Europe Alginates Market Size (2024-2030)

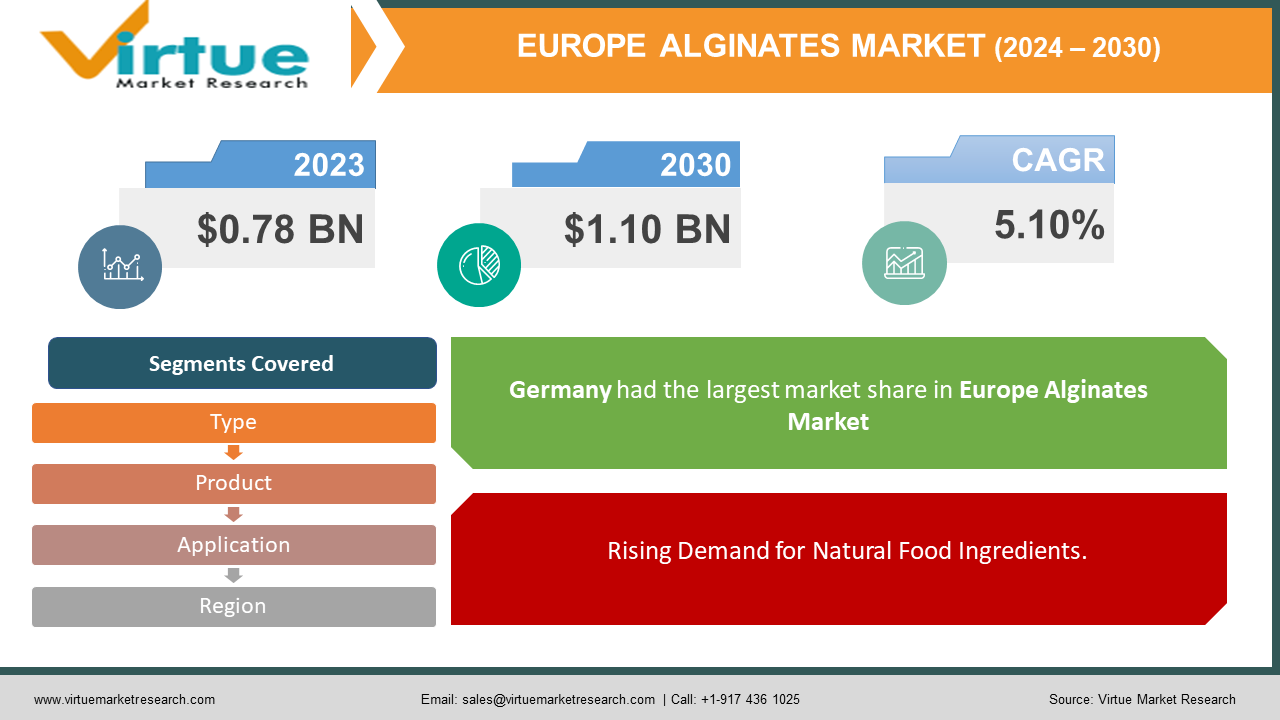

The Europe Alginates Market was valued at USD 0.78 billion in 2023 and is projected to reach a market size of USD 1.10 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.10 % between 2024 and 2030.

The Europe alginates market is poised for significant growth, driven by the diverse applications and increasing demand across various industries. Alginates, natural polysaccharides derived from brown seaweed, have become essential due to their versatile properties such as gelling, thickening, and stabilizing. These unique characteristics have led to widespread use in food and beverage production, pharmaceuticals, cosmetics, and even in biotechnological fields. The market is bolstered by the rising consumer preference for natural and sustainable ingredients, aligning with the broader trend towards eco-friendly and health-conscious products. Additionally, advancements in extraction and processing technologies have enhanced the quality and functionality of alginates, further expanding their application scope. In the food industry, alginates are increasingly utilized in dairy products, bakery items, and meat processing for their ability to improve texture and shelf-life. In pharmaceuticals, their biocompatibility and ability to form hydrogels make them valuable for drug delivery systems. As Europe continues to emphasize innovation and sustainability, the alginates market is expected to experience robust growth, supported by ongoing research and development efforts and strategic collaborations among key industry players. This dynamic market landscape presents numerous opportunities for stakeholders aiming to capitalize on evolving consumer preferences and technological advancements.

Key Market Insights:

- Sodium alginate dominates market share, likely exceeding 50% due to its versatility across industries.

- Food & Beverages is the largest application segment, potentially over 70% of the market share, due to its use as a thickener, gelling agent, and stabilizer in various food products.

- Significant growth in research and development efforts to optimize alginate use across industries, indicating potential for future market expansion.

- Potassium alginate is gaining popularity in Europe as a substitute for sodium alginate due to a growing preference for lower-sodium diets.

- Leading countries with significant market shares include Germany, the UK, and France; other European nations contribute a smaller portion.

- Alginate production can be affected by weather conditions impacting seaweed growth, and influencing market stability.

Europe Alginates Market Drivers:

Rising Demand for Natural Food Ingredients.

European consumers are increasingly interested in natural and organic food products, a trend that significantly boosts the demand for alginates. Derived from brown algae, alginates are prized for their natural origin and versatile properties, fitting perfectly into the growing market for clean-label ingredients. These natural polysaccharides are used extensively in the food industry for their gelling, thickening, and stabilizing capabilities, making them ideal for enhancing the texture and shelf-life of various food products such as dairy items, bakery goods, and processed meats. The shift towards health-conscious and environmentally sustainable eating habits is fueling this demand, as consumers seek food products that align with their values of naturalness and sustainability. Furthermore, regulatory bodies in Europe are increasingly supporting the use of natural additives, further encouraging manufacturers to adopt alginates. This heightened interest is not only driven by individual health concerns but also by a broader awareness of environmental impact, leading to a preference for ingredients sourced from renewable resources. As the trend for natural food ingredients continues to gain momentum, the alginate market in Europe is set to experience substantial growth, presenting significant opportunities for producers and innovators in the food industry.

Growth of the Food Industry.

The European food industry is on a trajectory of steady growth, driven by a combination of factors such as a large and diverse population, rising disposable incomes, and high levels of food consumption. This robust expansion is set to naturally amplify the demand for food additives, including alginates, which are essential for their functional properties as thickeners, gelling agents, and emulsifiers. As consumers increasingly seek out high-quality, convenient, and innovative food products, manufacturers are relying more on versatile additives like alginates to enhance product appeal and performance. The surge in processed and ready-to-eat food segments, alongside the growing trend towards health-oriented and functional foods, further propels the utilization of alginates in the industry. Additionally, the dynamic food service sector, catering to both domestic and international culinary preferences, underscores the need for reliable and efficient food additives. Alginates, derived from sustainable brown algae, not only meet these technical requirements but also align with the rising consumer demand for natural and eco-friendly ingredients. Consequently, as the European food industry continues to expand and evolve, the demand for alginates is expected to rise significantly, offering ample growth opportunities for producers and suppliers within this thriving market.

Europe Alginates Market Restraints and Challenges:

Despite the promising growth prospects, the Europe alginates market faces several restraints and challenges that could impede its development. One of the primary challenges is the fluctuating availability and cost of raw materials, as alginates are derived from brown seaweed, which is subject to environmental and climatic conditions. This variability can lead to supply chain disruptions and increased production costs, affecting the stability of supply for manufacturers. Additionally, stringent regulatory frameworks governing food additives in Europe can pose significant hurdles. Compliance with these regulations requires extensive testing and documentation, leading to higher costs and longer time-to-market for new products. Furthermore, the competitive landscape within the food additives market presents challenges, with alginates competing against synthetic alternatives and other natural thickeners and stabilizers that may offer cost advantages or different functional benefits. Market penetration is also hindered by a lack of consumer awareness about the specific benefits of alginates compared to other additives, necessitating ongoing education and marketing efforts. Lastly, sustainability concerns related to seaweed harvesting practices may lead to stricter environmental regulations, potentially impacting alginate production. Addressing these challenges requires strategic planning, innovation, and collaboration among stakeholders to ensure the sustainable growth of the alginates market in Europe.

Europe Alginates Market Opportunities:

The Europe alginates market is poised for significant growth, driven by the diverse applications and increasing demand across various industries. Alginates, natural polysaccharides derived from brown seaweed, have become essential due to their versatile properties such as gelling, thickening, and stabilizing. These unique characteristics have led to widespread use in food and beverage production, pharmaceuticals, cosmetics, and even in biotechnological fields. The market is bolstered by the rising consumer preference for natural and sustainable ingredients, aligning with the broader trend towards eco-friendly and health-conscious products. Additionally, advancements in extraction and processing technologies have enhanced the quality and functionality of alginates, further expanding their application scope. In the food industry, alginates are increasingly utilized in dairy products, bakery items, and meat processing for their ability to improve texture and shelf-life. In pharmaceuticals, their biocompatibility and ability to form hydrogels make them valuable for drug delivery systems. As Europe continues to emphasize innovation and sustainability, the alginates market is expected to experience robust growth, supported by ongoing research and development efforts and strategic collaborations among key industry players. This dynamic market landscape presents numerous opportunities for stakeholders aiming to capitalize on evolving consumer preferences and technological advancements.

EUROPE ALGINATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.10% |

|

Segments Covered |

By Product, Type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

FMC Corporation, KIMICA Corporation, Cargill, Incorporated, Marine Biopolymers Ltd., Algaia, Döhler GmbH, DuPont de Nemours, Inc., Kappa Bioscience AS, Dow Chemical Company, Ashland Global Holdings Inc. |

Europe Alginates Market Segmentation:

Europe Alginates Market Segmentation By Product:

- Sodium Alginate

- Calcium Alginate

- Potassium Alginate

- Propylene Glycol Alginate

The Europe Alginates Market Segmented by Product, Sodium Alginate had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Sodium alginate stands out as a highly versatile ingredient across several industries, including food and beverage, pharmaceuticals, and textiles. Its functional properties as a thickener, gelling agent, and stabilizer make it indispensable in food production, finding application in a wide array of products such as jams, jellies, and ice creams. Despite the growing preference for reducing sodium intake in Europe, sodium alginate remains favored due to its established functionalities. While alternatives like potassium alginate exist, the versatility and efficacy of sodium alginate in various applications solidify its dominant market share. Although other alginate types such as calcium and potassium offer their own unique properties, sodium alginate's longstanding use and recognized functional benefits ensure its continued prominence in industries where its multifaceted characteristics are crucial for product development and quality assurance. This entrenched position underscores sodium alginate's resilience and enduring appeal, maintaining its status as a key ingredient in diverse industrial processes across Europe and beyond.

Europe Alginates Market Segmentation By Type:

- High M

- High G

The Europe Alginates Market Segmented by Type, High M had the largest market share last year and is poised to maintain its dominance throughout the forecast period. While sodium and calcium alginate types frequently take precedence in discussions within readily available market reports, the lesser-discussed "High M" and "High G" alginate variations are pivotal for a holistic comprehension of the European alginate market. Divergent insights regarding the market share of these types, notably "High G," create a nuanced landscape. Certain reports indicate that "High G" commands a significant majority share, surpassing 50% in the global market, a trend likely echoed in the European market. However, to validate these assertions and attain a clearer understanding of the market dynamics, a deeper exploration into specialized market reports concentrating on the European alginate market segmentation by type, specifically "High M" and "High G," is imperative. Scrutinizing reports from reputable market research firms offering comprehensive data and analysis can elucidate the prevalence and influence of High M and High G alginate types within Europe.

Europe Alginates Market Segmentation By Application:

- Food and Beverages

- Pharmaceutical

- Industrial

The Europe Alginates Market Segmented by Application, Food, and Beverages had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Alginates are extensively utilized in food applications owing to their multifunctional properties, serving as thickeners, gelling agents, stabilizers, and emulsifiers in various food products such as jams, jellies, ice creams, dairy alternatives, and beverages. The European market is experiencing a surge in demand for convenient and processed food items, wherein alginates play a pivotal role in enhancing texture, stability, and shelf life. Furthermore, the escalating preference for natural and clean-label ingredients among consumers aligns perfectly with alginates' origin from seaweed, bolstering their adoption in the food sector. Although the Food and Beverages segment likely commands the lion's share in the utilization of alginates due to the sheer volume and variety of applications, other segments like pharmaceuticals and textiles show potential for accelerated growth. Particularly in pharmaceuticals, emerging applications such as wound healing and drug delivery could contribute to higher growth rates, diversifying the utilization of alginates beyond traditional food applications. Despite the dominance of the Food and Beverages segment, the expanding scope of alginates across various industries underscores their versatility and significance in modern manufacturing processes.

Europe Alginates Market Segmentation By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The Europe Alginates Market Segmented by Region, Germany had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Germany emerges as a significant player in industries heavily reliant on alginates, such as food processing, pharmaceuticals, and textiles. This robust industrial base corresponds to a heightened demand for alginates within the country. Supported by market research, reports like the one by Market Research Future indicate Germany's prominence, highlighting it as the fastest-growing market for alginates in Europe. While such reports may not explicitly state Germany's largest market share, the country's industrial landscape suggests a compelling case for its leadership position in the European Alginates Market. However, definitive confirmation necessitates thorough research encompassing a breakdown of market share by region within Europe. By delving deeper into market dynamics, growth trajectories, and industry trends, stakeholders can elucidate Germany's contribution to the overall European alginate market and its potential as a frontrunner. This comprehensive analysis will provide valuable insights for strategic decision-making and investments tailored to the prevailing market conditions within Germany and across Europe.

COVID-19 Impact Analysis on the Europe Alginates Market.

The COVID-19 pandemic significantly impacted the Europe alginates market, presenting both challenges and opportunities across various segments. The widespread disruptions in supply chains, logistics, and manufacturing operations disrupted the production and distribution of alginates, leading to temporary shortages and delays in product availability. Additionally, the implementation of stringent lockdown measures and social distancing protocols resulted in reduced consumer spending and disrupted demand patterns, particularly in sectors such as food service and hospitality, which are major consumers of alginates. However, amidst these challenges, the pandemic also underscored the importance of food safety and hygiene, driving heightened demand for packaged and processed foods, where alginates are widely utilized as thickeners, stabilizers, and emulsifiers. Furthermore, the increased focus on health and wellness during the pandemic prompted consumers to seek out natural and clean-label ingredients, aligning with the natural origin of alginates derived from seaweed. As the region gradually recovers from the pandemic and economic activities resume, the Europe alginates market is expected to rebound, driven by ongoing innovation, shifting consumer preferences, and the resumption of demand from key end-use industries.

Latest trends / Developments:

In the Europe alginates market, several noteworthy trends and developments are shaping the industry landscape. Firstly, there is a growing emphasis on sustainability and eco-friendliness, driving increased adoption of alginates derived from seaweed, a renewable resource. This trend aligns with consumers' preferences for natural and clean-label ingredients, boosting demand across various applications in food, pharmaceuticals, and cosmetics. Additionally, technological advancements in extraction and processing techniques are enhancing the quality and functionality of alginates, expanding their application scope, and driving innovation in product formulations. Moreover, the COVID-19 pandemic has highlighted the importance of food safety and hygiene, leading to a surge in demand for packaged and processed foods, where alginates play a crucial role as thickeners, stabilizers, and emulsifiers. Furthermore, the rise of alternative protein sources and plant-based diets is driving the adoption of alginates in meat and dairy alternatives, further diversifying their application portfolio. As the market continues to evolve, stakeholders are increasingly focusing on product differentiation, sustainability, and innovation to capitalize on emerging opportunities and meet evolving consumer preferences, driving the Europe alginates market towards continued growth and expansion.

Key Players:

- FMC Corporation

- KIMICA Corporation

- Cargill, Incorporated

- Marine Biopolymers Ltd.

- Algaia

- Döhler GmbH

- DuPont de Nemours, Inc.

- Kappa Bioscience AS

- Dow Chemical Company

- Ashland Global Holdings Inc.

Chapter 1. Europe Alginates Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Alginates Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Alginates Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Alginates Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Alginates Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Alginates Market– By Product

6.1. Introduction/Key Findings

6.2. Sodium Alginate

6.3. Calcium Alginate

6.4. Potassium Alginate

6.5. Propylene Glycol Alginate

6.6. Y-O-Y Growth trend Analysis By Product

6.7. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. Europe Alginates Market– By Type

7.1. Introduction/Key Findings

7.2 High M

7.3. High G

7.4. Y-O-Y Growth trend Analysis By Type

7.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Europe Alginates Market– By Application

8.1. Introduction/Key Findings

8.2. Food and Beverages

8.3 Pharmaceutical

8.4. Industrial

8.4. Y-O-Y Growth trend Analysis Application

8.5. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Europe Alginates Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product

9.1.3. By Type

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Alginates Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 FMC Corporation

10.2. KIMICA Corporation

10.3. Cargill, Incorporated

10.4. Marine Biopolymers Ltd.

10.5. Algaia

10.6. Döhler GmbH

10.7. DuPont de Nemours, Inc.

10.8. Kappa Bioscience AS

10.9. Dow Chemical Company

10.10. Ashland Global Holdings Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the Europe Alginates market is expected to be valued at US$ 0.78 billion.

Through 2030, the Europe Alginates market is expected to grow at a CAGR of 5.10 %.

By 2030, the Europe Alginates Market is expected to grow to a value of US$ 1.1 billion.

Germany is predicted to lead the Europe Alginates market.

The Europe Alginates Market has segments By Type, Application, Product Distribution Channel, and Region.