Latin America Alginates Market Size (2024-2030)

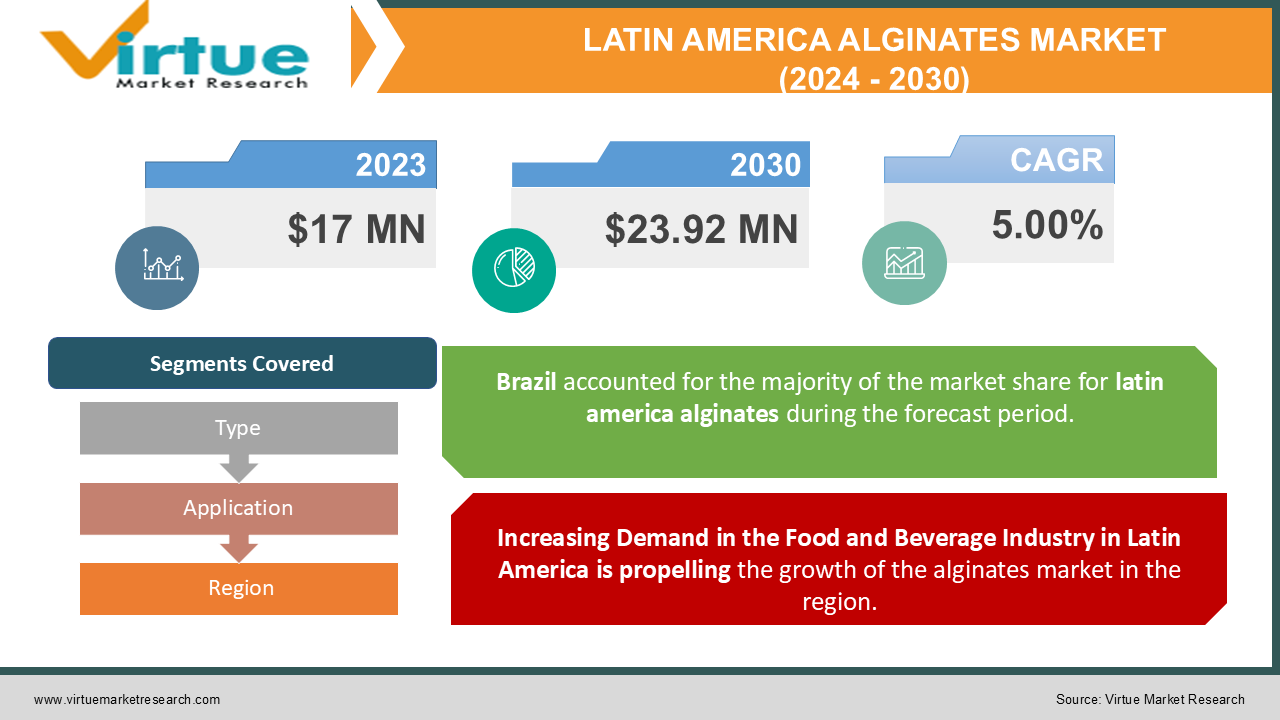

The Latin America Alginates Market was valued at USD 17 Million in 2023 and is projected to reach a market size of USD 23.92 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.00%.

The Latin American alginates market is experiencing robust growth, driven by increasing demand across diverse industries such as food and beverage, pharmaceuticals, and cosmetics. Alginates, extracted from brown seaweed, find extensive applications as thickeners, stabilizers, and gelling agents in various food products. The region's expanding food industry, coupled with a rising inclination towards natural and plant-based ingredients, fuels the demand for alginates as a versatile and sustainable solution. The pharmaceutical and cosmetic sectors are incorporating alginates for their unique properties, contributing to the overall market growth. The market is characterized by the presence of key players focusing on product innovation and sustainable sourcing practices, reflecting a response to the growing consumer preference for clean-label and environmentally friendly products in Latin America.

Key Market Insights:

Algae, encompassing microalgae, represent photosynthetic organisms renowned for their potential to produce dietary foods with high protein content and various nutritional advantages. This makes them a sought-after ingredient in the formulation of dietary supplements, cosmetics, functional food and beverage products, and animal feed. Beyond their protein-rich composition, algae and microalgae harbor diverse bioactive components, contributing to enhanced health benefits. Microalgae, compared to many plant species, boast higher pigment concentrations.

The proteins derived from algae exhibit comprehensive essential amino acid profiles, surpassing conventional sources like meat, poultry, and dairy products in protein content. Many microalgae species are recognized for their richness in proteins, carbohydrates, lipids, and various bioactive compounds. Some microalgae-derived components, including peptides, have been associated with antioxidative, antihypertensive, immunomodulatory, anticancerogenic, hepato-protective, and anticoagulant activities.

According to Becker et al., microalgae emerge as excellent sources of vitamins such as A, B1, B2, B6, B12, C, and E, as well as essential minerals including potassium, iron, magnesium, calcium, and iodine. Furthermore, their composition includes potent probiotic compounds, fostering immune system strength, aiding detoxification, and promoting energy levels.

Latin America Alginates Market Drivers:

Increasing Demand in the Food and Beverage Industry in Latin America is propelling the growth of the alginates market in the region.

The growing food and beverage industry in Latin America is a significant driver for the alginates market. Alginates serve as essential ingredients in various food products due to their versatile properties as thickeners, stabilizers, and gelling agents. The rising consumer demand for convenience foods, processed foods, and dairy products contributes to the increasing use of alginates by manufacturers to improve texture, enhance shelf life, and stabilize formulations. The trend towards natural and plant-based ingredients in the food industry aligns with alginates' natural origin from seaweed, further boosting their popularity in the region.

Expanding Applications in Pharmaceuticals and Cosmetics is expanding the demand for alginates in Latin America.

The pharmaceutical and cosmetic industries in Latin America are experiencing significant growth, and alginates are finding increased application in these sectors. Alginates are valued for their biocompatibility, gelling capabilities, and film-forming properties, making them suitable for various pharmaceutical and cosmetic formulations. In pharmaceuticals, alginates are used in drug delivery systems, wound care products, and dental applications. In the cosmetics industry, alginates contribute to the formulation of skin care products, masks, and hair care items. The expanding awareness of natural and sustainable ingredients in pharmaceuticals and cosmetics enhances the demand for alginates, driving market growth in Latin America.

Latin America Alginates Market Restraints and Challenges:

Dependency on the Seaweed Supply Chain is a major growth-limiting factor for the Latin America Alginates market.

The primary source of alginates is brown seaweed, and the market's growth is inherently tied to the seaweed supply chain. Variabilities in seaweed availability due to factors such as climate change, environmental conditions, and geopolitical issues can pose a challenge to the consistent and reliable production of alginates. Any disruptions in the seaweed supply chain can impact the stability of prices and the availability of alginates, affecting the market's overall performance. To mitigate this challenge, companies in the industry need to establish resilient and diversified supply chains, explore sustainable seaweed cultivation practices, and closely monitor environmental factors that could impact seaweed resources.

Stringent Regulatory Environment issues pose a hindrance to the growth of this market.

The alginate market is subject to stringent regulatory standards, especially in the food and pharmaceutical sectors where these ingredients are widely used. Compliance with quality and safety regulations, as well as addressing concerns related to potential impurities or contaminants in alginates, poses a challenge for market players. Navigating through complex regulatory frameworks, ensuring product conformity, and obtaining necessary certifications can be time-consuming and costly.

Latin America Alginates Market Opportunities:

The Latin American alginates market presents compelling growth opportunities, driven by increasing consumer demand for natural and plant-based ingredients across various industries. With a rising awareness of the health and environmental benefits associated with alginates, there is a significant opportunity for market players to capitalize on the expanding food and beverage, pharmaceutical, and cosmetic sectors. The versatile applications of alginates, including their use as thickeners, stabilizers, and emulsifiers, align with the region's evolving consumer preferences for clean-label products. Leveraging advancements in technology for sustainable seaweed cultivation and extraction processes can further enhance the market's potential. As Latin American consumers increasingly prioritize health-conscious and environmentally friendly choices, companies in the alginates sector are well-positioned to innovate and meet the growing demand for natural and sustainable ingredients in the region.

LATIN AMERICA ALGINATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.00% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Brazil, Argentina, Colombia, Chile, Rest of Latin America |

|

Key Companies Profiled |

Algaetech, DuPont de Nemours, Inc., KIMICA Corporation, Cargill, Inc., Algas Brasil, Foodchem International Corporation |

Latin America Alginates Market Segmentation:

Latin America Alginates Market Segmentation: By Type

- Sodium Alginate

- Calcium Alginate

- Potassium Alginate

The largest segment in the Latin American alginates market is Sodium Alginate which has a huge market share of 79%. This dominance is attributed to the extensive utilization of sodium alginate in the food and beverage industry, where it serves as a versatile gelling and thickening agent. Its widespread application in products such as dairy, sauces, and desserts, along with its ability to improve texture and stability, makes sodium alginate a key ingredient in the region's culinary landscape. The growing consumer preference for natural and plant-based additives aligns with sodium alginate's profile, further propelling its prominence in the Latin American market. The fastest-growing segment in the Latin American alginates market by type is also Sodium Alginate expanding at a rate of 23%. This growth is propelled by the widespread adoption of sodium alginate in the food and beverage industry for its exceptional gelling, thickening, and stabilizing properties. As consumer preferences for natural and plant-based ingredients continue to surge, sodium alginate, derived from brown seaweed, aligns with the clean-label trend. Its versatility in applications such as dairy products, sauces, and confectionery, further increases its demand.

Latin America Alginates Market Segmentation: By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics

- Others

The largest segment by application in the Latin American alginates market is the Food and Beverage industry which has a market share of 74%, due to the widespread use of alginates as crucial functional ingredients in the food sector. Alginates, particularly sodium alginate, serve as effective gelling agents, thickeners, and stabilizers, enhancing the texture and stability of a variety of food products. With the rising demand for natural and plant-based ingredients in the food industry, alginates are increasingly preferred for their versatility and clean-label appeal. The growing popularity of convenience foods and the expanding consumer interest in novel textures and culinary experiences further drive the significant uptake of alginates in the Latin American food and beverage sector. The fastest-growing segment in the Latin America alginates market by application is the pharmaceuticals sector expected to grow at a CAGR of 13.4%. This growth is propelled by the increasing utilization of alginates in pharmaceutical applications, particularly in drug delivery systems and wound care products. The unique properties of alginates, such as biocompatibility and the ability to form gels, make them valuable in creating controlled-release formulations and effective wound dressings. The rising prevalence of chronic diseases, coupled with advancements in pharmaceutical research and development, is driving the demand for alginates in the pharmaceutical sector.

Latin America Alginates Market Segmentation: Regional Analysis

- Brazil

- Argentina

- Colombia

- Chile

- Rest of Latin America

Brazil stands out as the largest in the Latin American alginates market having a market share of 42%. This dominance is attributed to Brazil's substantial share in the overall Latin American economy and its robust food and beverage industry. With a populous consumer base and a thriving food sector, the demand for alginates in Brazil is driven by the increasing adoption of natural ingredients and the growing trend toward innovative and processed food products. Brazil's expanding pharmaceutical and cosmetic industries contribute to the significant consumption of alginates, making it a key player in the regional market. The Rest of Latin America region is anticipated to be the fastest-growing segment in the alginates market. The Rest of Latin America, encompassing countries like Mexico, Colombia, and Peru, holds immense growth potential. The expanding food and beverage industry, coupled with increasing consumer awareness of the benefits of natural and plant-based ingredients, is fueling the demand for alginates in various applications. The pharmaceutical and cosmetics sectors in these countries are showing a rising inclination toward alginates for their diverse applications.

COVID-19 Impact Analysis on the Latin America Alginates Market:

The Latin American alginates market, like many other sectors, has encountered challenges and opportunities amid the COVID-19 pandemic. The initial disruptions in supply chains and manufacturing processes affected production and distribution, causing temporary setbacks. The pandemic-induced shift towards health and wellness consciousness has driven the demand for natural and plant-based ingredients, positively impacting the alginates market. The food and beverage industry's resilience, coupled with an increased focus on pharmaceutical and cosmetic applications, has provided avenues for market recovery. As economies gradually reopen and consumer preferences continue to align with cleaner labels, the Latin American alginates market is poised for a rebound, with innovation and sustainability likely to play pivotal roles in shaping its post-pandemic trajectory.

Latest Trends/ Developments:

A prominent trend in the Latin American alginates market is the increasing consumer preference for plant-based and natural ingredients. There is a growing awareness of health and environmental considerations, leading consumers to seek clean-label products. Alginates, derived from brown seaweed, align with this trend as a natural and sustainable ingredient. The trend is driving food, pharmaceutical, and cosmetic industries in the region to incorporate alginates in their formulations, meeting the rising demand for products perceived as healthier and environmentally friendly.

A significant development in the Latin American alginates market is the ongoing technological advancements in the extraction processes of alginates. Continuous innovation in extraction methods is enhancing the efficiency of production, ensuring higher purity levels, and reducing environmental impact. Improved extraction technologies contribute to the overall sustainability of alginates, aligning with the growing emphasis on eco-friendly practices. This development not only enhances the quality of alginates but also addresses concerns related to resource utilization and environmental conservation in the production process.

Key Players:

- Algaetech

- DuPont de Nemours, Inc.

- KIMICA Corporation

- Cargill, Inc.

- Algas Brasil

- Foodchem International Corporation

Chapter 1. Latin America Alginates Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Alginates Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Alginates Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Alginates Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Alginates Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Alginates Market– By Type

6.1. Introduction/Key Findings

6.2. Sodium Alginate

6.3. Calcium Alginate

6.4. Potassium Alginate

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Latin America Alginates Market– By Application

7.1. Introduction/Key Findings

7.2. Food & Beverage

7.3. Pharmaceuticals

7.4. Cosmetics

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Latin America Alginates Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Alginates Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Algaetech

9.2. DuPont de Nemours, Inc.

9.3. KIMICA Corporation

9.4. Cargill, Inc.

9.5. Algas Brasil

9.6. Foodchem International Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Latin America Alginates Market was valued at USD 17 Million in 2023 and is projected to reach a market size of USD 23.92 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.00%.

Increasing Demand in the Food and Beverage Industry in Latin America and Expanding Applications in Pharmaceuticals and Cosmetics are drivers of the Latin American alginates market.

Based on type, the Latin America Alginates Market is segmented into Sodium Alginate, Calcium Alginate, and Potassium Alginate

Brazil is the most dominant region for the Latin America Alginates Market

Algaetech, DuPont de Nemours, Inc., KIMICA Corporation, and Cargill, Inc. are a few of the key players operating in the Latin America Alginates Market.