Global Gas Separation Membrane Market Size (2023-2030)

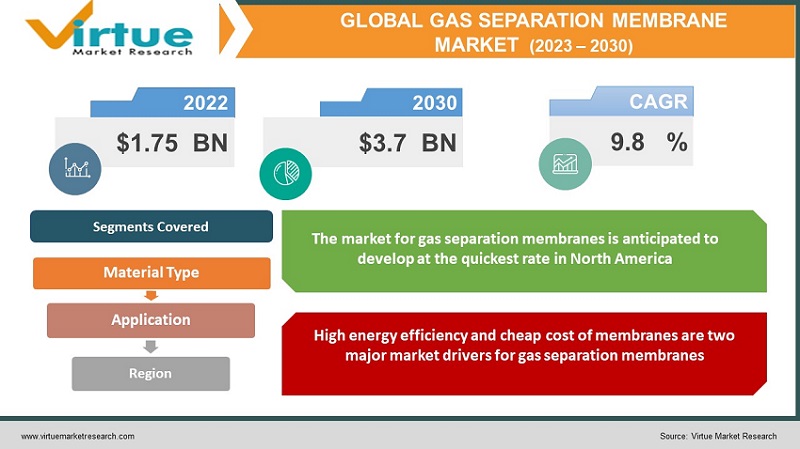

The Global Gas Separation Membrane Market was estimated to be worth USD 1.75 billion in 2022 and is projected to reach a value of USD 3.7 billion by 2030, growing at a CAGR of 9.8% during the forecast period 2023-2030.

The removal of organic compounds and waste streams is a requirement for the effectiveness of industrial operations and the longevity of industrial equipment, and this is accomplished by gas separation membrane technologies, which are a part of industrial processes. The highly corrosive acid gases that companies release erode pipes and have an impact on all industrial operations. The separating procedure is crucial for the processing of natural grasses. The development of long-lasting membrane materials with improved selectivity and permeability at competitive prices by manufacturers in recent years has fueled the expansion of the gas separation membrane market. In a similar vein, compared to other polymeric membranes, gas separation membranes are thought to be the most economical in the sector. A further factor driving the general expansion of the Gas separation membrane sector is the strict laws put in place by the governments of numerous nations for the monitoring and control of carbon dioxide emissions.

Global Gas Separation Membrane Market Drivers:

The market for gas separation membranes is anticipated to benefit greatly from the rising need for membranes in carbon dioxide separation processes:

One of the most significant uses of gas separation membranes in several sectors is the removal of carbon dioxide from gas streams. Gas sweetening, also known as natural gas purification, increased oil recovery, and biogas purification all make use of it. The main use of gas separation membranes is for the removal of carbon dioxide from natural gas, followed by increased oil recovery. Natural gas contains large amounts of carbon dioxide, which is classified as an acid gas. When coupled with water, it becomes extremely corrosive and corrodes machinery and pipes. Additionally, it decreases pipeline capacity and the heating value of natural gas. Carbon dioxide must be eliminated in LNG facilities to keep low-temperature chillers from freezing. Therefore, removing carbon dioxide is a crucial separation step for improved natural gas processing and delivery. There are several different gas removal processes, including membranes, the amine guard process, the cryogenic process, pressure swing adsorption, thermal swing adsorption, and the Benfield process. Each technology has benefits and drawbacks of its own. The market for gas separation membranes in carbon dioxide removal applications is anticipated to be driven by these factors.

High energy efficiency and cheap cost of membranes are two major market drivers for gas separation membranes:

Gas separation membranes are tools that can sort various gases according to the size and form of their molecules. When compared to other gas separation processes like distillation, absorption, or adsorption, they provide higher energy efficiency and cheaper prices. This is so that gas separation membranes can avoid the energy- and resource-intensive phase change from gas to liquid. Since gas separation membranes are more straightforward and modular than other gas treatment options, they also need less operational and capital costs. Gas separation membranes are used in a variety of industrial processes, including the purification of natural gas, upgrading of biogas, manufacture of oxygen and nitrogen, carbon dioxide capture, and creation of hydrogen. The utilization of clean and sustainable energy sources may be increased and carbon emissions can be decreased thanks to these applications. As a result, there is a growing need for gas separation membranes, particularly in light of climate change and the energy transition.

Global Gas Separation Membrane Market Challenges:

The technical shortcomings of gas separation membranes compared to other gas separation methods are one of the market's biggest challenges:

Due to flux and selectivity problems, gas separation membranes are currently only employed for moderate-volume gas streams. The membrane gas separation technique cannot compete with amine absorption technology for large-volume gas streams, which is primarily used to remove carbon dioxide from natural gas, biogas, and other gas streams. Due to its superior efficiency, the pressure swing adsorption technique is used for nitrogen production and oxygen enrichment applications. In comparison to the latter, the pressure swing adsorption technique is more dependable in challenging conditions. The pressure swing adsorption method allows for high purity levels of 99.5%–99.9%, whereas membranes are limited to roughly 95% purity levels. Furthermore, compared to membrane separation technology, pressure swing adsorption technology has a substantially longer lifespan. The market for gas separation membranes is experiencing development restrictions as a result of these technological drawbacks.

COVID-19 Impact on Global Gas Separation Membrane Market:

The COVID-19 pandemic significantly impacted the worldwide market for gas separation membranes by causing supply chain and demand disruptions across several gas separation membrane-using sectors, including oil and gas, pharmaceuticals, and biomedicine. The manufacture and distribution of gas separation membranes were impacted by the travel bans and lockdowns imposed by several nations. However, as the limits are relaxed and the demand for clean and sustainable energy sources, such as biogas and natural gas, rises, the market is anticipated to rebound and expand between 2023 and 2030. The growing need for membrane separation technology in several end-use industries, including carbon dioxide capture, hydrogen generation, oxygen and nitrogen production, and natural gas purification, is another factor driving the market.

Global Gas Separation Membrane Market Recent developments:

- In November 2021: To conduct a feasibility study on retrofitting SK's hydrogen plant with carbon capture, Honeywell established a partnership with SK Innovation and Energy, a Korean energy refining firm. It is anticipated that SK Innovation and Energy would investigate removing and storing 400,000 tons of carbon dioxide (CO2) from current hydrogen production plants.

- In June 2021: The membrane business units of Air Products have received a new brand name and will go by the name Air Products Membrane Solutions going forward.

GAS SEPARATION MEMBRANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Material Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air Products and Chemicals Inc , Ube Industries Ltd , Air Liquide Advanced Separation , Schlumberger Limited , Membrane Technology and Research Inc , Evonik Industries AG , FUJIFILM Manufacturing Europe BV , Honeywell International Inc , Generon IGS Inc. , DIC Corporation |

Global Gas Separation Membrane Market Segmentation:

Global Gas Separation Membrane Market Segmentation: By Material Type

-

Polyimide &Polyamide

-

Polysulfide

-

Cellulose Acetate

-

Others

The cellulose acetate sector is now the most important one in the market for gas separation membranes. Because of their low cost and great selectivity, cellulose acetate membranes are often utilized in gas separation applications. Additionally, they are employed in several sectors including oil & gas, food & beverage, and healthcare. Due to their inexpensive cost and advantageous mechanical characteristics, cellulose acetate membranes are also expanding at a respectable rate.

The polyimide and polyamide segments are anticipated to have the quickest growth in the market for gas separation membranes. This is a result of the rising demand for these materials in a variety of applications, including the production of nitrogen, the recovery of hydrogen, and the removal of carbon dioxide. This is due to the excellent selectivity and permeability, strong thermal and chemical stability, improved mechanical strength, and improved film-forming properties of polyimide and polyamide membranes. They are useful for gas separation applications because of these characteristics.

Global Gas Separation Membrane Market Segmentation: By Application

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- Others

The segment with the fastest predicted growth during the projection period will be nitrogen production and oxygen enrichment. This is a result of the rising demand for nitrogen and oxygen gases from end-use sectors including the food and beverage, healthcare, and chemical industries. This is a result of the rising demand for nitrogen and oxygen gases from end-use sectors including the food and beverage, healthcare, and chemical industries.

The carbon dioxide removal sector is now the most dominant one in the gas separation membrane market. This is due to the widespread usage of carbon dioxide removal membranes in biogas upgrading and natural gas treatment applications. The necessity to lower CO2 emissions and adhere to environmental standards is what drives the market for carbon dioxide removal membranes.

Global Gas Separation Membrane Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

The market for gas separation membranes is anticipated to develop at the quickest rate in North America. This is because the area has significant end-use industries including the chemical, healthcare, and oil and gas sectors. The market in North America is also being driven by stringent environmental laws about emission control. Gas separation membranes are anticipated to be the largest and most dominant market in the Asia Pacific region. This is a result of nations like China and India's quick industrialization and economic expansion. The Asia Pacific market is expanding as a result of the rising demand from the industrial sector for nitrogen, oxygen, and hydrogen.

Key Players:

-

Air Products and Chemicals Inc

-

Ube Industries Ltd

-

Air Liquide Advanced Separation

-

Schlumberger Limited

-

Membrane Technology and Research Inc

-

Evonik Industries AG

-

FUJIFILM Manufacturing Europe BV

-

Honeywell International Inc

-

Generon IGS Inc.

-

DIC Corporation

Chapter 1. GAS SEPARATION MEMBRANE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GAS SEPARATION MEMBRANE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GAS SEPARATION MEMBRANE MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GAS SEPARATION MEMBRANE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GAS SEPARATION MEMBRANE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GAS SEPARATION MEMBRANE MARKET – By Material Type

6.1. Polyimide & polyamide

6.2. Polysulfone

6.3. Cellulose acetate

6.4. Other

Chapter 7. GAS SEPARATION MEMBRANE MARKET – BY Applications

7.1. Nitrogen technology and oxygen enrichment

7.2. Hydrogen recovery

7.3. Carbon dioxide removal

7.4. Others

Chapter 8. GAS SEPARATION MEMBRANE MARKET – By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4.Latin America

8.5. Middle-East and Africa

Chapter 9. GAS SEPARATION MEMBRANE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Fujifilm Manufacturing Europe B.V.,

9.2. Air Products and Chemicals, Inc.,

9.3. Honeywell International Inc

9.4. Air Liquide Advanced Separations

9.5. Schlumberger Ltd.,

9.6. DIC Corporation

9.7. Ube Industries Ltd.,

9.8. Evonik Industries AG

9.9. Membrane Technology and Research Inc., and

9.10. Generon IGS Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global gas separation membrane market refers to the market for membranes used in gas separation applications such as nitrogen generation, hydrogen recovery, and carbon dioxide removal.

The fastest-growing segments in the global gas separation membrane market include the polyimide & polyamide material type segment and the nitrogen generation & oxygen enrichment application segment

The most dominant segment in the global gas separation membrane market is currently the carbon dioxide removal application segment

The key regions in the global gas separation membrane market include North America, Europe, Asia-Pacific, South America, and the Middle East and Africa

The growth of the global gas separation membrane market is driven by factors such as increasing demand for nitrogen, oxygen, and hydrogen gases, stringent environmental regulations, and rapid industrialization and economic growth in emerging economies.