Home Dialysis Systems Market Size (2024 – 2030)

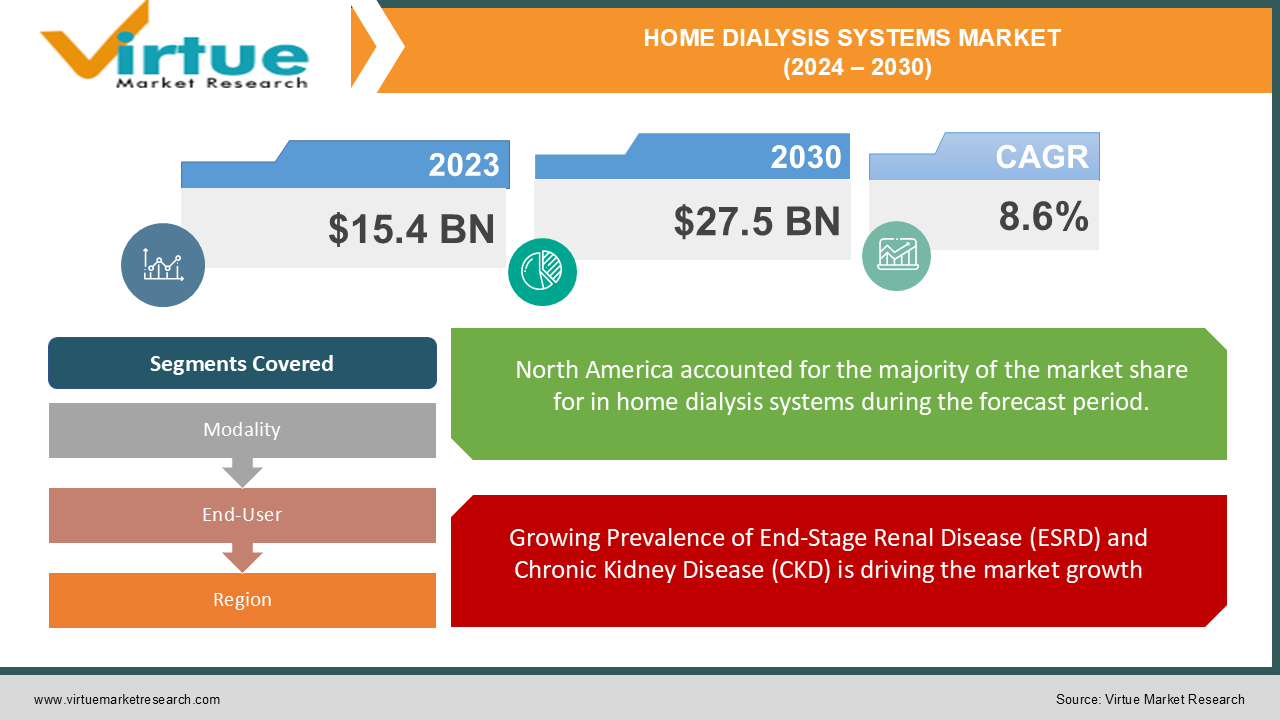

The Global Home Dialysis Systems Market was valued at USD 15.4 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The market is expected to reach USD 27.5 billion by 2030.

Home dialysis systems, which include both peritoneal dialysis and home hemodialysis, have gained significant traction due to the growing prevalence of end-stage renal disease (ESRD) and the increasing demand for more convenient and cost-effective alternatives to in-center dialysis. The aging global population, advancements in dialysis technology, and rising awareness about the benefits of home-based treatments are key factors driving the market’s growth.

Key Market Insights:

Peritoneal dialysis holds the largest market share in 2023, accounting for more than 60% of the total revenue due to its ease of use and lower infrastructure requirements.

Home hemodialysis is expected to witness faster growth, supported by technological innovations that allow patients to perform dialysis safely and efficiently at home.

North America leads the global home dialysis systems market with over 40% of the market share in 2023, attributed to the high prevalence of chronic kidney disease (CKD), favorable reimbursement policies, and a well-established healthcare infrastructure.

The increasing adoption of telemedicine and remote monitoring technologies in dialysis care is driving the demand for home dialysis systems, providing real-time patient data and improving treatment outcomes.

Global Home Dialysis Systems Market Drivers:

Growing Prevalence of End-Stage Renal Disease (ESRD) and Chronic Kidney Disease (CKD) is driving the market growth

The increasing prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD) is one of the primary drivers of the global home dialysis systems market. According to the World Health Organization (WHO), approximately 10% of the global population is affected by CKD, with millions progressing to ESRD each year. Patients with ESRD require dialysis or kidney transplantation to survive. Home dialysis systems, particularly peritoneal dialysis and home hemodialysis, offer a viable alternative to traditional in-center dialysis, providing patients with greater flexibility, convenience, and improved quality of life. The rising incidence of diabetes and hypertension, two major risk factors for CKD, is also contributing to the growing demand for home dialysis systems. As the global population continues to age, the prevalence of these chronic conditions is expected to increase, further driving the need for home-based dialysis solutions.

Advancements in Dialysis Technology and Increasing Adoption of Home-Based Healthcare are driving the market growth

Technological advancements in dialysis systems have significantly improved the safety, efficiency, and ease of use of home dialysis systems. Innovations such as automated peritoneal dialysis (APD) machines, portable home hemodialysis devices, and wearable dialysis technologies are making it easier for patients to perform dialysis treatments at home. Additionally, the integration of telemedicine and remote monitoring systems allows healthcare providers to monitor patients’ treatment progress in real-time, reducing the need for frequent hospital visits and enabling early detection of complications. The shift towards home-based healthcare, accelerated by the COVID-19 pandemic, has further boosted the adoption of home dialysis systems. Patients and healthcare providers are increasingly recognizing the benefits of home dialysis, including reduced risk of infections, greater independence, and the ability to tailor treatment schedules to patients’ lifestyles.

Favorable Reimbursement Policies and Government Initiatives are driving the market growth

Supportive reimbursement policies and government initiatives aimed at improving access to home dialysis systems are playing a critical role in driving the market. In countries like the United States, Medicare provides coverage for home dialysis treatments, encouraging more patients to opt for home-based care. The Centers for Medicare & Medicaid Services (CMS) introduced the ESRD Treatment Choices (ETC) Model, which incentivizes healthcare providers to promote home dialysis and kidney transplantation as preferred treatment options for ESRD patients. Similar policies and programs have been implemented in other countries, such as Canada and the UK, to support the adoption of home dialysis. Governments are also investing in training programs for healthcare professionals and patients to ensure the safe and effective use of home dialysis systems. These initiatives are expected to increase the penetration of home dialysis systems, especially in regions with underdeveloped healthcare infrastructure.

Global Home Dialysis Systems Market Challenges and Restraints:

High Initial Costs and Limited Awareness Among Patients is restricting the market growth

Despite the growing popularity of home dialysis systems, the high initial costs associated with purchasing dialysis machines and setting up home-based infrastructure can be a significant barrier for patients, particularly in low- and middle-income countries. Home dialysis systems require specialized equipment, including dialysis machines, water treatment systems, and consumables, which can be expensive to acquire and maintain. Although reimbursement policies in developed regions help offset these costs, patients in developing countries may face financial challenges in accessing home dialysis services. Moreover, limited awareness about the availability and benefits of home dialysis among patients and healthcare providers can hinder market growth. Many patients are still unfamiliar with home dialysis options and may feel more comfortable receiving treatment in a clinical setting due to a lack of knowledge about how to safely perform dialysis at home. Addressing these challenges through education and financial support programs will be crucial for expanding the global home dialysis systems market.

Complexity of Home Hemodialysis and Training Requirements is restricting the market growth

Home hemodialysis, while growing in popularity, remains more complex than peritoneal dialysis, requiring specialized training for both patients and their caregivers. The procedure involves more technical steps, such as vascular access management, monitoring blood pressure, and handling dialysis machines, which can be overwhelming for some patients. Ensuring that patients and caregivers receive adequate training and support to perform home hemodialysis safely is critical to reducing the risk of complications such as infections, blood clots, or equipment malfunctions. Additionally, many healthcare providers are hesitant to recommend home hemodialysis due to concerns about patient safety and the potential for emergency situations that could arise during home treatments. To overcome these challenges, manufacturers and healthcare organizations are investing in the development of user-friendly dialysis machines and comprehensive training programs that empower patients to confidently manage their dialysis treatments at home.

Market Opportunities:

The Global Home Dialysis Systems Market offers significant opportunities for growth as healthcare systems increasingly shift towards home-based treatments and telemedicine solutions. The rising demand for home dialysis systems is driven by several factors, including the growing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), an aging population, and the increasing need for more convenient and cost-effective treatment options.

One of the most promising opportunities lies in the growing adoption of telemedicine and remote monitoring technologies. These innovations enable healthcare providers to closely monitor patients' dialysis treatments in real-time, ensuring that any potential issues can be addressed quickly, improving patient outcomes and reducing the need for frequent hospital visits. As telemedicine becomes more integrated into healthcare systems, the demand for home dialysis systems that are compatible with remote monitoring platforms is expected to increase. Another key opportunity for growth in the home dialysis systems market is the expanding market presence in emerging economies, particularly in Asia-Pacific and Latin America. The rising incidence of diabetes and hypertension, along with improving healthcare infrastructure, is creating a fertile ground for home dialysis systems in these regions. Governments and private healthcare providers in these areas are increasingly investing in dialysis care infrastructure and patient education, driving market growth. Manufacturers that can provide affordable and user-friendly home dialysis solutions will be well-positioned to capitalize on the growing demand in these markets.

HOME DIALYSIS SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Modality, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., B. Braun Melsungen AG, NxStage Medical, Inc., Outset Medical, Inc.,Quanta Dialysis Technologies Ltd., Medtronic Plc, Asahi Kasei Medical Co., Ltd., Nipro Corporation, AWAK Technologies |

Home Dialysis Systems Market Segmentation - By Modality

-

Peritoneal Dialysis

-

Home Hemodialysis

Peritoneal dialysis is the dominant product segment in the home dialysis systems market, accounting for more than 60% of the total revenue in 2023. This modality is preferred by patients and healthcare providers due to its simplicity, ease of use, and the fact that it can be performed without the need for specialized vascular access, which is required for hemodialysis. Peritoneal dialysis offers greater flexibility and can be done overnight using automated peritoneal dialysis (APD) machines, allowing patients to maintain a more normal lifestyle. As a result, it continues to be the leading choice for home dialysis treatments.

Home Dialysis Systems Market Segmentation - By End-User

-

Home Care Settings

-

Dialysis Centers

Home care settings are the dominant end-user segment, contributing over 70% of the total market revenue in 2023. The convenience and comfort of receiving dialysis treatments at home make it an attractive option for patients with ESRD. Home care settings reduce the need for frequent visits to dialysis centers, allowing patients to adhere to their treatment schedules more consistently. Additionally, home care settings are associated with lower healthcare costs and a reduced risk of infections, further driving their popularity.

Home Dialysis Systems Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the dominant region in the global home dialysis systems market, accounting for over 40% of the total market share in 2023. The region's dominance can be attributed to several factors, including the high prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), a well-established healthcare infrastructure, and favorable reimbursement policies. The United States, in particular, has a robust home dialysis market, driven by Medicare’s coverage of home dialysis treatments and initiatives like the ESRD Treatment Choices (ETC) Model, which encourages the adoption of home-based care. Additionally, the presence of leading dialysis equipment manufacturers and the growing popularity of telemedicine and remote patient monitoring are further supporting market growth in North America.

COVID-19 Impact Analysis on the Global Home Dialysis Systems Market:

The COVID-19 pandemic had a profound impact on the global healthcare system, including the home dialysis systems market. During the pandemic, many dialysis centers faced operational challenges due to lockdowns, social distancing measures, and a surge in COVID-19 cases, leading to a greater demand for home-based dialysis treatments. Patients with end-stage renal disease (ESRD) were particularly vulnerable to severe complications from COVID-19, prompting healthcare providers to recommend home dialysis as a safer alternative to in-center treatments. As a result, the adoption of home dialysis systems, especially peritoneal dialysis, saw a significant increase during the pandemic. The pandemic also accelerated the adoption of telemedicine and remote monitoring technologies in the home dialysis market. Patients and healthcare providers embraced digital health solutions to ensure continuity of care while minimizing the risk of exposure to the virus. Telemedicine platforms allow healthcare providers to remotely monitor patients' dialysis treatments, adjust treatment plans, and provide guidance, reducing the need for in-person visits. However, the pandemic also posed challenges for the home dialysis systems market, particularly in terms of supply chain disruptions and shortages of essential dialysis supplies. Manufacturing facilities experienced delays, and the global supply chain faced disruptions, leading to temporary shortages of dialysis machines and consumables. Despite these challenges, the long-term impact of COVID-19 on the home dialysis systems market has been largely positive, with an increased focus on home-based care and telemedicine likely to drive sustained market growth in the post-pandemic era.

Latest Trends/Developments:

The global home dialysis systems market is experiencing several key trends and developments that are shaping its future growth. One of the most notable trends is the increasing demand for user-friendly and portable home dialysis machines. Manufacturers are developing more compact and portable devices that are easier for patients to use independently, without the need for extensive training. These advancements are making home dialysis more accessible to a broader range of patients, including elderly individuals and those with limited mobility. Another important trend is the growing emphasis on eco-friendly dialysis solutions. Environmental sustainability is becoming a key focus for healthcare providers and manufacturers, leading to the development of dialysis machines and consumables that reduce water usage, minimize waste, and use biodegradable materials. This trend aligns with the broader global push towards sustainability in healthcare and is expected to gain further momentum in the coming years. The integration of telemedicine and remote patient monitoring is also playing a significant role in the home dialysis market. Telemedicine platforms allow healthcare providers to remotely monitor patients' dialysis treatments, track treatment outcomes, and adjust therapy as needed, all while ensuring patient safety. This trend has been accelerated by the COVID-19 pandemic and is expected to become a standard practice in the management of home dialysis patients.

Key Players:

-

Fresenius Medical Care AG & Co. KGaA

-

Baxter International Inc.

-

B. Braun Melsungen AG

-

NxStage Medical, Inc.

-

Outset Medical, Inc.

-

Quanta Dialysis Technologies Ltd.

-

Medtronic Plc

-

Asahi Kasei Medical Co., Ltd.

-

Nipro Corporation

-

AWAK Technologies

Chapter 1. Home Dialysis Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Home Dialysis Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Home Dialysis Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Home Dialysis Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Home Dialysis Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Home Dialysis Systems Market – By Modality

6.1 Introduction/Key Findings

6.2 Peritoneal Dialysis

6.3 Home Hemodialysis

6.4 Y-O-Y Growth trend Analysis By Modality

6.5 Absolute $ Opportunity Analysis By Modality, 2024-2030

Chapter 7. Home Dialysis Systems Market – By End-User

7.1 Introduction/Key Findings

7.2 Home Care Settings

7.3 Dialysis Centers

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Home Dialysis Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Modality

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Modality

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Modality

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Modality

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Modality

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Home Dialysis Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Fresenius Medical Care AG & Co. KGaA

9.2 Baxter International Inc.

9.3 B. Braun Melsungen AG

9.4 NxStage Medical, Inc.

9.5 Outset Medical, Inc.

9.6 Quanta Dialysis Technologies Ltd.

9.7 Medtronic Plc

9.8 Asahi Kasei Medical Co., Ltd.

9.9 Nipro Corporation

9.10 AWAK Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Home Dialysis Systems Market was valued at USD 15.4 billion in 2023 and is expected to reach USD 27.5 billion by 2030, growing at a CAGR of 8.6%.

Key drivers include the growing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), advancements in dialysis technology, and favorable reimbursement policies supporting home-based care.

The market is segmented by modality (Peritoneal Dialysis, Home Hemodialysis) and by end-user (Home Care Settings, Dialysis Centers).

North America is the dominant region, accounting for over 40% of the market share, driven by a high prevalence of CKD, strong healthcare infrastructure, and supportive reimbursement policies.

Leading players include Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., B. Braun Melsungen AG, NxStage Medical, Inc., and Outset Medical, Inc.