Agriculture Drones Market Size (2025-2030)

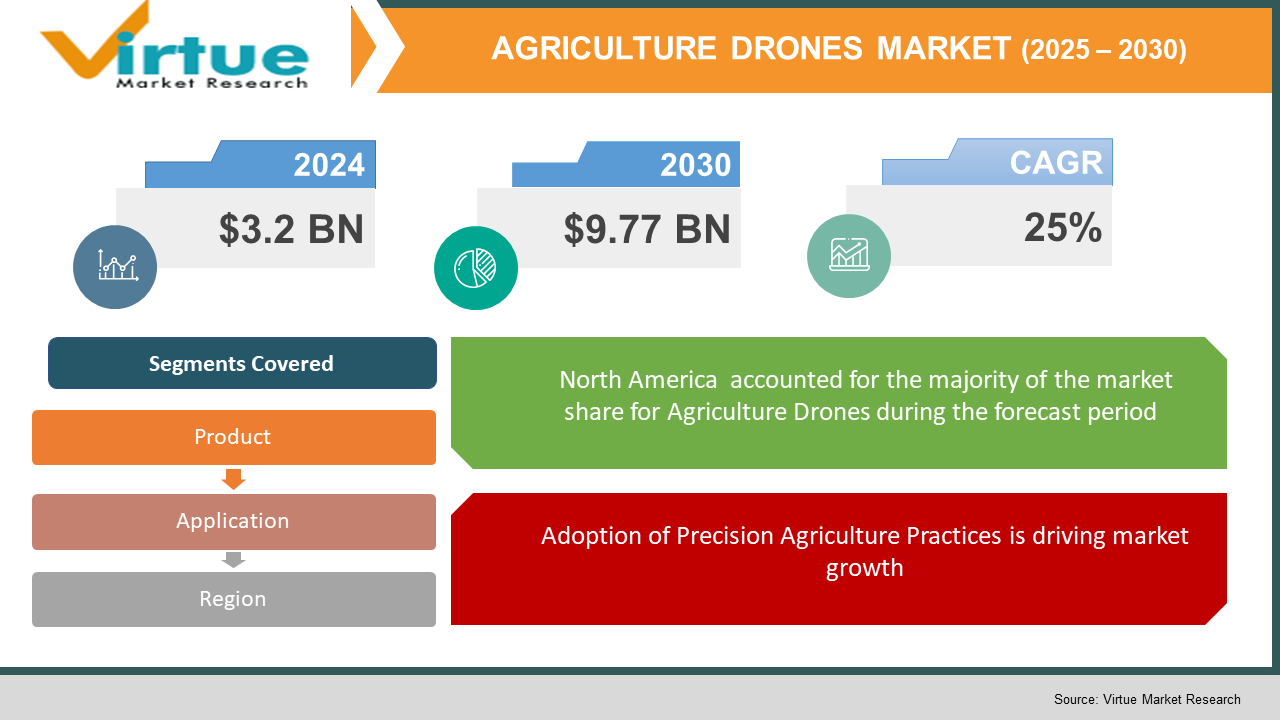

The Global Agriculture Drones Market was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 25% from 2025 to 2030, reaching USD 9.77 billion by 2030.

Agriculture drones are unmanned aerial vehicles (UAVs) that are used for a variety of tasks in farming, including crop monitoring, irrigation management, pest control, and soil health monitoring. These drones are equipped with advanced technologies such as multispectral imaging, GPS systems, and high-resolution cameras, enabling farmers to monitor crops with precision and gather data to optimize farm management practices. The market is expanding rapidly as the demand for sustainable farming practices grows, driven by the need for precision agriculture to increase yield, reduce resource use, and enhance productivity. This shift is being supported by the growing adoption of drones across small, medium, and large-scale farms globally.

Key Market Insights:

- The agriculture drones market is expected to see a significant increase in adoption as precision agriculture becomes a vital part of modern farming practices, enhancing efficiency and reducing costs.

- The Asia-Pacific region, particularly countries like China and India, is witnessing rapid growth in the agriculture drones market due to the need for increased food production and sustainable farming techniques.

- The use of drones in precision agriculture has been shown to increase crop yields by up to 20% and reduce water and pesticide use, making them a highly valuable tool for modern farmers.

- The increasing demand for high-quality food products, along with environmental concerns related to resource depletion, is driving the need for smarter farming solutions like drones.

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) into drones is allowing for enhanced data analysis and decision-making, further expanding the utility of drones in agricultural applications.

- The high initial cost of drones remains a significant barrier to adoption, especially among small-scale farmers, though falling prices and government incentives are expected to alleviate this challenge.

- The rise of drone-as-a-service (DaaS) models is expected to further accelerate the adoption of agriculture drones, as farmers can now access drone technology without the upfront investment.

Global Agriculture Drones Market Drivers:

Adoption of Precision Agriculture Practices is driving market growth:

The rise of precision agriculture has been one of the primary drivers for the growth of the agriculture drones market. Precision agriculture refers to farming practices that use data and technology to optimize field-level management regarding crop farming. Drones are integral to this method, offering farmers real-time insights into crop health, soil conditions, and irrigation needs. The ability to collect accurate and actionable data using drones allows farmers to make more informed decisions, resulting in increased yields and reduced costs. With the growing awareness of the benefits of precision farming, the adoption of drones has accelerated. By using drones to monitor vast areas of farmland quickly and effectively, farmers can detect problems early and apply resources such as water, fertilizers, and pesticides more efficiently. This leads to cost savings, enhanced productivity, and minimal environmental impact. As farmers continue to embrace technological solutions for better resource management, drones are becoming indispensable tools in precision agriculture.

Technological Advancements in Drone Features is driving market growth:

The technological advancements in agriculture drones are another major driver of market growth. Modern drones are equipped with cutting-edge sensors, cameras, and software that allow them to perform a wide range of agricultural tasks. These drones often include multispectral and hyperspectral imaging technology that can monitor plant health, detect pest infestations, and assess nutrient levels in soil. Furthermore, the integration of GPS technology enables accurate mapping and analysis of farm areas, ensuring precise data collection. Additionally, the development of AI and machine learning algorithms has enhanced drone capabilities, enabling them to autonomously fly over fields, collect data, and even make recommendations based on the information gathered. These advancements have made drones more reliable, efficient, and accessible to farmers, driving their increased use in agricultural settings. As technology continues to evolve, drones are becoming more affordable and capable of performing even more complex tasks, increasing their adoption across the global agriculture sector.

Government Support and Regulatory Developments is driving market growth:

Government initiatives and regulatory frameworks have played a pivotal role in accelerating the adoption of agriculture drones. Many governments around the world recognize the potential of drones to boost agricultural productivity and sustainability. In countries like the United States, India, and Japan, agricultural subsidies and financial incentives are being provided to encourage farmers to adopt drone technology. Additionally, regulatory bodies are gradually developing frameworks that enable the safe and effective use of drones in agriculture. For example, in the U.S., the Federal Aviation Administration (FAA) has implemented regulations that allow for commercial drone use in agriculture, streamlining the process for farmers to gain approvals for drone flights. These regulations ensure that drones can be used safely while minimizing the risk of accidents and damage. As regulations become more streamlined and government support increases, the agriculture drone market will continue to expand, especially in developing regions.

Global Agriculture Drones Market Challenges and Restraints:

High Initial Costs and Investment Barriers is restricting market growth: While the benefits of agriculture drones are clear, their high initial cost remains a significant barrier to adoption, especially for small-scale farmers. The cost of purchasing and maintaining drones equipped with advanced sensors and cameras can be prohibitive for many in the farming community. Additionally, the costs associated with training personnel to operate drones and interpret data effectively can further discourage smaller operations from adopting this technology. Even though the cost of drones has been decreasing over time, it still represents a significant investment, particularly in developing regions where farmers may have limited access to capital. However, the introduction of financing options and the growth of drone-as-a-service (DaaS) models are helping to overcome these barriers, enabling more farmers to access drone technology without the heavy upfront cost.

Regulatory and Safety Concerns is restricting market growth: The regulatory environment surrounding the use of drones in agriculture can pose challenges to their widespread adoption. While several countries have made strides in implementing regulations for drone usage, many regions still lack clear and comprehensive frameworks. Strict regulations regarding drone flight paths, altitude restrictions, and no-fly zones can limit the areas in which drones can be operated. Additionally, concerns over the safety and security of drone operations have led to the implementation of various safety standards, which can further complicate the regulatory landscape. In some regions, drone operators must obtain permits and adhere to safety protocols, which can be cumbersome for farmers looking to implement drones quickly and efficiently. As the market matures, there is a growing need for global harmonization of drone regulations to simplify operations for farmers and ensure the safe use of drones in agricultural settings.

Market Opportunities:

The agriculture drones market presents numerous opportunities for growth, innovation, and expansion, especially as the global agricultural sector seeks to become more sustainable and efficient. One of the major opportunities lies in the development of specialized drones designed for specific agricultural tasks, such as precision spraying and irrigation management. As technology continues to advance, drones are being optimized for a wider variety of functions, enabling them to offer even more value to farmers. For example, drones equipped with multi-spectral imaging can detect early signs of plant diseases or nutrient deficiencies, providing farmers with early intervention opportunities to prevent crop loss. Additionally, the growing demand for organic and sustainably produced food offers an opportunity for drones to be used in environmentally friendly farming practices, such as reducing pesticide use through precision spraying. The rise of drone-as-a-service (DaaS) platforms also represents a significant opportunity, particularly in regions where individual farmers cannot afford the high upfront costs of drones. DaaS allows farmers to access drone services on-demand, paying only for the services they need. This model is expected to gain traction as more service providers enter the market, offering specialized solutions tailored to the needs of farmers. Another promising opportunity lies in the integration of drones with other advanced technologies such as artificial intelligence (AI) and machine learning (ML), which can provide farmers with predictive insights based on data collected by drones. This could allow for more efficient decision-making, ultimately leading to higher yields and lower operational costs. Furthermore, as agricultural drone technology becomes more widespread, there will be increased demand for drone maintenance and software development, creating a burgeoning ecosystem of service providers and technology companies focused on the agriculture sector. These opportunities, combined with ongoing advancements in drone technology, suggest a highly promising future for the agriculture drones market.

AGRICULTURE DRONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI Innovations, Parrot SA, AeroVironment, Trimble Inc., and AG Leader Technology. |

Agriculture Drones Market Segmentation:

Agriculture Drones Market Segmentation By Product:

- Fixed-wing Drones

- Rotary-wing Drones

- Hybrid Drones

The rotary-wing drones segment dominates the agriculture drones market. These drones are widely preferred due to their versatility, ease of operation, and ability to hover in place, making them ideal for crop monitoring, spraying, and mapping. Their ability to fly at lower altitudes provides farmers with high-resolution data and ensures precise application of inputs. The rotary-wing drones are also more cost-effective and easier to maneuver, especially in smaller fields. These advantages have led to their widespread adoption, particularly in precision agriculture, where accuracy and flexibility are paramount.

Agriculture Drones Market Segmentation By Application:

- Crop Monitoring

- Irrigation Management

- Pest Control and Fertilization

- Soil Health Monitoring

- Livestock Monitoring

- Other Applications

The crop monitoring segment is the most dominant application in the agriculture drones market. The use of drones for crop health monitoring, detecting diseases, assessing plant growth, and identifying areas that need attention has proven to be one of the most valuable applications. Drones equipped with multispectral sensors provide farmers with accurate, real-time data on crop conditions, enabling timely interventions and reducing the need for manual labor and field visits. This data-driven approach helps farmers make informed decisions, ultimately leading to higher yields and reduced costs.

Agriculture Drones Market Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The North American region is the dominant region in the global agriculture drones market. The United States, in particular, leads the market due to its technological advancements, strong agricultural infrastructure, and high rate of drone adoption among farmers. The presence of major agricultural drone manufacturers, coupled with supportive government policies and incentives, has made North America a hotspot for drone technology in agriculture. Additionally, the region's large-scale farms and focus on precision agriculture further contribute to its dominance in the market. As drone technology becomes more affordable and accessible, other countries in the region, such as Canada and Mexico, are also seeing increasing adoption of agricultural drones.

COVID-19 Impact Analysis on the Agriculture Drones Market:

The COVID-19 pandemic had a mixed impact on the agriculture drones market. On one hand, the pandemic resulted in disruptions to supply chains, causing delays in the production and delivery of drones and related equipment. On the other hand, the pandemic highlighted the importance of efficient, technology-driven farming solutions, accelerating the adoption of drones as farmers sought alternatives to traditional, labor-intensive methods. With the social distancing measures and labor shortages caused by the pandemic, many farmers turned to drones for tasks like crop monitoring and spraying, minimizing the need for physical presence in the fields. As a result, the demand for agriculture drones surged in certain regions. The long-term impact of COVID-19 on the agriculture drones market is expected to be positive, as it has increased awareness of the benefits of precision agriculture and has encouraged further investment in agricultural technology.

Latest Trends/Developments:

The agriculture drones market has seen several trends and developments over recent years, including the increasing integration of Artificial Intelligence (AI) and machine learning (ML) into drone technology. AI and ML allow drones to analyze vast amounts of data collected during flight and make predictions regarding crop health, pest infestations, and soil conditions. Another major trend is the rise of drone-as-a-service (DaaS) models, which allow farmers to access drone technology on a subscription or per-use basis, removing the need for significant upfront investment. Additionally, the development of drones capable of carrying out precision spraying, fertilization, and irrigation management tasks is gaining momentum, providing more value to farmers looking to optimize their agricultural operations. Furthermore, regulatory bodies are gradually developing clearer guidelines and frameworks for drone use in agriculture, enhancing the market’s stability and ensuring safer operations.

Key Players:

- DJI Innovations

- Parrot SA

- 3D Robotics

- AeroVironment Inc.

- Trimble Inc.

- AG Leader Technology

- Delair

- Yuneec International

- Sentera Inc.

- PrecisionHawk

Chapter 1. AGRICULTURE DRONES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AGRICULTURE DRONES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AGRICULTURE DRONES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AGRICULTURE DRONES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AGRICULTURE DRONES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AGRICULTURE DRONES MARKET – By Product

6.1 Introduction/Key Findings

6.2 Fixed-wing Drones

6.3 Rotary-wing Drones

6.4 Hybrid Drones

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. AGRICULTURE DRONES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Crop Monitoring

7.3 Irrigation Management

7.4 Pest Control and Fertilization

7.5 Soil Health Monitoring

7.6 Livestock Monitoring

7.7 Other Applications

7.8 Air Based

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. AGRICULTURE DRONES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AGRICULTURE DRONES MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 DJI Innovations

9.2 Parrot SA

9.3 3D Robotics

9.4 AeroVironment Inc.

9.5 Trimble Inc.

9.6 AG Leader Technology

9.7 Delair

9.8 Yuneec International

9.9 Sentera Inc.

9.10 PrecisionHawk

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global agriculture drones market was valued at USD 3.2 billion in 2024 and is expected to reach USD 9.77 billion by 2030.

Key drivers include the rise of precision agriculture, technological advancements in drones, and government support for drone adoption.

The market is segmented by product (fixed-wing, rotary-wing, hybrid) and application (crop monitoring, pest control, soil health).

North America is the dominant region, with the United States leading the market in drone adoption for agriculture

Leading players include DJI Innovations, Parrot SA, AeroVironment, Trimble Inc., and AG Leader Technology.