Smart Factories Market Size (2024 – 2030)

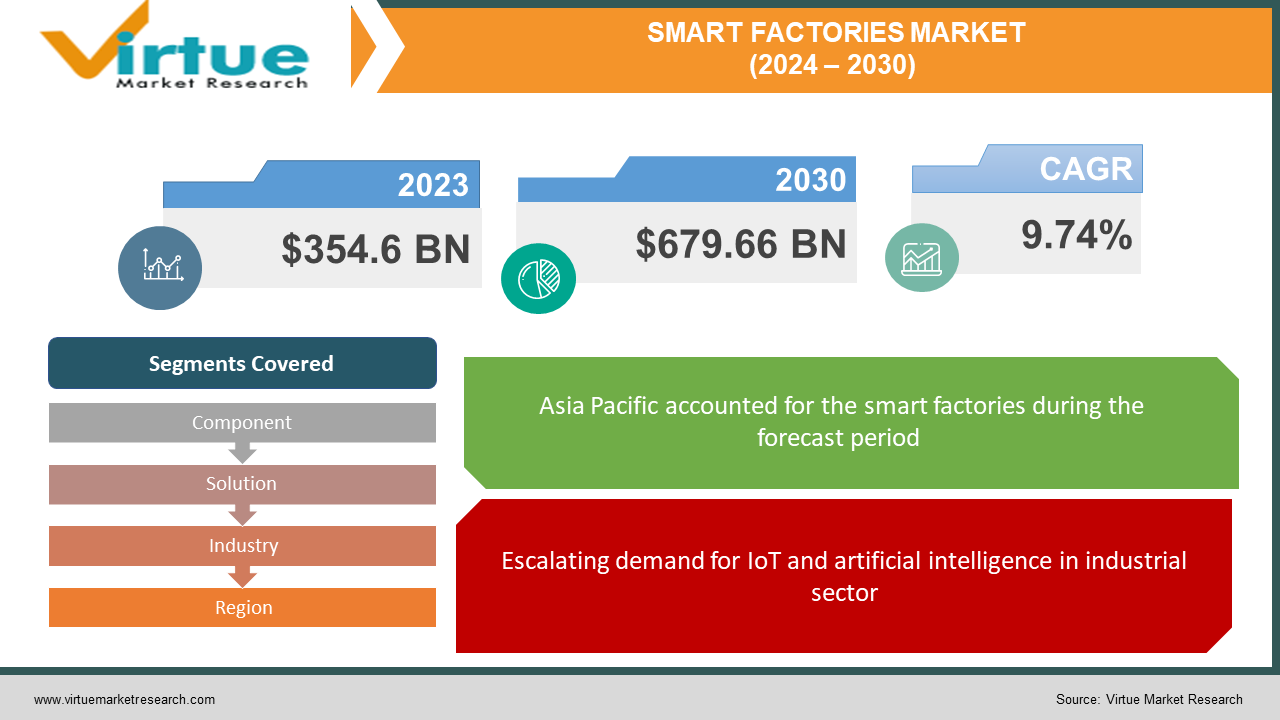

The Smart Factories Market was valued at USD 354.6 billion in 2024 and is projected to reach a market size of USD 679.66 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 9.74%.

A highly connected and digital production facility that depends on intelligent manufacturing is known as a "smart factory." The thought of the "smart factory" is a significant result of Industry 4.0 or the fourth industrial revolution. Several smart factories are being employed by the manufacturing industry, which utilises cutting-edge technology such as robotics, big data analytics, AI and the Internet of Things. These factories can self-correct and function autonomously on a huge scale. An intelligent factory offers connectivity, autonomy, and visibility. Though companies have already applied automation, smart factories go one step ahead and function automatically.

Key Market Insights:

-

It is observed that smart asset-tracking solutions based on IoT and RFID overtook traditional, spreadsheet-based methods in 2022, as per the Zebra’s Manufacturing Vision Study. Maryville University computes that by 2025, over 180 trillion gigabytes of data are expected to be created globally yearly. IIoT-enabled industries will produce a huge portion of this. Moreover, an Industrial IoT (IIoT) company Microsoft Corporation survey observed that 85 percent of organizations have at least one IIoT use case project.

-

Incremental modernization in technology, combined with a sustained growth in the development of manufacturing facilities, is anticipated to affect the market growth rate during the future years. For example, Intel has recently collaborated with Telecom Italia and hardware producer Exor International to come up with a smart manufacturing facility that utilizes artificial intelligence (AI) and 5G networking.

-

Moreover, the advancement in the field equipment market, robots, and sensors may additionally widen the scope of the studied market. As per the Cisco projections, machine-to-machine (M2M) connections that encourage IoT applications may be responsible for more than 50 percent of the world's 28.5 billion connected devices. Several governments also support manufacturing companies to deploy in IoT technologies for smart factory adoption, which generates a favorable outlook for the development of the studied market.

Smart Factories Market Drivers:

Escalating demand for IoT and artificial intelligence in industrial sector

Artificial intelligence (AI) in manufacturing sectors hold technologies such as deep learning, computer vision, natural language processing (NLP), and context consciousness. These technologies not only facilitate machines to execute activities that are presently being performed by humans but also increase business processes and overcome hurdles that producers face. Big data and computer vision technologies are increasingly being utilised because of the accelerating adoption of AI-based solutions in production industries such as semiconductor & electronics, energy & power, pharmaceuticals, automotive, heavy metals and machinery manufacturing, and food & beverage

The combination of IoT has revolutionized numerous industries, notably manufacturing, giving growth to the term Industrial IoT (IIoT). IIoT is reforming manufacturing plants by linking intelligent equipment through SCADA systems, establishing fully digitalized facilities. SCADA systems, inbuilt with IoT and AI technologies, encourage industries to monitor and control applications, increase response times, and estimate machine failures more precisely. This impacts in lowered operational expenses and heightened efficiency. Applying IoT- and AI-based SCADA platforms ensures seamless data transmission and analysis, narrowing plant operations. Smart factories facilitate automatic data collection and analysis, aiding managers to take up well-informed decisions and maximise production. Sensors and machines interact data to the cloud through IoT connectivity solutions at the factory level. Using such IoT equipment in smart factories results in high productivity and bettered quality. Manual inspection business models are substituted by AI-powered visual insights, which lower manufacturing mistakes and save money and time.

Smart Factories Market Restraints and Challenges:

Involves huge capital investments.

The development of a conventional manufacturing facility into a sophisticated smart production plant requires significant capital investment in advanced machinery, software, and IT infrastructure. This involves major elements such as smart field equipment, industrial robots, and advanced communication advancements for seamless industrial automation. However, this transformation poses a financial threat for industries in price-sensitive places like Asia Pacific and South America. Industry specialists cite overall charges, constituting expenses for advancing conventional systems, as a major impediment in altering to smart factories. The upfront setup cost for overhauling the complete production process is usual impractical for many organisations owing to its high magnitude. Furthermore, ongoing maintenance and upgrades needed for automation software systems pose additional financial burdens, especially for small businesses.

Prone to Cyberattacks

Advancing a sensor-based network for controlling and monitoring significant infrastructures must answer the important challenge of cyberattacks. SCADA systems, encompassing sensors, mainframe computers, and interaction and storage systems, are susceptible to such challenges. These processes, handling critical infrastructure operations, experience the risk of disruption, affecting organizations, communities, and economies. Disasters like oil or sewage leaks and electricity grid failures can impact in long-term results. SCADA systems, with versatile communication processes, are prone to cyberattacks at multiple nodes, causing malfunctions and potential catastrophes such as oil spills, radiation leaks, and transportation delays. While applying usual technology standards like IPv5 and IPv6 increases connectivity and approachability of real-time data for informed decision-making, it also escalates vulnerability to external attacks in shared networks.

Smart Factories Market Opportunities:

Penetration of 5G technology in smart factory

To partner and creating real-time analytics, Smart factories combine sensors, robots, and computerized maintenance management systems (CMMS). This facilitates automated techniques, increasing productivity and lowering downtime. Smart factories propel large-scale industrial automation because of specially connected via Ethernet, Wi-Fi, or 4G LTE. The arrival of 5G technology, anticipated to be ten times faster than 4G, promises to widen the accessibility of individual organisations. With 5G, factories constitute powerfully networked and consistently updated components. Smart factory owners use 5G for secure cellular technology usage, customised to specific use cases. Placing sensors on device linked to 5G networks facilitates seamless real-time optimization by extracting data without linking to machines. Producers increasingly adopt 5G networks for robust, uninterrupted networks. The installation of 5G in factories removes the demand for wired connectivity, encouraging a high-speed, flexible manufacturing environment with minimised downtime. A network supporting pace, coverage, and dependability becomes significant for industries. The development of 5G networks is poised to provide a comprehensive solution for factories, generating significant opportunities for smart manufacturing.

SMART FACTORIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.74% |

|

Segments Covered |

By Component, Solution, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB (Switzerland), Emerson Electric Co. (US), Siemens (Germany), Mitsubishi ElectricCorporation (Japan), General Electric (US), Rockwell Automation, Inc. (US), Honeywell International Inc. (US), Yokogawa Electric Corporation (Japan), OMRON Corporation (Japan), Endress+Hauser (Switzerland) |

Smart Factories Market Segmentation: By Component

-

Industrial Sensor

-

Industrial Robots

-

Industrial 3D Printing

-

Machine Vision

It is anticipated that Industrial sensors holds the biggest market share in the future years. Influenced by a surge in demand for automation and data-driven decision-making, the industrial sensor market has observed major global expansion,. Numerous industries, encompassing manufacturing, healthcare, and energy, are increasingly encouraging sensor technologies to boost efficiency. Technological developments, especially the initiation of IoT and AI, is escalating the adoption of sensors. The enhancing recognition of the benefits associated with real-time data controlling and analytics is a primary factor driving the widespread growth of the global industrial sensor industry.

Smart Factories Market Segmentation: By Solution

-

SCADA

-

MES

-

Industrial Safety

-

PAM

It is expected that Manufacturing Execution Systems (MES) segment to hold the major share owing to its market revenue. The worldwide expansion of Manufacturing Execution Systems (MES) is gaining traction, influenced by extensive adoption of Industry 4.0. MES plays a crucial role in real-time monitoring, data analysis, and process optimization, increasing complete manufacturing efficiency. Its combination with cutting-edge technologies like IoT and AI is amplifying its appeal, offering modern production visibility and traceability. As a reaction to the developing stress on smart manufacturing, MES implementation is on the growth across multiple industries, leading to narrowed operations, cost decrement, and enhanced competitiveness on a global scale.

Smart Factories Market Segmentation: By Industry

-

Process Industry

-

Oil & Gas

-

Chemicals

-

Pharmaceuticals

-

Energy & Power

-

Metal & Mining

-

Pulp & Paper

-

Food & Beverages

-

-

Discrete Industry

-

Automotive

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Machine Manufacturing

-

Medical Devices

-

It is expected for Metal & Mining to register largest CAGR during the future period. The metal and mining sector has seen great development in the employment of smart factory systems, initiating cutting-edge technologies like IoT, AI, and automation. These smart factories dedicate to escalated functional efficiency, real-time monitoring, and predictive maintenance, impacting in streamlined manufacturing processes and optimized resource utilization. This modification has substantially elevated protection standards, lowered downtime, and pushed overall productivity within the metal and mining industry. The ongoing combination of smart technologies remains a primary driver of innovation and competitiveness, heralding a crucial departure from traditional industry practices.

Smart Factories Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

It is seen that Asia Pacific to hold biggest market share in the future years. The smart factory market in the Asia-Pacific region is observing robust development, driven by enhancing industrial automation and employment of advanced technologies. Elements such as the demand for bettered efficiency, growing investments in Industry 4.0, and government initiatives encouraging smart manufacturing dedicate to the sector's expansion. The combination of technologies such as IoT, Artificial Intelligence, and robotics additionally pushes the smart factory market's evolution, stating the Asia-Pacific as a dominant player in the global smart manufacturing industry.

COVID-19 Impact Analysis on the Smart Factories Market:

Outbreak of COVID-19 posed crucial challenges in all the sectors including Smart Factory Market sector across the globe. It has resulted in the negative growth of the Smart Factory services as supply chain disruptions due to trade regulations and restrictions affected the product demand.

Latest Trends:

Increasing demand in the Semiconductor Sector

Manufacturers of Semiconductor depend on smart manufacturing techniques to manufacture higher yields and margins. By modernizing semiconductor innovation and supporting the further implementation of modern technologies powered by updated chips, producers can make sure that production keeps pace with growing demand as factories become more complex and networked. The cost goes on device, the maintenance of which is significant to ongoing function. By using creative producing technologies to experience equipment health and execute predictive maintenance, fabs can lower unplanned maintenance time majorly. The semiconductor fabrication plants worldwide are on development. Furthermore, the Semiconductor Industry Association mentioned enhanced spending on new semiconductor equipment. These elements will also propel the employment of smart factories in the semiconductor market.

Key Players:

-

ABB (Switzerland)

-

Emerson Electric Co. (US)

-

Siemens (Germany)

-

Mitsubishi ElectricCorporation (Japan)

-

General Electric (US)

-

Rockwell Automation, Inc. (US)

-

Honeywell International Inc. (US)

-

Yokogawa Electric Corporation (Japan)

-

OMRON Corporation (Japan)

-

Endress+Hauser (Switzerland)

Recent Developments

-

In December 2023, in Industrial area of Talegaon, Maharashtra, India, Mitsubishi Electric India has launched a cutting-edge smart manufacturing technology for advanced Factory Automation Systems. This technology sticks to top industry standards, making sure of the production of high-quality and trust worthy products.

-

In November 2022, In Bangalore, India, ABB Measurement & Analytics started its first smart instrumentation facility to encourage the region's aim of becoming a global manufacturing centre. Devised with modern technology, it complies with the "Make in India" program, supporting efficient and green customer functions.

-

In May 2022 Stratasys Ltd., a key player in polymer 3D printing solutions, has introduced an array of modern manufacturing materials spanning three distinct 3D printing technologies. Observably, this release involves third-party materials particularly customised for FDM® 3D printers, marking an important milestone. With the launch of 16 new materials, Stratasys majorly widens its capabilities, facilitating diverse applications in an extensive range of manufacturing environments.

Chapter 1. Smart Factories Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Factories Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Factories Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Factories Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Factories Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Factories Market – By Component

6.1 Introduction/Key Findings

6.2 Industrial Sensor

6.3 Industrial Robots

6.4 Industrial 3D Printing

6.5 Machine Vision

6.6 Y-O-Y Growth trend Analysis By Component

6.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Smart Factories Market – By Solution

7.1 Introduction/Key Findings

7.2 SCADA

7.3 MES

7.4 Industrial Safety

7.5 PAM

7.6 Y-O-Y Growth trend Analysis By Solution

7.7 Absolute $ Opportunity Analysis By Solution, 2024-2030

Chapter 8. Smart Factories Market – By Industry

8.1 Introduction/Key Findings

8.2 Process Industry

8.3 Oil & Gas

8.4 Chemicals

8.5 Pharmaceuticals

8.6 Energy & Power

8.7 Metal & Mining

8.8 Pulp & Paper

8.9 Food & Beverages

8.10 Discrete Industry

8.11 Automotive

8.12 Aerospace & Defense

8.13 Semiconductor & Electronics

8.14 Machine Manufacturing

8.15 Medical Devices

8.16 Y-O-Y Growth trend Analysis By Industry

8.17 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 9. Smart Factories Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Solution

9.1.4 By Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Solution

9.2.4 By Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Solution

9.3.4 By Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Solution

9.4.4 By Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Solution

9.5.4 By Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Smart Factories Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB (Switzerland)

10.2 Emerson Electric Co. (US)

10.3 Siemens (Germany)

10.4 Mitsubishi ElectricCorporation (Japan)

10.5 General Electric (US)

10.6 Rockwell Automation, Inc. (US)

10.7 Honeywell International Inc. (US)

10.8 Yokogawa Electric Corporation (Japan)

10.9 OMRON Corporation (Japan)

10.10 Endress+Hauser (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Factories Market was valued at USD 354.6 billion in 2024 and is projected to reach a market size of USD 619.34 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 9.74%.

The heightened demand for ML and AI in IoT is propelling the Smart Factories Market.

Smart Factories Market is segmented based on Component, Solution, Industry and Region.

Asia- Pacific is the most dominant region for the Smart Factories Market.

Endress+Hauser (Switzerland), FANUC Corporation (Japan), WIKA (Germany), Dwyer Instruments, LLC. (US), Stratasys (US), 3D Systems Corporation (US) are the few of the key players operating in the Smart Factories Market.