Hydrogen Purifiers Market Size (2024 – 2030)

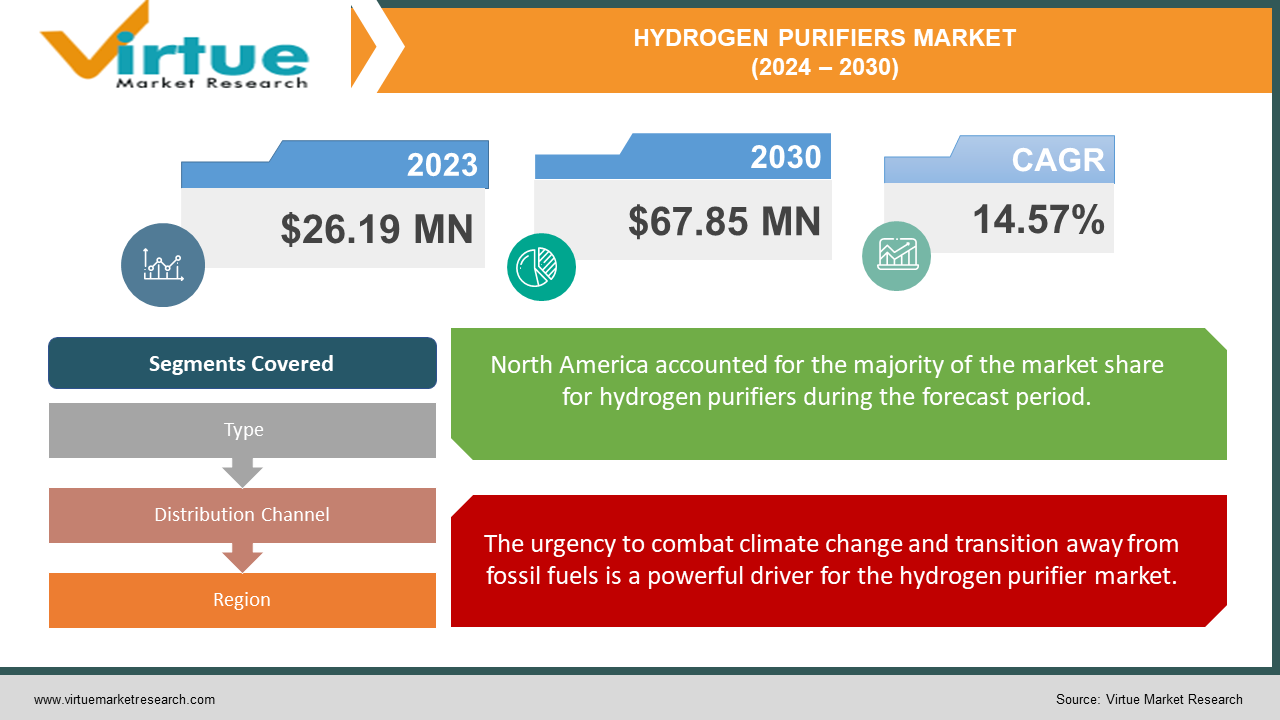

The Global Hydrogen Purifiers Market was valued at USD 26.19 Million in 2023 and is projected to reach a market size of USD 67.85 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.57%.

Hydrogen derived from various sources, such as natural gas reforming or electrolysis of water, often contains impurities like methane, carbon monoxide, and water vapor. These impurities can hinder the performance and efficiency of technologies that utilize hydrogen, such as fuel cells. Hydrogen purifiers act as the gatekeepers, meticulously removing these contaminants to ensure hydrogen meets the stringent purity requirements for various applications. Significant advancements in fuel cell technology are paving the way for wider deployment of hydrogen-powered vehicles and stationary fuel cells. These applications require high-purity hydrogen for optimal performance and efficiency.

Key Market Insights:

- Since the manufacturing of semiconductors requires high-purity hydrogen, the electronics industry presently holds a 30% share of the market for hydrogen purifiers.

- The increased use of hydrogen in hydrocracking and desulfurization processes is expected to drive 25% of market growth in the oil refining sector by 2029.

- It is projected that 20% of the market growth by 2029 will come from the increasing demand for hydrogen fuel cell electric cars, or FCEVs. FCEVs require ultra-high-quality hydrogen in order to run at maximum efficiency and range.

- Global investments in hydrogen-generating facilities are projected to reach $1.5 billion by 2025. This increase in production capacity will necessitate a commensurate increase in hydrogen.

- Manufacturers are increasingly focusing on developing high-efficiency purifiers that minimize energy consumption and operational costs. Additionally, automation technologies are being integrated to streamline purification processes and enhance consistency

Hydrogen Purifiers Market Drivers:

The urgency to combat climate change and transition away from fossil fuels is a powerful driver for the hydrogen purifier market.

Hydrogen, when used in fuel cells, produces electricity and water vapor as byproducts, emitting zero greenhouse gases at the point of use. This clean-burning nature makes it a frontrunner in the race to decarbonize various sectors, including transportation, power generation, and industrial processes.

Hydrogen acts as a versatile energy carrier, enabling the storage and transportation of energy generated from renewable sources such as solar and wind power. However, the hydrogen produced through the electrolysis of water often contains impurities like oxygen. These impurities can hinder the efficiency and durability of fuel cells and other hydrogen-powered technologies. Hydrogen purifiers ensure that the hydrogen derived from renewable sources meets the necessary purity standards, maximizing the environmental benefits of this clean energy integration.

The automotive industry is undergoing a transformative shift towards electric vehicles (EVs). To maximize the range and efficiency of EVs, lightweight materials are paramount.

Fuel cell developers are constantly innovating to improve the efficiency and performance of these devices. This translates into a need for even higher purity hydrogen, as impurities can cause performance degradation and even damage fuel cell components. Hydrogen purifiers capable of achieving ultra-high purity levels become essential to ensure optimal fuel cell operation. Fuel cells are no longer limited to powering electric vehicles.

Stationary fuel cells are gaining traction for backup power generation and distributed energy systems. Additionally, portable fuel cells are being explored for various applications, from powering consumer electronics to providing electricity in remote areas. As the application landscape for fuel cells expands, the demand for reliable and cost-effective hydrogen purification is growing alongside.

The development of hydrogen refueling stations and hydrogen pipelines for transportation applications requires a robust purification infrastructure. Hydrogen purifiers are deployed at various stages of the hydrogen supply chain, ensuring consistent quality throughout the journey from production to end use.

Hydrogen Purifiers Market Restraints and Challenges:

Unpredictable fluctuations in raw material prices make it difficult for manufacturers to accurately forecast production costs and set competitive pricing for hydrogen purifiers. This uncertainty can deter investment in research and development and create a hesitant market environment.

For large-scale hydrogen production and utilization projects, fluctuating raw material costs can significantly impact project feasibility. Unforeseen price hikes can disrupt project budgets and potentially delay or even derail important clean energy initiatives. High and unpredictable purifier costs can hinder the widespread adoption of hydrogen technology. If the cost of purification adds significantly to the overall hydrogen production price, it can make hydrogen less competitive compared to traditional fossil fuels.

With various companies developing and deploying hydrogen infrastructure, there is a risk of incompatible equipment and processes. This can lead to difficulties in integrating hydrogen purifiers seamlessly into existing or future hydrogen infrastructure.

Hydrogen Purifiers Market Opportunities:

Electrolysis is growing in popularity as a means of producing hydrogen due to the growing use of renewable energy sources such as solar and wind power. Since the hydrogen produced by electrolysis needs to be purified to get rid of leftover oxygen and other impurities, this presents a big potential for hydrogen purifiers. Future hydrogen purification systems will be smoothly integrated with renewable energy sources. By doing this, the industrial chain's need for fossil fuels will be reduced and a really sustainable hydrogen environment will be created.

For hydrogen-powered vehicles, purity is paramount. Hydrogen purifiers at refueling stations are the final checkpoint before the clean fuel reaches the vehicle's fuel cell, guaranteeing optimal performance and efficiency.

The semiconductor industry utilizes high-purity hydrogen for various processes, such as silicon epitaxy and oxide layer deposition. As demand for advanced electronics continues to soar, the hydrogen purifier market can cater to the growing needs of semiconductor manufacturers.

Hydrogen finds application in food processing for hydrogenation reactions, which improve the shelf life and stability of certain food products. Hydrogen purifiers ensure the purity of hydrogen used in these processes, maintaining food safety and quality.

GLOBAL HYDROGEN PURIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.57% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ally Hi-Tech, Chart Industries, Air Products, Schmack Carbotech GmbH, SAES Pure Gas Inc., Petronas, Xebec, Advanced Extraction Technologies Inc., Yangtze Energy Technologies Inc., Honeywell UOP |

SEGMENTATION ANALYSIS

Global Hydrogen Purifiers Market Segmentation: By Type

-

Pressure Swing Adsorption (PSA)

-

Membrane Separation

-

Cryogenic Distillation

-

Other Technologies

Pressure Swing Adsorption (PSA) is the dominant technology accounting for roughly 65-70% of the hydrogen purifier market share. PSA utilizes specialized adsorbent materials that selectively capture contaminants such as oxygen, nitrogen, and water vapor from the hydrogen stream under varying pressure conditions. PSA systems are known for their high efficiency, reliability, and ability to handle large-scale hydrogen purification. PSA systems can achieve very high levels of hydrogen purity, exceeding 99.99% in some cases. This makes them ideal for applications such as fuel cells in electric vehicles, where even trace impurities can significantly impact performance.

While PSA dominates the market, membrane separation technologies are experiencing the fastest growth, with a projected CAGR of around 10-12% in the coming years. Membrane separation systems are known for their compact and modular designs. This makes them ideal for distributed hydrogen production facilities or on-site purification at hydrogen refueling stations. Compared to cryogenic distillation, membrane separation systems require less energy to operate. This aligns well with the growing focus on energy-efficient solutions within the clean energy sector. Advances in membrane materials and manufacturing processes hold the potential for further cost reductions in membrane separation systems, making them even more competitive in the future.

Global Hydrogen Purifiers Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Engineering, Procurement, and Construction (EPC) Contractors

-

E-commerce Platforms

Manufacturers who use the direct sales route offer purifiers directly to industrial gas companies, research institutes, and large-scale hydrogen producers. Close cooperation, solution customization, and maybe larger profit margins for producers are all made possible by direct sales. The requirements of individual applications are often met by highly customized hydrogen purifiers, especially for large-scale hydrogen production facilities. Manufacturers and end users can work closely together through direct sales to make sure the purifiers exactly suit their demands. Manufacturers are able to offer their clients comprehensive technical knowledge and committed after-sales assistance because of direct sales. This is essential to guaranteeing the purifiers' long-term operation and best performance, particularly for complicated applications.

Even while direct sales are still king for the time being, internet marketplaces are starting to make an impact. Online platforms have the ability to educate a wider variety of potential clients and increase knowledge of hydrogen purifiers as the hydrogen economy grows. Smaller-scale hydrogen producers and researchers can find purifiers more easily and effectively by using online marketplaces, which expedites the purchasing process. These systems have the ability to compare prices between various manufacturers and models and offer clear pricing information, which could result in more affordable prices for consumers.

Global Hydrogen Purifiers Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

The United States and Canada together make up North America, which has grown to be a major player in the market for hydrogen purifiers. The presence of well-established chemical and energy industries, along with a strong emphasis on technological breakthroughs, are the reasons for this region's dominance.

Fuel cell technology, petroleum refining, and semiconductor manufacturing are just a few of the industries in North America that depend on effective and dependable purification systems. These industries have a high need for hydrogen purifiers. With several of the top producers located there, the United States in particular has been at the forefront of the development of hydrogen purifier technology. The market for hydrogen purifiers has expanded as a result of the region's dedication to lowering greenhouse gas emissions and supporting renewable energy alternatives.

The area of Asia-Pacific, which includes South Korea, Japan, and China as its main leaders, is now showing the quickest rate of growth for the hydrogen purifier market. The market for hydrogen purifiers has grown as a result of this region's fast industrialization, the implementation of strict environmental rules, and the rising need for sustainable energy solutions. Among the primary contributors to the growth of the Asia-Pacific market, China stands out. The nation's emphasis on lowering air pollution and supporting clean energy technologies, like hydrogen fuel cells, has increased demand for dependable and effective hydrogen purification systems. The existence of significant manufacturing centers and rising infrastructure development expenditures have also contributed to the widespread use of hydrogen purifiers across a range of industries.

COVID-19 Impact Analysis on the Hydrogen Purifiers Market:

Lockdowns and travel restrictions disrupted global supply chains, hindering the movement of raw materials and components crucial for hydrogen purifier manufacturing. This led to delays in production timelines and shortages of essential parts. The economic uncertainty triggered by the pandemic caused delays in hydrogen infrastructure projects that utilize hydrogen purifiers.

Additionally, some investors became hesitant to commit capital to new hydrogen ventures, further impacting demand for purifiers. During the peak of the pandemic, the focus shifted towards sectors deemed essential, such as healthcare and food production. This diverts resources and manpower away from non-essential sectors such as hydrogen development, potentially impacting hydrogen purifier production and deployment.

The pandemic highlighted the need for sustainable energy solutions. As countries strive for economic recovery, there is a growing emphasis on clean energy sources such as hydrogen, potentially boosting demand for hydrogen purifiers in the long run. Concerns about supply chain disruptions during the pandemic might encourage the adoption of smaller-scale, decentralized hydrogen production facilities. This could create a niche market for hydrogen purifiers tailored to these decentralized systems.

Latest Trends/ Developments:

The increasing adoption of renewable energy for hydrogen production via electrolysis requires purification systems specifically designed for this purpose. These systems cater to the unique impurities present in hydrogen generated through electrolysis, ensuring it meets the stringent requirements for various applications.

The integration of hydrogen purifiers directly into renewable energy plants is gaining traction. This allows for the purification of the hydrogen as soon as it is produced, minimizing contamination risks and transportation costs of unpurified hydrogen. The future might see microgrids incorporating hydrogen production from renewable sources alongside on-site purification. This localized approach can benefit remote communities or industrial facilities seeking a self-sufficient clean energy solution.

The development of new membrane materials with enhanced selectivity and higher hydrogen permeation rates is a key area of focus. These advances can improve the efficiency of the purification process and potentially reduce energy consumption. Research is underway to create composite membranes that combine the strengths of different materials. This can lead to membranes with superior performance characteristics, offering better separation of hydrogen from impurities.

Key Players:

-

SAES Pure Gas Inc.

-

Xebec

-

Advanced Extraction Technologies Inc.

-

Yangtze Energy Technologies Inc.

-

Honeywell UOP

Chapter 1. Hydrogen Purifiers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydrogen Purifiers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydrogen Purifiers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydrogen Purifiers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydrogen Purifiers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydrogen Purifiers Market – By Type

6.1 Introduction/Key Findings

6.2 Pressure Swing Adsorption (PSA)

6.3 Membrane Separation

6.4 Cryogenic Distillation

6.5 Other Technologies

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Hydrogen Purifiers Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Engineering, Procurement, and Construction (EPC) Contractors

7.5 E-commerce Platforms

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Hydrogen Purifiers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Hydrogen Purifiers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ally Hi-Tech

9.2 Chart Industries

9.3 Air Products

9.4 Schmack Carbotech GmbH

9.5 SAES Pure Gas Inc.

9.6 Petronas

9.7 Xebec

9.8 Advanced Extraction Technologies Inc.

9.9 Yangtze Energy Technologies Inc.

9.10 Honeywell UOP

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing global focus on clean energy solutions and reducing greenhouse gas emissions is a major driver for hydrogen adoption. As hydrogen emerges as a frontrunner in clean energy applications, the need for high-purity hydrogen intensifies, increasing the demand for purifiers.

Hydrogen purifiers, especially for large-scale applications, can be expensive to purchase and install. This can be a significant hurdle for potential adopters, particularly smaller-scale hydrogen producers or research institutions.

Ally Hi-Tech, Chart Industries, Air Products, Schmack Carbotech GmbH, SAES, Pure Gas Inc., Petronas, Xebec, Advanced Extraction Technologies Inc., Yangtze Energy Technologies Inc., Honeywell UOP.

North America has emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 40% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.