Latin America Plant-based Protein Market Segmentation Market Size (2024-2030)

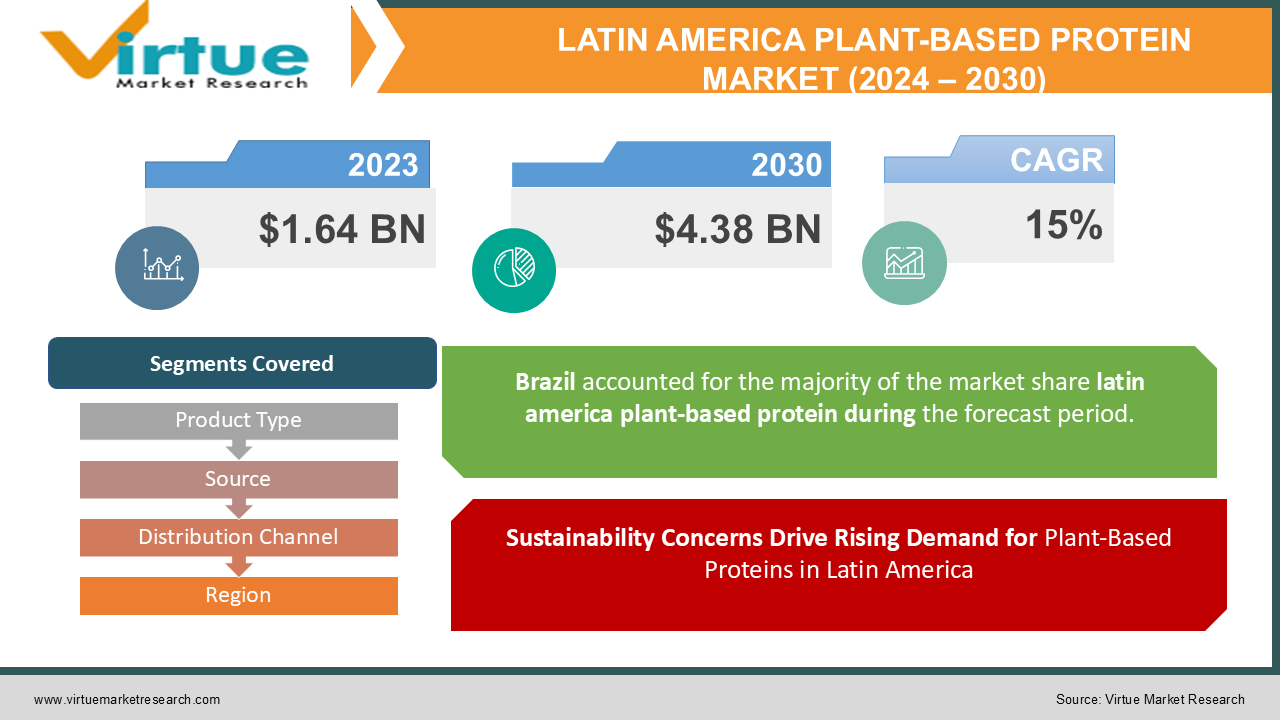

The Latin America Plant-based Protein Market was valued at USD 1.64 billion in 2023 and is projected to reach a market size of USD 4.38 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 15% between 2024 and 2030.

The Latin America Plant-based Protein Market is experiencing rapid growth, driven by increasing consumer awareness of health and environmental benefits associated with plant-based diets. As the region faces rising concerns over meat consumption's impact on health and sustainability, plant-based proteins have emerged as a popular alternative, appealing to health-conscious consumers and those with dietary restrictions. This trend is further fueled by the growing vegan and vegetarian population, along with the influence of global movements advocating for reduced animal product consumption. The market is also benefiting from innovations in food technology, which have improved the taste and texture of plant-based protein products, making them more appealing to a broader audience. Additionally, key players in the food industry are increasingly investing in plant-based protein offerings, expanding their product portfolios to cater to the evolving consumer preferences. The Latin America Plant-based Protein Market is poised for continued growth, supported by favorable regulatory frameworks, increasing urbanization, and rising disposable incomes, which are encouraging the adoption of healthier and more sustainable dietary choices across the region.

Key Market Insights:

- The Latin America Plant-based Protein Market is expected to grow at a CAGR of 8% over the next five years.

- 32% of consumers in the region have reduced meat consumption in favor of plant-based alternatives.

- Urban areas account for 65% of the demand for plant-based protein products.

- Plant-based meat alternatives hold 47% of the market share within the plant-based protein segment.

- Online sales of plant-based protein products have surged by 27% during the COVID-19 pandemic.

- 52% of consumers choose plant-based products due to environmental concerns.

- 22% of new product launches in the market feature local ingredients like quinoa and amaranth.

Latin America Plant-based Protein Market Drivers:

Health Awareness and Clean Eating Trends Drive Growth in Latin America's Plant-Based Protein Market.

One of the primary drivers of the Latin America Plant-based Protein Market is the increasing health consciousness among consumers, leading to significant dietary shifts. As awareness grows about the adverse health effects associated with excessive meat consumption, such as cardiovascular diseases, obesity, and certain cancers, many consumers are turning to plant-based diets as a healthier alternative. The region's rising incidence of lifestyle-related health conditions has further intensified the demand for nutritious, plant-based protein sources that can support overall well-being. Additionally, the trend towards clean eating and natural, minimally processed foods is pushing consumers to seek plant-based proteins, which are perceived as wholesome and beneficial. This shift in consumer preferences is creating substantial growth opportunities for plant-based protein products, encouraging food manufacturers to innovate and introduce a variety of appealing and nutritious plant-based alternatives to meet the evolving needs of health-conscious consumers.

Sustainability Concerns Drive Rising Demand for Plant-Based Proteins in Latin America

Environmental and sustainability concerns are playing a crucial role in driving the Latin America Plant-based Protein Market. With growing awareness of the environmental impact of livestock farming, including greenhouse gas emissions, deforestation, and water usage, consumers and businesses alike are seeking more sustainable food choices. Plant-based proteins, which have a significantly lower environmental footprint compared to animal-based proteins, are increasingly being recognized as a viable solution to address these concerns. Governments and environmental organizations in the region are also advocating for sustainable agricultural practices and the reduction of meat consumption as part of broader efforts to combat climate change. This shift towards sustainability is not only influencing consumer behavior but also encouraging food companies to develop and market plant-based protein products as part of their commitment to environmental responsibility. As a result, the demand for plant-based proteins is expected to continue rising, driven by the collective push towards a more sustainable and eco-friendly food system in Latin America.

Latin America Plant-based Protein Market Restraints and Challenges:

The Latin America Plant-based Protein Market faces several restraints and challenges that could hinder its growth despite its promising potential. One significant challenge is the relatively high cost of plant-based protein products compared to traditional animal-based proteins. This price disparity makes it difficult for consumers, particularly in low- to middle-income segments, to adopt plant-based alternatives on a larger scale. Additionally, cultural preferences and deeply ingrained dietary habits centered around meat consumption in many Latin American countries present a substantial barrier to market penetration. While awareness of plant-based diets is growing, overcoming the strong cultural attachment to meat remains a challenge. Furthermore, limited availability and distribution of plant-based protein products in rural and less developed areas of the region also pose a significant restraint, as these markets are still under-served by both local and international plant-based brands. Finally, concerns about the nutritional adequacy and taste of plant-based proteins compared to traditional animal proteins continue to be a challenge, requiring ongoing efforts in product development and consumer education. Addressing these challenges will be crucial for the sustained growth of the plant-based protein market in Latin America.

Latin America Plant-based Protein Market Opportunities:

The Latin America Plant-based Protein Market presents significant opportunities for growth, driven by the increasing demand for healthier and more sustainable food options. One of the key opportunities lies in product innovation and diversification, where companies can develop a wider range of plant-based protein products tailored to local tastes and dietary preferences. By incorporating traditional Latin American ingredients such as quinoa, amaranth, and beans, manufacturers can create products that resonate with consumers and align with regional culinary traditions. Additionally, expanding distribution channels, particularly through online platforms and retail partnerships, can help reach a broader audience, including consumers in rural and underserved areas. There is also a growing opportunity to cater to specific consumer segments, such as flexitarians, vegans, and individuals with food allergies or intolerances, by offering specialized plant-based protein products that meet their unique dietary needs. Furthermore, the increasing awareness of environmental and ethical issues related to meat production is driving demand for sustainable and ethically sourced plant-based proteins. Companies that can effectively communicate the health, environmental, and ethical benefits of their products will be well-positioned to capitalize on this growing market. With strategic investments and targeted marketing efforts, the Latin America Plant-based Protein Market is poised for substantial growth.

LATIN AMERICA PLANT-BASED PROTEINMARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Product Type, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

ADM (Archer Daniels Midland), Cargill, Incorporated, Ingredion Incorporated, DuPont Nutrition & Biosciences, Kerry Group, Roquette Frères, Tereos S.A., Axiom Foods, Inc., BENEO GmbH, The Scoular Company |

Latin America Plant-based Protein Market Segmentation:

Latin America Plant-based Protein Market Segmentation By Source:

- Soy

- Pea

- Rice

- Wheat

The Latin America Plant-based Protein Market by Source, Soy market share last year and is poised to maintain its dominance throughout the forecast period. Soy has been a staple in Latin America for decades, with long-standing cultivation establishing a robust supply chain and processing infrastructure that supports its cost-effective production. The economies of scale and well-established farming practices make soy a relatively affordable protein source compared to newer alternatives. Its versatility is a significant advantage, as soy protein can be incorporated into a diverse range of products, from beverages to meat substitutes, enhancing its market appeal. Consumer perception also favors soy due to its long history in the market, leading to higher awareness and acceptance. This established presence translates to affordability, making soy products a budget-friendly option for many consumers. However, other plant-based proteins, such as pea protein, face higher production costs, making them less competitive at present. Additionally, there is a need for increased consumer education to highlight the benefits of these alternative protein sources and drive broader adoption. As the market evolves, addressing these challenges will be crucial for diversifying and expanding the range of plant-based proteins available to consumers.

Latin America Plant-based Protein Market Segmentation By Product Type:

- Protein Beverages

- Plant-Based Ice Creams

- Dairy Alternatives

- Meat Substitutes.

- Lactose-Free Products

- Non-Dairy Creamers

- Nutraceuticals

The Latin America Plant-based Protein Market by Product Type, Protein Beverages market share last year and is poised to maintain its dominance throughout the forecast period. Protein beverages have become a leading segment in Latin America's plant-based protein market due to their convenience, portability, and variety. These beverages align well with busy modern lifestyles, offering a quick and easy way to consume protein on-the-go. The market's wide range of flavors, protein sources, and nutritional profiles caters to diverse consumer preferences, reflecting a growing focus on health and wellness. Consumers are increasingly prioritizing protein intake for its health benefits, driving demand for these beverages. However, other segments like plant-based meat and dairy alternatives are gaining traction but face challenges such as achieving the desired taste and texture of traditional products, higher price points, and overcoming established consumer preferences. Future trends indicate that while protein beverages will continue to dominate, innovation will be key to sustaining growth, including new flavors, functional ingredients, and advanced packaging. Premiumization is expected, with a focus on high-value, health-conscious options. Expanding distribution channels will also support market growth. Overall, protein beverages are likely to remain the dominant product segment in the Latin American plant-based protein market, with ongoing developments enhancing their appeal and accessibility.

Latin America Plant-based Protein Market Segmentation By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Sales

- Foodservice

The Latin America Plant-based Protein Market by Distribution Channel, Supermarkets and Hypermarkets market share last year and is poised to maintain its dominance throughout the forecast period. Supermarkets and hypermarkets remain the primary distribution channels for plant-based protein products in Latin America due to their established infrastructure, widespread presence, and extensive distribution networks. These stores offer a diverse range of plant-based products, catering to various consumer preferences, and attract shoppers with regular promotions and discounts. Despite the growing interest in convenience stores and online sales, supermarkets and hypermarkets dominate because most consumers still prefer the physical shopping experience, where they can inspect products firsthand. However, convenience stores generally offer a more limited selection of plant-based items, and online shopping can be perceived as more expensive due to delivery charges. Additionally, trust and verification concerns drive some consumers to prefer in-store purchases. Future trends suggest that while supermarkets and hypermarkets will continue to lead, there will be notable changes, including the growth of private label brands within these stores and the expansion of their online presence with delivery and click-and-collect options. Specialty stores focused on plant-based proteins may also emerge in urban areas. Overall, supermarkets and hypermarkets are expected to maintain their dominant position in the distribution of plant-based protein products in the near future.

Latin America Plant-based Protein Market Segmentation By Region:

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

The Latin America Plant-based Protein Market by Distribution Region, Brazil's market share last year and is poised to maintain its dominance throughout the forecast period. Brazil's dominance in Latin America's plant-based protein market is driven by several key factors. As the largest country in the region by population, Brazil offers a substantial consumer base for plant-based products. The growing middle class with increasing disposable income is fueling demand for healthier and diverse food options. Additionally, rising environmental concerns, particularly related to deforestation from animal agriculture, are driving interest in plant-based alternatives. Brazil’s strong agricultural sector provides a solid foundation for the plant-based protein industry, supported further by government initiatives aimed at promoting sustainable agriculture and plant-based diets. Despite Brazil's leadership, other countries like Mexico and Argentina are also experiencing growth, though Brazil benefits from a more mature market and better-developed infrastructure for food production and distribution. Future trends suggest that Brazil's plant-based protein market will continue to expand, with an expected increase in product diversification including meat and dairy alternatives as well as ready-to-eat meals. Brazil is likely to remain a regional leader in plant-based protein technology and innovation, driven by its combination of population size, economic growth, environmental awareness, and agricultural strength.

COVID-19 Impact Analysis on the Latin America Plant-based Protein Market.

The COVID-19 pandemic has had a profound impact on the Latin America Plant-based Protein Market, both challenging and accelerating its growth. On one hand, disruptions in supply chains and economic downturns during the pandemic initially slowed market expansion, as production and distribution of plant-based products faced significant hurdles. However, the pandemic also spurred a shift in consumer behavior, with increased awareness of health, immunity, and the importance of a nutritious diet. The association of plant-based diets with better health outcomes led to a surge in demand for plant-based proteins, as consumers sought healthier alternatives to traditional animal-based products. Moreover, concerns about food safety and the origins of meat products, heightened by the pandemic, further fueled interest in plant-based alternatives. This period also saw an accelerated adoption of e-commerce and online grocery shopping, enabling plant-based brands to reach consumers more effectively despite physical store closures. As the region continues to recover from the pandemic, the long-term impact is likely to be positive, with sustained growth in the plant-based protein market driven by lasting changes in consumer attitudes towards health, sustainability, and food security.

Latest trends / Developments:

The Latin America Plant-based Protein Market is witnessing several emerging trends and developments that are shaping its growth trajectory. One notable trend is the increasing use of innovative and locally sourced ingredients to create more culturally relevant plant-based products. Companies are incorporating traditional staples like quinoa, amaranth, and various legumes into their formulations, appealing to regional tastes while promoting the nutritional benefits of these ancient grains. Additionally, there is a growing focus on product diversification, with manufacturers expanding beyond meat alternatives to offer plant-based dairy, snacks, and even ready-to-eat meals, catering to a wider range of consumer needs and preferences. Another key development is the rise of clean-label products, driven by consumer demand for transparency and natural ingredients, leading companies to prioritize minimal processing and avoid artificial additives. The market is also seeing increased investment in research and development to improve the taste, texture, and nutritional profile of plant-based proteins, making them more competitive with traditional animal proteins. Furthermore, collaborations between food tech startups and established food companies are accelerating innovation and scaling production capabilities. These trends, coupled with the growing adoption of e-commerce and plant-based food delivery services, are positioning the Latin America Plant-based Protein Market for robust growth in the coming years.

Key Players:

- ADM (Archer Daniels Midland)

- Cargill, Incorporated

- Ingredion Incorporated

- DuPont Nutrition & Biosciences

- Kerry Group

- Roquette Frères

- Tereos S.A.

- Axiom Foods, Inc.

- BENEO GmbH

- The Scoular Company

Chapter 1. Latin America Plant-based Protein Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Plant-based Protein Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Plant-based Protein Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Plant-based Protein Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Plant-based Protein Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Plant-based Protein Market– By Source

6.1. Introduction/Key Findings

6.2. Soy

6.3. Pea

6.4. Rice

6.5. Wheat

6.6. Y-O-Y Growth trend Analysis By Source

6.7. Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Latin America Plant-based Protein Market– By Product Type

7.1. Introduction/Key Findings

7.2 Protein Beverages

7.3. Plant-Based Ice Creams

7.4. Dairy Alternatives

7.5. Meat Substitutes.

7.6. Lactose-Free Products

7.7. Non-Dairy Creamers

7.8. Nutraceuticals

7.9. Y-O-Y Growth trend Analysis By Product Type

7.10. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Latin America Plant-based Protein Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Sales

8.5. Foodservice

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Latin America Plant-based Protein Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Source

9.1.3. By Distribution Channel

9.1.4. By Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Plant-based Protein Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ADM (Archer Daniels Midland)

10.2. Cargill, Incorporated

10.3. Ingredion Incorporated

10.4. DuPont Nutrition & Biosciences

10.5. Kerry Group

10.6. Roquette Frères

10.7. Tereos S.A.

10.8. Axiom Foods, Inc.

10.9. BENEO GmbH

10.10. The Scoular Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Latin America Plant-based Protein market is expected to be valued at US$ 1.64 million

Through 2030, the Latin America Plant-based Protein market is expected to grow at a CAGR of 15%.

. By 2030, Latin America Plant-based Protein Market is expected to grow to a value of US$ 4.38 billion

Brazil is predicted to lead the Latin America Plant-based Protein market.

The Latin America Plant-based Protein Market has segments By Product Type, Source, Distribution Channel, and Region