Latin America Biofertilizers Market Size (2024-2030)

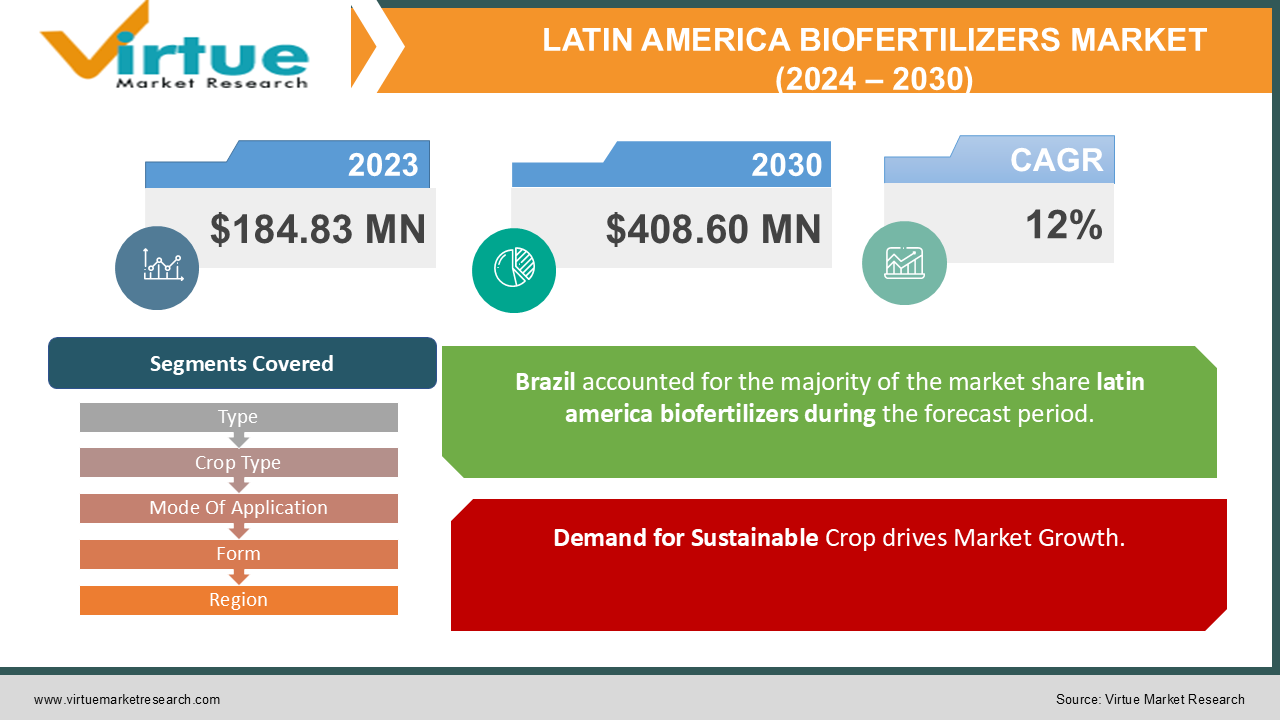

The Latin America Biofertilizers Market was valued at USD 184.83 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 408.60 million by 2030, growing at a CAGR of 12%.

Biofertilizers are organic soil amendments that consist of living microorganisms, including bacteria, fungi, and algae, which improve soil fertility and support plant development. These microorganisms play a crucial role in nutrient cycling, nitrogen fixation, and enhancing soil structure. The biofertilizers sector is witnessing considerable expansion due to the growing preference for organic food and sustainable farming methods. A significant factor driving this market is the increasing awareness among both farmers and consumers about the detrimental impacts of chemical fertilizers on the environment and human health. Unlike chemical fertilizers, which can diminish soil fertility over time, pollute water sources, and contribute to greenhouse gas emissions, biofertilizers are environmentally friendly and help to maintain soil health and promote biodiversity.

Key Market Insights:

The growing demand for biofertilizers is also fueled by the rising adoption of organic farming practices. Organic farming prohibits synthetic chemicals and encourages the use of natural inputs, such as biofertilizers.

As consumers become increasingly aware of the quality and safety of their food, there is a growing preference for organic products. This shift in consumer behavior is consequently boosting the demand for biofertilizers.

Latin America Biofertilizers Market Drivers:

Demand for Sustainable Crop drives Market Growth.

The demand for biofertilizers is projected to keep increasing due to the rising need for sustainable organic farming inputs and fertilizers that align with contemporary agricultural practices. Biofertilizers offer a cost-effective and environmentally friendly alternative for crop production, contributing to their growing adoption. Additionally, factors such as the increasing public concern over pesticide-free products and the escalation of health risks are further driving the demand for sustainable crop production solutions.

Increase in Production of Horticulture Crops and Cereal Crops drives market growth.

Biofertilizers are applicable in the cultivation of high-value crops, including those in horticulture. The reliance on intensive farming practices and the extensive use of chemical fertilizers has adversely affected soil fertility, underscoring the necessity for alternative solutions like biofertilizers. These products enhance soil fertility and boost microbial activity by replenishing the population of beneficial microorganisms in agricultural soils. Consequently, integrating biofertilizers with other agricultural inputs can enhance crop yields and sustain soil health.

Latin America Biofertilizers Market Restraints and Challenges:

Limited LifeShelf of Natural Fertilizers hinder market growth.

A key manufacturing challenge for biofertilizer producers is the proper storage and maintenance of the microorganisms incorporated into the final products. The effectiveness of biological fertilizers is directly influenced by the survival rate of these microorganisms, making their appropriate storage crucial. For example, biological fertilizer packets should be kept in a cool, dry environment, away from heat and sunlight. Therefore, maintaining efficiency requires both substantial technical expertise and a sophisticated logistics system.

Additionally, the performance of biofertilizers can be affected by soil and crop types. Microbial strains in the fertilizers might establish non-specific host-inoculant relationships or face competition from native soil bacteria, potentially reducing their effectiveness. Consequently, thorough research into the climate and soil characteristics of a region is essential to ensure optimal performance of these products across various environmental conditions.

Latin America Biofertilizers Market Opportunities:

Government initiatives and subsidies aimed at advancing sustainable agriculture are also driving the expansion of the biofertilizers market. Numerous countries are incentivizing farmers to adopt organic farming practices through financial support and technical assistance. This encouragement has resulted in a greater adoption of biofertilizers within the agricultural sector. The market for biofertilizers is experiencing considerable growth due to the rising demand for organic food, sustainable farming practices, and supportive government policies. Biofertilizers present a natural and environmentally friendly alternative to chemical fertilizers, enhancing soil health and promoting biodiversity. As awareness of the negative impacts of chemical fertilizers increases, the demand for biofertilizers is projected to continue growing.

LATIN AMERICA BIOFERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type, crop type, mode of application, form, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Rizobacter Argentina S.A., Ipl Biologicals Limited, T. Stanes & Company Limited, Symborg, Nutramax Laboratories Inc., Mapleton Agri Biotech Pty Ltd, Kan Biosys, Manidharma Biotech Pvt Ltd, Seipasa and Jaipur Bio Fertilizers. |

Latin America Biofertilizers Market Segmentation:

Latin America Biofertilizers Market Segmentation By Type:

- Nitrogen-fixing Biofertilizers

- Phosphate Solubilizing & Mobilizing Biofertilizers

- Potassium Solubilizing & Mobilizing Biofertilizers

- Other Types

The nitrogen-fixing microbes segment is anticipated to dominate the Latin American biofertilizers market. This segment's substantial market share is largely due to government initiatives, heightened awareness of sustainability in contemporary agriculture, concerns over the adverse effects of chemical fertilizers, increasing health issues, and the cost-effective benefits of providing nitrogen to plants.

Latin America Biofertilizers Market Segmentation By Crop Type:

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

- Other Crops

The oilseeds and pulses segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the increasing demand for organic oilseeds and pulses, as well as the rising popularity of plant-based foods.

In contrast, the cereals and grains segment has captured the largest revenue share in the market. The production of cereals and grains heavily relies on biofertilizers. Research indicates that Azotobacter inoculation enhances crop growth and reduces the need for nitrogen. Furthermore, the use of phosphate-solubilizing bacteria and Azotobacter inoculation improves wheat growth and yield. Incorporating these biofertilizers boosts vegetation growth and photosynthetic activity in cereal and grain cultivation.

Latin America Biofertilizers Market Segmentation By Mode Of Application:

- Soil Treatment

- Seed Treatment

- Other Modes Of Application

The seed treatment segment is projected to hold the largest share of the Latin American biofertilizers market. This prominence is due to the role of biofertilizers in solubilizing phosphorus in the soil, thereby enhancing its availability, and the growing use of these products in the seed treatment of various crops, including cereals such as rice, wheat, sorghum, and maize, as well as oilseeds like groundnut, sunflower, and soybean. Soil often contains insoluble forms of organic or inorganic phosphorus, and its deficiency can limit plant growth. To address this, microbiologists and agricultural organizations are introducing phosphate-solubilizing microorganisms as biofertilizers to improve plant development. Bacteria such as Bacillus, Pseudomonas, and Aspergillus are commonly employed for this purpose.

The seed treatment process typically involves soaking seeds in a mixture of phosphorus and nitrogen fertilizers, followed by sun-drying and sowing. Coating seeds with biofertilizers promotes rapid and robust plant growth. The increasing demand for organic foods is anticipated to further drive the use of biofertilizers in seed treatment.

In soil treatment, biofertilizers are recognized for their effectiveness in improving soil conditions and facilitating the uptake of essential minerals by plants. When applied to the soil, they play a

crucial role in nitrogen fixation, phosphate scavenging, and enhancing soil mineralization, thus improving soil properties for better cultivation. These benefits have been observed to result in a significant increase in crop yield, ranging from approximately 15% to 25%.

Latin America Biofertilizers Market Segmentation By Form:

- Liquid

- Carrier-based

The liquid biofertilizers segment is expected to exhibit the highest compound annual growth rate (CAGR) during the forecast period. This segment's rapid growth is attributed to its ease of use, cost-effectiveness, high efficiency and absorbability, and the ability to achieve uniform application.

Latin America Biofertilizers Market Segmentation- by Region

- Brazil

- Argentina

- Colombia

- Chile

- Rest of Latin America

Brazil is anticipated to hold the largest share of the Latin American biofertilizers market. This substantial market share is driven by several factors, including a growing economy, an increasing population, extensive agricultural land, advancements in farming technology, limited availability of arable land, significant fertilizer consumption, and an expanding area of land dedicated to organic cultivation.

Argentina is currently the fastest-growing region in the biofertilizers market. This growth is driven by favorable government policies, a streamlined registration process, and an increasing number of organic farms. Among the various types of biofertilizers, the Rhizobium biofertilizer segment is the market leader in Latin America. Despite extensive legislative frameworks in major Latin American countries, there is a lack of specific and comprehensive regulations governing the use of biofertilizers and organic fertilizers in certain countries, such as Peru, Colombia, Bolivia, and Venezuela. Consequently, the growth of the biofertilizer market in these countries is expected to be slower compared to more advanced markets like Brazil and Argentina.

COVID-19 Pandemic: Impact Analysis

The industry has faced significant challenges due to the novel coronavirus pandemic. Key issues such as labor shortages and logistical constraints have emerged as major concerns for manufacturers. Many producers, particularly small and medium-sized enterprises (SMEs), have been forced to halt or reduce production. To ensure the continued progression of farming activities, the government issued an emergency directive to facilitate the circulation and transportation of agricultural products. However, the abrupt outbreak of the coronavirus has severely impacted production nationwide. Biofertilizer prices were anticipated to rise due to product shortages and increased production costs. Nonetheless, downstream demand remains uncertain, and pressures from the export market continue to strain the biofertilizers sector in 2020. To support market growth in future agricultural cycles, cooperation among the government, farmers, and the industry is crucial.

Latest Trends/ Developments:

- October 2022: Koppert has announced plans to invest in three new production facilities in Brazil, reinforcing its leadership position in both the Brazilian and global markets for biological agricultural inputs. One of the new units will cover over 8,000 square meters and will focus on producing a comprehensive range of microbiological products, including those based on viruses, fungi, and bacteria, available in both liquid and solid formulations.

- September 2022: Corteva Agriscience reached an agreement to acquire Symborg Inc., aiming to enhance its global footprint through a robust distribution network.

Key Players:

These are top 10 players in the Latin America Biofertilizers Market :-

- Rizobacter Argentina S.A.

- Ipl Biologicals Limited

- T. Stanes & Company Limited

- Symborg

- Nutramax Laboratories Inc.

- Mapleton Agri Biotech Pty Ltd

- Kan Biosys

- Manidharma Biotech Pvt Ltd

- Seipasa

- Jaipur Bio Fertilizers

Chapter 1. Latin America Biofertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Biofertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Biofertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Biofertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Biofertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Biofertilizers Market– By Type

6.1. Introduction/Key Findings

6.2. Nitrogen-fixing Biofertilizers

6.3. Phosphate Solubilizing & Mobilizing Biofertilizers

6.4. Potassium Solubilizing & Mobilizing Biofertilizers

6.5. Other Types

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Biofertilizers Market– By Crop Type

7.1. Introduction/Key Findings

7.2 Cereals & Grains

7.3. Pulses & Oilseeds

7.4. Fruits & Vegetables

7.5. Other Crops

7.6. Y-O-Y Growth trend Analysis By Crop Type

7.7. Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 8. Latin America Biofertilizers Market– By Mode Of Application

8.1. Introduction/Key Findings

8.2. Soil Treatment

8.3. Seed Treatment

8.4. Other Modes Of Application

8.5. Y-O-Y Growth trend Analysis Mode Of Application

8.6. Absolute $ Opportunity Analysis Mode Of Application , 2024-2030

Chapter 9. Latin America Biofertilizers Market– By Form

9.1. Introduction/Key Findings

9.2. Liquid

9.3. Carrier-based

9.4. Y-O-Y Growth trend Analysis Form

9.5. Absolute $ Opportunity Analysis Form , 2024-2030

Chapter 10. Latin America Biofertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. Latin America

10.1.1. By Country

10.1.1.1. Mexico

10.1.1.2. Brazil

10.1.1.3. Argentina

10.1.1.4. Chile

10.1.1.5. Colombia

10.1.1.6. Rest of Latin America

10.1.2. By Type

10.1.3. By Form

10.1.4. By Crop Type

10.1.5. BY Mode Of Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Latin America Dairy Alternatives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments

11.1 Rizobacter Argentina S.A.

11.2. Ipl Biologicals Limited

11.3. T. Stanes & Company Limited

11.4. Symborg

11.5. Nutramax Laboratories Inc.

11.6. Mapleton Agri Biotech Pty Ltd

11.7. Kan Biosys

11.8. Manidharma Biotech Pvt Ltd

11.9. Seipasa

11.10. Jaipur Bio Fertilizers

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The growing demand for biofertilizers is also fueled by the rising adoption of organic farming practices. Organic farming prohibits synthetic chemicals and encourages the use of natural inputs, such as biofertilizers

The top players operating in the Latin America Biofertilizers Market are - Rizobacter Argentina S.A., Ipl Biologicals Limited, T. Stanes & Company Limited, Symborg, Nutramax Laboratories Inc., Mapleton Agri Biotech Pty Ltd, Kan Biosys, Manidharma Biotech Pvt Ltd, Seipasa and Jaipur Bio Fertilizers

The industry has faced significant challenges due to the novel coronavirus pandemic.

October 2022: Koppert has announced plans to invest in three new production facilities in Brazil, reinforcing its leadership position in both the Brazilian and global markets for biological agricultural inputs.

Argentina is currently the fastest-growing region in the biofertilizers market.