Home Pizza Oven Market Size (2024 –2030)

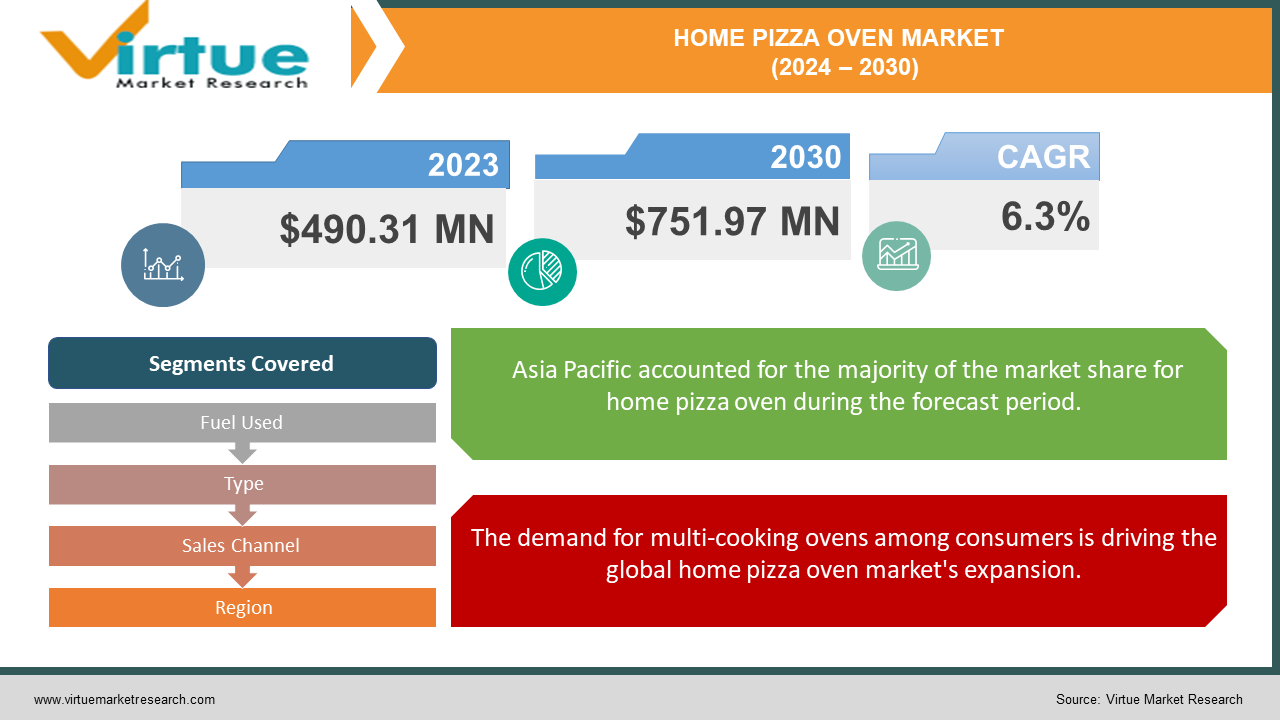

The Global Home Pizza Oven Market was estimated to be worth USD 490.31 Million in 2023 and is projected to reach a value of USD 751.97 Million by 2030, growing at a CAGR of 6.3% during the outlook period 2024-2030.

A device that generates heat is an oven. It contains an interior compartment for storing items to be heated gradually. For a very long time, ovens have been used for a variety of purposes requiring controlled heating. Ovens come in various varieties for a variety of uses, and they heat materials in various ways. An oven's primary function is to cook food by raising its temperature to the proper level. A kitchen appliance designed for preparing pizza at home is the home pizza oven. They are available in various styles and sizes. Three types of pizza ovens are commonly available for home use: brick, regular, and convection ovens. These ovens heat food in a variety of ways. While some people use gas, coal, or wood, others use electricity. Whereas electric ovens use electricity to heat food, microwave ovens use microwaves. Forcing air into the oven can help home pizza ovens heat up faster or alter the way food cooks.

Key Market Insights:

Outdoor pizza ovens account for approximately 60% of the home pizza oven market share, driven by the growing popularity of outdoor cooking and the desire for authentic wood-fired pizza experiences at home.

The gas-fired pizza oven segment constitutes around 45% of the market demand, owing to its convenience, consistent heat distribution, and ability to reach high temperatures quickly.

In terms of region, the Asia-Pacific region held the largest share of the Global Home Pizza Oven Market. North America also holds a significant market share of home pizza ovens, attributed to the region's strong pizza culture, high disposable incomes, and increasing trend of home entertaining.

The adoption of smart home pizza ovens, featuring Wi-Fi connectivity, temperature control apps, and automated cooking programs, is growing at a rate of approximately 20% annually, driven by the increasing integration of smart technology in kitchen appliances and the demand for user-friendly cooking experiences.

Global Home Pizza Oven Market Drivers:

The demand for multi-cooking ovens among consumers is driving the global home pizza oven market's expansion.

Ovens with multiple functions, such as baking, roasting, grilling, and defrosting, are becoming more and more popular. This is driving up the popularity of multifunction ovens. Additionally, as baking grows in popularity, more bakeries and food stores require these adaptable ovens.

The COVID-19 pandemic and subsequent shift in consumer behavior toward work-from-home models is another factor fueling the global home pizza oven market's expansion.

Due to the ongoing COVID-19 situation and the fact that they have more disposable income, more people are opting to cook at home rather than go out to eat. Because they are so convenient, frozen and ready-to-eat foods have become more and more popular. Consequently, there is now a greater need for pizza ovens at home.

Home Pizza Oven Market Challenges and Restraints:

The major obstacle facing the worldwide home pizza oven market is the high cost of initial and ongoing maintenance. Depending on the type and style, home pizza ovens can be pricey, which may turn away consumers on a tight budget. Due to their multiple cooking functions, modern home pizza ovens are more expensive than their traditional counterparts. Furthermore, the cost of manufacturing these ovens is high because certain raw materials are required, which might not be easily obtained. More people find it more difficult to adopt and afford home pizza ovens as a result of these factors.

Home Pizza Oven Market Opportunities:

The worldwide market for pizza ovens at home presents a significant opportunity due to technological advancements. By introducing new technologies, such as smart ovens with wireless connectivity and app functionality, manufacturers can contribute to the growth of this market. Users may find home pizza ovens more appealing and practical as a result of these advancements.

HOME PIZZA OVEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Fuel Used, Type, Sales Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BakerStone International (United States), Fontana Forni (United States), Forno Bravo (United States), Cuisinart (United States), KettlePizza, LLC (United States), Marra Forni (United States), WP Bakery Technologies (Germany), Mont Alpi (United States), Camp Chef (United States), Black + Decker Inc. (United States) |

Global Home Pizza Oven Market Segmentation: By Fuel Used

-

Wood-Fired Pizza Ovens

-

Electric Pizza Ovens

-

Gas Pizza Ovens

Based on the kind of fuel they use, wood-fired, electric, and gas pizza ovens make up the three segments of the global home pizza oven market. Pizza ovens powered by gas held the largest market share in 2023. Pizzas are cooked in gas pizza ovens using natural gas, such as LPG. Compared to electric ovens, they are less expensive and require less maintenance, which is why home chefs favor them. Regular pizzas are frequently made on screens in gas ovens. However, large pans required for different pizzas might not fit in gas ovens because they are typically smaller than electric ones. Because of this, gas ovens are perfect for baking little, individual pizzas.

Global Home Pizza Oven Market Segmentation: By Type

-

Brick Ovens

-

Conventional Ovens

-

Convection Ovens

Brick ovens, conventional ovens, and convection ovens make up the three segments of the worldwide home pizza oven market. Conventional ovens held the largest market share in 2023. Often referred to as traditional ovens, conventional ovens are typical kitchen appliances. The heating element is typically located at the bottom of these ovens, with the broiler situated on top. Food that is closer to the heat source cooks more quickly than food that is farther away, a phenomenon known as hotspots. Traditional pizza ovens work well for cooking food on several racks, which encourages roasting, browning, and crisping. They can handle lengthy baking cycles without drying out the food because they generate intense heat that can help cook food more quickly and preheat it quickly.

Global Home Pizza Oven Market Segmentation: By Sales Channel

-

Online channel

-

Offline channel

There are two segments in the worldwide home pizza oven market: online and offline sales channels. The offline channel held the biggest market share in 2023. This is because developing nations like China and India are experiencing an increase in demand for ovens, which is contributing to the growth of the kitchen appliance distributor and reseller network. In addition to providing a large selection of pizza ovens for the home, local appliance stores foster enduring relationships with their clientele. Manufacturers are also encouraging offline retailers by providing competitive sales margins, which accelerates this market's expansion.

Global Home Pizza Oven Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

The Middle East & Africa

-

South America

Asia-Pacific held the biggest market share for home pizza ovens worldwide in 2023. The increasing demand for 4D hot air ovens in India, the popularity of conventional and convection ovens in China and India, and the trend toward motorized rotisseries in Japan are the main causes of this growth. Due to a rise in oven usage, North America had the second-largest market share. The Middle East and Africa region is anticipated to grow at the fastest rate in the upcoming years, primarily due to higher disposable income levels in countries such as Saudi Arabia and South Africa.

COVID-19 Impact on the Global Home Pizza Oven Market:

The global market for home pizza ovens was significantly impacted by the COVID-19 pandemic. Large kitchen appliance manufacturers found it challenging to produce ovens because of lockdowns and travel restrictions that prevented them from operating normally. The difficulty in getting ovens to retailers and customers' homes resulted in a decrease in the number of ovens sold. However, with everyone cooped up at home, a lot of them developed an interest in baking and cooking. This increased their desire to purchase ovens and other kitchen appliances. Therefore, even though the pandemic made things difficult for the market for pizza ovens at home, it also gave more people the chance to start cooking at home and purchase ovens.

Latest Trend/Development:

There are some fascinating developments taking place in the realm of pizza ovens for homes. First off, people are starting to use smart ovens more and more because they can cook meals to perfection every time and can be controlled with a phone. This trend can be seen in recent products like the Solo Stove Pi, Hestan Campania Pizza Oven, and Tovala Smart Oven Air Fryer. More people are purchasing ovens for their homes in regions like Europe, the Middle East, Asia-Pacific, and Africa. Additionally, more people are beginning to purchase ovens online. Conventional ovens continue to be the most widely used type, but gas ovens are also well-liked because they are less expensive and simpler to operate.

Key Players:

-

BakerStone International (United States)

-

Fontana Forni (United States)

-

Forno Bravo (United States)

-

Cuisinart (United States)

-

KettlePizza, LLC (United States)

-

Marra Forni (United States)

-

WP Bakery Technologies (Germany)

-

Mont Alpi (United States)

-

Camp Chef (United States)

-

Black + Decker Inc. (United States)

Market News:

- In February 2023, Tovala, a company well-known for its smart countertop ovens and fresh meal delivery service, introduced the sleek stone-gray Tovala Smart Oven Air Fryer. These ovens cook Tovala Meals and other foods to perfection using automated cooking cycles and barcode or QR code scanning, which makes meal preparation and cleanup quick and simple.

- May 2022 saw the release of the Campania Pizza Oven by Hestan, a company recognized for introducing cutting-edge commercial appliance technology to residential kitchens. This oven, which is ideal for residential outdoor kitchens, blends traditional quality with modern design and innovation, drawing inspiration from the pizza-loving region of Italy.

- In March 2022, Solo Stove, a company well-known for its smokeless fire pits, introduced Pi, a lifetime warranty backyard pizza oven. Pi provides a flexible and classic pizza-making experience with its efficient heat distribution design and wood-fired and propane cooking options.

Chapter 1. Home Pizza Oven Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Home Pizza Oven Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Home Pizza Oven Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Home Pizza Oven Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Home Pizza Oven Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Home Pizza Oven Market – By Fuel Used

6.1 Introduction/Key Findings

6.2 Wood-Fired Pizza Ovens

6.3 Electric Pizza Ovens

6.4 Gas Pizza Ovens

6.5 Y-O-Y Growth trend Analysis By Fuel Used

6.6 Absolute $ Opportunity Analysis By Fuel Used, 2024-2030

Chapter 7. Home Pizza Oven Market – By Type

7.1 Introduction/Key Findings

7.2 Brick Ovens

7.3 Conventional Ovens

7.4 Convection Ovens

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Home Pizza Oven Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 Online channel

8.3 Offline channel

8.4 Y-O-Y Growth trend Analysis By Sales Channel

8.5 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 9. Home Pizza Oven Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Fuel Used

9.1.3 By Type

9.1.4 By By Sales Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Fuel Used

9.2.3 By Type

9.2.4 By Sales Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Fuel Used

9.3.3 By Type

9.3.4 By Sales Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Fuel Used

9.4.3 By Type

9.4.4 By Sales Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Fuel Used

9.5.3 By Type

9.5.4 By Sales Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Home Pizza Oven Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BakerStone International (United States)

10.2 Fontana Forni (United States)

10.3 Forno Bravo (United States)

10.4 Cuisinart (United States)

10.5 KettlePizza, LLC (United States)

10.6 Marra Forni (United States)

10.7 WP Bakery Technologies (Germany)

10.8 Mont Alpi (United States)

10.9 Camp Chef (United States)

10.10 Black + Decker Inc. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Home Pizza Oven Market was estimated to be worth USD 490.31 Million in 2023 and is projected to reach a value of USD 751.97 Million by 2030, growing at a forecasted CAGR of 6.3% during the outlook period 2024-2030.

The Global Home Pizza Oven Market Drivers are the increasing consumer preference for multi-cooking functionalities and the consumers’ shift to the work-from-home model during and after the COVID-19 pandemic.

Based on the Fuels Used, the Global Home Pizza Oven Market is segmented into Wood-Fired Pizza Oven, Electric Pizza Oven, and Gas Pizza Oven.

The Asia-Pacific region held the largest share of the Global Home Pizza Oven Market in 2023.

WP Bakery Technologies, Black + Decker Inc., and BakerStone International are the leading players in the Global Home Pizza Oven Market.