Indoor Positioning System Market Size (2025 – 2030)

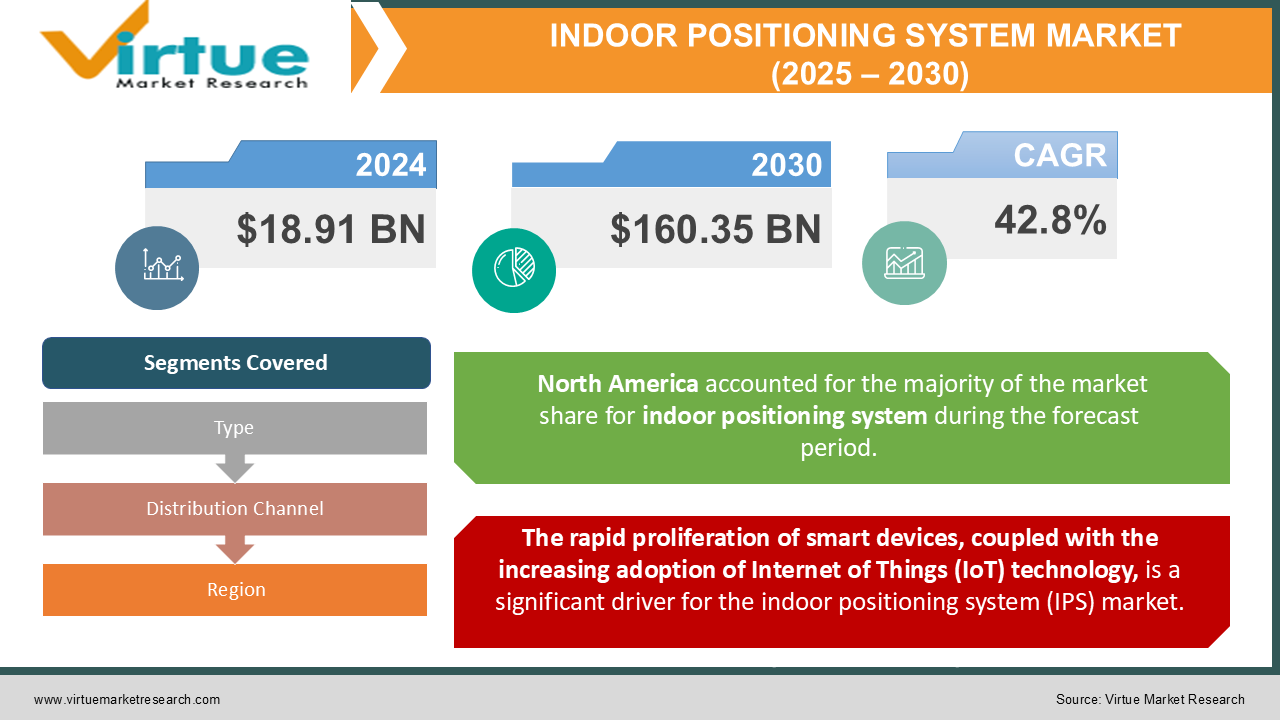

The Indoor Positioning System Market was valued at USD 18.91 Billion in 2024 and is projected to reach a market size of USD 160.35 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 42.8%.

The indoor positioning system (IPS) market represents a dynamic and transformative segment of the technology industry, fundamentally altering how businesses, institutions, and consumers navigate and interact within indoor spaces. Unlike GPS, which is optimized for outdoor navigation, IPS is designed specifically to address the unique challenges of indoor environments, such as multi-floor buildings, underground locations, and other areas where satellite signals are unreliable or non-existent.

Key Market Insights:

-

The indoor positioning system market recorded a total revenue of $12.8 billion in 2023.

-

Over 68% of retail stores reported utilizing IPS for personalized customer experiences in 2023.

-

Approximately 34 million IPS devices were deployed across various industries globally in 2023.

-

The healthcare sector accounted for 22% of IPS deployments in 2023.

-

Indoor navigation apps using IPS solutions saw a 47% increase in downloads in 2023 compared to 2022.

-

Nearly 56% of airports worldwide implemented IPS technology to enhance passenger navigation in 2023.

-

The integration of IPS with AR and VR solutions surged by 38% in 2023.

-

BLE-based IPS solutions accounted for 29% of the market share in 2023.

-

UWB technology witnessed a 19% adoption increase in IPS systems in 2023.

-

Smart warehouses using IPS improved operational efficiency by an average of 21% in 2023.

-

Approximately 61% of IPS installations in 2023 were in smart buildings and offices.

-

The logistics and supply chain sector contributed 18% to the market revenue in 2023.

-

75% of IPS users rated system accuracy as the top priority in 2023.

-

Real-time location systems (RTLS) accounted for 31% of IPS applications in 2023.

-

Global shipments of IPS hardware devices reached 12.2 million units in 2023.

-

The education sector increased IPS adoption by 23% in 2023 for campus navigation and safety.

-

IPS-enabled museums and galleries experienced a 15% rise in visitor engagement in 2023.

-

Data privacy concerns were cited as a major challenge by 41% of IPS users in 2023.

-

Retailers using IPS observed a 26% increase in customer retention rates in 2023.

-

The global IPS workforce grew by 11% in 2023, reflecting the market's expansion.

Market Drivers:

The rapid proliferation of smart devices, coupled with the increasing adoption of Internet of Things (IoT) technology, is a significant driver for the indoor positioning system (IPS) market.

Modern businesses and consumers alike are leveraging interconnected devices to streamline operations and enhance user experiences. Smart sensors, beacons, and mobile devices form the backbone of IPS implementations, enabling precise real-time location tracking within enclosed environments. IoT integration amplifies the capabilities of IPS, as connected ecosystems can transmit, process, and analyse large volumes of location data. For example, in a smart warehouse, IoT-enabled IPS solutions facilitate inventory tracking, reducing misplaced items and optimizing stock management. Industries such as healthcare, logistics, retail, and education have witnessed a surge in demand for IoT-driven IPS solutions. Hospitals use the technology to locate medical equipment and personnel efficiently, while retailers deploy IPS to provide tailored recommendations to shoppers based on their in-store location. The convergence of IPS and IoT empowers businesses to enhance operational efficiency, ensure safety, and drive consumer satisfaction. The evolution of wireless communication technologies has played a crucial role in driving IPS adoption. Techniques like Bluetooth Low Energy (BLE), ultra-wideband (UWB), Wi-Fi, and magnetic positioning offer unparalleled accuracy and reliability for indoor tracking systems. Among these, BLE has gained substantial traction due to its cost-effectiveness and compatibility with smartphones. Similarly, UWB technology is being recognized for its precision, especially in scenarios requiring high accuracy, such as industrial automation and robotics. The rise of 5G connectivity is further revolutionizing the IPS market by enabling ultra-low latency and high-speed data transfer. This advancement facilitates real-time location updates, which are critical for applications like augmented reality (AR) navigation in malls and airports or automated guided vehicles (AGVs) in manufacturing plants. As wireless communication continues to advance, IPS systems are becoming more robust, scalable, and accessible, paving the way for innovative use cases across various sectors.

Market Restraints and Challenges:

Despite its numerous benefits, the indoor positioning system market faces several challenges that may hinder its growth. One significant restraint is the high implementation cost of IPS infrastructure. Setting up an IPS requires substantial investment in hardware components like beacons, sensors, and communication modules, as well as software and system integration. This can be a financial burden for small and medium-sized enterprises (SMEs) and organizations with limited budgets. Additionally, maintenance and periodic upgrades further increase the total cost of ownership. Interoperability issues also pose a challenge, as IPS solutions from different vendors often lack standardization. Businesses deploying multi-vendor systems may encounter compatibility issues, leading to inefficiencies and increased costs. Moreover, the lack of universally accepted standards complicates the development of scalable and uniform IPS solutions. Another pressing concern is data privacy and security. IPS solutions rely heavily on real-time data collection and processing, raising concerns about potential misuse or breaches of sensitive information. As location data becomes a valuable asset, organizations must prioritize robust cybersecurity measures to ensure compliance with privacy regulations and protect user trust. Lastly, environmental factors such as signal interference, building materials, and structural layouts can impact the accuracy and reliability of IPS systems. For instance, metal and concrete structures may obstruct wireless signals, while densely populated areas can experience signal congestion. Overcoming these technical limitations requires continuous innovation and optimization of IPS technologies.

Market Opportunities:

The indoor positioning system market offers significant growth opportunities, driven by technological advancements and evolving business needs. One notable opportunity lies in the integration of IPS with emerging technologies such as augmented reality (AR) and virtual reality (VR). Combining IPS with AR/VR can revolutionize customer experiences in sectors like retail, tourism, and education. For instance, museums can use AR-powered IPS to provide immersive, interactive tours, while shopping malls can enhance navigation with virtual guides. The healthcare sector presents another lucrative opportunity. IPS solutions can transform hospital operations by improving asset tracking, optimizing staff allocation, and ensuring patient safety. As healthcare facilities increasingly adopt digital transformation initiatives, the demand for IPS solutions is expected to rise. Smart cities and infrastructure projects also hold immense potential for IPS adoption. Governments and urban planners are leveraging IPS to optimize traffic flow, enhance public safety, and manage infrastructure efficiently. For example, IPS-enabled smart parking systems can guide drivers to available parking spots, reducing congestion and saving time. Additionally, the education sector is emerging as a promising market for IPS. Universities and schools are adopting IPS for campus navigation, resource tracking, and emergency response. These solutions enhance campus safety and improve operational efficiency, aligning with the growing emphasis on technology-driven education.

INDOOR POSITIONING SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

42.8% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, Apple Inc., Google LLC, Microsoft Corporation, Qualcomm Technologies, Zebra Technologies, STMicroelectronics, Inpixon,IndoorAtlas, Senion AB |

Indoor Positioning System Market Segmentation: by Type

-

Proximity-based systems

-

Triangulation-based systems

-

Hybrid systems

Fastest-Growing Type: Hybrid systems are witnessing rapid growth due to their ability to combine multiple technologies, such as BLE, UWB, and Wi-Fi, to deliver superior accuracy and reliability.

Most Dominant Type: Proximity-based systems remain the most widely used due to their cost-effectiveness and simplicity, making them suitable for a broad range of applications.

Indoor Positioning System Market Segmentation: by Distribution Channel

-

Direct sales

-

Distributors and resellers

-

Online platforms

Fastest-Growing Channel: Online platforms are gaining momentum as businesses seek convenient and cost-effective procurement methods.

Most Dominant Channel: Direct sales continue to dominate, particularly for large-scale enterprise solutions requiring customization and technical support.

Indoor Positioning System Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

Most Dominant Region: North America leads the market, driven by technological advancements, high adoption of smart devices, and a robust IoT ecosystem.

Fastest-Growing Region: Asia-Pacific is the fastest-growing region, fueled by the rapid urbanization, increasing investments in smart infrastructure, and expanding retail and healthcare sectors.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly influenced the IPS market, accelerating the adoption of digital and contactless solutions across industries. IPS played a critical role in ensuring social distancing, contact tracing, and crowd management in public spaces. Retailers leveraged IPS to implement contactless shopping experiences, while healthcare facilities used it to monitor patient movements and manage resources effectively. The pandemic underscored the importance of location-based technologies, driving increased investment and innovation in the IPS market.

Latest Trends and Developments:

The IPS market is witnessing remarkable trends and developments. Key innovations include the integration of AI and machine learning to enhance accuracy and predictive capabilities, the adoption of UWB technology for centimetre-level precision, and the convergence of IPS with 5G networks. Furthermore, the rise of smart cities and connected infrastructure is driving demand for IPS solutions, while advancements in AR and VR applications are unlocking new use cases across industries. These trends highlight the market's dynamic nature and its potential for continuous growth.

Key Players

-

Cisco Systems

-

Apple Inc.

-

Google LLC

-

Microsoft Corporation

-

Qualcomm Technologies

-

Zebra Technologies

-

STMicroelectronics

-

Inpixon

-

IndoorAtlas

-

Senion AB

Chapter 1. Indoor Positioning System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Indoor Positioning System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Indoor Positioning System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Indoor Positioning System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Indoor Positioning System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Indoor Positioning System Market – By Type

6.1 Introduction/Key Findings

6.2 Proximity-based systems

6.3 Triangulation-based systems

6.4 Hybrid systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Indoor Positioning System Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct sales

7.3 Distributors and resellers

7.4 Online platforms

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Indoor Positioning System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Indoor Positioning System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cisco Systems

9.2 Apple Inc.

9.3 Google LLC

9.4 Microsoft Corporation

9.5 Qualcomm Technologies

9.6 Zebra Technologies

9.7 STMicroelectronics

9.8 Inpixon

9.9 IndoorAtlas

9.10 Senion AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the Indoor Positioning System Market include increasing demand for real-time location services, IoT integration, advancements in wireless communication technologies, rising adoption in healthcare and retail sectors, and the growing emphasis on smart infrastructure development.

The main concerns about the Indoor Positioning System (IPS) market include high implementation costs, interoperability challenges, data privacy risks, signal interference from building materials, lack of standardization, and accuracy issues in complex environments, impacting widespread adoption and scalability.

Cisco Systems, Apple Inc., Google LLC, Microsoft Corporation, Qualcomm Technologies, Zebra Technologies, STMicroelectronics.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.