Hard Seltzer Market Size (2025-2030)

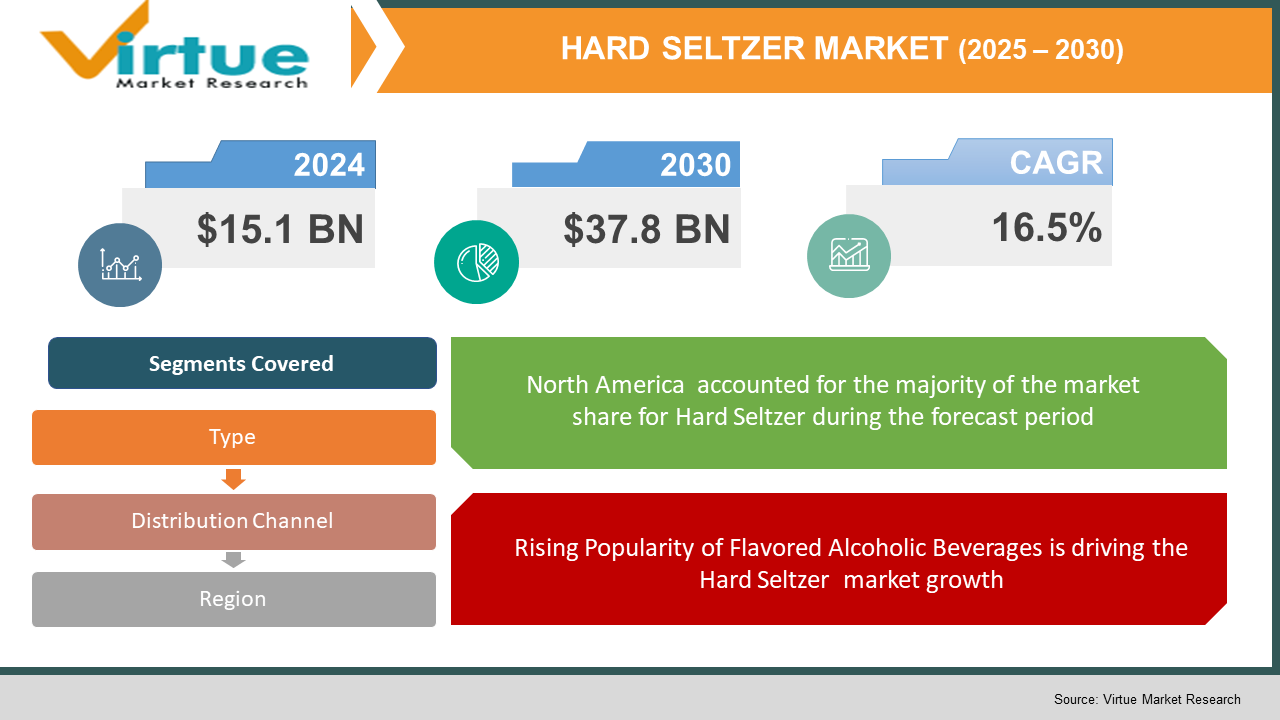

The Global Hard Seltzer Market was valued at USD 15.1 billion in 2024 and is projected to reach USD 37.8 billion by 2030, growing at a CAGR of 16.5% during the forecast period.

Hard seltzer, a low-calorie alcoholic beverage, has emerged as a popular choice among health-conscious consumers, offering a refreshing alternative to traditional alcoholic drinks.

This growth is attributed to the increasing consumer demand for flavored alcoholic beverages, the rising trend of low-calorie and low-alcohol content drinks, and the popularity of ready-to-drink (RTD) options. North America leads the market due to the strong presence of innovative brands and the growing popularity of social drinking.

Key Market Insights

- The flavored hard seltzer segment dominated the market in 2024, accounting for 75% of the revenue share, driven by the preference for fruity and exotic flavors.

- The online distribution channel is growing rapidly, with a CAGR of over 18%, fueled by the rise of e-commerce platforms and convenience in doorstep delivery.

- Millennials and Gen Z are the primary consumers of hard seltzer, valuing its low calorie and gluten-free attributes.

- The market in North America contributed over 60% of the revenue in 2024, with significant contributions from the U.S. and Canada.

- Innovative marketing strategies, including partnerships with influencers and social media campaigns, are driving brand awareness and adoption.

- The introduction of seasonal and limited-edition flavors is creating opportunities for market expansion and consumer engagement.

- Increasing adoption of hard seltzer in Asia-Pacific highlights emerging opportunities in countries like China, Japan, and India, fueled by urbanization and changing lifestyles.

Global Hard Seltzer Market Drivers

1. Shift Toward Health-Conscious Alcohol Consumption is driving the Hard Seltzer market growth

Modern consumers, particularly millennials, are prioritizing health and wellness, seeking low-calorie and low-alcohol beverages. Hard seltzers, often marketed as gluten-free and low-sugar, cater perfectly to these preferences.

Hard seltzer's appeal lies in its ability to combine flavor with functionality. Unlike traditional alcoholic drinks, it offers guilt-free indulgence, aligning with the global trend of "better-for-you" products. Additionally, brands have capitalized on consumer concerns by emphasizing transparency in labeling and natural ingredients.

2. Rising Popularity of Flavored Alcoholic Beverages is driving the Hard Seltzer market growth

Flavored alcoholic beverages have become increasingly popular among younger demographics, driven by a desire for variety and novelty. Hard seltzers come in a wide range of flavors, from classic lime and berry to exotic blends like passionfruit and mango.

The availability of diverse flavor options has enabled brands to capture different consumer segments and occasions. Seasonal and limited-edition offerings further drive excitement and repeat purchases, making flavored hard seltzer the dominant segment.

3. Growth of Ready-to-Drink (RTD) Beverages is driving the Hard Seltzer market growth

The global shift toward convenience has spurred the growth of RTD alcoholic beverages, including hard seltzers. These drinks are easy to consume, portable, and perfect for social gatherings, aligning with the fast-paced lifestyles of modern consumers.

RTD beverages, including hard seltzers, benefit from innovative packaging solutions such as cans, which enhance portability and shelf life. Additionally, the growing acceptance of RTD options in on-premise venues, such as bars and restaurants, is expanding market penetration.

Global Hard Seltzer Market Challenges and Restraints

1. Intense Competition from Substitutes is restricting the Hard Seltzer market growth

The hard seltzer market faces stiff competition from a diverse range of alcoholic beverages, including craft beer, wine, and cocktails, as well as non-alcoholic alternatives like kombucha and sparkling water. These beverages offer varying flavor profiles, alcohol content, and price points, catering to a wide spectrum of consumer preferences. While hard seltzers have gained significant popularity, they must continuously innovate to maintain their market share. Brands face increasing pressure to differentiate their offerings through unique and exciting flavor profiles, going beyond traditional fruit flavors and exploring more adventurous options. Furthermore, sustainability initiatives, such as the use of recyclable packaging and eco-friendly sourcing practices, are crucial for attracting environmentally conscious consumers. Creative marketing campaigns that resonate with target audiences and build brand loyalty are also essential for navigating the competitive landscape and maintaining a strong market position.

2. Regulatory Challenges and Taxes is restricting the Hard Seltzer market growth

The alcoholic beverage industry operates within a complex regulatory framework, with varying regulations and tax structures across different regions. These regulations pose significant challenges for hard seltzer manufacturers, particularly in emerging markets with complex and evolving regulatory landscapes. Compliance with labeling requirements, which often vary in terms of ingredient disclosure, allergen information, and health warnings, is crucial. Strict advertising restrictions, including limitations on marketing channels and target audiences, can significantly impact marketing and promotional efforts. Age verification policies, designed to prevent underage consumption, require robust age-gating mechanisms and may restrict certain sales channels. Furthermore, higher excise taxes on alcoholic beverages, which vary significantly across different jurisdictions, can significantly impact product pricing and profitability, reducing competitiveness and potentially hindering market growth. Navigating these complex regulatory environments requires careful planning, ongoing monitoring of regulatory changes, and adherence to strict compliance protocols.

Market Opportunities

The Global Hard Seltzer Market presents significant growth opportunities driven by a confluence of factors. The expansion into emerging markets, particularly in regions like Asia-Pacific and Latin America, offers untapped potential. Urbanization, rising disposable incomes, and a growing preference for innovative alcoholic beverages are driving demand in these regions. Sustainability is gaining increasing importance, with consumers favoring brands that adopt eco-friendly practices, such as using recyclable packaging and sourcing sustainable ingredients. Investments in sustainability can enhance brand image and attract environmentally conscious consumers. The trend of personalized experiences offers opportunities for brands to introduce customizable hard seltzer options, such as mix-your-own flavors or branded subscription services, catering to individual preferences. The incorporation of functional ingredients, such as vitamins, antioxidants, and CBD, presents a promising avenue for differentiation and premium pricing, appealing to health-conscious consumers. These trends are collectively shaping the future of the hard seltzer market, driving innovation and creating new avenues for growth and expansion.

HARD SELTZER MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

White Claw Hard Seltzer, Truly Hard Seltzer, Bud Light Seltzer, Corona Hard Seltzer, Bon & Viv Spiked Seltzer, Smirnoff Spiked Sparkling Seltzer, Vizzy Hard Seltzer, Topo Chico Hard Seltzer, Mike's Hard Lemonade Co., Henry’s Hard Sparkling Water |

Hard Seltzer Market Segmentation

Hard Seltzer Market Segmentation By Type:

- Flavored

- Non-Flavored

The flavored hard seltzer segment undeniably dominated the Hard Seltzer market in 2024, capturing a commanding 75% of the revenue share. This dominance can be attributed to several key factors. Firstly, consumer preference for refreshing and flavorful beverages has driven a strong demand for hard seltzers that offer a diverse range of taste experiences. Fruity flavors, such as mango, lime, and berry, have proven particularly popular, appealing to a wide range of palates. Secondly, the introduction of innovative and exciting flavor combinations, including limited-edition and seasonal offerings, has kept the category dynamic and engaging, constantly introducing new and exciting taste experiences to consumers. This continuous innovation in flavor profiles has played a crucial role in driving the growth and popularity of the flavored hard seltzer segment.

Hard Seltzer Market Segmentation By Distribution Channel:

- Online

- Offline

The offline distribution channel, encompassing supermarkets, hypermarkets, and liquor stores, held the dominant position in the hard seltzer market in 2024. These channels offer several advantages, including the ability to physically examine products, compare prices, and receive personalized recommendations from store staff. However, the online channel is poised for significant growth, with a projected CAGR of 18%. This rapid growth is driven by the increasing convenience and accessibility of e-commerce platforms. Online platforms offer a wider selection of products, enable easy price comparisons, and provide the convenience of home delivery, making them increasingly attractive to consumers.

Hard Seltzer Market Regional Segmentation

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

North America accounted for over 60% of the Hard Seltzer market revenue in 2024, driven by the strong presence of established brands and high consumer acceptance.

The U.S. leads the region, with hard seltzer becoming a mainstream beverage in social settings. The focus on innovation, such as unique flavors and functional ingredients, further solidifies North America’s dominance. The region's high disposable income levels and evolving drinking culture contribute significantly to Hard Seltzer market growth.

COVID-19 Impact Analysis

The COVID-19 pandemic accelerated the adoption of hard seltzers as consumers turned to RTD beverages for at-home consumption. With bars and restaurants closed during lockdowns, demand for portable and easy-to-store beverages surged.

E-commerce platforms played a pivotal role in meeting consumer demand, as online alcohol sales witnessed exponential growth. Brands leveraged digital marketing and direct-to-consumer strategies to maintain visibility and engagement.

Despite supply chain disruptions, the market demonstrated resilience, with manufacturers adapting to changing consumer preferences and logistics challenges. Post-pandemic, the hard seltzer market continues to thrive, supported by the sustained demand for RTD beverages.

Latest Trends/Developments

The hard seltzer market is witnessing several key trends. Brands are increasingly incorporating health-focused ingredients like electrolytes and adaptogens into their formulations to appeal to fitness-conscious consumers seeking beverages that not only quench thirst but also provide potential health benefits. Marketing strategies are evolving to leverage the power of social media influencers and celebrity endorsements, driving brand visibility and fostering consumer trust. To maintain consumer interest, brands are expanding their flavor portfolios with limited-edition and seasonal offerings, keeping the product range dynamic and exciting. Sustainability is also gaining prominence, with companies investing in eco-friendly packaging and adopting carbon-neutral operations to align with consumer values and environmental concerns. Furthermore, the introduction of alcohol-free hard seltzers caters to the growing sober-curious demographic, offering a refreshing and flavorful alternative for those seeking to moderate their alcohol consumption or abstain entirely. These trends are collectively shaping the future of the hard seltzer market, driving innovation and expanding its appeal to a wider range of consumers.

Key Players

- White Claw Hard Seltzer

- Truly Hard Seltzer

- Bud Light Seltzer

- Corona Hard Seltzer

- Bon & Viv Spiked Seltzer

- Smirnoff Spiked Sparkling Seltzer

- Vizzy Hard Seltzer

- Topo Chico Hard Seltzer

- Mike's Hard Lemonade Co.

- Henry’s Hard Sparkling Water

Chapter 1. GLOBAL HARD SELTZER MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL HARD SELTZER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL HARD SELTZER MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL HARD SELTZER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL HARD SELTZER MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL HARD SELTZER MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Flavored

6.3. Non-Flavored

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. GLOBAL HARD SELTZER MARKET– BY DISTRIBUTION CHANNEL

7.1. Introduction/Key Findings

7.2. Online

7.3 Offline

7.4. Y-O-Y Growth trend Analysis By DISTRIBUTION CHANNEL

7.5. Absolute $ Opportunity Analysis By DISTRIBUTION CHANNEL , 2024-2030

Chapter 8. GLOBAL HARD SELTZER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL HARD SELTZER MARKET – Company Profiles – (Overview, Product Product TypeProduct Product Type s Portfolio, Financials, Strategies & Development

9.1. White Claw Hard Seltzer

9.2. Truly Hard Seltzer

9.3. Bud Light Seltzer

9.4. Corona Hard Seltzer

9.5. Bon & Viv Spiked Seltzer

9.6. Smirnoff Spiked Sparkling Seltzer

9.7. Vizzy Hard Seltzer

9.8. Topo Chico Hard Seltzer

9.9. Mike's Hard Lemonade Co.

9.10. Henry’s Hard Sparkling Water

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Hard Seltzer market was valued at USD 15.1 billion in 2024 and is projected to reach USD 37.8 billion by 2030, growing at a CAGR of 16.5%.

Key drivers include the rising demand for health-conscious alcoholic beverages, the popularity of flavored drinks, and the growth of RTD options

The Hard Seltzer market is segmented by Type (Flavored, Non-Flavored) and Distribution Channel (Online, Offline).

North America dominates the Hard Seltzer market, contributing over 60% of revenue in 2024, driven by innovative brands and high consumer acceptance.

Key players include White Claw, Truly, Bud Light Seltzer, Corona Hard Seltzer, and Vizzy.