Latin America Agriculture Drones Market Size (2023-2030)

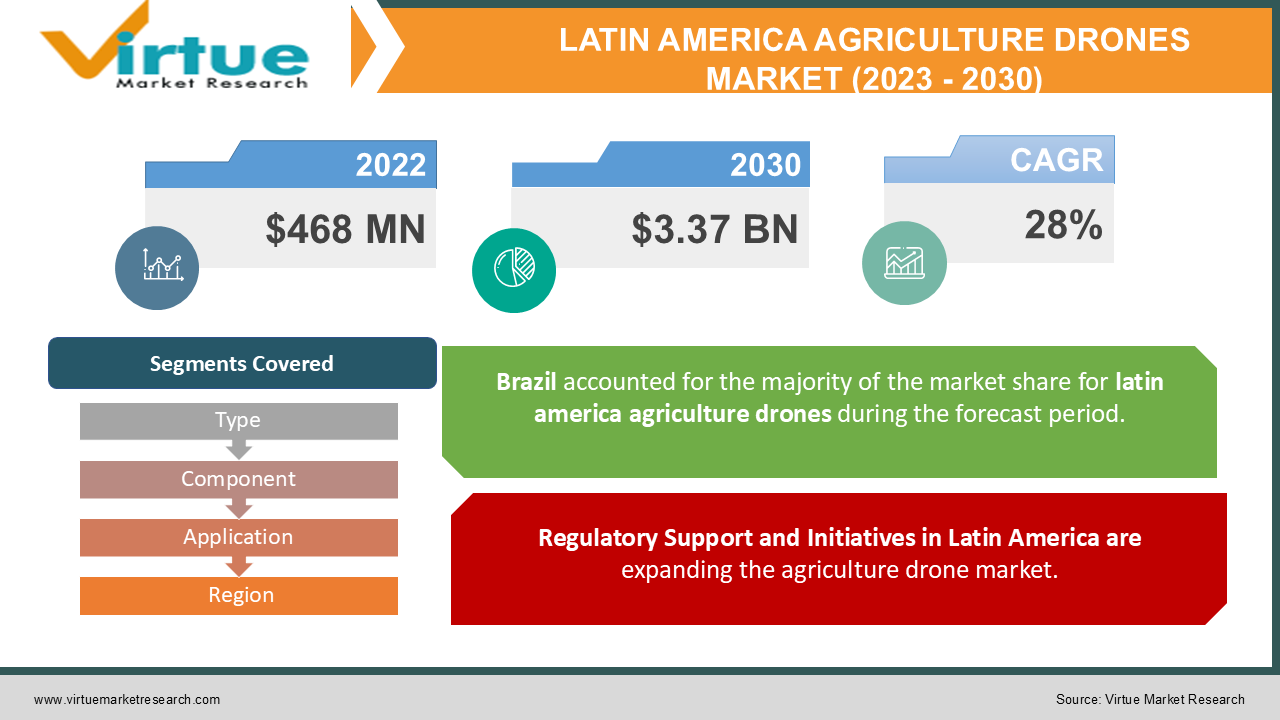

The Latin America Agriculture Drones Market was valued at USD 468 Million in 2022 and is projected to reach a market size of USD 3.37 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 28%.

The Latin American agriculture drone market is witnessing significant growth and transformation as precision agriculture becomes increasingly crucial in the region. With advancements in technology and the adoption of drones, farmers across Latin America are optimizing their crop management processes. These drones offer capabilities such as crop monitoring, soil analysis, and pesticide spraying, enhancing agricultural productivity and resource management. Factors driving the market include the need for efficient land use, improved crop yields, and sustainable farming practices. Moreover, government initiatives and supportive policies are further propelling the adoption of agriculture drones in Latin America, making it a burgeoning market for precision agriculture solutions.

Key Market Insights:

In Brazil, the count of officially registered drones has witnessed an increase in recent years, reaching approximately 80,000 registered units by December 2019.

As of August 2019, DJI, a Chinese company, dominated the market as the most preferred manufacturer of agricultural drones in Brazil. As of now, DJI agriculture's agricultural drones have been deployed across more than 2.6 million acres of farmland in Latin America, serving a diverse range of crops such as coffee, sugarcane, melons, corn, and various others throughout South America.

In 2020, the agricultural industry in Haiti made a substantial contribution, accounting for around 20.4 percent of the total value added to the country's GDP, marking the highest reported contribution in the Latin America region.

Ecuador, the world's leading banana exporter, faces challenges in effectively spraying pesticides on its tall banana trees. Traditional fixed-wing aircraft pose contamination risks to nearby rivers and communities due to proximity. Consequently, the Ecuadorian government has advocated for precise drone-based aerial spraying to mitigate river pollution concerns.

Latin America Agriculture Drones Market Drivers:

Precision Agriculture Adoption is significantly increasing the agriculture drone market in Latin America.

Precision agriculture, also known as smart farming, has witnessed widespread adoption as a key driver for the agricultural drone market. Farmers and agricultural enterprises are increasingly embracing technology-driven solutions to optimize crop management and improve yields. Agricultural drones play a pivotal role in this transformation by offering capabilities such as remote sensing, data analytics, and precise crop monitoring. They provide farmers with real-time information about crop health, soil conditions, and irrigation needs, enabling data-driven decision-making. This data-driven approach helps in reducing resource wastage, optimizing fertilizer and pesticide application, and ultimately increasing agricultural productivity. Precision agriculture not only enhances crop yields but also contributes to sustainable farming practices, making agricultural drones a valuable tool in modern agriculture.

Regulatory Support and Initiatives in Latin America are expanding the agriculture drone market.

Another significant driver for the agricultural drone market is the regulatory support and initiatives by governments and aviation authorities in various countries. Recognizing the potential benefits of drones in agriculture, many governments have introduced regulations and policies to facilitate their safe and responsible use in farming operations. These regulations often include streamlined processes for obtaining licenses or permits to operate agricultural drones. Additionally, government initiatives and subsidies aimed at promoting the adoption of drone technology in agriculture have boosted market growth. Farmers are incentivized to invest in agricultural drones due to financial support and favorable regulatory frameworks. Such support not only accelerates market adoption but also contributes to the expansion of the agricultural drone ecosystem.

Latin America Agriculture Drones Market Restraints and Challenges:

High Initial Costs and Limited Access to Capital could limit the growth of the agriculture drone market.

One of the primary restraints in the Latin American agriculture drone market is the high initial cost associated with acquiring and implementing drone technology. The expense includes purchasing the drone itself, specialized sensors, software for data analysis, and training for operators. Many farmers in Latin America, especially those with smaller land holdings or limited financial resources, may find it challenging to invest in such technology. Additionally, securing loans or capital for agricultural drone adoption can be difficult, as financial institutions may be cautious about lending to farmers without a track record of drone use. This financial barrier restricts the widespread adoption of agricultural drones, particularly among small-scale farmers, who make up a significant portion of the agricultural landscape in Latin America.

Regulatory and Legal Challenges pose hindrances in Latin America's agriculture drone market.

Latin American countries often have complex regulatory frameworks related to drone operation, and these regulations can vary significantly from one country to another. The lack of standardized and clear regulations can be a significant restraint for agricultural drone adoption. Farmers and drone operators face challenges in navigating these regulations, obtaining the necessary permits, and ensuring compliance with aviation and privacy laws. Additionally, there can be concerns about data privacy and land ownership when collecting and analyzing agricultural data with drones. Legal uncertainties and the potential for fines or legal disputes deter some farmers from embracing this technology. To overcome these challenges, there is a need for standardized and farmer-friendly regulations, as well as increased awareness and education on compliance and best practices in agricultural drone use.

Latin America Agriculture Drones Market Opportunities:

The Latin America Agriculture Drones Market holds substantial opportunities for growth, primarily driven by the region's vast agricultural sector and the increasing need for precision farming practices. Opportunities lie in the provision of cost-effective and accessible drone solutions tailored to the specific needs of small-scale and large-scale farmers. These drones can offer valuable insights into crop health, soil conditions, and irrigation requirements, helping farmers optimize resource utilization and increase yields. Additionally, there is potential for the development of localized data analytics and AI solutions to enhance decision-making processes in agriculture, further bolstering the adoption of drones across the region.

LATIN AMERICA AGRICULTURE DRONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

2.6% |

|

Segments Covered |

By Type, Component, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, Rest of Latin America |

|

Key Companies Profiled |

XMobots , Aibotix LatAm , DroneFly , Sensix , Agrofly , Agribotix LLC , Agrisoma Biosciences Inc. , DJI Technology Co., Ltd. , Parrot Drones SAS, SenseFly SA |

Latin America Agriculture Drones Market Segmentation:

Latin America Agriculture Drones Market Segmentation: By Type:

- Fixed Wing

- Rotary Wing

The rotary wings segment holds the largest share, in the Latin American agriculture drones market accounting for over 63% share, due to its versatility and ability to cover a wide range of agricultural applications efficiently. Rotary-wing drones, such as quadcopters and hexacopters, offer stability, and ease of operation, making them suitable for tasks like crop monitoring, pesticide spraying, and crop mapping in diverse terrains and field sizes. Additionally, these drones can hover in place, providing more precise data collection and enabling farmers to navigate challenging and uneven landscapes effectively. Their adaptability and suitability for small to medium-sized farms have contributed to their widespread adoption, solidifying their position as the largest segment in the market.

The fixed-wing segment is experiencing rapid growth with a CAGR of 25.6% in the Latin America agricultural drone market due to its unique advantages. Fixed-wing drones offer longer flight endurance and wider coverage compared to their multi-rotor counterparts, making them well-suited for large-scale farming operations common in Latin America. They can cover expansive fields efficiently, collect extensive data, and map vast areas in a single flight. Fixed-wing drones are capable of carrying various sensors for crop monitoring and data collection, contributing to their popularity among farmers and agricultural enterprises seeking cost-effective and comprehensive solutions for precision agriculture in the region.

Latin America Agriculture Drones Market Segmentation: By Component

- Hardware

- Frames

- Flight Control Systems

- Navigation Systems

- Propulsion Systems

- Cameras

- Sensors

- Others

- Software

- Services

- Professional Services

- Managed Services

The hardware segment is the largest component in this market holding approximately 51% of revenue share, due to the fundamental role it plays in the drone's physical infrastructure. Hardware components, including the drone itself, sensors, cameras, GPS systems, and propulsion systems, are essential for drone functionality and data collection. As drones become increasingly advanced and capable of carrying various sensors and payloads, demand for sophisticated hardware components rises to ensure accurate data acquisition and reliable drone performance. This pivotal role of hardware in drone functionality positions it as the largest segment within the agricultural drone market.

The service segment is the fastest-growing component growing at a CAGR of 26% in the Latin American agricultural drone market due to the increasing demand for comprehensive support and maintenance services. As the adoption of agricultural drones continues to rise, farmers and agricultural enterprises are looking for reliable and specialized services that encompass drone setup, training, repair, and data analysis. Ongoing advancements in drone technology require regular updates and maintenance, making service providers indispensable for ensuring uninterrupted drone performance, which further fuels the growth of this segment.

Latin America Agriculture Drones Market Segmentation: By Application

- Crop Management

- Field Management

- Crop Spraying

- Livestock Monitoring

- Variable Rate Application (VRA)

- Others

Crop management is the largest segment by application in the agricultural drone market because it addresses a critical need for farmers: optimizing crop health and productivity. Agricultural drones equipped with advanced sensors and imaging technologies provide real-time data on crop conditions, allowing farmers to detect issues such as disease outbreaks, nutrient deficiencies, and irrigation needs early on. This proactive approach enables precision farming, minimizes resource wastage, and maximizes yields, making crop management a top priority for farmers seeking to enhance their agricultural practices and profitability.

The field mapping segment is experiencing the fastest growth in the Latin America agriculture drones market expanding at a CAGR of 25.7%, due to its ability to provide farmers with invaluable real-time data and insights. Field mapping drones equipped with advanced sensors and imaging technologies offer precise information about crop health, soil conditions, and irrigation needs. This data-driven approach enables farmers to make informed decisions, optimize resource allocation, and enhance overall crop yields. The demand for such technology has surged as it not only improves efficiency but also aligns with the increasing emphasis on precision agriculture practices aimed at sustainable and productive farming.

Latin America Agriculture Drones Market Segmentation: Regional Analysis:

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Brazil stands as the largest segment by region in the Latin America Agriculture Drones Market holding 35% of market share, due to its extensive agricultural landscape and robust adoption of precision farming practices. With vast expanses of farmland and diverse crops, the country's agriculture sector seeks innovative solutions for optimizing crop management. Agriculture drones play a pivotal role in this pursuit, offering tools for crop monitoring, soil analysis, and precision spraying. Brazil's commitment to modernizing agriculture, increasing productivity, and addressing environmental concerns has driven the widespread integration of agricultural drones, solidifying its position as the leading market within the Latin American region.

Mexico is experiencing rapid growth in the agriculture drone market due to several factors. The country boasts a diverse agricultural landscape, including large-scale commercial farms and smallholder operations, all of which benefit from the adoption of agriculture drones for improved crop management. Additionally, Mexico's government initiatives and subsidies aimed at modernizing agriculture, coupled with a rising awareness of the benefits of drone technology, have fueled its expansion. The country's strategic location as a key agricultural producer in the Latin American region also plays a role in driving the adoption of drones for precision farming practices, making it the fastest-growing region in the market.

COVID-19 Impact Analysis on the Latin America Agriculture Drones Market:

The Latin America Agriculture Drones Market felt the impact of the COVID-19 pandemic, resulting in both challenges and opportunities. While initial disruptions in the supply chain and restrictions on movement affected drone manufacturing and distribution, the pandemic underscored the importance of technology in agriculture. Farmers increasingly turned to agricultural drones to ensure crop monitoring and management while adhering to social distancing guidelines. As a result, the adoption of agriculture drones saw accelerated growth, particularly among larger commercial farms seeking to improve productivity and reduce manual labor dependence. This shift towards technology-driven agriculture is expected to have a lasting impact on the Latin America Agriculture Drones Market as it aligns with the region's focus on modernizing farming practices.

Latest Trends/ Developments:

One prominent trend is the integration of AI and ML algorithms into agricultural drones. Companies are developing sophisticated software that enables drones to capture and process large volumes of data more efficiently. These AI-powered drones can analyze imagery, sensor data, and other inputs to provide real-time insights on crop health, pest infestations, irrigation needs, and yield predictions. By leveraging AI and ML, agricultural drones can deliver more accurate and actionable information to farmers, helping them make data-driven decisions to optimize crop management and increase productivity.

Companies are increasingly focusing on customization and specialization to cater to specific agricultural needs. They are developing specialized drones equipped with sensors and tools tailored for particular crops or farm tasks. For example, drones designed for vineyard management may have sensors optimized for grape health, while those used in large-scale grain farming may focus on soil analysis and planting efficiency. By offering specialized solutions, companies can address the unique requirements of different agricultural sectors, enhancing the value proposition for farmers and agricultural enterprises.

Key Players:

- XMobots

- Aibotix LatAm

- DroneFly

- Sensix

- Agrofly

- Agribotix LLC

- Agrisoma Biosciences Inc.

- DJI Technology Co., Ltd.

- Parrot Drones SAS

- SenseFly SA

In September 2022, Embraer agreed to purchase a minority stake in XMobots, a prominent drone company in Latin America, headquartered in Sao Carlos, located in the rural areas of Sao Paulo. The objective of this agreement is to expedite advancements in the medium and large autonomous drone sector and collaboratively venture into new market segments

Chapter 1. Latin America Agriculture Drones Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Agriculture Drones Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Agriculture Drones Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Agriculture Drones Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Agriculture Drones Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Agriculture Drones Market– By Type

6.1. Introduction/Key Findings

6.2. Fixed Wing

6.3. Rotary Wing

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Latin America Agriculture Drones Market– By Component

7.1. Introduction/Key Findings

7.2 Hardware

7.2.1. Frames

7.2.2. Flight Control Systems

7.2.3. Navigation Systems

7.2.4. Propulsion Systems

7.2.5. Cameras

7.2.6. Sensors

7.2.6. Others

7.3. Software

7.4. Services

7.4.1. Professional Services

7.4.2. Managed Services

7.5. Y-O-Y Growth trend Analysis By Component

7.6. Absolute $ Opportunity Analysis By Component, 2023-2030

Chapter 8. Latin America Agriculture Drones Market– By Application

8.1. Introduction/Key Findings

8.2. Crop Management

8.3. Field Management

8.4. Crop Spraying

8.5. Livestock Monitoring

8.6. Variable Rate Application (VRA)

8.7. Others

8.8. Y-O-Y Growth trend Analysis Application

8.9. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Latin America Agriculture Drones Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Type

9.1.3. By Component

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Agriculture Drones Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 XMobots

10.2. Aibotix LatAm

10.3. DroneFly

10.4. Sensix

10.5. Agrofly

10.6. Agribotix LLC

10.7. Agrisoma Biosciences Inc.

10.8. DJI Technology Co., Ltd.

10.9. Parrot Drones SAS

10.10. SenseFly SA

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Agriculture Drones Market was valued at USD 468 Million in 2022 and is projected to reach a market size of USD 3.37 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 28%.

Precision Agriculture Adoption and Regulatory Support and Initiatives are helping to expand the Latin America Agriculture Drones market

Based on type, the Latin American agriculture Drone market is divided into Rotary wings and Fixed wings.

Brazil is the most dominant region for the Latin America Agriculture Drones Market.

XMobots, Aibotix LatAm, DroneFly, Sensix, and Agrofly are the key players operating in the Latin America Agriculture Drones Market