Europe Guar Gum Market Size (2024-2030)

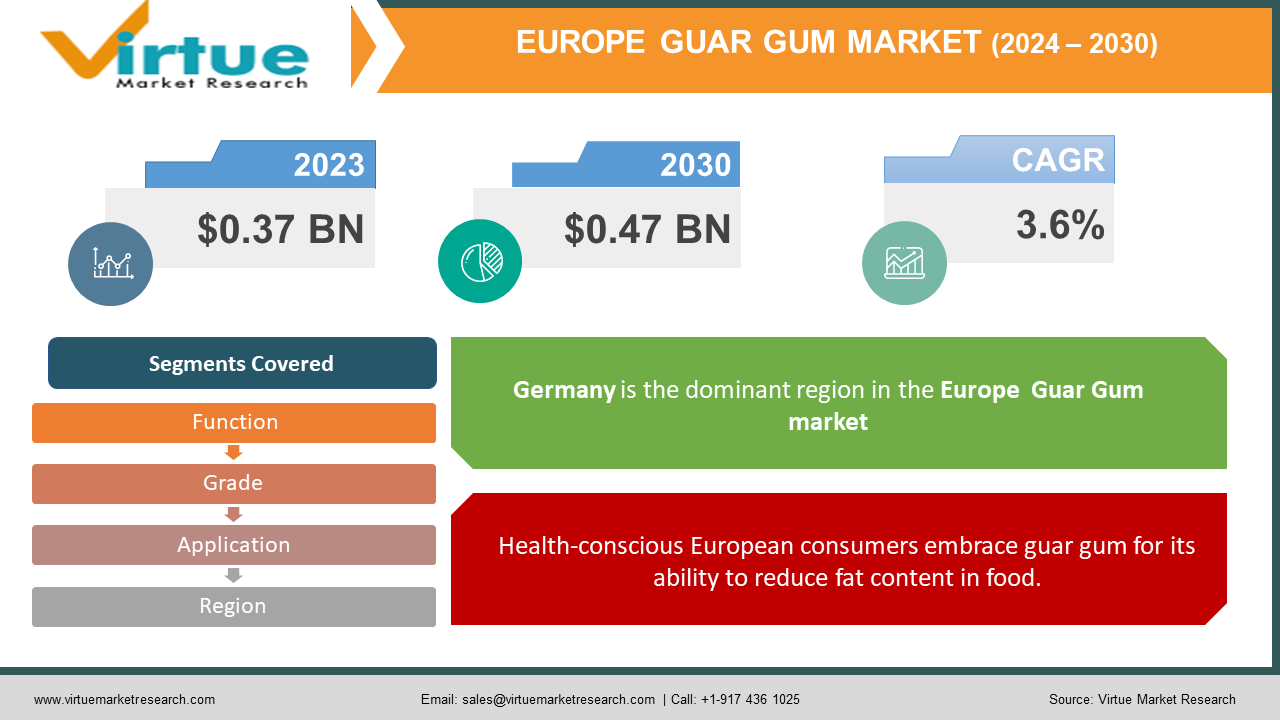

The Europe Guar Gum Market was valued at USD 0.37 billion in 2023 and is projected to reach a market size of USD 0.47 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 3.6%.

The European guar gum market is a key player on the global stage. Germany leads the continent in guar gum imports, fueled by its numerous processing industries that utilize this versatile ingredient. The rising health consciousness of European consumers and the multifunctional benefits guar gum brings to food products are driving its demand.

Key Market Insights:

The European guar gum market thrives on its functionality within the food industry. Its thickening, stabilizing, and gelling properties make it a popular choice for a variety of applications. From confectionery and baked goods (think low-fat cookies and cakes) to pet food, beverages, and even frozen food items, guar gum plays a crucial role in enhancing texture and stability. This widespread use is expected to propel the European guar gum market forward.

Beyond its dominance in the food sector, guar gum's versatility extends to other industries as well. This variety of uses, coupled with its functionality in food, paints a promising picture for the future of the European guar gum market.

The Europe Guar Gum Market Drivers:

Health-conscious European consumers embrace guar gum for its ability to reduce fat content in food.

The growing emphasis on health and wellness among European consumers is another major factor driving the demand for guar gum. Guar gum's thickening properties offer a valuable advantage to food manufacturers. By incorporating guar gum, manufacturers can effectively reduce the fat content in their products, catering to the growing health-conscious demographic in Europe who actively seek healthier food options without compromising on taste or texture. This consumer-driven shift towards healthier alternatives is a key driver for the European guar gum market.

Guar gum's versatility extends beyond food, with applications in pharmaceuticals, paper, and even oil and gas.

Guar gum's versatility extends far beyond its dominance in the food industry. Its remarkable binding and thickening properties make it a valuable ingredient in various other sectors. From pharmaceuticals and paper manufacturing to textiles and even the oil and gas industries, guar gum finds diverse applications due to its unique properties. This wide range of applications across various industries, coupled with its established presence in the food sector, paints a promising picture for the future of the European guar gum market.

The Europe Guar Gum Market Restraints and Challenges:

The European guar gum market, despite its promising growth trajectory, faces some hurdles that can impede its progress. Price volatility is a key concern. Fluctuations in guar bean yields due to weather patterns, shifts in global guar gum supply and demand, and even geopolitical events can cause significant price swings. This makes it challenging for manufacturers to accurately predict costs and maintain profitability. Another challenge comes from competition. Alternative thickening and gelling agents like xanthan gum, locust bean gum, and cellulose gum offer similar functionalities and may be perceived as more cost-effective options by some manufacturers. This competition can exert pressure on guar gum prices and potentially limit its market share within the European market.

Quality concerns also pose a challenge, particularly for guar gum sourced from regions outside India, the leading producer. Outdated processing facilities or variations in processing methods can lead to inconsistencies in guar gum quality. This can impact the product's functionality and potentially cause production problems for European manufacturers who rely on guar gum's specific properties. Finally, a lack of significant research and development efforts in some European countries can hinder the exploration of new functionalities and applications for guar gum. This limits its potential for further market expansion. While guar gum has established applications, additional research could unlock its potential in new domains, propelling further market growth.

The Europe Guar Gum Market Opportunities:

The fast-paced lives of Europeans are driving a surge in convenient, easy-to-prepare food options, and guar gum plays a starring role here. The booming convenience food sector presents a golden opportunity for guar gum manufacturers and distributors to solidify their position in the European market. Furthermore, the rising popularity of vegan and gluten-free diets opens a unique niche for guar gum. As a natural, plant-based thickener and binder, it offers a perfect alternative to animal products and gluten-containing flours. This caters perfectly to the growing health-conscious demographic seeking healthy and sustainable food options. Guar gum suppliers can capitalize on this trend by specifically targeting this segment with their products. Innovation also plays a key role in unlocking the potential of guar gum. Advancements in processing techniques and research into its functionalities can open doors to entirely new applications and markets. Finally, the focus on environmental sustainability presents another exciting opportunity. This could potentially lead to a premium market segment for sustainable guar gum products, solidifying guar gum's place in a responsible and environmentally conscious future.

EUROPE GUAR GUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.6 % |

|

Segments Covered |

By function, grade, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Jai Bharat Gum and Chemicals Ltd, Hindustan Gum & Chemicals Ltd. Gum Industries Limited Branch, Shree Ram Industries, Dabur India Ltd, Tiku Ram Gum & Chemicals Pvt Ltd, Sarda Gums & Chemicals, Guangrao Liuhe Chemicals Co., Ltd, Ingredion Incorporated, Europe Gums & Chemicals Pvt. Ltd |

The Europe Guar Gum Market Segmentation:

Europe Guar Gum Market Segmentation: By Function:

- Stabilizer & Emulsifier

- Thickening & Gelling Agent

- Binder

- Friction Reducer

- Other Functions

The European guar gum market is segmented by function, with “Stabilizer & Emulsifier" holding the dominant position due to its widespread use in preventing ingredient separation in various food products. The "Thickening & Gelling Agent" segment is projected to be the fastest-growing sector, driven by the rising demand for convenient food options and its role in enhancing texture and quality. This trend aligns perfectly with the popularity of ready-to-eat meals and processed foods across Europe.

Europe Guar Gum Market Segmentation: By Grade:

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

By Grade sector, the Food Grade segment is likely the most dominant in the European Guar Gum Market due to its extensive use in the food and beverage industry. However, information regarding the fastest-growing segment is not conclusive. Some sources suggest the industrial-grade segment might experience faster growth due to increasing applications in oil and gas drilling activities.

Europe Guar Gum Market Segmentation: By Application:

- Food & Beverages

- Mining & Explosives

- Oil & Gas

- Paper Manufacturing

- Pharmaceuticals & Cosmetics

- Others

The European guar gum market caters to diverse applications, with food & beverages reigning supreme. This segment leverages guar gum's thickening and stabilizing properties in various food items, from confectionery to frozen meals. However, the fastest growth is projected in the pharmaceuticals & cosmetics segment. Guar gum's binding and controlled-release properties in pharmaceuticals, along with its thickening function in cosmetics, are attracting increasing interest, making it a promising area for future market expansion.

Europe Guar Gum Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

As the leading importer of guar gum in Europe, Germany boasts a robust market fueled by its numerous processing industries. These industries utilize guar gum's functional properties in a variety of applications, contributing significantly to the overall demand within the country. This dominance makes Germany a crucial player in the European guar gum market.

COVID-19 Impact Analysis on the Europe Guar Gum Market:

The COVID-19 pandemic wasn't all sunshine and rainbows for the European guar gum market. Lockdowns and travel restrictions disrupted global supply chains, causing temporary shortages and price fluctuations in Europe. This created uncertainty for manufacturers who rely on guar gum for their products. Additionally, a decline in restaurant dining due to closures meant less demand for guar gum used in food service applications like sauces and dressings.

However, there were silver linings. The surge in demand for packaged food like frozen meals and baked goods, which heavily utilize guar gum, helped bolster the market. Furthermore, the pandemic heightened health consciousness among consumers, potentially making guar gum's natural thickening and fat-reduction properties even more appealing.

Latest Trends/ Developments:

The European guar gum market is brimming with exciting developments. Sustainability is a key driver, with a growing focus on eco-friendly guar gum production methods that minimize water usage and environmental impact. This caters to the European consumer's demand for responsible ingredients and could even lead to a premium market segment for "green" guar gum.

Research and development efforts are also breaking new ground. Scientists are exploring guar gum's potential in entirely new applications, such as a fat replacer in food or a controlled-release agent in pharmaceuticals. These advancements have the potential to unlock entirely new markets and propel guar gum's growth within Europe.

The rise of e-commerce platforms presents another interesting development. While traditional supply chains may be impacted, online marketplaces are gaining traction for guar gum distribution. This could offer new opportunities for both manufacturers and individual consumers seeking guar gum for various applications.

Finally, advancements in guar gum processing technologies are noteworthy. These advancements are making it possible to produce guar gum with improved consistency, purity, and functionality. This translates to higher-quality guar gum products, potentially enhancing its performance in various applications and attracting a wider range of customers within the European market.

Key Players:

- Jai Bharat Gum and Chemicals Ltd

- Hindustan Gum & Chemicals Ltd. Gum Industries Limited Branch

- Shree Ram Industries

- Dabur India Ltd

- Tiku Ram Gum & Chemicals Pvt Ltd

- Sarda Gums & Chemicals

- Guangrao Liuhe Chemicals Co., Ltd

- Ingredion Incorporated

- Europe Gums & Chemicals Pvt. Ltd

Chapter 1. Europe Guar Gum Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Guar Gum Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Guar Gum Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Guar Gum Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Guar Gum Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Guar Gum Market– By Function

6.1. Introduction/Key Findings

6.2. Stabilizer & Emulsifier

6.3. Thickening & Gelling Agent

6.4. Binder

6.5. Friction Reducer

6.6. Other Functions

6.7. Y-O-Y Growth trend Analysis By Function

6.8. Absolute $ Opportunity Analysis By Function , 2024-2030

Chapter 7. Europe Guar Gum Market– By Grade

7.1. Introduction/Key Findings

7.2 Food Grade

7.3. Industrial Grade

7.4. Pharmaceutical Grade

7.5. Y-O-Y Growth trend Analysis By Grade

7.6. Absolute $ Opportunity Analysis By Grade , 2024-2030

Chapter 8. Europe Guar Gum Market– By Application

8.1. Introduction/Key Findings

8.2. Food & Beverages

8.3. Mining & Explosives

8.4. Oil & Gas

8.5. Paper Manufacturing

8.6. Pharmaceuticals & Cosmetics

8.7. Others

8.8. Y-O-Y Growth trend Analysis Application

8.9. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Europe Guar Gum Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Function

9.1.3. By Grade

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Guar Gum Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Jai Bharat Gum and Chemicals Ltd

10.2. Hindustan Gum & Chemicals Ltd. Gum Industries Limited Branch

10.3. Shree Ram Industries

10.4. Dabur India Ltd

10.5. Tiku Ram Gum & Chemicals Pvt Ltd

10.6. Sarda Gums & Chemicals

10.7. Guangrao Liuhe Chemicals Co., Ltd

10.8. Ingredion Incorporated

10.9. Europe Gums & Chemicals Pvt. Ltd

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Guar Gum Market was valued at USD 0.37 billion in 2023 and is projected to reach a market size of USD 0.47 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 3.6%.

Surging Demand in the Food Industry, Health-Conscious Consumers Champion Guar Gum, Germany The Undisputed Leader in Guar Gum Imports, Functional Benefits Beyond the Culinary Sphere

Food & Beverages, Mining & Explosives, Oil & Gas, Paper Manufacturing, Pharmaceuticals & Cosmetics, Others

Germany reigns supreme as the most dominant region in the European Guar Gum Market, boasting the highest import volume due to its numerous processing industries.

Jai Bharat Gum and Chemicals Ltd, Hindustan Gum & Chemicals Ltd. Gum Industries Limited Branch, Shree Ram Industries, Dabur India Ltd, Tiku Ram Gum & Chemicals Pvt Ltd, Sarda Gums & Chemicals, Guangrao Liuhe Chemicals Co., Ltd, Ingredion Incorporated, Europe Gums & Chemicals Pvt. Ltd.