Industrial Motors Market Size (2024 – 2030)

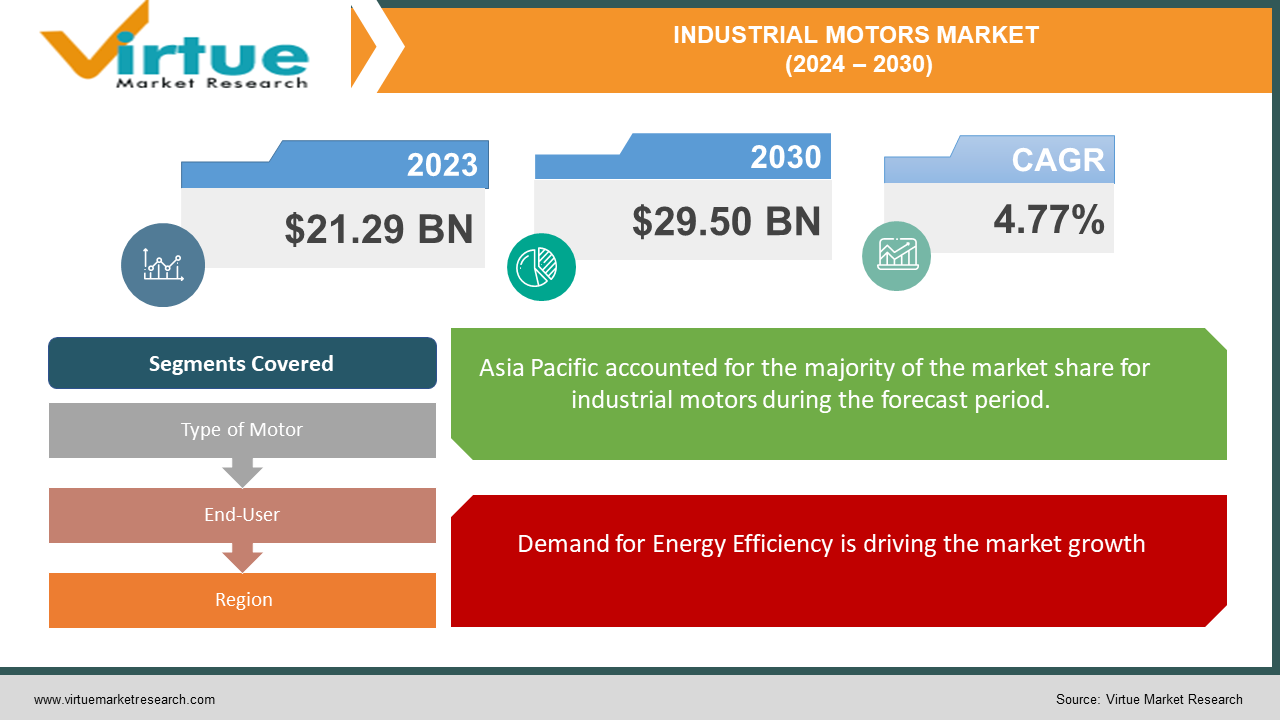

The Global Industrial Motors Market was valued at USD 21.29 billion in 2023 and will grow at a CAGR of 4.77% from 2024 to 2030. The market is expected to reach USD 29.50 billion by 2030.

The industrial motor market is the global network of businesses that manufacture, distribute, and use electric motors specifically designed for powering industrial machinery. This market encompasses a wide range of motors, from those powering massive pumps in factories to intricate motors controlling robots in assembly lines. It's a crucial sector that underpins various industries, and recent trends are pushing for motors that are more efficient, intelligent, and customized for specific needs.

Key Market Insights:

Pumps and fans account for the biggest application segment, estimated at around 23.4% market share in 2022. This segment is expected to reach a value of $6.7 billion by 2032

Rising demand for energy-efficient motors is a key driver, fueled by increasing electricity prices and stricter energy regulations

Fluctuating raw material prices for components like copper and permanent magnets create market instability

Global Industrial Motors Market Drivers:

Demand for Energy Efficiency is driving the market growth

Stringent government regulations and rising electricity prices are driving the demand for energy-efficient industrial motors. This is because electric motors are responsible for a significant portion of industrial energy consumption, up to 70% according to the report. By switching to more efficient motors, businesses can reduce their energy consumption and their electricity bills. This can lead to significant cost savings over the lifetime of the motor. In addition, some government regulations encourage the use of energy-efficient motors, which can further incentivize businesses to make the switch. Overall, the focus on energy efficiency is a major driver of the demand for industrial motors.

Infrastructure Development is driving the market growth

The global infrastructure boom is fueling the demand for industrial motors across various sectors. As governments invest heavily in projects like power generation, water treatment, and transportation, a surge in motor use is inevitable. Power plants rely on industrial motors to drive turbines and generators, while water treatment facilities utilize them in pumps and filtration systems. Similarly, the transportation sector incorporates motors in everything from electric vehicle charging stations to railway systems and ventilation fans in tunnels. This increased demand is multifaceted. Firstly, these projects require a sheer volume of motors to function. Secondly, the specific needs of each infrastructure project necessitate a variety of motor types, from high-power workhorses to specialized models for precise control. In essence, the global infrastructure push is creating a vast and diverse market for industrial motors, playing a crucial role in bringing these essential projects to life.

Industrial Automation and Growth is driving the market growth

The rise of Industry 4.0, with its emphasis on automation and data-driven smart manufacturing, is acting as a supercharger for the industrial motors market. Factories are increasingly adopting robots, conveyor belts, and other automated equipment, all of which rely heavily on industrial motors to function. This creates a surging demand for dependable and efficient motors that can handle the continuous operation of these advanced systems. Moreover, as Industry 4.0 integrates the Industrial Internet of Things (IIoT) and real-time data analysis, motors themselves are becoming more intelligent. Manufacturers are developing new motors with embedded sensors and controls that can communicate with factory networks, allowing for predictive maintenance, optimized performance, and improved energy use. This trend is particularly pronounced in regions experiencing a boom in industrial development. These regions are building up their manufacturing infrastructure from the ground up, requiring a robust foundation of industrial motors to power their growth. In short, Industry 4.0 is fostering a perfect storm for the industrial motors market, driven by the need for ever-more sophisticated and powerful motors to fuel the automation revolution.

Global Industrial Motors Market challenges and restraints:

The high upfront costs are restricting the market growth

The allure of significant energy cost savings over the lifespan of an industrial motor is undeniable, but the upfront investment can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). Unlike their conventional, less-efficient counterparts, high-efficiency motors come with a heftier price tag. This initial investment can be a major hurdle for SMEs, whose budgets are often tighter and require quicker returns. While the long-term energy savings can be substantial, the upfront cost can create a cash flow squeeze, impacting other areas of the business. This situation can be further exacerbated by limited access to financing or capital expenditure restrictions. Ultimately, SMEs must carefully weigh the long-term energy savings against the immediate financial strain, potentially requiring creative solutions like extended payback periods from suppliers or exploring government incentives that promote energy-efficient upgrades

Fluctuating raw material prices are restricting the market growth

The stability of the industrial motor market is constantly challenged by the unpredictable nature of raw material prices. Copper, a crucial component in motor windings, and rare earth elements used in permanent magnets are particularly susceptible to price swings. Geopolitical tensions, supply chain disruptions, and unexpected market forces can cause these raw materials to surge or plummet. This volatility disrupts the carefully calculated production costs for manufacturers. They may be forced to absorb the increased material expense, leading to lower profit margins, or pass it on to customers, resulting in price hikes for end users. This price instability can be particularly damaging for businesses reliant on stable motor pricing for budgeting and project planning. Furthermore, manufacturers are hesitant to commit to long-term contracts with fluctuating material costs, potentially leading to supply shortages and project delays. The industry is constantly seeking solutions, like exploring alternative materials or implementing flexible pricing models, to mitigate the impact of this raw material price rollercoaster.

Market Opportunities:

The industrial motors market presents a wealth of exciting opportunities. The ever-increasing focus on energy efficiency creates a prime opportunity for manufacturers to develop and market high-efficiency motors that comply with government regulations and significantly reduce operational costs for businesses. The rise of Industry 4.0 fosters a demand for intelligent motors embedded with sensors and controls, allowing for predictive maintenance, real-time performance optimization, and integration with factory networks. This opens doors for innovation in motor design and functionality. Furthermore, the global infrastructure boom necessitates a diverse range of industrial motors for applications like power generation, water treatment, and transportation. This presents an opportunity for manufacturers to cater to these specific needs with specialized motor solutions. Additionally, the growing popularity of electric vehicles creates a demand for high-performance and reliable motors for electric car components. By capitalizing on these trends and investing in research and development, manufacturers can establish a strong foothold in this promising market.

INDUSTRIAL MOTORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.77% |

|

Segments Covered |

By Type of Motor, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB , Siemens , Nidec Corporation , WEG , Eaton , Honeywell , Rockwell Automation , United Technologies Corporation , Regal Beloit Corporation , Emerson Electric Co. |

Industrial Motors Market Segmentation - by Type of Motor

-

Alternating Current (AC) motors

-

Direct Current (DC) motors

AC motors reign supreme in the industrial motor world. Their reputation for reliability, lower maintenance requirements, and ability to handle continuous operation make them the most dominant choice for powering industrial applications. While DC motors offer precise speed control, their reliance on brushes and commutators for current reversal translates to higher maintenance needs. This, coupled with AC motors' generally simpler design and lower overall cost, makes them the workhorse of the industrial motor market.

Industrial Motors Market Segmentation - By End-User

-

Oil and Gas

-

Power Generation

-

Mining and Metals

-

Chemicals and Petrochemicals

The oil and gas industry currently holds the dominant position in the industrial motors market. This is due to their extensive reliance on these motors throughout their operations. From the high-durability and explosion-proof motors required for drilling and extraction to those powering pumps and refineries, the oil and gas sector utilizes a vast array of industrial motors. Reports indicate this trend is likely to continue, with the oil and gas industry projected to witness significant growth in its demand for industrial motors.

Industrial Motors Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific currently reigns supreme. This dominance can be attributed to several factors. Firstly, the region boasts a booming manufacturing sector, particularly in countries like China and India, fueling a high demand for industrial motors across various applications. Secondly, government initiatives promoting industrial automation and infrastructure development further drive market growth. Additionally, the presence of established domestic and international motor manufacturers within the region fosters a competitive landscape that promotes innovation and cost-effectiveness. These combined factors solidify Asia-Pacific's position as the most dominant region in the global industrial motor market.

COVID-19 Impact Analysis on the Global Industrial Motors Market

The COVID-19 pandemic threw a curveball at the industrial motors market. Disruptions in global supply chains due to lockdowns and travel restrictions hampered the manufacturing and delivery of industrial motors. This, coupled with a temporary halt or slowdown in industrial activity across various sectors like automotive and manufacturing, led to a decline in demand for industrial motors in the short term. Additionally, project delays and budget cuts in infrastructure projects further dampened the market.

However, the impact wasn't all negative. As economies recovered and industries restarted operations, the demand for industrial motors began to pick up again. The long-term drivers like focus on energy efficiency, automation through Industry 4.0, and infrastructural development are still very much in play. In fact, some sectors like healthcare and food processing, which witnessed increased activity during the pandemic, might even experience a rise in demand for specific industrial motors. Additionally, the growing emphasis on post-pandemic sustainability could further propel the demand for energy-efficient industrial motors. Overall, while the COVID-19 pandemic caused a temporary setback, the long-term outlook for the global industrial motors market remains positive, driven by robust underlying trends and potential areas of growth.

Latest trends/Developments

The industrial motor market is buzzing with advancements focused on efficiency, intelligence, and customization. A major trend is the growing demand for high-efficiency motors, driven by rising energy costs and stricter regulations. Manufacturers are innovating with materials and designs to create motors that deliver more power with less energy consumption. Additionally, the rise of Industry 4.0 is pushing for smart motors integrated with sensors and connectivity features. These motors allow for real-time monitoring, predictive maintenance, and remote control, optimizing performance and reducing downtime. Another trend gaining traction is motor customization. Manufacturers are increasingly offering motors tailored to specific applications, with features like variable speeds, integrated drives, and specialized cooling systems. This caters to the growing need for motors that seamlessly integrate into complex industrial processes. Finally, the development of alternative materials like advanced ceramics and new permanent magnet compositions is being explored to address price fluctuations in traditional materials and improve motor performance. These trends are shaping the future of industrial motors, leading to a more sustainable, intelligent, and application-specific industry

Key Players:

-

ABB

-

Siemens

-

Nidec Corporation

-

WEG

-

Eaton

-

Honeywell

-

Rockwell Automation

-

United Technologies Corporation

-

Regal Beloit Corporation

-

Emerson Electric Co.

Chapter 1. Industrial Motors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Motors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Motors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Motors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Motors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Motors Market – By Type of Motor

6.1 Introduction/Key Findings

6.2 Alternating Current (AC) motors

6.3 Direct Current (DC) motors

6.4 Y-O-Y Growth trend Analysis By Type of Motor

6.5 Absolute $ Opportunity Analysis By Type of Motor, 2024-2030

Chapter 7. Industrial Motors Market – By End-User

7.1 Introduction/Key Findings

7.2 Oil and Gas

7.3 Power Generation

7.4 Mining and Metals

7.5 Chemicals and Petrochemicals

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Industrial Motors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type of Motor

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type of Motor

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type of Motor

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type of Motor

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type of Motor

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial Motors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ABB

9.2 Siemens

9.3 Nidec Corporation

9.4 WEG

9.5 Eaton

9.6 Honeywell

9.7 Rockwell Automation

9.8 United Technologies Corporation

9.9 Regal Beloit Corporation

9.10 Emerson Electric Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Motors Market was valued at USD 21.29 billion in 2023 and will grow at a CAGR of 4.77% from 2024 to 2030. The market is expected to reach USD 29.50 billion by 2030.

Industrial Automation and Growth, and Infrastructure Development are the reasons which are driving the market.

Based on the type of motor it is divided into two segments – Alternating Current (AC) motors

Asia Pacific is the most dominant region for the Industrial Motors Market.

Siemens, Nidec Corporation, WEG, Eaton