Commercial Oven Market Size (2024 – 2030)

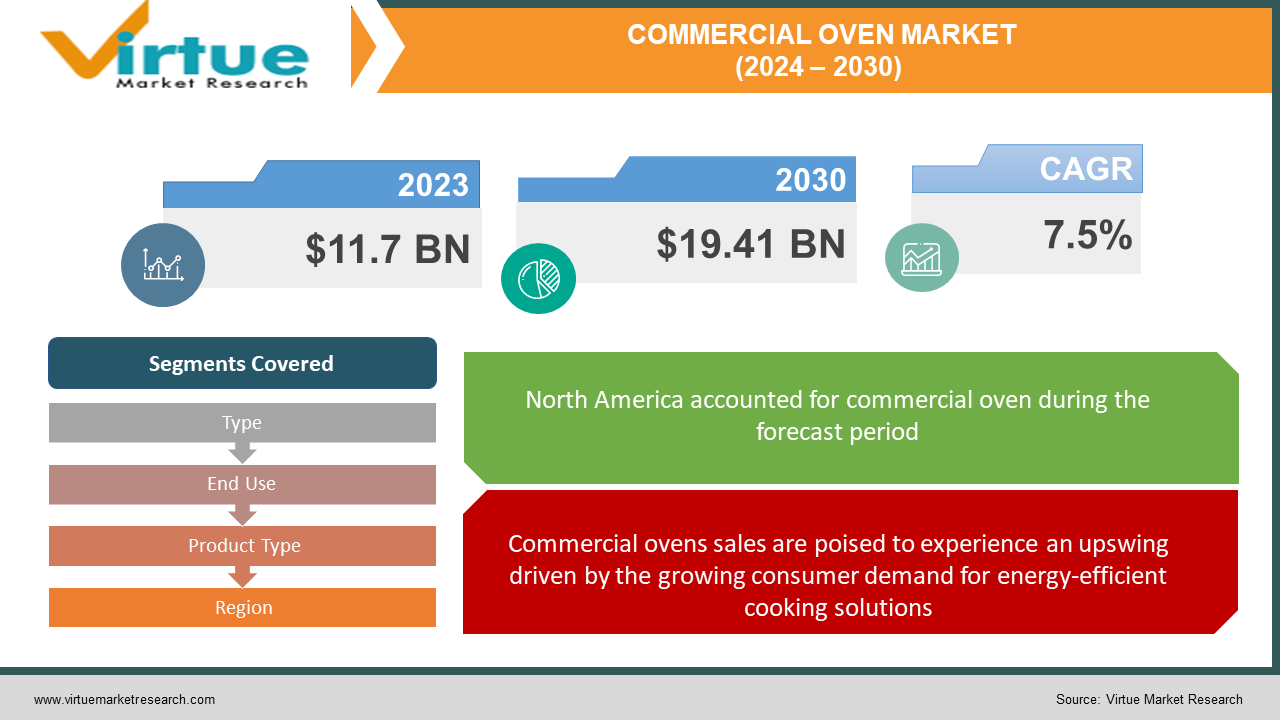

The Global Commercial Oven Market size was exhibited at USD 11.7 billion in 2023 and is projected to hit around USD 19.41 billion by 2030, growing at a CAGR of 7.5% during the forecast period from 2024 to 2030.

The Commercial Oven Market constitutes a crucial sector within the foodservice industry, incorporating a varied array of ovens specifically crafted for deployment in commercial kitchens. These ovens cater to the culinary needs of restaurants, bakeries, hotels, and other dining establishments, efficiently addressing the elevated cooking requirements inherent in professional environments. This market exhibits distinctive segmentation, principally categorized into Gas Ovens and Electric Ovens. Gas ovens are preferred for their operational efficiency and economical attributes, whereas Electric Ovens are garnering recognition owing to technological progressions and a growing emphasis on energy conservation.

Key Market Insights:

The global commercial oven market is anticipated to experience growth during the forecast period, driven by the increasing inclination towards high-speed convection ovens. These ovens are preferred over traditional ones as they ensure the production of high-quality food items in a considerably shorter timeframe. Notably, high-speed convection ovens operate at a speed ten times faster than their conventional counterparts. For instance, TurboChe's Tornado series utilizes a combination of microwave and air impingement technology to achieve rapid cooking. Various oven products available in the market facilitate the quick cooking, reheating, and defrosting of food. High-speed convection ovens excel in baking items such as pizzas, croissants, sub sandwiches, cookies, and pastries in significantly less time compared to conventional ovens. For example, the cooking time for a pizza in high-speed convection ovens is reduced to three minutes, whereas it takes eight minutes in conventional ovens. Furthermore, food service establishments are actively seeking ovens that enhance operational efficiency and boost production volume to increase profit margins.

Another factor contributing to market growth is the rising preference for ventless ovens. Traditionally, commercial oven users install expensive ventilation systems in their kitchens to eliminate harmful gas emissions and excess heat. In a bid to reduce operating costs associated with ventilation system installation, commercial oven manufacturers are introducing ventless oven technology. Ventless ovens employ catalyst technology, converting grease and volatile organic compounds into carbon dioxide and water, thereby limiting gas emissions. The increasing adoption of ventless technology is a significant driver for market expansion during the forecast period.

Global Commercial Oven Market Drivers:

Commercial ovens sales are poised to experience an upswing driven by the growing consumer demand for energy-efficient cooking solutions.

Notably, commercial kitchens emerge as substantial energy consumers, surpassing the energy consumption per square foot in comparison to various other commercial building types, such as those in full-service and quick-service restaurants, hotels, and hospitals. Given that energy expenses typically constitute 25% to 30% of the overall operating costs for these establishments, upgrading equipment to enhance energy efficiency can lead to increased bottom-line revenues. Moreover, such upgrades offer notable non-energy benefits, including improved operational performance, more consistent cooking results, and enhanced comfort for kitchen staff.

The current market boasts a diverse array of commercial ovens designed to accommodate various baking needs, ranging from bread and muffins to cakes, pizzas, and other culinary items. Anticipated growth in the demand for commercial ovens is attributed to the increasing consumer preference for prepared and bakery food items, coupled with the rapid expansion of bakeries worldwide.

The contemporary trend towards ready-to-eat foods, driven by the constraints on people's time for preparing elaborate dinners, contributes significantly to the market's expansion. Additionally, as these convenience foods require heating for preparation, they serve as a key driver for industry growth. The market is expected to derive substantial benefits from the rising adoption of portable ovens. The portable oven, offering comparable performance to traditional counterparts, prolonged battery life, and cost-effectiveness, is likely to witness heightened demand, thereby contributing to the overall market growth.

Global Commercial Oven Market Restraints and Challenges:

Challenges in Achieving Energy Efficiency Impact Market Growth.

The Global Commercial Oven Market encounters a significant challenge in its ongoing efforts to enhance energy efficiency. The prevailing focus on sustainable practices and environmental awareness compels businesses to seek energy-efficient solutions. Particularly, gas-powered commercial ovens come under scrutiny due to concerns about their environmental impact. Striking a balance between meeting stringent energy efficiency standards and maintaining optimal performance poses a complex task for manufacturers. The industry's commitment to greener alternatives necessitates substantial investments in research and development, presenting challenges in harmonizing environmental considerations with operational efficiency.

Hurdles in Technological Adoption Impede Market Expansion.

The incorporation of advanced technologies presents a notable challenge for the Commercial Oven Market. While features such as smart capabilities, IoT connectivity, and digital controls enhance functionality, they also contribute to increased product complexity and associated costs. The challenge lies in ensuring that these technological advancements align with user needs, remain user-friendly, and deliver tangible benefits without overwhelming operators. Additionally, comprehensive training programs are essential to equip kitchen staff with the skills required for the effective operation and maintenance of these sophisticated ovens. Successfully navigating these hurdles is crucial for the industry to integrate technology into commercial ovens and ensure widespread adoption across diverse culinary settings.

Global Commercial Oven Market Opportunities:

The Global Commercial Oven Market unveils a range of opportunities propelled by shifting consumer preferences and advancements in technology. The increasing demand for appliances that are both energy-efficient and environmentally friendly creates a significant avenue for manufacturers to innovate and produce commercial ovens with heightened environmental consciousness. Another promising area lies in the upsurge of smart kitchen technologies, providing opportunities to incorporate IoT connectivity, digital controls, and automation features, thereby optimizing operations for commercial kitchens. Addressing the expanding foodservice industry in emerging markets emerges as a substantial growth opportunity, given the rising number of restaurants and bakeries in these regions. Furthermore, diversifying product offerings, such as hybrid ovens that combine gas and electric functionalities, enables manufacturers to access a wider market. Aligning with the preferences of the eco-conscious consumer base by adopting sustainable materials and manufacturing processes is another strategic move. Seizing these opportunities positions companies to excel in a competitive landscape, meeting the dynamic needs of the global commercial oven market.

COMMERCIAL OVEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type, End Use, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dongbu Daewoo Electronics, AB Electrolux, LG Electronics, Alto-Shaam, Panasonic Corporation, SMEG, Sharp Corporation, Haier Group Corporation, Robert Bosch GmbH, Whirlpool Corporation |

Global Commercial Oven Market Segmentation: By Type

-

Gas Ovens

-

Electric Ovens

The Commercial Oven Market demonstrates a dynamic type-based segmentation, primarily categorized into Gas Ovens and Electric Ovens. Gas Ovens, recognized for their efficiency and cost-effectiveness, historically lead the market as the predominant segment, catering to diverse requirements in commercial kitchens. However, the landscape is swiftly evolving, with Electric Ovens emerging as the fastest-growing sector. Technological advancements and an industry-wide focus on energy efficiency propel the Electric Oven market forward. This shift indicates a rising demand for precision and innovation in commercial cooking equipment, influenced by evolving culinary preferences. While Gas Ovens maintain their prominence, the surging popularity of Electric Ovens signifies a transformative trend in the Commercial Oven Market, emphasizing a trajectory towards advanced, eco-friendly, and technologically sophisticated solutions for the evolving needs of modern commercial kitchens.

Global Commercial Oven Market Segmentation: By End Use

-

Restaurant

-

Hotels

-

Bakeries

-

Food Processing

-

Others

The Food Processing Segment Dominates the Commercial Oven Market, with an anticipated market share of around 36.9% by 2030. This segment is expected to witness significant expansion over the forecast period, driven by the increasing adoption of vent-free ovens for food production and processing. This trend propels the growth of the industrial oven market.

Commercial ovens find strategic applications in various high-tech industries, including electronics and chemicals. They are used for tasks such as baking sand cores in foundries, curing exotic materials in laboratories, preheating metals for anti-corrosion coatings, and serving as diffusion furnaces for semiconductors used in computers.

Global Commercial Oven Market Segmentation: By Product Type

-

Deck oven

-

Convection oven

-

Conveyor oven

-

Brick oven

The convection oven segment commands the maximum market share and is expected to maintain its dominance throughout the forecast period. Operators prefer convection ovens for their efficiency in reducing baking time. Popular types include combination and hybrid convection ovens, with combination ovens using both pressure less steam and convection heat, while hybrid convection ovens utilize microwave and air impingement technology for baking. These convection ovens require less time for baking, and countertop variations are favored for their space efficiency in small pizzerias and bakeries with limited space.

Global Commercial Oven Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically, North America leads the market and is projected to maintain its dominance throughout the forecast period. Key factors contributing to the region's market growth include the proliferation of pizzerias and bakeries and the trend of renovating and remodeling food service establishments. North America holds the highest revenue share in the commercial oven market, driven by a high demand for technology aligned with customer preferences. Countries in this region are notable spenders on commercial oven items. China stands out as a major supplier due to affordable raw materials and finished products. The Chinese market focuses on understanding customer taste and preferences, with technology upgrades playing a significant role in increasing demand for commercial ovens.

COVID-19 Impact on the Global Commercial Oven Market:

The Global Commercial Oven Market has experienced notable effects from the COVID-19 pandemic, presenting a combination of challenges and opportunities. The enforced closures of restaurants, hotels, and catering services during lockdowns initially led to a temporary decline in demand. Supply chain disruptions and manufacturing delays introduced complexities to the production process. However, as the foodservice industry adapts to the evolving landscape, there is a discernible shift towards increased demand for compact and efficient commercial ovens, driven by the growing focus on takeout and delivery services. Moreover, the heightened emphasis on hygiene and safety in commercial kitchens has hastened the adoption of smart and touchless technologies in ovens. While the initial impact was disruptive, the market is currently displaying resilience and adaptability, with opportunities emerging from evolving consumer behaviors and the industry's dedication to innovation.

Recent Trends and Innovations in the Global Commercial Oven Market:

-

In April 2022, Panasonic pioneered the first sensitivity-improvement technique for photonic crystal-structured far-infrared sensors.

-

According to Kitchen Ideas in May 2022, Hafele unveiled a premium line of baking appliances, featuring an oven with precise temperature control for accurately cooking meat or vegetables. This innovation is poised to enhance cooking precision in the baking industry.

Key Players:

-

Dongbu Daewoo Electronics

-

AB Electrolux

-

LG Electronics

-

Alto-Shaam

-

Panasonic Corporation

-

SMEG

-

Sharp Corporation

-

Haier Group Corporation

-

Robert Bosch GmbH

-

Whirlpool Corporation

Chapter 1. Commercial Oven Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commercial Oven Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commercial Oven Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commercial Oven Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commercial Oven Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commercial Oven Market – By Type

6.1 Introduction/Key Findings

6.2 Gas Ovens

6.3 Electric Ovens

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Commercial Oven Market – By Product Type

7.1 Introduction/Key Findings

7.2 Deck oven

7.3 Convection oven

7.4 Conveyor oven

7.5 Brick oven

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Commercial Oven Market – By End-User

8.1 Introduction/Key Findings

8.2 Restaurant

8.3 Hotels

8.4 Bakeries

8.5 Food Processing

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Commercial Oven Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Product Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Product Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Product Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Product Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Product Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Commercial Oven Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Dongbu Daewoo Electronics

10.2 AB Electrolux

10.3 LG Electronics

10.4 Alto-Shaam

10.5 Panasonic Corporation

10.6 SMEG

10.7 Sharp Corporation

10.8 Haier Group Corporation

10.9 Robert Bosch GmbH

10.10 Whirlpool Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Commercial Oven Market size is valued at USD 11.7 billion in 2023.

The worldwide Global Commercial Oven Market growth is estimated to be 7.5% from 2024 to 2030.

The Global Commercial Oven Market is segmented By Type (Gas Ovens, Electric Ovens), By End Use (Restaurant, Hotels, Bakeries, Food Processing, Others), By Product Type (Deck oven, Convection oven, Conveyor oven, Brick oven).

Future trends and opportunities for the Global Commercial Oven Market may include increased demand for eco-friendly and energy-efficient ovens, integration of advanced technologies like IoT and smart features, and catering to evolving consumer preferences for compact, versatile, and hygienic cooking solutions, presenting avenues for innovation and growth.

The COVID-19 pandemic significantly impacted the Global Commercial Oven Market, initially causing a dip in demand due to closures and disruptions. However, adaptation to new norms, a surge in takeout services, and a focus on hygiene accelerated smart technology adoption, fostering resilience and innovation within the industry amid changing consumer behaviors.