ISOBUS Component Market Size (2025 –2030)

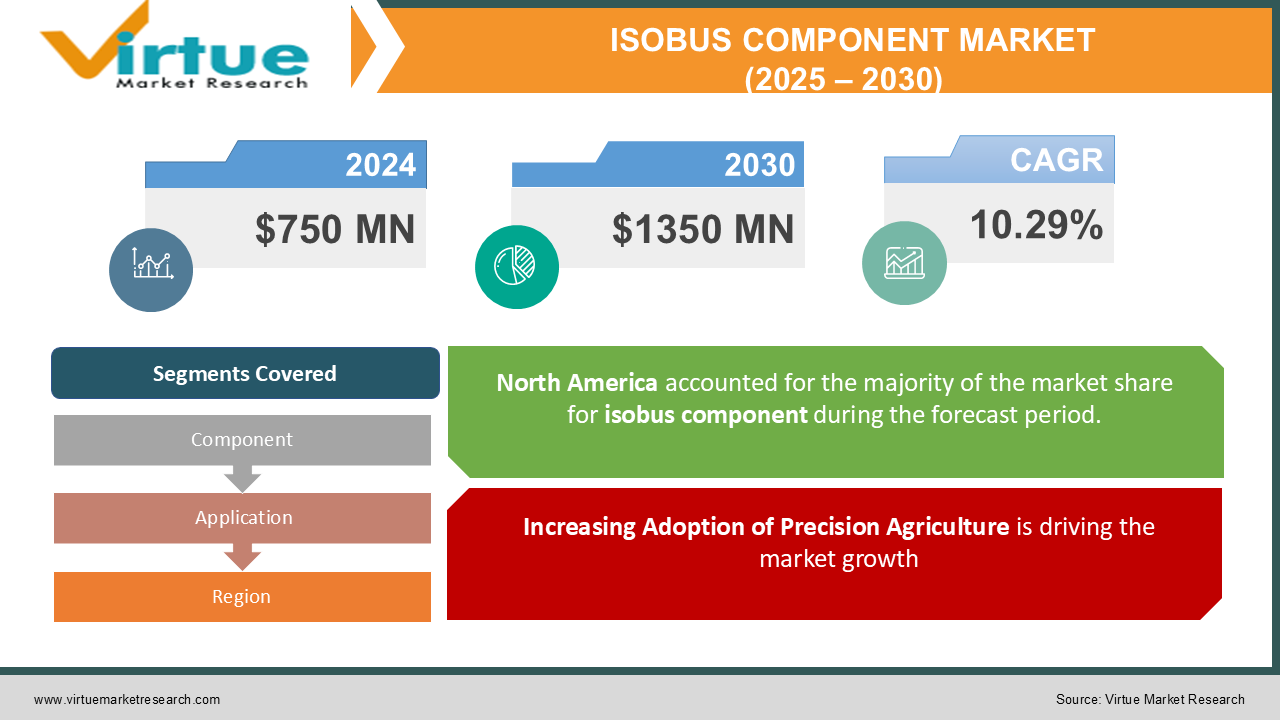

The Global ISOBUS Component Market was valued at USD 750 million in 2024 and is projected to reach USD 1,350 million by 2030, growing at a CAGR of 10.29% during the forecast period.

ISOBUS (ISO 11783) is a standardized communication protocol designed to enable seamless interoperability between agricultural machinery, implements, and control systems. The increasing adoption of precision agriculture technologies, automation in farming, and demand for efficient data management systems are driving the growth of the ISOBUS component market.

Key Market Insights

-

Hardware components dominate the market, holding a 55% share, driven by increasing demand for ISOBUS-compatible tractors, harvesters, and sprayers.

-

The software segment is expected to grow at the highest CAGR of 12.5%, due to the rising adoption of cloud-based farm management solutions.

-

Tractors represent the largest application segment, accounting for 40% of total ISOBUS adoption, as precision farming relies heavily on ISOBUS-enabled tractors.

-

North America leads the market with a 38% share, supported by the rapid adoption of smart farming technologies and government incentives for precision agriculture.

-

Europe is the second-largest market (32%), driven by strict environmental regulations and advanced farming practices in Germany, France, and the UK.

-

The Asia-Pacific region is the fastest-growing market (CAGR 12.8%), fueled by the increasing adoption of precision agriculture in China, India, and Australia.

-

Challenges such as high initial costs, lack of standardization in developing countries, and compatibility issues with legacy equipment hinder market growth.

Global ISOBUS Component Market Drivers

1. Increasing Adoption of Precision Agriculture is driving the market growth

The growing emphasis on efficiency, productivity, and resource optimization in farming is driving the adoption of precision agriculture. ISOBUS technology enables real-time communication between tractors and implements, improving farm operations.

2. Demand for Automated and Smart Farming Solutions is driving the market growth

The integration of IoT, AI, and big data analytics in agriculture has increased the demand for automated farm machinery. ISOBUS components help synchronize multiple farm operations, reducing manual intervention and improving efficiency.

3. Government Support for Smart Farming Initiatives is driving the market growth

Governments worldwide are promoting smart agriculture technologies through subsidies and grants. Programs such as the EU’s Common Agricultural Policy (CAP) and the U.S. Precision Agriculture Connectivity Act encourage the adoption of ISOBUS-enabled farm equipment.

Global ISOBUS Component Market Challenges and Restraints

1. High Initial Investment Costs is restricting the market growth

The adoption of ISOBUS-compatible machinery requires significant upfront investment, which can be a barrier for small and medium-sized farms.

2. Lack of Standardization in Developing Regions is restricting the market growth

While ISOBUS is widely accepted in Europe and North America, developing regions lack the necessary infrastructure and technical expertise to fully implement ISOBUS solutions.

Market Opportunities

The global ISOBUS component market is ripe with opportunities for innovation and expansion. Advancements in Wireless and Cloud-Based Farm Management Systems present a significant avenue for growth. Integrating ISOBUS with cloud platforms will revolutionize remote farm monitoring and data analytics. Farmers will be able to access real-time data from their ISOBUS-connected machinery and sensors from anywhere with an internet connection. This will enable more informed decision-making regarding irrigation, fertilization, and other farm operations, leading to increased efficiency and optimized resource utilization. Cloud connectivity will also facilitate data sharing with other stakeholders, such as agronomists and equipment manufacturers, fostering collaboration and enabling the development of data-driven insights for precision agriculture. Expansion in Emerging Markets offers another substantial opportunity. Increasing agricultural mechanization in regions like Asia, Africa, and Latin America will create significant demand for ISOBUS-compatible equipment. As these regions modernize their agricultural practices, farmers will seek technologies that improve efficiency and productivity. ISOBUS, with its standardized communication capabilities, will be a crucial enabler of precision agriculture in these emerging markets. Companies that can effectively cater to the specific needs and requirements of farmers in these regions will be well-positioned for growth. Furthermore, the Development of Universal Compatibility Solutions holds immense potential. Many farms still utilize legacy machinery that is not ISOBUS-compatible. Developing solutions that allow ISOBUS-compatible systems to seamlessly integrate with this existing equipment will significantly expand market adoption. This could involve developing retrofit kits or adapters that bridge the communication gap between older and newer technologies. Making ISOBUS more accessible to farmers with legacy equipment will unlock a vast untapped market and accelerate the transition to precision agriculture. By focusing on these key opportunities – cloud integration, emerging market expansion, and universal compatibility – businesses can unlock the full potential of the ISOBUS component market and contribute to the advancement of smart farming practices globally.

ISOBUS COMPONENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.29% |

|

Segments Covered |

By Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

John Deere, CNH Industrial (Case IH & New Holland Agriculture), AGCO Corporation, Trimble Inc., Topcon Agriculture, Hexagon Agriculture, Krone Group, Kuhn Group, DICKEY-john, Raven Industries |

ISOBUS Component Market Segmentation - By Component

-

Hardware

-

Software

-

Cables & Connectors

The hardware segment currently holds the dominant share. This segment encompasses the physical components that make up the ISOBUS system, including electronic control units (ECUs), displays, sensors, and other in-cab devices. These hardware components are essential for implementing ISOBUS functionality on agricultural machinery, enabling communication and control between different implements and tractors. While software plays a crucial role in enabling ISOBUS communication and data processing, and cables and connectors are necessary for physically connecting the various components, the hardware itself represents the most significant portion of the market value. This is because the hardware components, such as the ECUs and displays, are specialized and often require significant development and manufacturing costs. Software, while essential, is often bundled with the hardware or offered as a separate service. Cables and connectors, while necessary, represent a smaller fraction of the overall system cost compared to the specialized hardware components. Therefore, the hardware segment constitutes the largest portion of the ISOBUS market due to the essential and specialized nature of the physical components required for implementing ISOBUS technology.

ISOBUS Component Market Segmentation - By Application

-

Tractors

-

Harvesters

-

Sprayers

-

Others

Tractors currently represent the largest segment. Tractors are the central power units in agricultural operations, and their compatibility with ISOBUS is essential for connecting and controlling various implements. The widespread adoption of precision farming practices and the increasing use of smart tractors equipped with ISOBUS capabilities drive the demand for ISOBUS components in this segment. While harvesters, sprayers, and other agricultural implements also utilize ISOBUS technology, their adoption rates are generally lower compared to tractors. This is due to the fact that tractors are often used with multiple implements, making ISOBUS compatibility on the tractor itself a crucial requirement for efficient and integrated farm operations. Therefore, the tractor segment dominates the ISOBUS market due to its central role in agricultural operations and the increasing demand for smart and connected tractors.

ISOBUS Component Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The global ISOBUS market exhibits distinct regional trends. North America leads with a 38% share, driven by high precision farming adoption and smart tractor use in the U.S. and Canada, further supported by USDA initiatives. Europe follows closely at 32%, with Germany, France, and the UK as early ISOBUS adopters, propelled by EU sustainability policies favoring precision agriculture. Asia-Pacific is the fastest-growing region (12.8% CAGR), fueled by smart agriculture investments in China, India, and Australia, including programs like India's Digital Agriculture Mission. Latin America, the Middle East, and Africa hold a combined 7% share, with Brazil and Argentina investing in agricultural automation, and South Africa emerging as a key precision farming adopter.

COVID-19 Impact Analysis

The COVID-19 pandemic presented a complex and multifaceted impact on the ISOBUS component market. Initially, the pandemic's onset caused significant disruptions in global supply chains. Lockdowns, border closures, and factory shutdowns led to delays in the manufacturing and delivery of ISOBUS components, affecting the production of agricultural machinery and slowing down the adoption of ISOBUS technology. Farmers faced challenges in acquiring new equipment and upgrading existing machinery with ISOBUS capabilities, creating a temporary setback for the market. However, as the world gradually recovered from the initial shock of the pandemic, the ISOBUS component market began to witness a resurgence. The pandemic underscored the vulnerability of global food supply chains and highlighted the importance of resilient and efficient agricultural practices. This renewed focus on food security fueled increased investment in smart farming technologies, including ISOBUS-compatible equipment. Governments and agricultural organizations implemented initiatives to support farmers in adopting advanced technologies, accelerating the adoption of ISOBUS and precision agriculture solutions. Furthermore, the pandemic accelerated the trend towards remote farm management. With travel restrictions and social distancing measures in place, farmers increasingly relied on digital tools and remote monitoring systems to manage their operations. This surge in demand for remote farm management solutions directly drove the demand for ISOBUS-compatible equipment, as these systems rely on standardized data exchange between machinery and software platforms. ISOBUS enabled farmers to remotely monitor equipment performance, track field data, and make informed decisions about their operations, contributing to increased efficiency and productivity.

Latest Trends/Developments

The ISOBUS (ISO 11783) standard, designed to standardize communication between agricultural machinery and electronic devices, is undergoing a significant evolution, driven by technological advancements and the increasing demand for precision agriculture. One key trend is the Integration of AI and IoT with ISOBUS. Combining the standardized communication of ISOBUS with the analytical power of Artificial Intelligence (AI) and the interconnectedness of the Internet of Things (IoT) is revolutionizing real-time data processing for automated farming. AI algorithms can analyze data from ISOBUS-connected sensors and machinery to optimize operations like planting, fertilization, and harvesting, improving efficiency and reducing resource waste. IoT connectivity enables remote monitoring and control of equipment, further enhancing automation capabilities. Cloud-Based Farm Management Solutions are also gaining prominence. Connecting ISOBUS-compatible machinery to centralized data platforms via cloud computing allows farmers to access and analyze real-time data from all their operations in one place. This comprehensive view of farm data enables better decision-making regarding resource allocation, crop management, and overall farm operations. Cloud-based platforms also facilitate data sharing with other stakeholders, such as agronomists and input suppliers, enabling collaborative and informed decision-making. The Development of Wireless ISOBUS Solutions is another significant advancement. Traditional ISOBUS systems rely on physical cables for communication, which can be cumbersome and prone to damage. Wireless ISOBUS solutions, utilizing technologies like Bluetooth or Wi-Fi, reduce reliance on physical cables, improving connectivity and flexibility in the field. Wireless communication also makes it easier to integrate various sensors and devices into the ISOBUS network, expanding the scope of data collection and automation. Finally, the Expansion of ISOBUS into Livestock Farming presents new opportunities. While ISOBUS has traditionally focused on crop production, its principles of standardized communication can be extended to livestock farming. Automating tasks like feed distribution and herd management through ISOBUS-connected systems can improve efficiency and animal welfare. Integrating sensors to monitor animal health and behavior can provide valuable data for optimizing livestock production. These combined trends – AI and IoT integration, cloud connectivity, wireless solutions, and expansion into livestock – are shaping the future of ISOBUS, transforming it into a powerful tool for precision agriculture and smart farming

Key Players

-

John Deere

-

CNH Industrial (Case IH & New Holland Agriculture)

-

AGCO Corporation

-

Trimble Inc.

-

Topcon Agriculture

-

Hexagon Agriculture

-

Krone Group

-

Kuhn Group

-

DICKEY-john

-

Raven Industries

Chapter 1. ISOBUS Component Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ISOBUS Component Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ISOBUS Component Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ISOBUS Component Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ISOBUS Component Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ISOBUS Component Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Cables & Connectors

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2025-2030

Chapter 7. ISOBUS Component Market – By Application

7.1 Introduction/Key Findings

7.2 Tractors

7.3 Harvesters

7.4 Sprayers

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. ISOBUS Component Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Component

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Component

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Component

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Component

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Component

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ISOBUS Component Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 John Deere

9.2 CNH Industrial (Case IH & New Holland Agriculture)

9.3 AGCO Corporation

9.4 Trimble Inc.

9.5 Topcon Agriculture

9.6 Hexagon Agriculture

9.7 Krone Group

9.8 Kuhn Group

9.9 DICKEY-john

9.10 Raven Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 750 million in 2024 and is projected to reach USD 1,350 million by 2030, growing at a CAGR of 10.29%.

Key drivers include the adoption of precision agriculture, increasing demand for smart farming solutions, and government support for agtech innovations.

North America leads the market with a 38% share, driven by precision farming advancements and strong government incentives.

Tractors, harvesters, and sprayers are the primary applications, enabling seamless communication between farm machinery and implements.

Key players include John Deere, CNH Industrial, AGCO, Trimble, Topcon Agriculture, and Raven Industries.