Biofertilizers Market Size (2024 – 2030)

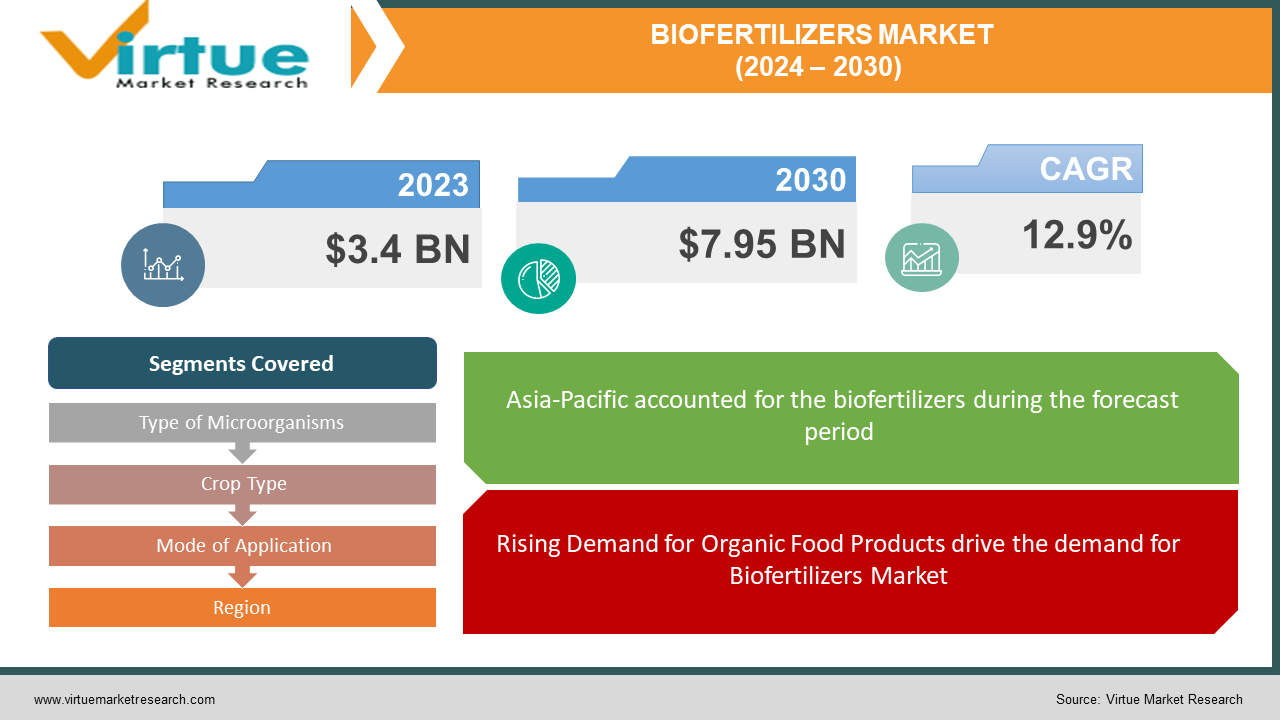

The Global Biofertilizers Market was valued at USD 3.4 billion and is projected to reach a market size of USD 7.95 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.9%.

Biofertilizers are fertilizers derived from natural sources. Natural sources are bacteria, fungi, and algae. Biofertilizers enhance soil fertility and crop productivity. The Biofertilizers Market is expected to grow significantly in the coming years due to increasing awareness about sustainable agricultural practices, rising demand for organic food products, and government initiatives promoting eco-friendly farming methods. The major well-established key players in the Biofertilizers Market are Novozymes A/S, Bayer CropScience AG, Rizobacter Argentina S.A., Lallemand Inc., and National Fertilizers Limited (NFL).

Key Market Insights:

Biofertilizers help to increase crop production, ranging from 20 to 30 percent. Increasing environmental sustainability awareness, rising demand for organic food, government regulations, technological advancements, soil health focus, integrated nutrient management adoption, emerging market expansion, and climate change mitigation efforts are propelling the Biofertilizers Market. The restraints to the Biofertilizers Market include limited awareness, variable efficacy, storage challenges, regulatory hurdles, cost considerations, distribution challenges, and compatibility issues. Ongoing advancements in technology have led to the development of more enhanced biofertilizers. Asia-Pacific occupies the highest share of the Biofertilizers Market. North America and Europe are the fastest-growing regions during the forecast period.

Biofertilizers Market Drivers:

Rising Demand for Organic Food Products drive the demand for Biofertilizers Market

The rising demand for organic food products is a key driver for Biofertilizers Market. The consumer preference for organic food products is growing rapidly. This is mainly due to concerns about health and food safety. Environmental sustainability is another significant driver of the biofertilizers market. Consumers are increasingly preferring organic foods due to their health benefits. Organic foods are free from synthetic chemicals, pesticides, and genetically modified organisms (GMOs). Farmers are adopting organic farming practices to meet this growing consumer demand. Biofertilizers are essential for organic farming. Biofertilizers provide essential nutrients to crops without the use of synthetic chemicals. This aligns with consumer preferences for natural and sustainable agricultural practices.

Increasing Awareness of Environmental Sustainability is propelling the Biofertilizers Market

The increasing awareness of environmental sustainability is a significant driver for Biofertilizers Market. There is a growing awareness of the environmental impacts of conventional agricultural practices. This includes soil degradation, water pollution, and biodiversity loss. Biofertilizers are environmentally sustainable compared to chemical fertilizers. Chemical fertilizers result in soil degradation, nutrient runoff, and greenhouse gas emissions. Chemical fertilizers can cause environmental problems. Biofertilizers improve soil fertility, promote soil health, and reduce environmental problems. Biofertilizers are used to reduce the environmental impact of food production. Governments and consumers strongly focus on environmental sustainability. Adopting eco-friendly agricultural practices fuels the demand for Biofertilizers.

Biofertilizers Market Restraints and Challenges

The major challenge faced by the Biofertilizers Market is the limited awareness and knowledge among farmers about biofertilizers. They are unaware of the benefits and proper application of biofertilizers. Many farmers don’t know the effectiveness of biofertilizers compared to chemical fertilizers. Another challenge in the Biofertilizers Market is the shorter shelf life compared to chemical fertilizers. This requires specific storage conditions to maintain. Ensuring the quality and effectiveness of biofertilizers during storage and distribution can be difficult. The other restraints to the Biofertilizers Market include variable efficacy, regulatory hurdles, cost considerations, distribution challenges, and compatibility issues.

Biofertilizers Market Opportunities:

The Biofertilizers Market has various opportunities in the market. With growing awareness of the environmental impacts of conventional farming practices and the rising demand for sustainable food production, the Biofertilizers Market is anticipated to witness significant growth in the coming years. This presents opportunities for biofertilizers as eco-friendly fertilizers. Ongoing research and development in biotechnology presents opportunities for the development of new biofertilizer formulations. This enhances efficacy, stability, and compatibility with different crops and soil types. Other Opportunities in the market include expansion in emerging markets, integration with precision agriculture, collaboration with microbial research, focus on organic farming, partnerships for market access, and government support and incentives.

BIOFERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.9% |

|

Segments Covered |

By Type of Microorganisms, Crop Type, Mode of Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Novozymes A/S, Bayer CropScience AG, Rizobacter Argentina S.A., Lallemand Inc., National Fertilizers Limited (NFL), Madras Fertilizers Limited (MFL), Gujarat State Fertilizers & Chemicals Ltd. (GSFC), Camson Bio Technologies Limited, Symborg, T.Stanes & Company Limited |

Biofertilizers Market Segmentation: By Type of Microorganisms

-

Nitrogen-Fixing Biofertilizers

-

Phosphate-Solubilizing Biofertilizers

-

Potash-Mobilizing Biofertilizers

-

Others (sulfur-fixing, zinc-solubilizing, etc.)

In 2023, based on market segmentation by Type of Microorganisms, Nitrogen-fixing biofertilizers occupy the highest share of the Biofertilizers Market. This is mainly due to the widespread demand for nitrogen fertilization across various crop types. Nitrogen-fixing bacteria are Rhizobium, Azotobacter, and Azospirillum. These convert atmospheric nitrogen into a form that plants can utilize.

However, Phosphate-solubilizing biofertilizers is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 15%. This is due to the increasing awareness of phosphorus deficiency in soils and its crucial role in plant nutrition. phosphate-solubilizing bacteria are Bacillus and Pseudomonas. These microorganisms solubilize insoluble phosphorus in the soil and make it available to plants.

Biofertilizers Market Segmentation: By Crop Type

-

Cereals & Grains (Wheat, Rice, Corn, etc.)

-

Pulses & Oilseeds (Soybean, Peanuts, etc.)

-

Fruits & Vegetables

-

Others (Tea, Coffee, Sugarcane, etc.)

In 2023, based on market segmentation by Crop Type, the Cereals and grains segment occupies the highest share of the Biofertilizers Market. This is mainly due to the high global demand for cereals and grains. Cereals and grains like wheat, rice, and corn are used for food purposes. Biofertilizers are commonly applied to cereals and grains to enhance soil fertility and improve crop yields.

However, Fruits and vegetables are the fastest-growing segment during the forecast period. This is mainly due to the increasing consumer demand for fresh and healthy fruits and vegetables. There is a growing focus on organic farming practices in the production of fruits and vegetables. Biofertilizers provide essential nutrients to fruits and vegetables in organic farming systems. It also maintains soil health and sustainability.

Biofertilizers Market Segmentation: By Mode of Application

-

Seed Treatment

-

Soil Application

-

Root Dipping

-

Foliar Spray

-

Others

In 2023, based on market segmentation by the Mode of Application, the Soil application segment occupies the highest share of the Biofertilizers Market. This is mainly due to its ease of application and widespread adoption by farmers. Soil application of biofertilizers involves direct contact with plant roots. This ensures nutrient uptake and enhances soil fertility over time.

However, Seed treatment is the fastest-growing segment during the forecast period. This growth is driven by its efficiency in delivering beneficial microorganisms directly to the germinating seed. Seed treatment is coating seeds with biofertilizers before planting. Seed treatment with biofertilizers can be used where soil conditions are less favorable.

Biofertilizers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the Biofertilizers Market. This growth is due to its extensive agricultural activity, diverse crop types, and increasing adoption of sustainable farming practices. Countries like China, India, Japan, and Southeast Asian nations have significant market share due to government initiatives promoting organic farming. Nitrogen-fixing biofertilizers are dominant and popular due to the region's heavy reliance on nitrogen-intensive crops like rice and wheat.

However, North America and Europe are the fastest-growing segments during the forecast period. This is mainly due to the stringent regulations on chemical fertilizer use, growing consumer awareness of environmental sustainability, and government support for organic farming. Nations like the U.S. and Canada in North America have higher growth due to a growing number of farmers adopting biofertilizers to reduce synthetic chemicals and improve soil health. Countries like Germany, France, and the Netherlands in Europe have large market share of biofertilizers due to a strong focus on reducing greenhouse gas emissions and enhancing soil biodiversity. Phosphate-solubilizing biofertilizers are popular in North America and Europe due to phosphorus runoff and water pollution.

COVID-19 Impact Analysis on the Global Biofertilizers Market:

The COVID-19 pandemic had a significant impact on the Biofertilizers Market. There were lockdowns, social distancing, travel rules, and other safety restrictions. There were disruptions in global supply chains. This affected the availability of raw materials and inputs for biofertilizer production. This also impacted the supply of biofertilizers to farmers. The pandemic resulted in labor shortages in agriculture and manufacturing sectors. During the pandemic, there was a heightened awareness of health and sustainability. There was increased interest in organic and sustainably produced food. This increased the demand for biofertilizers. The pandemic accelerated the adoption of digital technologies in agriculture. This included remote monitoring and precision agriculture tools. Thus, the pandemic accelerated certain trends in the Biofertilizers Market.

Latest Trends/ Developments:

One of the developments, in the Biofertilizers Market is the rise in integration of Biofertilizers in Integrated Nutrient Management (INM). Biofertilizers are used in INM strategies to improve nutrient availability, enhance soil health, and reduce dependency on chemical inputs.

Consumers and governments are focusing on sustainable agricultural practices. Major concerns are about food security, environmental sustainability, and climate change. Biofertilizers are a sustainable alternative to chemical fertilizers. Other trends in the Biofertilizers Market include advancements in microbial research, expansion of production and distribution networks, government support and regulatory initiatives, focus on customized formulations and application methods, and exploration of emerging technologies like nanotechnology.

Key Players:

-

Novozymes A/S

-

Bayer CropScience AG

-

Rizobacter Argentina S.A.

-

Lallemand Inc.

-

National Fertilizers Limited (NFL)

-

Madras Fertilizers Limited (MFL)

-

Gujarat State Fertilizers & Chemicals Ltd. (GSFC)

-

Camson Bio Technologies Limited

-

Symborg

-

T.Stanes & Company Limited

Market News:

-

In August 2023, FMC India unveiled ENTAZIA™ biofungicide, harnessing Bacillus subtilis to combat fungal diseases in crops while promoting plant health, reinforcing the company's commitment to sustainable agriculture.

-

In February 2024, The Government of India launched a Biofertilizer scheme, a new initiative aimed at promoting the adoption of biofertilizers and organic fertilizers for sustainable agriculture, with a substantial total outlay of ₹3,70,128.7 crore, demonstrating its commitment to environmentally friendly farming practices.

Chapter 1. Biofertilizers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biofertilizers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biofertilizers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biofertilizers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biofertilizers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biofertilizers Market – By Type of Microorganisms

6.1 Introduction/Key Findings

6.2 Nitrogen-Fixing Biofertilizers

6.3 Phosphate-Solubilizing Biofertilizers

6.4 Potash-Mobilizing Biofertilizers

6.5 Others (sulfur-fixing, zinc-solubilizing, etc.)

6.6 Y-O-Y Growth trend Analysis By Type of Microorganisms

6.7 Absolute $ Opportunity Analysis By Type of Microorganisms, 2024-2030

Chapter 7. Biofertilizers Market – By Crop Type

7.1 Introduction/Key Findings

7.2 Cereals & Grains (Wheat, Rice, Corn, etc.)

7.3 Pulses & Oilseeds (Soybean, Peanuts, etc.)

7.4 Fruits & Vegetables

7.5 Others (Tea, Coffee, Sugarcane, etc.)

7.6 Y-O-Y Growth trend Analysis By Crop Type

7.7 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 8. Biofertilizers Market – By Mode of Application

8.1 Introduction/Key Findings

8.2 Seed Treatment

8.3 Soil Application

8.4 Root Dipping

8.5 Foliar Spray

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Mode of Application

8.8 Absolute $ Opportunity Analysis By Mode of Application, 2024-2030

Chapter 9. Biofertilizers Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Microorganisms

9.1.3 By Crop Type

9.1.4 By By Mode of Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Microorganisms

9.2.3 By Crop Type

9.2.4 By Mode of Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Microorganisms

9.3.3 By Crop Type

9.3.4 By Mode of Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Microorganisms

9.4.3 By Crop Type

9.4.4 By Mode of Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Microorganisms

9.5.3 By Crop Type

9.5.4 By Mode of Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biofertilizers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Novozymes A/S

10.2 Bayer CropScience AG

10.3 Rizobacter Argentina S.A.

10.4 Lallemand Inc.

10.5 National Fertilizers Limited (NFL)

10.6 Madras Fertilizers Limited (MFL)

10.7 Gujarat State Fertilizers & Chemicals Ltd. (GSFC)

10.8 Camson Bio Technologies Limited

10.9 Symborg

10.10 T.Stanes & Company Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biofertilizers Market was valued at USD 3.4 billion and is projected to reach a market size of USD 7.95 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.9%.

Increasing environmental sustainability awareness, rising demand for organic food, government regulations, technological advancements, soil health focus, integrated nutrient management adoption, emerging market expansion, and climate change mitigation efforts are the market drivers of the Global Biofertilizers Market.

Seed Treatment, Soil Application, Root Dipping, Foliar Spray, and Others are the segments under the Global Biofertilizers Market by Mode of Application.

Asia-Pacific is the most dominant region for the Global Biofertilizers Market.

Novozymes A/S, Bayer CropScience AG, Rizobacter Argentina S.A., Lallemand Inc., and National Fertilizers Limited (NFL) are the key players in the Global Biofertilizers Market.