Latin America Biostimulants Market Size (2024-2030)

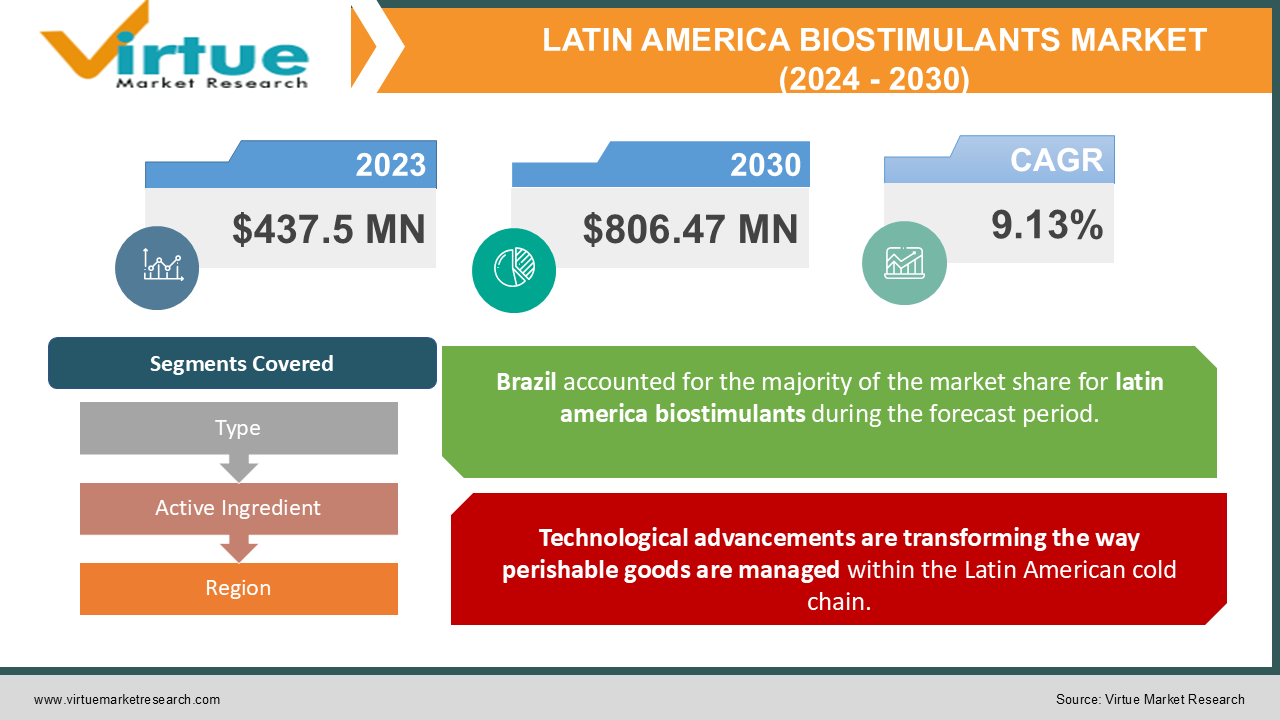

The Latin America Bio stimulants Market was valued at USD 437.5 Million in 2024 and is projected to reach a market size of USD 806.47 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.13%.

Latin America's agriculture industry is changing, with an increasing focus on more sustainable methods and higher crop yields. A major factor in this evolution is the use of bio stimulants, a class of artificial or natural materials that improve plant growth and stress tolerance without actually supplying nutrients. Growing awareness of the advantages of bio stimulants in improving crop health, stress resilience, and eventually yield improvement is spreading among Latin American farmers. The uptake of these products across different crop kinds is being driven by this increased awareness. The region is seeing a transition in farming techniques towards more ecologically friendly ones due to worries about sustainability. Because they are organic or produced from natural sources, bio stimulants are a perfect fit for this change and provide a sustainable substitute for conventional chemical fertilisers. Latin American consumers are putting more and more demands on fresh, high-quality fruits and vegetables. Produce quality and shelf life can be increased with the use of bio stimulants, satisfying an increasing consumer demand.

Key Market Insights:

The growing interest in discovering natural and sustainable sources of bio-stimulant chemicals is predicted to propel the market for bio-stimulants produced from plant extracts or botanical sources, which is projected to reach $120 million.

The market for bio-stimulants that target particular interactions between the rhizosphere and the soil microbiome is expected to reach $80 million due to the growing need for products that support balanced and healthy soil ecosystems.

The growing usage of precision farming techniques is expected to increase the need for bio-stimulants developed for site-specific management and precision agriculture, with the market expected to reach $70 million by 2024.

The growing interest in discovering natural and sustainable sources of bio-stimulant chemicals is predicted to propel the market for bio-stimulants produced from plant extracts or botanical sources, which is projected to reach $120 million by the end of 2024.

Latin America Bio stimulants Market Drivers:

Sustainability concerns are rippling across the agricultural sector in Latin America. Farmers are increasingly aware of the environmental impact of traditional agricultural practices, particularly the overuse of chemical fertilizers.

Excessive reliance on synthetic fertilizers can lead to soil degradation, reducing its fertility and natural ability to retain nutrients and moisture. This necessitates ever-increasing fertilizer application to achieve the same yields, creating a vicious cycle. Chemical fertilizer runoff contaminates water sources, impacting aquatic life and human health. The rise of stricter environmental regulations is pushing farmers to adopt more sustainable practices to avoid hefty fines or production restrictions. Bio stimulants can stimulate root development and improve nutrient uptake efficiency, allowing plants to utilize existing nutrients in the soil more effectively. This reduces the reliance on external fertilizer inputs. Bio stimulants can trigger the plant's natural defence mechanisms, making them more resilient to abiotic stresses like drought, salinity, and extreme temperatures. This reduces crop losses and ensures consistent yields.

Technological advancements are transforming the way perishable goods are managed within the Latin American cold chain.

Biostimulants can improve the post-harvest quality and shelf life of fruits and vegetables. This is achieved by delaying ripening, reducing spoilage during transportation and storage, and ultimately ensuring fresh produce reaches consumers in optimal condition. Biostimulants can enhance the physical characteristics of fruits and vegetables, leading to improved colour, size, and firmness. Additionally, some bio stimulants can stimulate the production of beneficial antioxidants and other health-promoting compounds within the plant. Improved post-harvest quality leads to less spoilage, minimizing food waste throughout the supply chain. This not only benefits farmers but also contributes to a more sustainable food system. The growing consumer demand for high-quality produce creates a compelling economic incentive for farmers to adopt biostimulants. As consumers become more discerning and health-conscious, the role of biostimulants in ensuring a consistent supply of high-quality fruits and vegetables will become increasingly important.

Latin America Bio stimulants Market Restraints and Challenges:

Facilities for cold storage, especially in rural regions, are sometimes insufficient to fulfil the rising demand. This results in lost opportunities to maximize the value of agricultural production, financial losses, and product spoilage. The abundant crop of strawberries that local farmers produce is spoiled before it reaches consumers, resulting in lost revenue and resource waste. This is caused by the absence of cold storage facilities in the area. There are shortcomings in the region's transport network. Inadequate chilled transportation choices, ineffective logistics networks, and poor road conditions can cause delays and temperature swings that lower the quality of the goods. Energy-efficient solutions are lacking in many transit networks and cold storage facilities. This raises operating expenses, narrows company profit margins, and eventually deters capital expenditures for cold chain infrastructure modernization. Inadequate tracking and monitoring systems can make it difficult to maintain real-time visibility of product location and temperature conditions throughout the cold chain. This lack of transparency hinders proactive problem-solving and increases the risk of product spoilage or safety hazards.

Latin America Bio stimulants Market Opportunities:

Governments can create incentives and partner with private investors to encourage the development of new cold storage facilities, particularly in rural areas. This can involve tax breaks, subsidies, or streamlined permitting processes to attract investment and address storage capacity limitations. Investments in road infrastructure, refrigerated transportation options, and intermodal connectivity can significantly enhance efficiency. This could involve building new roads, improving existing ones, and providing tax breaks for the purchase of refrigerated trucks. Additionally, promoting intermodal transportation that seamlessly integrates land, sea, and air freight, with proper cold chain protocols in place, would facilitate efficient movement of perishables across vast distances. Government subsidies or tax breaks can incentivize the adoption of energy-efficient refrigeration systems and sustainable building practices for cold storage facilities. This could involve promoting the use of solar panels, LED lighting, and improved insulation materials to minimize energy requirements.

LATIN AMERICA BIO STIMULANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.13% |

|

Segments Covered |

By Type, Active ingredient, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

BASF, Bayer , Syngenta, FMC, Biotecnología Industrial, Verde AgriTech, Symborg , Isagro |

Latin America Bio stimulants Market Segmentation:

Latin America Bio stimulants Market Segmentation: By Type:

- Fruits & Vegetables

- Row Crops (Corn, Soybeans)

- Ornamental Plants

Row Crops (Corn, Soybeans segment holds the largest market share, accounting for approximately 45-50% of the total bio stimulant consumption in Latin America. Corn and soybeans occupy vast swathes of agricultural land in Latin America, particularly in countries like Brazil, Argentina, and Paraguay. These crops are essential food commodities, and farmers are constantly seeking ways to maximize yields to meet growing demand. Drought and heat stress are significant challenges for row crop production in Latin America. Biostimulants can help mitigate these stresses and improve yields. Biostimulants can trigger the plant's natural defence mechanisms, making them more resilient to abiotic stresses such as drought, heatwaves, and salinity. This is particularly crucial in Latin America, where these stresses pose a significant threat to crop yields.

The segment of fruits and vegetables is witnessing the fastest growth in the Latin American biostimulants market. Consumers are increasingly health-conscious and prioritize fresh, high-quality produce. This creates a demand for fruits and vegetables with superior visual appeal, extended shelf life, and potentially enhanced nutritional value. Biostimulants can contribute on all these fronts. Latin American countries are increasingly exporting high-value fruits and vegetables to global markets. Biostimulants can help farmers meet the stringent quality standards and extended shelf-life requirements demanded by international buyers.

Latin America Bio stimulants Market Segmentation: By Active Ingredient:

- Seaweed Extracts

- Humic Acids

- Amino Acids

- Microbial Formulations

With a 40–45% market share, seaweed extracts are in a prominent position. Their broad-spectrum advantages and adaptability to different crop kinds account for their widespread use. Many advantages can be obtained from seaweed extracts, such as bettering root development, increasing stress tolerance, encouraging nutrient uptake, and activating plant growth hormones. Their adaptability renders them appropriate for a vast array of crops and uses. Seaweed extracts, which come from the ocean, fit in nicely with the increasing interest in organic and ecological farming methods. Seaweed extracts are exciting to farmers looking for environmentally friendly solutions. Years of research and practical application have solidified the effectiveness of seaweed extracts in enhancing crop health and yield. This established track record inspires confidence among farmers.

The fastest-growing segment in the Latin American biostimulants market belongs to amino acids. These organic compounds act as the building blocks for proteins, crucial for various plant functions. Amino acid biostimulants can be formulated with specific combinations of amino acids to address particular needs. For example, formulations rich in certain amino acids can promote faster vegetative growth, while others may focus on enhancing stress tolerance. Plants can readily absorb amino acids through their leaves, leading to a faster response compared to some other biostimulants. This can be beneficial during critical growth stages or in response to sudden stress events.

Latin America Bio stimulants Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil is the largest country in the Latin American Bio-stimulants Market, holding a noteworthy 38.9% market share as of 2024. Brazil's dominance can be attributed to a number of factors, including its large agricultural industry, perfect climate, and increasing use of sustainable farming practices. Brazil is a major player in the world agricultural market, growing a broad range of products, including grains, oilseeds, fruits, and vegetables. The nation is ideal for applying biostimulants to increase crop productivity and output due to its vast expanse of arable territory and tropical and subtropical temperatures.

Colombia is becoming the region's fastest-growing nation. Colombia's biostimulants business is expected to grow at an impressive rate of 10.2% between 2020 and 2024, putting it in a position to take a larger portion of the regional market.

Colombia has experienced rapid expansion in the biostimulants market due to a number of factors. First off, the desire for creative and sustainable agricultural solutions like bio-stimulants has been spurred by the nation's varied agricultural environment, which includes everything from the production of coffee and cut flowers to the cultivation of fruits and vegetables. The Colombian government has realised that biostimulants can boost agricultural output while having the least negative effects on the environment. As a result, it has put in place laws and policies that promote the use of bio stimulant goods, such as tax breaks and financing for research.

COVID-19 Impact Analysis on the Latin America Bio stimulants Market:

Travel bans and lockdowns affected the availability of raw materials and completed bio stimulant products in Latin America, upsetting global supply chains. Imports from important suppliers were severely hindered, especially from Asia. The timely delivery of biostimulants to farmers was hampered by delays in the transit of goods induced by border closures and transportation limitations. This might have affected particular crops' critical application windows. Travel restrictions and lockdowns led to a shortage of farm labour. Farmers may have found it more challenging to apply biostimulants as a result, especially when using labor-intensive application techniques like foliar spraying. The pandemic highlighted the importance of food security. Governments in some Latin American countries placed a greater emphasis on domestic food production, potentially leading to increased support for sustainable agricultural practices, which could benefit the biostimulants market.

Latest Trends/ Developments:

Research advancements are providing a deeper understanding of how different bio stimulant components interact with plants. This knowledge allows scientists to create targeted formulations with specific combinations of active ingredients. Advances in soil microbiome research are revealing the crucial role these organisms play in plant health. Precision biostimulants may incorporate specific microbial strains to enhance beneficial soil communities for targeted outcomes. Consumers are increasingly seeking out food produced using sustainable practices. Farmers utilizing organic biostimulants can cater to this growing demand and potentially command premium prices for their produce. Stricter environmental regulations in some Latin American countries are pushing farmers to adopt more sustainable practices. Organic biostimulants offer a viable solution in this context. Drone-based and automated applicator systems are being developed to enable precise application of biostimulants, minimizing waste and maximizing coverage.

Key Players:

- BASF

- Bayer

- Syngenta

- FMC

- Biotecnología Industrial

- Verde AgriTech

- Symborg

- Isagro

Chapter 1. Latin America Bio stimulants Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Bio stimulants Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Bio stimulants Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Bio stimulants Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Bio stimulants Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Bio stimulants Market– By Type

6.1. Introduction/Key Findings

6.2. Fruits & Vegetables

6.3. Row Crops (Corn, Soybeans)

6.4. Ornamental Plants

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Bio stimulants Market– By Active Ingredient

7.1. Introduction/Key Findings

7.2 Seaweed Extracts

7.3. Humic Acids

7.4. Amino Acids

7.5. Microbial Formulations

7.6. Y-O-Y Growth trend Analysis By Active Ingredient

7.7. Absolute $ Opportunity Analysis By Active Ingredient , 2024-2030

Chapter 8. Latin America Bio stimulants Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Active Ingredient

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Bio stimulants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF

9.2. Bayer

9.3. Syngenta

9.4. FMC

9.5. Biotecnología Industrial

9.6. Verde AgriTech

9.7. Symborg

9.8. Isagro

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing segment of consumers in Latin America, as elsewhere, are seeking out food produced using sustainable practices. Farmers utilizing biostimulants can contribute to a more sustainable food system, potentially commanding premium prices for their produce

While awareness is growing, some farmers, particularly small-scale producers, may still lack a deep understanding of the different types of biostimulants, their appropriate application methods, and the specific benefits they offer.

BASF, Bayer, Syngenta, FMC, Biotecnología Industrial, Verde AgriTech, Symborg, Isagro

Brazil emerges as the most dominant country in the Latin American Bio-stimulants Market, commanding a substantial 38.9% market share as of 2024

Colombia is emerging as the fastest-growing country in the region. With a remarkable growth rate of 10.2% from 2020 to 2024, Colombia's bio-stimulants industry is poised to capture an increasing share of the regional market.