen

7.4. Canned

7.5. Y-O-Y Growth trend Analysis By Processing Type

7.6. Absolute $ Opportunity Analysis By Processing Type , 2023-2030

Chapter 8. Asia Pacific Processed Meat Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarket/Hypermarket

8.3. Convenience Stores

8.4. Specialty Retailers

8.5. Online Stores

8.6. Others

8.7. Y-O-Y Growth trend Analysis By Distribution Channel

8.8. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Processed Meat Market– By End-User

9.1. Introduction/Key Findings

9.2. Commercial

9.3. Residential

9.4. Y-O-Y Growth trend Analysis By End-User

9.5. Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 10. Asia Pacific Processed Meat Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. India

10.1.1.3. Japan

10.1.1.4. Rest of MEA

10.1.2. By Product Type

10.1.3. By Processing Type

10.1.4. Distribution Channel

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Asia Pacific Processed Meat Market– Company Profiles – (Overview, Distribution Channel Portfolio, Financials, Strategies & Developments)

11.1 BRF S.A.

11.2. CP Foods (Charoen Pokphand Foods)

11.3. Zhejiang Yurun Food

11.4. Ajinomoto Co., Inc.

11.5. JBS Foods

11.6. Ajinomoto Co., Inc.

11.7. Sime Darby Foods

11.8. Hormel Foods

11.9. Majestic Meat

11.10. Cargill

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Processed Meat Market was valued at USD 70 billion and is projected to reach a market size of USD 161.32 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 11%.

Lifestyle changes as well as consumer preferences and associated advantages are the main drivers propelling the Asia Pacific Processed Meat Market

Based on the Distribution Channel, the Asia Pacific Processed Meat Market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Specialty Retailers, Online Stores, and Others.

China is the most dominant region for the Asia Pacific Processed Meat Market

BRF S.A., CP Foods (Charoen Pokphand Foods), and Zhejiang Yurun Foods are the key players operating in the Asia Pacific Processed Meat Market