Guar Gum market Size (2024 – 2030)

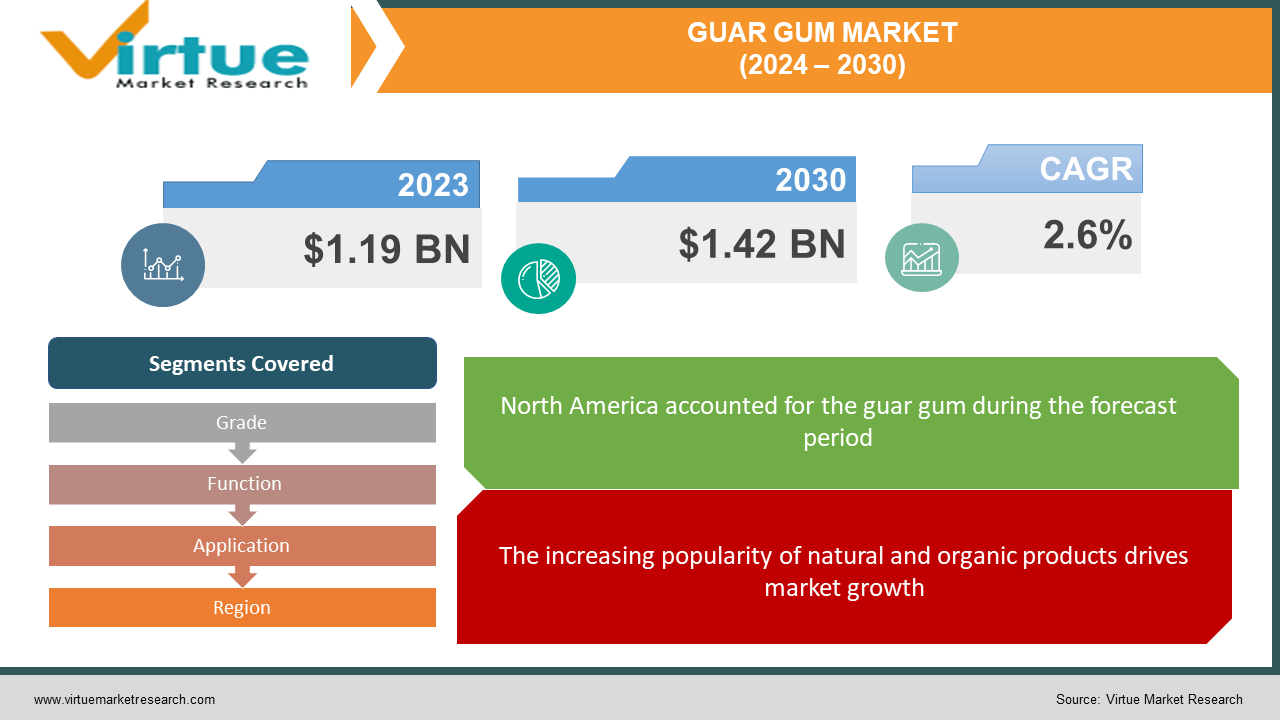

The guar gum market was valued at USD 1.19 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.42 billion by 2030, growing at a CAGR of 2.6%.

Guar gum, recognized alternatively as guaran, holds broad acknowledgment as a fundamental component across diverse sectors including food and beverage, oil and gas, pharmaceuticals, and cosmetics. This galactomannan polysaccharide is esteemed for its capacity to thicken and stabilize, rendering it particularly suitable for application within these industries.

Key Market Insights:

Guar gum facilitates the uniform dispersion of sugar within liquid solutions and helps prevent crystallization at the bottom. Its medicinal attributes, coupled with its high dietary fiber content, allow for its consumption with water as a remedy for stomach-related issues. Additionally, it finds extensive application in traditional lithography and printing processes.

Guar gum market Drivers:

The increasing popularity of natural and organic products drives market growth.

The burgeoning preference for natural products within the food and beverage sectors is anticipated to propel notable growth in the guar gum market throughout the projected time frame. Moreover, owing to their high dietary fiber content, guar gum products aid in facilitating bowel movements and digestion, thereby driving their escalating consumption globally. Concurrently, manufacturers and producers are accentuating the nutritional advantages of guar gum in their promotional endeavors.

Diversified Guar Gum applications in various industries increase market demand.

Alternatively, guar gum finds extensive application as a thickening agent in food production processes. Additionally, guar gum powder serves as an additive in ceramic glazes, an adhesive in rolling papers, and a binder in the production of watercolor paints. Moreover, within the food industry, guar gum is widely utilized as a microencapsulating agent in the production of confectionery, beverages, bakery items, and dairy products. The expanding scope of guar gum applications across various industries is anticipated to propel growth in the global guar gum market.

Guar gum market Restraints and Challenges:

The guar gum market could encounter obstacles due to shortages of raw materials and fluctuations in the prices of guar gum products. Recently, the global guar gum market encountered a significant challenge in the form of the coronavirus outbreak. This pandemic has adversely affected manufacturers and producers worldwide, thereby directly impacting the demand in the global market.

Guar gum market Opportunities:

The proliferation of domestic vendors and e-commerce platforms is broadening opportunities for key players and manufacturers within the market. Additionally, the increasing consumer inclination towards natural ingredients serves as another significant factor driving opportunities for guar gum manufacturers and key players.

In tandem with busy consumer lifestyles, there is a rising global demand for convenience food. Factors such as heightened utilization of household technologies, extended working hours, and escalating consumer incomes have collectively influenced the surge in convenience food demand worldwide. Guar gum plays a pivotal role as a food additive, enhancing the quality of convenience food items such as soups, cakes, pastries, bread, gravies, and snacks. Anticipated growth in consumer interest in processed food products is poised to bolster the expansion of the guar gum market in the foreseeable future.

Moreover, the increasing preference for low-calorie and low-fat food options containing guar gum has contributed to reducing the overall fat content in foods, thereby benefiting the guar gum market. Guar gum serves as a fat substitute in processed foods. Globally, there is a mounting consumer demand for convenient food products tailored to fit their lifestyles.

GUAR GUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.6% |

|

Segments Covered |

By Grade, Function, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hindustan Gums & Chemicals Ltd. (India), Dabur India Ltd (India), DuPont (US), India Glycols Limited (India), Lucid Colloids Ltd. (India), Supreme Gums Pvt. Ltd. (India), Gums & Chemicals (Pakistan), Altrafine Gums (India), Cargill Incorporated (US), Rama Gum Industries Limited (India) |

Guar gum market Segmentation - By Grade

-

Pharmaceutical

-

Industrial

-

Food

The food segment currently dominates the market share and is expected to maintain the highest Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period. This growth is primarily driven by shifts in global population lifestyles, dietary preferences, and increasing disposable incomes, which are contributing to a rising demand for convenience foods. Moreover, the escalating preference for low-calorie and low-fat food options aligns favorably with guar gum, thereby facilitating its market expansion. Manufacturers are intensifying their focus on integrating advanced technologies into product development, further propelling the rapid growth of this segment.

Significant quantities of industrial-grade guar gum find application in the hydraulic fracking process for shale oil and gas extraction, with demand expected to surge in parallel with the expansion of the shale oil and gas industry. Additionally, due to its diverse applications in the pharmaceutical sector, substantial growth is anticipated in the pharmaceuticals segment.

Guar gum market Segmentation - By Function

-

Stabilizers and Emulsifiers

-

Thickening and Gelling Agents

-

Binders

-

Friction Reducers

The Stabilizer and Emulsifier segment has emerged as the dominant force in the market, commanding 54.38% of the global market share. This segment is projected to sustain a robust Compound Annual Growth Rate (CAGR) of 6.9% over the foreseeable future. Guar gum plays a pivotal role in ice cream production, serving as a vital stabilizer to improve viscosity and extend shelf life by preventing ice crystallization during storage. Furthermore, in personal care products, emulsifiers are essential for blending water and essential oils effectively.

Guar gum market Segmentation - By Application

-

Oils and Gas

-

Food and Beverage

-

Pharmaceuticals and Cosmetics

The oil and gas industry held a significant share of 37.62% in the guar gum market, primarily attributed to the North American shale gas boom. The surge in exploration and drilling activities worldwide is expected to bolster the expansion of this segment. Industrial-grade guar gum, prized for its functional attributes including gelling, thickening, and friction reduction, is primarily employed within the oil and gas sector. The burgeoning initiatives in oil well drilling projects and shale gas production are driving the demand for guar gum in this industry. Notably, approximately 90 percent of guar gum production in India and Pakistan is consumed by the shale oil and gas extraction industries.

Following closely, the Food and Beverage segment emerged as the second-largest application segment in the guar gum market, constituting 32.74 percent of the market share. The anticipated rise in demand for guar gum during the forecast period is attributed to the growing popularity of organic and processed foods.

Guar gum Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In the Guar Gum market, North America is poised to maintain its dominance, driven by significant growth in the adoption of hydraulic fracking and oil well drilling within the oil and gas industry.

Following closely, Europe holds the second-largest market share in the Guar Gum market, attributed to increasing awareness regarding the product's weight-loss benefits, which is expected to augment its demand. Notably, the German Guar Gum market commands the largest market share, while the UK Guar Gum market exhibits the fastest growth in the European region.

The Asia-Pacific Guar Gum market is projected to witness the fastest Compound Annual Growth Rate (CAGR). This growth trajectory can be attributed to factors such as population growth, rising disposable incomes, and rapid urbanization, which have stimulated the consumption of processed foods in the region. Furthermore, China leads the Guar Gum market in terms of market share, while the Indian Guar Gum market is the fastest-growing market in the Asia-Pacific region.

These nations face challenges in areas such as guar seed production, the development of industry-specific products, manufacturing, and processing technology, as well as distribution infrastructure. While some institutions in these countries are focusing on the development of certified seeds, agricultural universities, and existing research institutions often encounter funding constraints for research on new varieties, product processing optimization, and technological advancements. Furthermore, even farmers interested in using certified seeds may face affordability issues. Additionally, the guar industry requires skilled human resources, necessitating training initiatives. To address these challenges, Indian manufacturers should consider allocating a portion of export tax revenue toward establishing national-level research and development institutes.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic exerted unforeseen pressure on all segments of the food supply chain, impacting farm cultivation, processing, transportation, and final demand. Many disruptions stemmed from policies enacted to mitigate the virus's spread. However, there was a notable uptick in demand for natural products during the pandemic, driven by heightened concerns regarding health and wellness. As a result, food products enriched with natural ingredients emerged as the preferred choice among health-conscious consumers, consequently amplifying the demand for guar gum. Despite guar gum's predominant industrial application during the pandemic phase, there was a notable increase in demand for guar within the food sector.

Latest Trends/ Developments:

-

In December 2022, Nexira, a prominent provider of natural and botanical ingredients, unveiled its latest range of effective texturizers under the brand name 'Native'. Native encompasses three key types of hydrocolloids, comprising tara gum, locust bean gum, and specialized guar, tailored for both plant-based and dairy applications.

-

In April 2022, Solvay, a leading Belgian chemicals company, announced its recent collaboration with Procter & Gamble (P&G), a major player in the beauty industry, for its sustainable guar initiative farming programs. Through this partnership, Solvay aims to amplify its impact by extending efforts to educate guar farmers, particularly women farmers, on the adoption of sound agricultural practices.

Key Players:

These are the top 10 players in the guar gum market: -

-

Hindustan Gums & Chemicals Ltd. (India)

-

Dabur India Ltd (India)

-

DuPont (US)

-

India Glycols Limited (India)

-

Lucid Colloids Ltd. (India)

-

Supreme Gums Pvt. Ltd. (India)

-

Gums & Chemicals (Pakistan)

-

Altrafine Gums (India)

-

Cargill Incorporated (US)

-

Rama Gum Industries Limited (India)

Chapter 1. Guar Gum Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Guar Gum Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Guar Gum Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Guar Gum Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Guar Gum Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Guar Gum Market – By Grade

6.1 Introduction/Key Findings

6.2 Pharmaceutical

6.3 Industrial

6.4 Food

6.5 Y-O-Y Growth trend Analysis By Grade

6.6 Absolute $ Opportunity Analysis By Grade, 2024-2030

Chapter 7. Guar Gum Market – By Function

7.1 Introduction/Key Findings

7.2 Stabilizers and Emulsifiers

7.3 Thickening and Gelling Agents

7.4 Binders

7.5 Friction Reducers

7.6 Y-O-Y Growth trend Analysis By Function

7.7 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 8. Guar Gum Market – By Application

8.1 Introduction/Key Findings

8.2 Oils and Gas

8.3 Food and Beverage

8.4 Pharmaceuticals and Cosmetics

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Guar Gum Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Grade

9.1.3 By Function

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Grade

9.2.3 By Function

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Grade

9.3.3 By Function

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Grade

9.4.3 By Function

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Grade

9.5.3 By Function

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Guar Gum Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hindustan Gums & Chemicals Ltd. (India)

10.2 Dabur India Ltd (India)

10.3 DuPont (US)

10.4 India Glycols Limited (India)

10.5 Lucid Colloids Ltd. (India)

10.6 Supreme Gums Pvt. Ltd. (India)

10.7 Gums & Chemicals (Pakistan)

10.8 Altrafine Gums (India)

10.9 Cargill Incorporated (US)

10.10 Rama Gum Industries Limited (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The burgeoning preference for natural products within the food and beverage sectors is anticipated to propel notable growth in the guar gum market throughout the projected time frame. Moreover, owing to their high dietary fiber content, guar gum products aid in facilitating bowel movements and digestion, thereby driving their escalating consumption globally.

The top players operating in the guar gum market are - Hindustan Gums & Chemicals Ltd. (India), Dabur India Ltd (India), DuPont (US), India Glycols Limited (India), Lucid Colloids Ltd. (India).

The COVID-19 pandemic exerted unforeseen pressure on all segments of the food supply chain, impacting farm cultivation, processing, transportation, and final demand. Many disruptions stemmed from policies enacted to mitigate the virus's spread.

The proliferation of domestic vendors and e-commerce platforms is broadening opportunities for key players and manufacturers within the market. Additionally, the increasing consumer inclination towards natural ingredients serves as another significant factor driving opportunities for guar gum manufacturers and key players.

The Asia-Pacific Guar Gum market is projected to witness the fastest Compound Annual Growth Rate (CAGR). This growth trajectory can be attributed to factors such as population growth, rising disposable incomes, and rapid urbanization, which have stimulated the consumption of processed foods in the region.