Biostimulants Market Size (2024 – 2030)

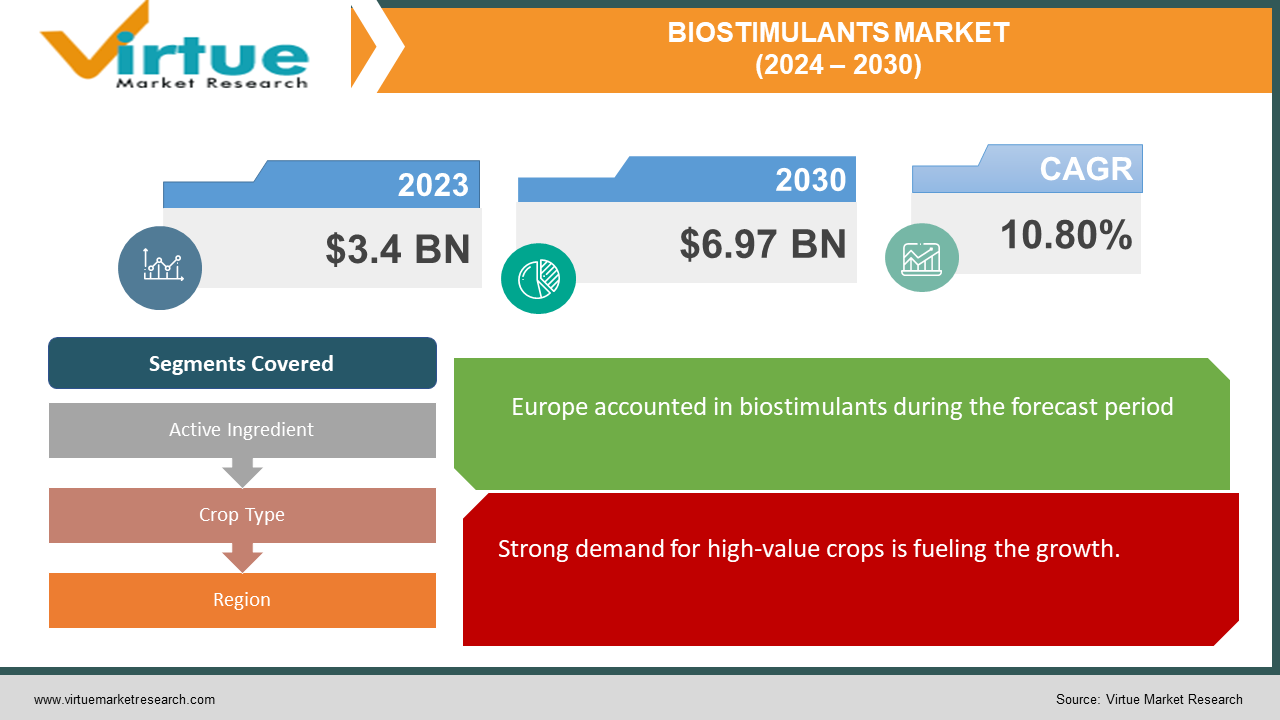

The biostimulants market was valued at USD 3.4 billion in 2023 and is projected to reach a market size of USD 6.97 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.80%.

Biostimulants are chemicals or microbes that encourage the rhizosphere's or plants' natural activities. They can support crop quality, abiotic stress tolerance, nutrient absorption, and efficient nutrient utilization. Moreover, biostimulants can encourage improved root germination and growth, which increases vigor and resilience to stress.

Key Market Insights:

Demand for biostimulants is driven by an emphasis on high-value crops, a move towards ecologically friendly farming methods, and strict laws governing chemical inputs, all of which encourage the use of biostimulants.Spurred by population growth and demand for organic food, the fruit and vegetable sector leads. Acid-based biostimulants lead growth, addressing soil health, nutrient availability, and water retention.North America adopts sustainable agriculture quickly due to farmer awareness and technological developments, while Europe leads market growth with robust policies supporting the practice. Research on new natural sources, integrating biostimulants with cutting-edge agricultural technology, and using biostimulants in combination to reduce abiotic stress are some examples of current innovation and potential market expansion.

Biostimulant Market Drivers:

Strong demand for high-value crops is fueling the growth.

The biostimulants market is driven by a combination of growth factors and their adoption. With the global shift towards sustainable agricultural practices, biostimulants have become important for increasing crop production while reducing environmental impact. Growing concerns about soil degradation, water scarcity, and climate change have led to the search for biostimulants as they provide solutions to improve soil health, nutrient production, and soil stability. In addition, strict regulations on chemical fertilizers and pesticides, along with growing consumer preference for organic products, have accelerated market expansion. Technological advances in methods and methods of application of biostimulants have also played an important role in market growth, providing farmers with effective and efficient solutions for crop management. As the agricultural sector continues to evolve towards sustainable and eco-friendly practices, the biostimulants market is poised for continued growth, offering promising opportunities for stakeholders.

Biostimulants Market Restraints and Challenges:

The biostimulants market faces several barriers and challenges that hinder its growth and widespread adoption. A serious challenge is the lack of standardized regulations governing biostimulant products, leading to uncertainty among producers and consumers regarding the quality and safety of products. In addition, the limited knowledge and understanding of biostimulants among farmers and producers creates barriers to market expansion. The high cost of biostimulant products compared to chemical fertilizers and pesticides hinders their adoption, especially among low-income farmers. The variability in the effectiveness of biostimulants across different crops, soil types, and environmental conditions presents a challenge to demonstrating consistent benefits, thereby affecting market confidence. Addressing these challenges will require a concerted effort by industry players, policymakers, and researchers to establish a clear regulatory framework, improve education and awareness, and improve the efficiency and capacity of products to unlock the potential of the biostimulants market. Meeting these challenges requires a balance between cost, environmental considerations, and technological progress, making it necessary for biostimulant marketers to manage these complexities for sustainable growth in market penetration.

Biostimulants Market Opportunities:

The biostimulants market presents a landscape with opportunities for innovation and sustainable practices. As global concerns for food security, environmental sustainability, and climate change intensify, the demand for solutions that improve crop production and reduce reliance on chemical inputs continues to grow. Grow-up Biostimulants, which have different organic and natural ingredients, offer a good way to solve these challenges. Their ability to improve nutrient absorption, stress tolerance, and overall plant health without leaving harmful substances is well suited to modern agricultural systems that support environmentally friendly, waste-free production methods. In addition, the increasing adoption of biostimulants by farmers in various cropping systems demonstrates their effectiveness and economic potential. With research and development continuing to focus on the restructuring of processes and the investigation of new materials, the biostimulants market is poised to undergo a major expansion, giving those with limited opportunities to contribute to sustainable agriculture.

BIOSTIMULANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.80% |

|

Segments Covered |

By Active Ingredient, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ASF SE, UPL, Gowan Group, ILSA S.p.A, Haifa Group, Rallis India Limited, FMC Corporation, Valagro S.p.A |

Biostimulants Market Segmentation: By Active Ingredient

-

Humic substances

-

Seaweed extracts

-

Microbial amendments

-

Amino acids

-

Acid-Based substances

-

Others

The acid-based biostimulants market segment is the largest due to several key factors. As agricultural practices develop in more sustainable ways, there is increasing attention to incorporating natural compounds such as humic and fulvic acids to improve crop productivity and resilience. These acids play an important role in improving soil structure, nutrient availability, and water retention, thereby increasing crop yields and reducing environmental stress. In addition, the growing awareness among farmers about the negative effects of chemical fertilizers and pesticides on soil health and ecological balance has boosted the demand for acid-based biostimulants as a safer alternative. This increasing acceptance of acid-based biostimulants is not only reshaping agricultural practices but also has a significant impact on the dynamics of the global biostimulant market. It contributes to market expansion by providing sustainable solutions that meet growing consumer preferences for environmentally friendly garden products. The amino acid segment of the biostimulants market is witnessing the fastest growth for several reasons. Amino acids, which are the building blocks of proteins, play an important role in the growth and development of plants. With an increasing focus on improving crop productivity and resilience to climate change, farmers are turning to amino acid-based biostimulants to improve nutrient absorption, stress tolerance, and overall plant health. The growing demand for sustainable agriculture promotes the adoption of amino acid biostimulants due to their natural origin and environmental profile.

Biostimulants Market Segmentation: By Crop Type

-

Cereals & grains

-

Fruits & vegetables

-

Turf & ornamentals

-

Oilseeds & pulses

-

Others

Based on the crop type, the fruit and vegetable sector dominates the market. Many factors are contributing to the growth of this segment, including the increase in the world's population, the changing diet for healthier options, and increasing awareness of the importance of eating fresh. In addition, the growing focus on sustainable agriculture and organic agriculture is increasing the demand for biostimulants in this area, as they provide a friendly solution to improve yield and quality. The impact of the fruit and vegetable segment on the global biostimulants market is profound, as it accounts for a significant share of the market. As consumer interest in natural and sustainable products continues, the demand for biostimulants in growing fruits and vegetables is expected to increase. The grain and grain sector is the fastest-growing, serving as an important resource for people around the world. As the world's population continues to increase, the demand for grain increases, putting more pressure on farmers to increase their productivity and yield. In response to this challenge, biostimulants are emerging as a key solution, providing a natural and sustainable method to promote plant growth and resilience. Biostimulants help to improve the absorption of food, raise the metabolism of plants, and reduce environmental stress, thereby promoting healthy, stronger corn. This growing reliance on biostimulants in the corn sector not only increases crop yields but also reduces the need for synthetic fertilizers and pesticides, in line with global changes in agriculture and the environment. Therefore, the increasing integration of biostimulants in the cultivation of corn has a significant impact on the global biostimulants market, promoting its growth characteristics as it becomes an important part of modern agricultural strategies.

Biostimulants Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe has the largest market share in 2023. First, strong legislation promoting sustainable agricultural practices promotes the adoption of biostimulants in the European agricultural sector. In addition, the increase in the number of consumers and the increasing demand for these processed foods led to the expansion of the market. Collaboration between research institutes, governments, and industry players promotes innovation, leading to the development of advanced biostimulant systems tailored to meet regional and crop needs. Furthermore, European stability and reduced environmental impact are consistent with the basic principles of using biostimulants, contributing to their acceptance and integration in many areas of traditional agriculture. As a result, the European segment serves as an important driver of growth and innovation in the global biostimulants market, setting trends and patterns that are replicated across continents. North America is the fastest-growing market. One important factor is the growing awareness among farmers about the benefits of biostimulants to improve crop quality and reduce environmental impact. Strict regulations on chemical fertilizers and pesticides encourage producers to look for sustainable alternatives, thus promoting the demand for biostimulants. Technological progress and innovations in biostimulant systems make these products more effective and accessible to different types of agriculture in the region. The growth of the North American biostimulants market is not only reshaping the agricultural sector but also has a significant impact on the global market. As North America is emerging as a major hub for biostimulant production and innovation, its growing market share and adoption rate are contributing to the growth and development of the global biostimulant industry.

COVID-19 Impact Analysis on the Biostimulants Market:

The COVID-19 pandemic has significantly influenced the biostimulants market, reshaping dynamics within the agricultural sector. While the crisis initially posed challenges due to disruptions in supply chains and logistical constraints, the overarching trend toward sustainable agriculture has amplified the demand for biostimulants. As farmers seek alternatives to traditional chemical inputs, biostimulants have emerged as a viable solution, offering benefits such as improved crop resilience and yield enhancement. Furthermore, the pandemic has heightened awareness regarding food security and the importance of sustainable production practices, prompting governments and agricultural stakeholders to prioritize investments in bio-based solutions. Despite the initial setbacks, the biostimulants market has demonstrated resilience, fueled by a growing recognition of their role in enhancing soil health, mitigating environmental impacts, and ensuring agricultural sustainability in the face of global challenges. As the world navigates through recovery phases, the biostimulants market is expected to witness continued growth and innovation, driven by evolving consumer preferences and regulatory initiatives promoting sustainable agriculture.

Latest Trends/ Developments:

The biostimulants market is witnessing changes and strong growth at the moment, which is promoted by developing agricultural systems and focusing more on sustainable solutions. Notable is the integration of biostimulants into the correct agricultural technology, as they play a key role in improving nutrient management and crop improvement. Another important development is the research and use of new methods obtained from natural sources, such as algae, harmful substances, and beneficial microbes, to reveal the effectiveness and a significant shift in biostimulant applications. In addition, there is a growing interest in combining biostimulants to reduce the negative effects of abiotic stress, including drought, salinity, and high temperatures, thus increasing crop productivity and resilience to climate change. As research continues to reveal the benefits of biostimulants and regulatory frameworks begin to accommodate their use, the market is poised for growth and innovation, shaping the future of sustainable agriculture.

Key Players:

-

ASF SE

-

UPL

-

Gowan Group

-

ILSA S.p.A

-

Haifa Group

-

Rallis India Limited

-

FMC Corporation

-

Valagro S.p.A

In May 2022, UPL Limited (India) launched a new solution, Zoatin, which effectively facilitates plant uptake and utilization of phosphorus to improve crop health and yield, was launched by UPL and Chr. Hansen Holdings A/S. Zoatin uses microbiological technology to provide phosphorus availability to the soil. This will help both companies penetrate the biostimulant market in several geographies.

In March 2022, Haifa Group (Israel) expanded to Ecuador by signing an agreement to acquire Horticoop Andina, a wholesaler of nutritional products for agriculture. This will help Haifa Group become a strong player in plant nutrition in Latin America.

Chapter 1. Biostimulants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biostimulants Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biostimulants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biostimulants Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biostimulants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biostimulants Market – By Active Ingredient

6.1 Introduction/Key Findings

6.2 Humic substances

6.3 Seaweed extracts

6.4 Microbial amendments

6.5 Amino acids

6.6 Acid-Based substances

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Active Ingredient

6.9 Absolute $ Opportunity Analysis By Active Ingredient, 2024-2030

Chapter 7. Biostimulants Market – By Crop Type

7.1 Introduction/Key Findings

7.2 Cereals & grains

7.3 Fruits & vegetables

7.4 Turf & ornamentals

7.5 Oilseeds & pulses

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Crop Type

7.8 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 8. Biostimulants Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Active Ingredient

8.1.3 By Crop Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Active Ingredient

8.2.3 By Crop Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Active Ingredient

8.3.3 By Crop Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Active Ingredient

8.4.3 By Crop Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Active Ingredient

8.5.3 By Crop Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biostimulants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ASF SE

9.2 UPL

9.3 Gowan Group

9.4 ILSA S.p.A

9.5 Haifa Group

9.6 Rallis India Limited

9.7 FMC Corporation

9.8 Valagro S.p.A

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The biostimulants market was valued at USD 3.4 billion in 2023 and is projected to reach a market size of USD 6.97 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.80%.

Strong demand for high-value crops is driving the biostimulants market.

Based on active ingredients, the biostimulants market is segmented into humic substances, seaweed extracts, microbial amendments, amino acids, and others.

Europe is the most dominant region for the biostimulant market.

BASF SE, UPL, Gowan Group, ILSA S.p.A., Haifa Group, Rallis India Limited, FMC Corporation, and Valagro S.p.A. are the major players in the biostimulants market.