Industrial Sensors Market Size (2025 – 2030)

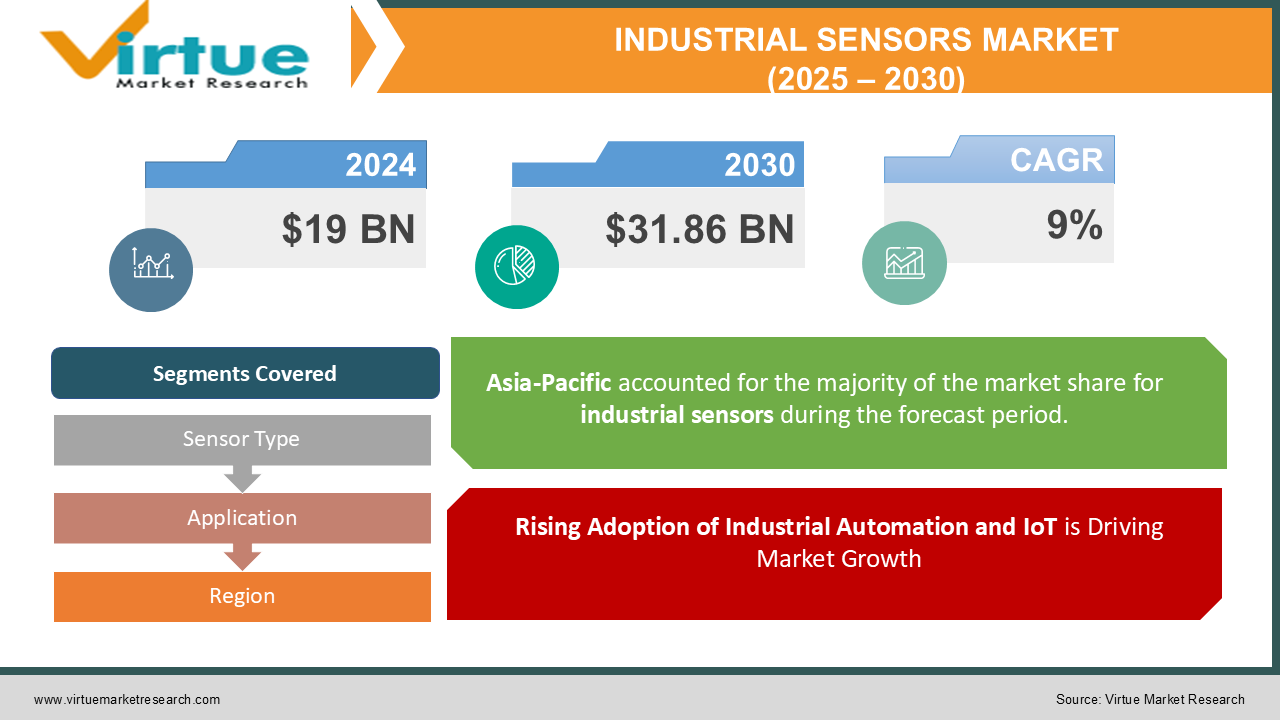

The Global Industrial Sensors Market was valued at USD 19 billion in 2024 and is projected to grow at a CAGR of 9% from 2025 to 2030. The market is expected to reach USD 31.86 billion by 2030.

Industrial sensors are critical components in modern industrial automation systems, enabling data acquisition and real-time monitoring of processes. These sensors are widely used across manufacturing, energy, automotive, healthcare, and aerospace industries for applications such as temperature measurement, pressure sensing, and proximity detection. The rapid adoption of Industry 4.0 and IoT technologies is propelling market growth, as sensors serve as the backbone of connected and intelligent industrial systems.

Key Market Insights

-

The manufacturing sector accounted for the largest revenue share in the industrial sensors market in 2024, driven by widespread automation and demand for predictive maintenance systems.

-

Temperature and pressure sensors remain the most widely used sensor types, essential for ensuring optimal operating conditions in industrial processes.

-

Asia-Pacific is the fastest-growing region in the market, fueled by industrial expansion and increasing investments in smart factories in countries like China, Japan, and India.

-

The automotive industry’s growing reliance on industrial sensors for applications such as engine management and advanced driver-assistance systems (ADAS) is a major growth driver.

-

Challenges such as data security concerns and integration complexities with legacy systems pose potential hurdles to market growth.

Global Industrial Sensors Market Drivers

Rising Adoption of Industrial Automation and IoT is Driving Market Growth:

The adoption of industrial automation has grown exponentially as industries strive for higher efficiency, productivity, and reduced operational costs. Industrial sensors play a pivotal role in automation by providing accurate data for process control, monitoring, and diagnostics. With the advent of the Industrial Internet of Things (IIoT), sensors are becoming smarter, equipped with communication capabilities to share data in real time. For instance, vibration sensors are used in predictive maintenance systems to identify potential equipment failures before they occur, minimizing downtime. As industries across manufacturing, logistics, and energy transition toward intelligent systems, the demand for high-performance industrial sensors is expected to rise steadily.

Growth of Industry 4.0 Practices is Driving Market Growth:

Industry 4.0 is revolutionizing manufacturing by integrating cyber-physical systems, cloud computing, and IoT technologies. Industrial sensors are foundational to this transformation, enabling connectivity, automation, and data-driven decision-making. Applications such as digital twins, real-time monitoring, and robotics heavily depend on sensor data for accurate operation. Temperature sensors are used for thermal regulation, while pressure sensors monitor hydraulic and pneumatic systems. The emphasis on smart factories and lean manufacturing practices is a major driver propelling the adoption of advanced industrial sensors globally.

Advancements in Sensor Technology is Driving Market Growth:

Innovations in sensor technology, such as miniaturization, enhanced sensitivity, and wireless connectivity, are significantly contributing to market growth. Modern industrial sensors are capable of detecting multiple parameters simultaneously, providing comprehensive insights into industrial operations. For example, multi-sensor systems that combine temperature, humidity, and pressure sensing offer holistic monitoring capabilities in sectors like food processing and pharmaceuticals. The availability of robust and energy-efficient sensors is further encouraging their integration into industrial systems, particularly in remote and hazardous environments.

Global Industrial Sensors Market Challenges and Restraints

Integration Challenges with Legacy Systems is restricting market growth:

Many industrial facilities still rely on legacy equipment and systems that were not designed to interface with modern sensors. Integrating new sensor technologies into such environments can be complex and costly, requiring significant modifications or retrofitting. Compatibility issues may arise due to differences in communication protocols or data formats, further complicating the integration process. Additionally, training personnel to operate and maintain systems equipped with advanced sensors can be a time-consuming and resource-intensive endeavor. Overcoming these challenges is crucial to unlocking the full potential of industrial sensors in traditional industries.

Data Security and Privacy Concerns is restricting market growth:

As industrial sensors become increasingly connected to IoT networks, concerns about data security and privacy have emerged as significant challenges. Industrial environments often handle sensitive operational data, and any breach could result in severe consequences, including financial losses and reputational damage. The transmission of sensor data over networks makes it vulnerable to cyberattacks, such as hacking and unauthorized access. Ensuring robust cybersecurity measures, including encryption and secure communication protocols, is essential to mitigate these risks. Additionally, regulatory compliance with data protection laws adds complexity to the deployment of connected industrial sensors.

Market Opportunities

The Industrial Sensors Market offers numerous growth opportunities driven by evolving technological trends and industrial needs. The rising adoption of predictive maintenance solutions is a key opportunity area, as sensors capable of monitoring machine health can significantly reduce downtime and maintenance costs. The expansion of renewable energy projects, such as wind and solar power, is creating demand for sensors that monitor environmental conditions and optimize energy generation. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are enabling sensors to deliver actionable insights, enhancing their value proposition. Emerging economies, particularly in Asia-Pacific and Africa, present lucrative opportunities as governments and private enterprises invest in industrial infrastructure and automation. The development of low-power and energy-efficient sensors is also aligning with global sustainability goals, opening avenues for innovation and market growth. By addressing challenges such as cost and data security, manufacturers can tap into these opportunities and expand their footprint in the rapidly evolving industrial sensors market.

INDUSTRIAL SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Sensor Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International, Siemens, Bosch Sensortec, ABB, STMicroelectronics, Texas Instruments, TE Connectivity, Rockwell Automation, Omron Corporation, Schneider Electric |

Industrial Sensors Market Segmentation - By Sensor Type

-

Temperature Sensors

-

Pressure Sensors

-

Proximity Sensors

-

Flow Sensors

-

Level Sensors

-

Humidity Sensors

-

Vibration Sensors

-

Optical Sensors

Temperature sensors are the most widely used, offering critical functionality for thermal management in industries such as manufacturing and healthcare.

Industrial Sensors Market Segmentation - By Application

-

Manufacturing

-

Automotive

-

Energy & Utilities

-

Healthcare

-

Aerospace & Defense

-

Others

Manufacturing leads the market, driven by extensive adoption of sensors for process control, quality assurance, and equipment monitoring.

Industrial Sensors Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific holds the largest share in the Industrial Sensors Market, driven by rapid industrialization, technological advancements, and increasing investments in smart factory initiatives. Countries like China, India, and Japan are at the forefront, with robust demand from the manufacturing, automotive, and electronics sectors. Government initiatives supporting automation and digitalization, coupled with the presence of key sensor manufacturers, are further boosting the region's market dominance.

COVID-19 Impact Analysis on the Industrial Sensors Market

The COVID-19 pandemic had a significant and multifaceted impact on the Industrial Sensors Market. During the early stages of the pandemic, disruptions in supply chains and reduced manufacturing activity led to a temporary decline in sensor demand. With industries grappling with these challenges, sensor production and availability were affected, causing delays in many sectors. However, as the crisis unfolded, there was a rapid acceleration in the adoption of automation and remote monitoring technologies to ensure operational continuity in the face of ongoing disruptions. Industrial sensors played a crucial role in enabling contactless operations, predictive maintenance, and remote monitoring, particularly in sectors such as healthcare, food processing, and energy. Sensors facilitated the shift to automated processes, helping industries minimize human interaction while maintaining productivity. In healthcare, for example, sensors supported medical equipment and diagnostics, while in food processing and energy, they helped monitor critical systems remotely and maintain operational efficiency. As the global economy began to recover, the Industrial Sensors Market experienced a resurgence in demand. Industries, now more focused on digital transformation and resilience, invested heavily in advanced automation and sensor technologies to future-proof their operations. The post-pandemic recovery emphasized the importance of industrial sensors in enhancing productivity, improving efficiency, and adapting to unforeseen challenges. Ultimately, the COVID-19 pandemic highlighted the essential role of industrial sensors in modern industrial operations. As industries continue to innovate and prioritize automation, sensors have become indispensable components of digital infrastructure, supporting the continuous evolution of industrial systems worldwide.

Latest Trends/Developments

The Industrial Sensors Market is experiencing rapid growth and transformation, fueled by technological advancements and evolving industry needs. One of the key trends driving this evolution is the growing adoption of wireless sensors. These sensors offer significant flexibility and reduce installation costs compared to traditional wired sensors, making them an attractive choice for many industries. Additionally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is significantly enhancing sensor capabilities. These technologies enable sensors to perform predictive analytics, detect anomalies, and improve overall operational efficiency by providing deeper insights into data. Sustainability is also becoming a focal point, with manufacturers increasingly developing energy-efficient sensors to support green manufacturing initiatives and reduce environmental footprints. Non-contact sensors, such as ultrasonic and optical sensors, are gaining popularity for their precision and durability, making them ideal for various industrial applications where traditional contact-based sensors may struggle. These sensors provide accurate measurements without direct interaction with the object, which increases their lifespan and reliability in harsh conditions. The rise of edge computing is further transforming sensor applications by enabling localized data processing at the sensor level. This reduces latency, improves response times, and allows for more efficient and real-time decision-making. In addition, the growing trend of digital twins and smart factories is driving increased demand for high-performance industrial sensors. These sensors are critical for enabling seamless connectivity and providing real-time insights that are vital for optimizing industrial operations, maintaining equipment, and enhancing overall productivity. As industries continue to embrace these innovations, the Industrial Sensors Market is expected to see continued growth, driven by the increasing need for advanced sensor solutions that support automation, sustainability, and data-driven decision-making.

Key Players

-

Honeywell International

-

Siemens

-

Bosch Sensortec

-

ABB

-

STMicroelectronics

-

Texas Instruments

-

TE Connectivity

-

Rockwell Automation

-

Omron Corporation

-

Schneider Electric

Chapter 1. Industrial Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Sensors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Sensors Market – By Sensor Type

6.1 Introduction/Key Findings

6.2 Temperature Sensors

6.3 Pressure Sensors

6.4 Proximity Sensors

6.5 Flow Sensors

6.6 Level Sensors

6.7 Humidity Sensors

6.8 Vibration Sensors

6.9 Optical Sensors

6.10 Y-O-Y Growth trend Analysis By Sensor Type

6.11 Absolute $ Opportunity Analysis By Sensor Type, 2025-2030

Chapter 7. Industrial Sensors Market – By Application

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Automotive

7.4 Energy & Utilities

7.5 Healthcare

7.6 Aerospace & Defense

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Industrial Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Sensor Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Sensor Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Sensor Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Sensor Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Sensor Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial Sensors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International

9.2 Siemens

9.3 Bosch Sensortec

9.4 ABB

9.5 STMicroelectronics

9.6 Texas Instruments

9.7 TE Connectivity

9.8 Rockwell Automation

9.9 Omron Corporation

9.10 Schneider Electric

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Industrial Sensors Market was valued at USD 19 billion in 2024 and is projected to grow at a CAGR of 9% from 2025 to 2030. The market is expected to reach USD 31.86 billion by 2030.

Key drivers include the rising adoption of industrial automation and IoT, growth of Industry 4.0 practices, and advancements in sensor technology.

The market is segmented by sensor type (e.g., temperature, pressure, and proximity sensors) and by application (e.g., manufacturing, automotive, and healthcare).

Asia-Pacific is the dominant region, supported by rapid industrialization and smart factory initiatives in countries like China, Japan, and India.

Leading players include Honeywell International, Siemens, Bosch Sensortec, ABB, and STMicroelectronics.