Industrial Robotics Market Size (2024 – 2030)

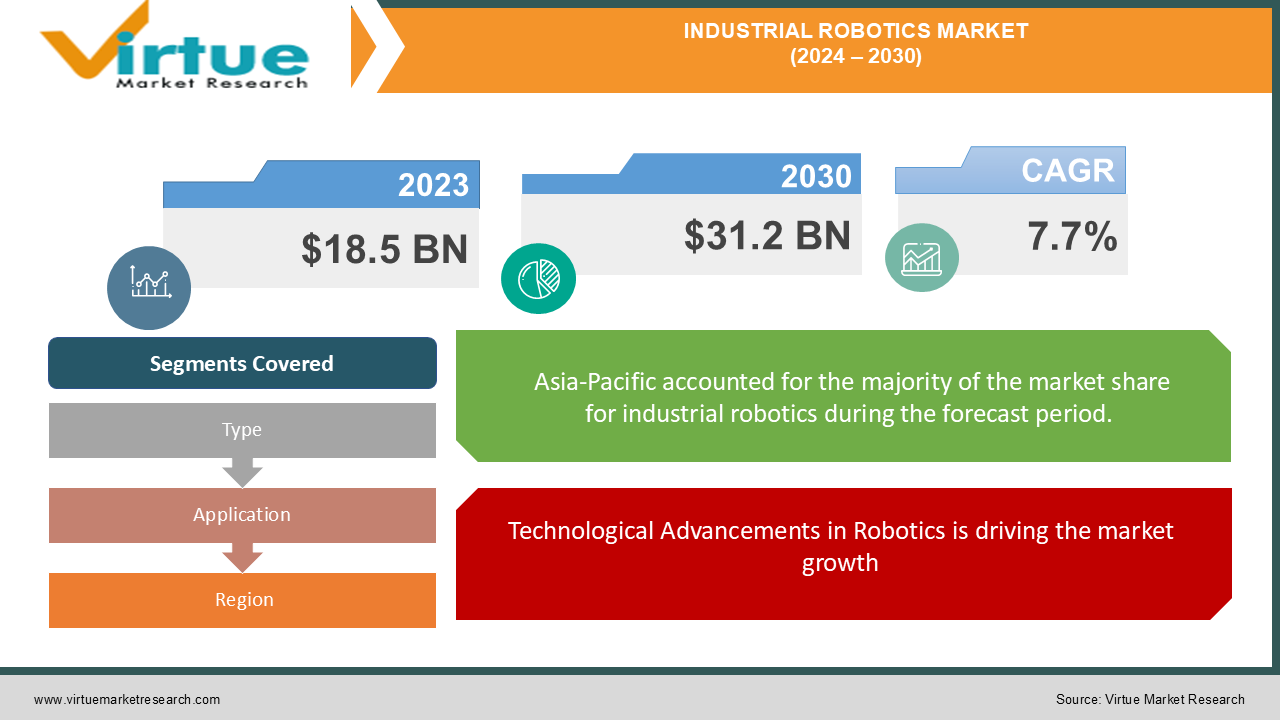

The Global Industrial Robotics Market was valued at approximately USD 18.5 billion in 2023 and is projected to reach USD 31.2 billion by 2030, growing at a CAGR of 7.7% during the forecast period.

Industrial robots are increasingly being adopted across various sectors, including automotive, electronics, and food and beverage, to enhance efficiency, precision, and safety in manufacturing processes. Technological advancements such as AI integration, improved sensor technologies, and robotics-as-a-service (RaaS) are fueling market growth and transforming industrial operations globally.

Industrial robotics refers to the use of robotic systems in industrial settings to automate tasks that were traditionally performed by humans. These robots are designed to perform repetitive and precise tasks with high efficiency and accuracy. They can be used for a wide range of applications, including manufacturing, assembly, welding, and materials handling. Industrial robots are typically controlled by computers and can be programmed to perform specific tasks. They are often equipped with sensors and actuators that allow them to interact with their environment and make decisions based on real-time information.

Key Market Insights:

Articulated robots are the most dominant type due to their flexibility and range of motion, making them suitable for various applications.

Asia-Pacific is the most dominant region, driven by the rapid industrialization and automation in countries like China, Japan, and South Korea.

Automotive and electronics sectors are major contributors to market growth, driven by the need for precision and efficiency in manufacturing processes.

Global Industrial Robotics Market Drivers:

Technological Advancements in Robotics is driving the market growth The rapid advancements in robotics technology are a primary driver of the industrial robotics market. Innovations such as artificial intelligence (AI), machine learning, and advanced sensor technologies have significantly enhanced the capabilities of industrial robots. AI integration allows robots to perform complex tasks, adapt to changing conditions, and optimize their performance in real-time. Advanced sensors improve robots’ ability to detect and respond to environmental changes, increasing their precision and reliability. Furthermore, developments in collaborative robots (cobots) that work alongside humans without safety barriers are expanding the scope of robotics applications. The continuous evolution of robotics technology is driving adoption across various industries, contributing to market growth.

Increasing Demand for Automation in Manufacturing is driving the market growth The growing need for automation in manufacturing processes is driving the demand for industrial robots. Automation helps manufacturers achieve higher production rates, improved quality, and reduced labor costs. In industries such as automotive, electronics, and pharmaceuticals, automation is crucial for maintaining competitiveness and meeting stringent quality standards. Robots are used for tasks such as welding, painting, assembly, and material handling, where they enhance precision, reduce errors, and ensure consistency. The push towards Industry 4.0, characterized by smart manufacturing and interconnected systems, further accelerates the adoption of industrial robots. As manufacturers seek to streamline operations and increase efficiency, the demand for advanced robotics solutions is expected to rise.

Expansion of Robotics-as-a-Service (RaaS) is driving the market growth The emergence of Robotics-as-a-Service (RaaS) is transforming the industrial robotics market by offering flexible and cost-effective solutions for businesses. RaaS allows companies to access robotic systems on a subscription or pay-per-use basis, reducing the capital investment required for purchasing and maintaining robots. This model is particularly attractive to small and medium-sized enterprises (SMEs) that may not have the resources for significant upfront investments. RaaS providers offer a range of services, including installation, maintenance, and support, making it easier for businesses to integrate robotics into their operations. The growth of RaaS is expanding the market for industrial robotics and enabling broader adoption across various industries.

Global Industrial Robotics Market Challenges and Restraints:

High Initial Investment Costs are restricting the market growth

One of the major challenges in the industrial robotics market is the high initial investment required for purchasing and implementing robotic systems. The cost of advanced robots, along with the associated infrastructure and integration expenses, can be significant, particularly for small and medium-sized enterprises (SMEs). While the long-term benefits of automation, such as increased productivity and cost savings, can outweigh the initial costs, the upfront financial burden remains a barrier for many businesses. Additionally, the need for skilled personnel to operate and maintain robotic systems adds to the overall cost. Manufacturers and suppliers are working to address these challenges by offering more affordable solutions and financing options to make robotics more accessible.

Integration and Compatibility Issues is restricting the market growth

Integrating industrial robots into existing manufacturing processes can pose challenges related to compatibility and system integration. Existing production lines and machinery may not be designed to accommodate new robotic systems, requiring modifications and adjustments. Ensuring seamless communication and coordination between robots and other automation components is crucial for achieving optimal performance. Additionally, the complexity of programming and configuring robots to work effectively within diverse environments can be a challenge. Addressing these integration issues requires careful planning, technical expertise, and collaboration between manufacturers, system integrators, and robotics providers.

Market Opportunities:

Emerging economies, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the industrial robotics market. Rapid industrialization, urbanization, and economic development in these regions are driving demand for automation solutions across various sectors. Countries such as China, India, and Brazil are investing heavily in infrastructure, manufacturing, and technology, creating opportunities for robotics companies to expand their presence. The increasing focus on improving manufacturing capabilities and competitiveness in emerging markets is expected to drive the adoption of industrial robots. Additionally, government initiatives and incentives to promote automation and technological advancements further support market growth in these regions. The development of collaborative robots (cobots) represents a significant opportunity for growth in the industrial robotics market. Cobots are designed to work alongside human operators, enhancing productivity and safety in various applications. Unlike traditional industrial robots, cobots are equipped with advanced sensors and safety features that allow them to operate in close proximity to humans without requiring safety barriers. The flexibility and ease of use of cobots make them suitable for a wide range of tasks, from assembly and packaging to quality inspection. As industries seek to leverage the benefits of human-robot collaboration, the demand for cobots is expected to increase. Innovations in cobot design and functionality are likely to drive further market growth and expansion.

INDUSTRIAL ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Denso Corporation, Omron Corporation, Staubli International AG, Kawasaki Heavy Industries, Ltd. |

Industrial Robotics Market Segmentation: By Type

-

Articulated Robots

-

SCARA Robots

-

Cartesian Robots

-

Collaborative Robots (Cobots)

-

Others

Articulated robots are the most dominant type in the industrial robotics market due to their flexibility and range of motion. They are widely used for tasks such as welding, assembly, and material handling, offering high precision and versatility. Their ability to perform complex movements and reach various angles makes them suitable for a broad range of applications.

Industrial Robotics Market Segmentation: By Application

-

Automotive

-

Electronics

-

Food and Beverage

-

Pharmaceuticals

-

Metal and Machinery

-

Others

The automotive industry is the largest application segment for industrial robots, driven by the need for automation in manufacturing processes such as welding, painting, and assembly. Robots play a crucial role in improving production efficiency, quality, and safety in automotive manufacturing.

Industrial Robotics Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the leading region in the industrial robotics market, driven by rapid industrialization and technological advancements in countries like China, Japan, and South Korea. The region’s strong manufacturing base, coupled with government initiatives to promote automation, contributes to its market dominance.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a significant impact on the industrial robotics market. During the initial phase of the pandemic, manufacturing disruptions, supply chain interruptions, and reduced workforce availability led to a temporary decline in demand for industrial robots. However, as economies began to recover and industries resumed operations, the demand for robotics solutions started to rebound. The pandemic accelerated the adoption of automation technologies, as companies sought to enhance resilience and operational efficiency in response to future disruptions. The increased focus on health and safety, along with the need for contactless solutions, further boosted the demand for robotics in various sectors. The pandemic highlighted the importance of flexible and adaptable manufacturing processes, driving growth and innovation in the industrial robotics market.

Latest Trends/Developments:

Several notable trends and developments are shaping the industrial robotics market. The integration of artificial intelligence (AI) and machine learning is enhancing the capabilities of robots, enabling them to perform complex tasks and adapt to changing conditions. Innovations in collaborative robots (cobots) are expanding the scope of human-robot collaboration, improving productivity and safety. The rise of robotics-as-a-service (RaaS) is providing flexible and cost-effective solutions for businesses, making robotics more accessible to SMEs. Additionally, advancements in sensor technologies and smart robotics are driving the development of robots with enhanced precision and functionality. The continuous evolution of robotics technology and the growing emphasis on automation are contributing to the market's growth and transformation. Another trend is the integration of artificial intelligence and machine learning, enabling robots to learn from their experiences, adapt to changing environments, and make more informed decisions. Additionally, advancements in sensor technology and computer vision are improving robots' ability to perceive and interact with their surroundings more accurately and autonomously. These trends are driving the expansion of industrial robotics into new industries and applications, such as healthcare, agriculture, and logistics.

Key Players:

-

ABB Ltd.

-

Fanuc Corporation

-

KUKA AG

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

Universal Robots A/S

-

Denso Corporation

-

Omron Corporation

-

Staubli International AG

-

Kawasaki Heavy Industries, Ltd.

Chapter 1. Industrial Robotics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Robotics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Robotics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Robotics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Robotics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Robotics Market – By Types

6.1 Introduction/Key Findings

6.2 Articulated Robots

6.3 SCARA Robots

6.4 Cartesian Robots

6.5 Collaborative Robots (Cobots)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Industrial Robotics Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Electronics

7.4 Food and Beverage

7.5 Pharmaceuticals

7.6 Metal and Machinery

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Industrial Robotics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial Robotics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ABB Ltd.

9.2 Fanuc Corporation

9.3 KUKA AG

9.4 Yaskawa Electric Corporation

9.5 Mitsubishi Electric Corporation

9.6 Universal Robots A/S

9.7 Denso Corporation

9.8 Omron Corporation

9.9 Staubli International AG

9.10 Kawasaki Heavy Industries, Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Robotics Market was valued at approximately USD 18.5 billion in 2023 and is projected to reach USD 31.2 billion by 2030, growing at a CAGR of 7.7% during the forecast period.

Key drivers of the Industrial Robotics Market include technological advancements in robotics, increasing demand for automation in manufacturing, and the expansion of Robotics-as-a-Service (RaaS). These factors contribute to enhanced efficiency, precision, and cost-effectiveness in industrial operations.

The Industrial Robotics Market is segmented by type into Articulated Robots, SCARA Robots, Cartesian Robots, Collaborative Robots (Cobots), and Others. By application, it is segmented into Automotive, Electronics, Food and Beverage, Pharmaceuticals, Metal and Machinery, and Others.

Asia-Pacific is the most dominant region for the Industrial Robotics Market, driven by rapid industrialization, technological advancements, and strong manufacturing bases in countries such as China, Japan, and South Korea.

Leading players in the Industrial Robotics Market include ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Denso Corporation, Omron Corporation, Staubli International AG, and Kawasaki Heavy Industries, Ltd.