Europe Hard Seltzer Market Size (2024-2030)

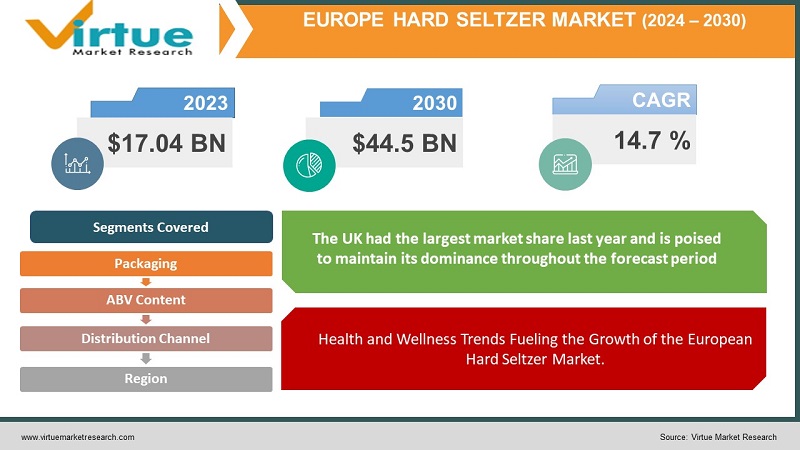

The Europe Hard Seltzer Market was valued at USD 17.04 billion in 2023 and is projected to reach a market size of USD 44.5 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 14.7 % between 2024 and 2030.

The European hard seltzer market is experiencing a dynamic evolution, reflecting a broader shift in consumer preferences toward health-conscious and convenient beverage options. Originating from the United States, hard seltzers, which are typically low-calorie, gluten-free alcoholic beverages with natural flavors, have rapidly gained popularity in Europe. This surge is driven by millennials and Gen Z consumers who prioritize wellness and are increasingly seeking alternatives to traditional alcoholic drinks. The appeal of hard seltzers lies in their positioning as a "better-for-you" option, combining the effervescence of sparkling water with the allure of alcohol, often packaged in sleek, portable cans that cater to an on-the-go lifestyle. Major beverage companies and startups alike are capitalizing on this trend, introducing a diverse range of flavors and innovative marketing strategies to capture market share. Countries such as the United Kingdom, Germany, and France are at the forefront of this burgeoning market, with numerous brands vying for consumer attention through both retail and e-commerce platforms. Furthermore, the market's growth is bolstered by increasing investments in distribution channels and promotional activities that emphasize the unique selling points of hard seltzers. As regulations around alcohol advertising continue to evolve, companies are leveraging social media and influencer partnerships to effectively reach their target audiences. Additionally, the sustainability aspect, with many brands focusing on eco-friendly packaging and production processes, resonates well with environmentally conscious consumers. The European hard seltzer market is not just a fleeting trend but represents a significant shift in the beverage industry, driven by changing lifestyle choices and a growing preference for beverages that offer a balance of enjoyment and health benefits. As this market continues to expand, it presents substantial opportunities for innovation and growth, signaling a promising future for both established players and new entrants.

Key Market Insights:

- Off-trade distribution channel holds around 70% of the market share, expected to continue dominance. On-trade distribution channel holds around 30% of the market share, with potential growth due to social consumption trends.

- The below 5% ABV segment is expected to dominate with around 65% market share, driven by the health and wellness trend. The more than 5% ABV segment may hold around 35% market share, with slower growth.

- The UK is likely the leader with approximately 40% market share.

- Eastern and Central Europe, along with Germany, is experiencing rapid growth, potentially reaching 20% market share by the end of the forecast period.

Europe Hard Seltzer Market Drivers:

Health and Wellness Trends Fueling the Growth of the European Hard Seltzer Market.

The increasing health-consciousness among Europeans is significantly propelling the growth of the hard seltzer market, as these beverages are frequently perceived as a lower-calorie and lower-sugar alternative to traditional alcoholic drinks. This trend aligns with the broader movement towards healthier lifestyles, where consumers are more mindful of their dietary intake and are actively seeking options that align with their wellness goals. Hard seltzers, with their typically low-calorie profiles and natural flavorings, cater to these preferences by offering a refreshing and guilt-free drinking experience. The market's expansion is further driven by the desire for transparency and simplicity in ingredient lists, which hard seltzers often promote. As a result, brands are emphasizing their health benefits in marketing campaigns, appealing particularly to millennials and Gen Z consumers who prioritize balanced living. This health-driven approach is not only shaping consumer behavior but also influencing the development of new product variants and innovations within the sector. The alignment of hard seltzers with health and wellness trends underscores their potential for sustained growth in the European market, as more consumers gravitate towards beverages that support a healthier lifestyle without compromising on taste and enjoyment.

Social Media Influence Driving Hard Seltzer Popularity in Europe.

Social media has become a pivotal force in shaping consumer preferences across Europe, and hard seltzer brands are effectively harnessing this power to boost their market presence. Platforms such as Instagram and TikTok are particularly influential, offering dynamic and visually engaging ways for brands to connect with their audience. Hard seltzer companies are leveraging these platforms to create compelling content that highlights not only the product itself but also the desirable lifestyle associated with it. By showcasing vibrant, on-the-go moments and health-conscious choices, brands are able to resonate deeply with millennial and Gen Z consumers. Influencer partnerships and user-generated content further amplify this reach, as trusted personalities and everyday users share their positive experiences with these beverages, enhancing credibility and appeal. These strategic social media campaigns are instrumental in driving brand awareness, fostering community engagement, and ultimately increasing sales. The interactive nature of these platforms allows for real-time feedback and adaptation, enabling brands to stay ahead of trends and continuously refine their marketing approaches. As social media continues to shape consumer behavior, the hard seltzer market in Europe is set to benefit from this digital influence, solidifying its presence and accelerating its growth in the beverage industry.

Europe Hard Seltzer Market Restraints and Challenges:

Despite the burgeoning popularity of hard seltzers in Europe, the market faces several restraints and challenges that could hinder its growth. One significant challenge is the regulatory landscape, which varies widely across different European countries and can complicate distribution and marketing efforts. Additionally, traditional alcoholic beverages, such as beer and wine, still dominate the market, making it difficult for hard seltzers to carve out a substantial niche. Consumer skepticism also poses a hurdle; while some embrace hard seltzers for their health benefits, others question their taste and authenticity compared to conventional drinks. The competition from well-established beverage brands further intensifies the market dynamics, requiring new entrants to invest heavily in branding and marketing to gain visibility. Supply chain disruptions and the rising cost of raw materials can also impact production and pricing strategies. Furthermore, the economic uncertainty in various regions may affect consumer spending habits, leading to reduced discretionary spending on premium or novel beverage options. Environmental concerns over packaging and sustainability are additional factors that brands must address to align with eco-conscious consumers. Overcoming these challenges will require strategic innovation, effective regulatory navigation, and robust consumer education to sustain the growth trajectory of hard seltzers in Europe.

Europe Hard Seltzer Market Opportunities:

The European hard seltzer market presents numerous opportunities for growth and innovation, driven by evolving consumer preferences and a dynamic beverage landscape. One major opportunity lies in product diversification, where brands can experiment with unique and region-specific flavors to cater to diverse palates across Europe. This can include incorporating local fruits and botanicals, which can resonate more deeply with local consumers. Another significant opportunity is the expansion of distribution channels, particularly through e-commerce platforms, which have seen a surge in popularity. Collaborations with food delivery services can also enhance accessibility and convenience for consumers. Additionally, aligning with the growing trend of sustainability offers a competitive edge, as brands that prioritize eco-friendly packaging and ethical production processes can attract environmentally conscious consumers. There is also potential in targeting niche markets, such as low-alcohol and organic segments, to appeal to health-focused individuals. Furthermore, leveraging advanced digital marketing strategies, including influencer partnerships and interactive campaigns on social media platforms, can effectively boost brand awareness and engagement. As more consumers seek low-calorie, refreshing alternatives to traditional alcoholic beverages, hard seltzer brands that can innovate and adapt to these emerging trends are well-positioned to capitalize on the expanding market opportunities in Europe.

EUROPE HARD SELTZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.7% |

|

Segments Covered |

By Packaging content, ABV Content, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

White Claw, Truly, Bodega Bay, Kopparberg, Fizzy Hop, NÜTRL Vodka Soda, Smirnoff Seltzer, Mikkeller, Onda, Mike's Hard Sparkling Water |

Europe Hard Seltzer Market Segmentation:

Europe Hard Seltzer Market Segmentation By Packaging:

- Metal Cans

- Glass Bottles

- Plastic Bottles

The Europe Hard Seltzer Market Segmented by Packaging and Glass Bottles had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the European hard seltzer market, glass bottles currently hold the largest market share, reflecting consumer preference for perceived quality and established distribution channels. Glass bottles are often associated with a premium image, enhancing the overall drinking experience. Additionally, their reusability and recyclability appeal to environmentally conscious consumers, bolstering their popularity. However, can present compelling advantages that could shift market dynamics. Cans are lighter, easier to transport, and chill faster than glass bottles, offering superior convenience for on-the-go lifestyles. They are also generally cheaper to produce and transport, potentially leading to cost savings for both manufacturers and consumers. Looking ahead, consumer preferences may evolve, and the prioritization of convenience could drive a shift towards cans. Innovations in can design could further enhance their appeal, potentially swaying consumers who currently favor glass for its aesthetic and premium feel. As the hard seltzer market is still relatively young, these future trends will play a crucial role in determining which packaging type will ultimately dominate. While glass bottles have the upper hand for now, the advantages of cans cannot be overlooked, presenting a potential challenge to the current market leader as consumer habits and preferences continue to evolve.

Europe Hard Seltzer Market Segmentation By ABV Content:

- More Than 5%

- Less Than 5%

The Europe Hard Seltzer Market Segmented by ABV Content, More Than 5% had the largest market share last year and is poised to maintain its dominance throughout the forecast period. A significant driver of the European hard seltzer market is the increasing consumer demand for healthier alcoholic options. Hard seltzers with lower ABV (Alcohol By Volume) content, generally below 5%, are particularly favored as they contain fewer calories and sugars, aligning with the health and wellness trends. Market research indicates that the below 5% ABV segment is expected to dominate the global hard seltzer market, including Europe. However, regional variations within Europe could influence preferences, with certain areas potentially favoring stronger hard seltzers. Additionally, some brands may strategically position their higher ABV hard seltzers as premium products, targeting a niche segment of consumers seeking a more robust alcoholic experience. Despite these nuances, the overall market trend strongly favors lower ABV hard seltzers due to their health-conscious appeal. This segment's dominance is further bolstered by marketing strategies that emphasize the balance between indulgence and a healthier lifestyle. While higher ABV hard seltzers may experience growth and find their own loyal consumer base, they are unlikely to surpass the popularity of their lower ABV counterparts. As the market continues to evolve, the emphasis on lower ABV options is expected to remain a key factor driving the expansion and consumer acceptance of hard seltzers in Europe.

Europe Hard Seltzer Market Segmentation By Distribution Channel:

- On-trade

- Off-trade

The Europe Hard Seltzer Market Segmented by Distribution Channel, Off-trade had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Several market research reports confirm that the off-trade segment, including supermarkets, convenience stores, and liquor stores, holds the largest share of the European hard seltzer market and is poised to continue leading its growth. This dominance is driven by multiple factors. Convenience is a major advantage, as off-trade outlets provide easy access to hard seltzers for home consumption, offering consumers flexibility in purchasing and enjoying their drinks. Additionally, off-trade venues often provide better deals and lower prices compared to on-trade establishments such as bars and restaurants, making them more attractive to cost-conscious consumers. The COVID-19 pandemic significantly accelerated this trend, as restrictions on on-premise dining and drinking shifted consumer behavior towards off-trade purchases. Furthermore, off-trade retailers have adeptly adapted to the growing demand for hard seltzers by expanding their variety of brands and flavors and implementing promotional campaigns and discounts to attract customers. While the on-trade segment remains relevant, especially for social and experiential drinking occasions, the combination of convenience, price competitiveness, and the lasting impact of the pandemic suggests that the off-trade channel will maintain its leading position in the European hard seltzer market.

Europe Hard Seltzer Market Segmentation By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The Europe Hard Seltzer Market Segmented by Region, The UK had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The UK leads the European hard seltzer market due to several key factors. As an early adopter, the UK embraced the hard seltzer trend ahead of other European nations, establishing a robust foothold in the beverage category. This early adoption was supported by substantial investments in marketing campaigns and the development of strong distribution networks, ensuring widespread availability and consumer awareness. Additionally, UK consumers have shown a cultural openness to new alcoholic beverage trends, making them more receptive to hard seltzers. However, the UK's dominance might not be absolute. Rapid growth in Eastern and Central European countries, as well as in Germany, suggests that these regions could challenge the UK's lead in the long term. Furthermore, consumer preferences are constantly evolving, and other regions may develop a taste for hard seltzers, potentially eroding the UK's market share. Despite these potential shifts, the UK's early and strong market presence positions it as a major player in the European hard seltzer market. Nevertheless, vigilance is required as other regions catch up quickly, driven by their growing interest and expanding market dynamics.

COVID-19 Impact Analysis on the Europe Hard Seltzer Market.

The COVID-19 pandemic has had a profound impact on the European hard seltzer market, accelerating its growth and altering consumer behavior. As lockdowns and social distancing measures were implemented, consumers shifted away from on-premise consumption in bars and restaurants to off-premise purchases, significantly boosting sales through supermarkets, convenience stores, and online platforms. This shift was driven by the need for at-home entertainment and the convenience of stocking up on beverages during extended periods of isolation. Additionally, the health and wellness trend, which gained momentum during the pandemic, further propelled the popularity of hard seltzers due to their low-calorie and low-sugar profiles. Brands quickly adapted by enhancing their digital marketing efforts and expanding e-commerce capabilities to reach consumers directly. The pandemic also heightened consumer awareness and preference for transparent ingredient labeling and eco-friendly packaging, aligning well with the values promoted by many hard seltzer brands. While the pandemic disrupted traditional sales channels, it simultaneously opened new avenues for growth, establishing hard seltzers as a staple in the European beverage market. As the region recovers, the habits formed during the pandemic are likely to persist, sustaining the market's expansion and solidifying the role of hard seltzers in consumers' lifestyles.

Latest trends / Developments:

The European hard seltzer market is witnessing several noteworthy trends and developments, reflecting evolving consumer preferences and industry dynamics. One prominent trend is the continued diversification of flavor offerings, with brands introducing innovative and exotic flavors to cater to diverse palates. Additionally, there is a growing emphasis on product differentiation through unique ingredients and brewing techniques, appealing to discerning consumers seeking novel drinking experiences. Another notable development is the increasing focus on sustainability, with brands adopting eco-friendly packaging materials and implementing sustainable production practices to align with the growing demand for environmentally conscious products. Moreover, collaborations between hard seltzer brands and other beverage companies, such as breweries and distilleries, are on the rise, leading to the creation of hybrid products that blend the best of both worlds. Furthermore, the expansion of distribution channels, particularly online platforms and direct-to-consumer sales, is enabling brands to reach a wider audience and capitalize on the growing trend of e-commerce. Overall, these trends underscore the dynamic nature of the European hard seltzer market, offering ample opportunities for innovation, growth, and market differentiation in the coming years.

Key Players:

- White Claw

- Truly

- Bodega Bay

- Kopparberg

- Fizzy Hop

- NÜTRL Vodka Soda

- Smirnoff Seltzer

- Mikkeller

- Onda

- Mike's Hard Sparkling Water

Chapter 1. Europe Hard Seltzer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Hard Seltzer Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Hard Seltzer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Hard Seltzer Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Hard Seltzer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Hard Seltzer Market– By Packaging

6.1. Introduction/Key Findings

6.2. Metal Cans

6.3. Glass Bottles

6.4. Plastic Bottles

6.5. Y-O-Y Growth trend Analysis By Packaging

6.6. Absolute $ Opportunity Analysis By Packaging , 2024-2030

Chapter 7. Europe Hard Seltzer Market– By ABV Content

7.1. Introduction/Key Findings

7.2 More Than 5%

7.3. Less Than 5%

7.4. Y-O-Y Growth trend Analysis By ABV Content

7.5. Absolute $ Opportunity Analysis By ABV Content , 2024-2030

Chapter 8. Europe Hard Seltzer Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. On-trade

8.3. Off-trade

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Hard Seltzer Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Packaging

9.1.3. By ABV Content

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Hard Seltzer Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 White Claw

10.2. Truly

10.3. Bodega Bay

10.4. Kopparberg

10.5. Fizzy Hop

10.6. NÜTRL Vodka Soda

10.7. Smirnoff Seltzer

10.8. Mikkeller

10.9. Onda

10.10. Mike's Hard Sparkling Water

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Europe Hard Seltzer market is expected to be valued at US$ 17.04 billion

Through 2030, the Europe Hard Seltzer market is expected to grow at a CAGR of 14.7 %.

By 2030, the Europe Hard Seltzer Market is expected to grow to a value of US$ 44.5 billion

The UK is predicted to lead the European hard Seltzer market

The Europe Hard Seltzer has segments like Packaging, ABV Content, Distribution Channel, and Region