Dialysis Equipment Market Size (2024–2030)

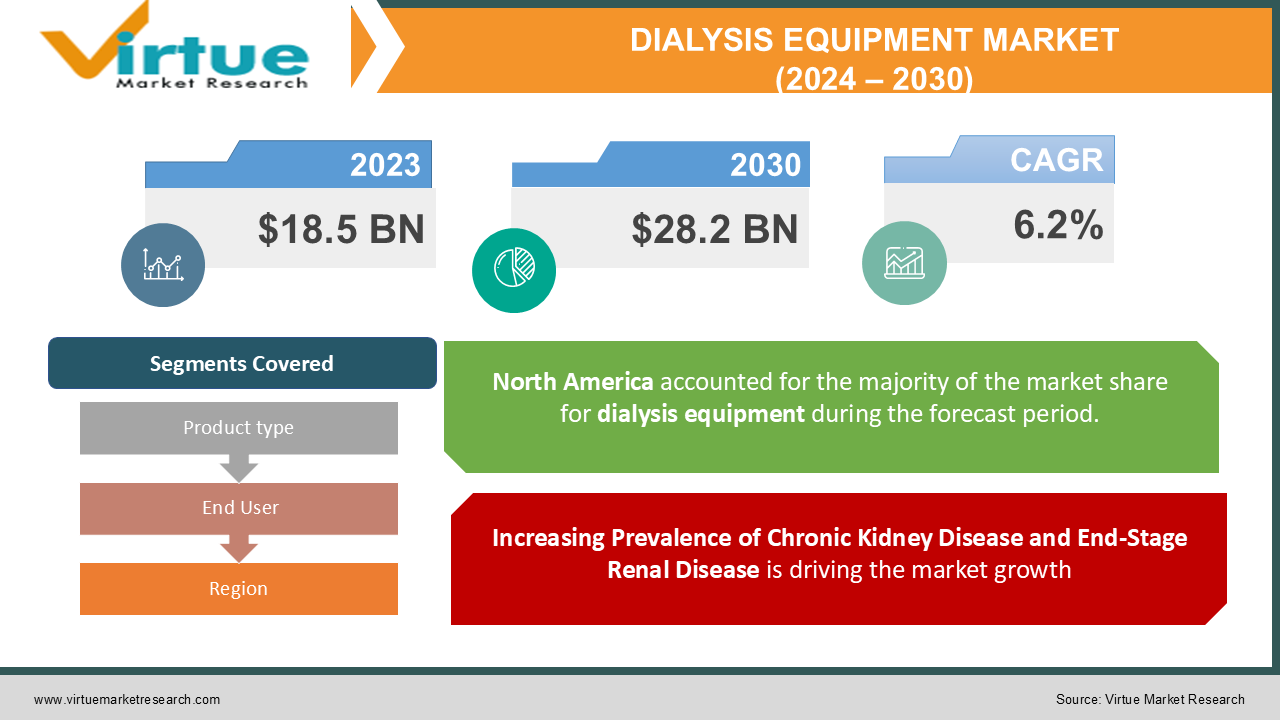

The Global Dialysis Equipment Market was valued at USD 18.5 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030, reaching an estimated USD 28.2 billion by 2030.

Dialysis equipment, essential in treating end-stage renal disease (ESRD) and chronic kidney disease (CKD), includes hemodialysis and peritoneal dialysis machines, as well as dialysis consumables like dialyzers and access supplies. The market’s expansion is driven by rising cases of kidney disease, which is fueled by an aging population, and an increase in diabetes, and hypertension rates globally.

With advancements in dialysis technology, a shift toward home-based dialysis, and innovations in wearable and portable devices, the dialysis equipment market is evolving to provide more accessible and patient-centered care. Governments worldwide are investing in dialysis infrastructure, while industry players are increasingly focusing on affordability and ease of use in dialysis systems.

Key Market Insights:

-

The hemodialysis machines segment accounted for 45% of the market share in 2023 due to the high demand for in-center dialysis treatments.

-

Peritoneal dialysis machines are projected to grow at a CAGR of 7.1% from 2024 to 2030, supported by increasing preference for home-based dialysis options.

-

North America dominated the market with 38% of the revenue share in 2023, attributed to a well-established healthcare system, high rates of CKD, and advanced dialysis facilities.

-

The Asia-Pacific region is expected to exhibit the fastest growth, with rising CKD incidence rates and improving healthcare infrastructure.

-

Wearable and portable dialysis devices are an emerging trend, offering convenience and quality-of-life improvements, which may transform the dialysis landscape over the next decade.

Global Dialysis Equipment Market Drivers:

Increasing Prevalence of Chronic Kidney Disease and End-Stage Renal Disease is driving the market growth:

The global incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) is on the rise, largely attributed to aging populations, diabetes, and hypertension—conditions that significantly increase the risk of renal impairment. As CKD progresses, dialysis becomes a necessary intervention for patients with severely compromised kidney function. According to recent statistics, approximately 10% of the global population is affected by some form of kidney disease, with a notable portion requiring dialysis treatment. As these health conditions continue to increase globally, the demand for dialysis equipment grows in tandem. Hemodialysis, which remains the most common form of dialysis, requires advanced equipment and regular treatments, often conducted multiple times a week. This high frequency of use amplifies demand for reliable, efficient dialysis machines and related consumables. Consequently, the growing population with CKD and ESRD is a significant driver for the expansion of the dialysis equipment market.

Advancements in Dialysis Equipment Technology and Home Dialysis are driving the market growth:

The development of advanced dialysis technology has expanded treatment options, particularly in the realm of home dialysis. Innovations in peritoneal dialysis and home hemodialysis equipment have made it possible for patients to manage dialysis at home, enhancing comfort and reducing the need for frequent clinic visits. Technologies such as portable dialysis machines and wearable artificial kidneys are transforming dialysis care by offering flexibility, mobility, and improved quality of life for patients. Home-based dialysis is a growing trend, especially in developed regions, where patients prefer treatments that allow for greater independence and convenience. Furthermore, telemedicine and remote monitoring technologies have facilitated the adoption of home dialysis, enabling healthcare providers to monitor patients’ progress remotely. These advancements are expected to drive the market for home dialysis equipment as patients and providers increasingly favor this flexible, patient-centric model of care.

Government Initiatives and Reimbursement Policies Supporting Dialysis is driving the market growth:

Governments across various countries are implementing policies to support and subsidize dialysis treatments, given the increasing burden of kidney diseases. Many nations provide dialysis services at a reduced cost or free of charge to eligible patients, alleviating the financial burden and encouraging more patients to seek treatment. For instance, the United States has established Medicare coverage for individuals diagnosed with ESRD, while similar policies exist in countries such as Canada and several European nations. Government-backed funding for dialysis infrastructure development is also a driver for the dialysis equipment market. In emerging economies, healthcare authorities are increasingly investing in dialysis clinics and equipment procurement to cater to the growing patient population. Reimbursement policies play a vital role in the market, as they determine the affordability and accessibility of dialysis services, directly influencing the demand for dialysis equipment.

Global Dialysis Equipment Market Challenges and Restraints:

The High Cost of Dialysis Equipment and Limited Access in Low-Income Regions are restricting the market growth:

Dialysis equipment, particularly advanced hemodialysis, and peritoneal dialysis machines is expensive, and the high cost of these devices remains a major barrier for low-income and developing regions. In addition to the initial purchase costs, maintenance, consumables, and operational expenses contribute to the overall financial burden, making dialysis unaffordable for many patients. While government subsidies and insurance programs alleviate some of the costs, coverage limitations often exclude advanced treatments, which limits accessibility for certain patient populations. The limited availability of dialysis centers in low-income regions exacerbates this challenge, as many patients are unable to travel long distances to access dialysis services. Furthermore, the lack of specialized healthcare professionals to operate and maintain dialysis equipment restricts its deployment in resource-poor settings. These challenges may hinder the market's growth potential in regions where there is a substantial need for affordable dialysis solutions.

Potential Complications and Risks Associated with Dialysis Treatment is restricting the market growth:

While dialysis is a life-saving procedure, it is associated with potential complications that can affect patient outcomes. Hemodialysis and peritoneal dialysis have inherent risks, including infections, cardiovascular complications, and, in some cases, dialysis access-related issues. The risk of infection is particularly concerning, as patients with compromised immune systems are more susceptible to healthcare-associated infections, including bloodstream infections. The prevalence of complications associated with dialysis treatments can deter some patients and healthcare providers from adopting these therapies, particularly in settings where infection control measures are challenging to maintain. Furthermore, complications resulting from improper dialysis procedures can lead to additional medical interventions, increasing the overall cost of treatment and impacting patient quality of life.

Market Opportunities:

The dialysis equipment market presents substantial growth opportunities driven by innovations in wearable dialysis technology, home dialysis systems, and biosimilar treatments. Wearable dialysis devices, such as the wearable artificial kidney, represent a breakthrough in patient-centered dialysis care. These devices offer greater flexibility and independence for patients, reducing the need for regular clinic visits and providing a more convenient alternative to traditional hemodialysis and peritoneal dialysis. The home dialysis market segment is poised for significant growth, with an increasing number of patients opting for home-based treatments that provide privacy, flexibility, and reduced travel requirements. Innovations in telehealth and remote monitoring solutions further support the shift toward home dialysis, enabling healthcare providers to monitor patient progress and troubleshoot issues remotely. Additionally, the development and approval of biosimilar products for dialysis consumables and drugs are expected to make dialysis treatment more affordable, particularly in cost-sensitive regions. Biosimilars offer a cost-effective alternative to branded dialysis drugs, reducing the financial burden on patients and expanding access to dialysis services. As regulatory bodies continue to approve biosimilars for dialysis applications, the availability of these affordable options is expected to drive growth in the global dialysis equipment market.

DIALYSIS EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., Nipro Corporation, Asahi Kasei Corporation, Medtronic plc, B. Braun Melsungen AG, Diaverum AB, NxStage Medical, Inc., JMS Co., Ltd., Quanta Dialysis Technologies Ltd. |

Dialysis Equipment Market Segmentation: By Product Type

-

Hemodialysis Machines

-

Peritoneal Dialysis Machines

-

Dialysis Accessories

-

Consumables

The hemodialysis machines segment is the dominant segment, holding approximately 45% of the market share in 2023. Hemodialysis remains the most commonly used dialysis modality, particularly in in-center settings, which contributes to its high demand.

Dialysis Equipment Market Segmentation: By End User

-

In-Center Dialysis

-

Home Dialysis

The in-center dialysis segment continues to lead the market, accounting for the largest share of the end-user segment. However, home dialysis is gaining traction, with increased adoption driven by patient preference for flexibility and independence in managing their treatment.

Dialysis Equipment Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the global dialysis equipment market, holding a 38% share of the total revenue in 2023. The region’s leadership is supported by advanced healthcare infrastructure, a high prevalence of CKD, and well-established dialysis facilities that drive demand for dialysis equipment and services.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly impacted the dialysis equipment market, particularly in the early stages, as healthcare facilities faced capacity constraints and supply chain disruptions. In-center dialysis facilities were particularly affected, as they posed an elevated risk of infection for patients. This led to a temporary decline in patient volumes and the postponement of non-urgent dialysis sessions. In response to these challenges, there was a marked shift toward home-based dialysis solutions, which offered a safer alternative for patients. The pandemic accelerated the adoption of home dialysis, telemedicine, and remote patient monitoring systems, which continue to influence the market as healthcare systems adapt to post-pandemic demands.

Latest Trends/Developments:

Recent trends in the dialysis equipment market include advancements in portable and wearable dialysis technologies, increased adoption of biosimilars, and telemedicine integration for home dialysis. These developments are enhancing patient access to dialysis care, improving affordability, and supporting a shift towards patient-centered, flexible treatment models. The dialysis equipment market is undergoing a significant transformation driven by technological advancements, the increasing prevalence of chronic kidney diseases (CKD) and end-stage renal disease (ESRD), and a growing preference for home dialysis. Key trends include the development of compact and portable dialysis machines, smart dialysis systems with advanced monitoring capabilities, and the integration of artificial intelligence for personalized treatment plans. Moreover, there's a rising demand for wearable dialysis devices, offering greater flexibility and convenience for patients. Additionally, the focus on improving dialysis efficiency, reducing treatment time, and enhancing patient comfort is driving the development of innovative filtration techniques and water purification systems. As healthcare systems prioritize cost-effective and patient-centric solutions, the dialysis equipment market is poised for continued growth and innovation.

Key Players:

-

Fresenius Medical Care AG & Co. KGaA

-

Baxter International Inc.

-

Nipro Corporation

-

Asahi Kasei Corporation

-

Medtronic plc

-

B. Braun Melsungen AG

-

Diaverum AB

-

NxStage Medical, Inc.

-

JMS Co., Ltd.

-

Quanta Dialysis Technologies Ltd.

Chapter 1. Dialysis Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dialysis Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dialysis Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dialysis Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dialysis Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dialysis Equipment Market – By Product

6.1 Introduction/Key Findings

6.2 Hemodialysis Machines

6.3 Peritoneal Dialysis Machines

6.4 Dialysis Accessories

6.5 Consumables

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Dialysis Equipment Market – By End User

7.1 Introduction/Key Findings

7.2 In-Center Dialysis

7.3 Home Dialysis

7.4 Y-O-Y Growth trend Analysis By End User

7.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Dialysis Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Dialysis Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Fresenius Medical Care AG & Co. KGaA

9.2 Baxter International Inc.

9.3 Nipro Corporation

9.4 Asahi Kasei Corporation

9.5 Medtronic plc

9.6 B. Braun Melsungen AG

9.7 Diaverum AB

9.8 NxStage Medical, Inc.

9.9 JMS Co., Ltd.

9.10 Quanta Dialysis Technologies Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 18.5 billion in 2023 and is projected to reach USD 28.2 billion by 2030, growing at a CAGR of 6.2%.

Key drivers include the increasing prevalence of CKD and ESRD, advancements in dialysis equipment technology, and supportive government initiatives for dialysis infrastructure and reimbursement.

The market is segmented by product type (hemodialysis machines, peritoneal dialysis machines, dialysis accessories, consumables) and end-user (in-center dialysis, home dialysis).

North America dominates, with a 38% share of the global market in 2023.

Leading players include Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., Nipro Corporation, Asahi Kasei Corporation, and Medtronic plc, among others.