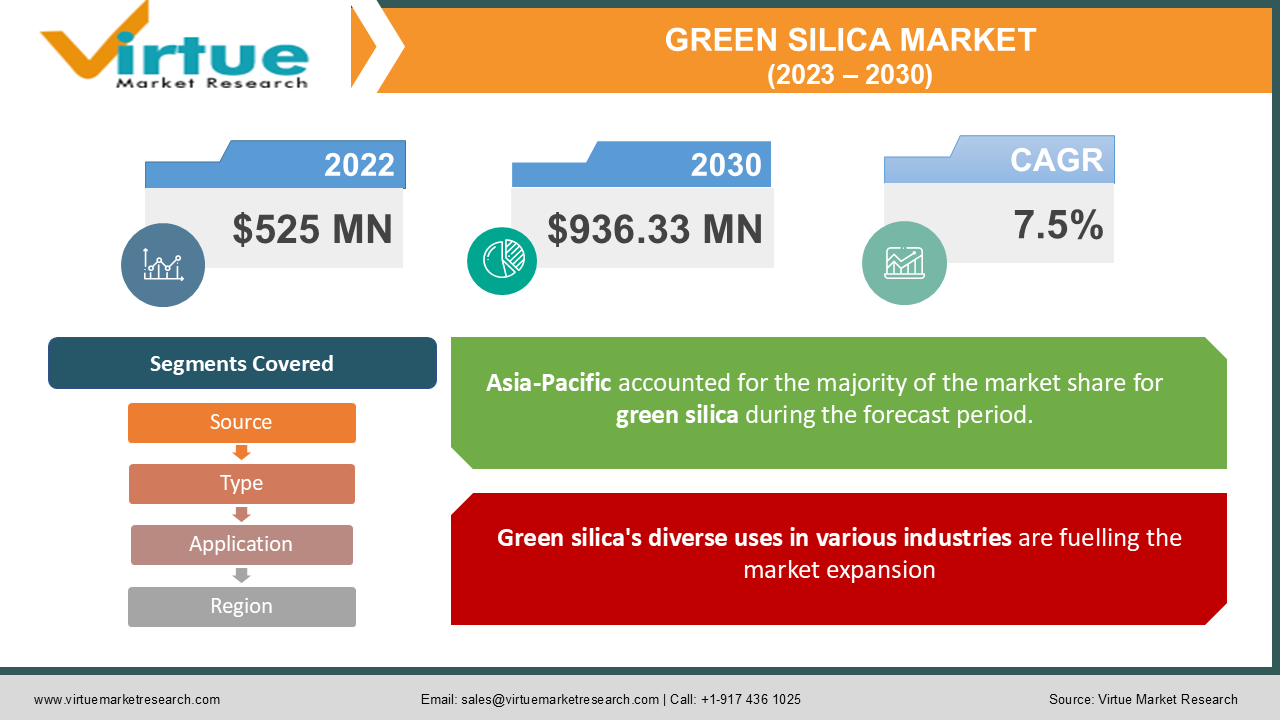

Green Silica Market Size (2023 – 2030)

In 2022, the Global Green Silica Market was valued at $525 million, and is projected to reach a market size of $936.33 million by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 7.5%.

Industry Overview:

Rice husk ash, sugarcane bagasse ash, bamboo leaf, and other materials are used to create green silica, an alternative to conventional silica. A crucial raw resource that gives silica unique qualities is rice husk ash, which enhances the performance of products. Rice husk ash (RHA) is an environmental waste. The amount of amorphous silica in it, however, ranges from 85% to 90%. As rice husk ash has a high silica content, it is a desirable source for silica extraction as it may be used to manufacture green silica. After the rice is milled, a rice husk is created. The Green Silica market can be divided into Highly Dispersible Silica and Easy Dispersible Silica. Green silica is environmentally friendly as it uses trash as the basic material for silica and uses less energy to produce it than traditional silica manufacturing methods. Nations all over the world are making substantial efforts to transition from the current fossil-based economy to a more sustainable bio-based one due to the threat of environmental problems and the acceleration of global warming. The adoption of bio-based goods and greener alternatives in response to growing environmental risks and regulations imposed on various chemicals is propelling the growth of the green silica market. The market for green silica is anticipated to expand steadily owing to increase demand for end products. Tires, industrial rubber, food items, footwear, paints & coatings, cosmetics & personal care, and other products are made predominantly with green silica. Rapid urbanization and the rise in disposable income of consumers have contributed to the demand for automobiles. The automotive industry is expanding consistently. As the demand for automobiles is increasing at a rapid pace, silica is gauging high demand, since it is being used as a key filler for automotive tires as it improves the physical & dynamic properties of tires such as abrasion resistance, tensile strength, tear resistance, and wet grip. To improve tire performance and lower carbon black content, all of the world's leading tire manufacturers are working to raise the silica content of tires. To diversify their product offering, major suppliers of green silica are concentrating on R&D, technological developments, collaboration, and product strategies.

COVID-19 Pandemic Impact on Green Silica Market

The COVID 19 pandemic's widespread impact has affected businesses, as well as their production and manufacturing facilities. The major players in the strength green silica market are currently focusing on improving their businesses to increase the scale of their operations. The goal of this development is to reduce risk factors and hazards while also enduring the dynamic that the recent Covid pandemic has brought about. Numerous associations that depend on the market for their goods and services were forced to cease operations owing to the unavailability of a skilled workforce, and other practical restrictions. The market is driven by the growth in the use of online entryways to fulfill the expanding interest and rising demand. The market services and goods that are the result of extensive speculations and advancements are being expanded by governments and major market players worldwide.

MARKET DRIVERS:

Green silica's diverse uses in various industries are fuelling the market expansion

The alternative to regular silica is green silica. Green silica is more environmentally friendly since it uses trash as the basic material for silica and uses less energy to produce it than traditional silica manufacturing methods. Green silica is largely utilized in the production of tires, industrial rubber, cosmetics, personal care items, food items, footwear, paints, and coatings, among other things. The consistent usage of market goods and services in numerous industries, including rubber, paints and coatings, personal care, agriculture, and cosmetics, among others, can be credited for the market expansion for green silica.

Increased demand for green silica in the manufacture of automotive tires is a major factor driving the global green silica market

The demand for green silica in the manufacture of automotive tires is anticipated to increase during the projected period. The automotive industry is the top application category for green silica demand owing to the widespread application and ongoing tire production and carbon emission reduction initiatives. The rise in consumer disposable income and growth in urbanization have both contributed to an increase in demand for automobiles. The automobile sector is continually growing. Green silica has emerged as a crucial filler for the automotive tire industry owing to its many advantageous characteristics. Tires' tensile strength, tear resistance, abrasion resistance, and wet traction are all enhanced by silica. The tire industry views silica as a substance that can alleviate environmental issues related to tire manufacture and take the role of carbon black. Additionally, the automotive industries are switching to the usage of green tires due to the tight enforcement of pollution standards and growing concern over the depletion of fossil resources, which is likely to favorably affect the green silica market during the projection period.

The global green silica market is projected to be driven by consumers' adoption of bio-based products and greener alternatives in response to the growing environmental hazards and regulations placed on various chemicals

In response to the threat of environmental difficulties and the acceleration of global warming, nations all over the world are making substantial efforts to transition from the current fossil-based economy to a more sustainable bio-based economy. Global economic sustainability on all fronts is anticipated as a result of the transition to a bio-based economy. The newest trend on the market is the creation of products made from biological materials. These materials are likely to address environmental problems connected to the chemical industry.

MARKET RESTRAINTS:

The expansion of the green silica market is likely to be constrained by the high cost of colloidal silica as well as the availability of less expensive alternatives that meet the needs of the global target audience

The main drawback of Specialty silica filler is its extreme hardness, which causes increased wear on polymer processing equipment. Additionally, it is anticipated that the availability of silica gel and colloidal silica substitutes at competitive prices can restrain the market expansion for green silica throughout the anticipated time frame. The low-cost substitute in the global market environment has an impact on the market's potential for continuity in terms of profit margin and revenue generation opportunities, which is developing as a significant problem for manufacturers in the green silica market size.

High reliance on cyclical end-use industries could slow market expansion

Green silica is a consumable material that has uses in a variety of end-use sectors rather than being a single finished product. The need for green silica may fluctuate depending on the end-use industry. For instance, the automotive industry exhibits cyclical behavior in terms of demand. The growth and profitability of the green silica market are reliant on the expansion and success of end-user industries as a result of demand that is derived from those sectors. The market players who operate in the worldwide market may find this to be a significant problem.

Green Silica Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Source, Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brisil, Novosilgreen, ORYZASIL, Green Silica Group, BSB Nanotechnology Joint Stock Company, Yihai Kerry, Amyris, Inc, Usher Agro Limited, Refratechnik, Agrilectric Power, and Wadham Energy Limited Partnership. |

Segmentation Analysis

Green Silica Market – By Source:

- Rice Husk Ash

- Bamboo Leaf

- Sugarcane Bagasse Ash

- Corncob

- Others

Among these sources, Rice Husk Ash emerges as the largest contributor in this segment. Rice Husk Ash is a byproduct of rice milling and is rich in silica content, making it a valuable and sustainable source for Green Silica production. On the other hand, Sugarcane Bagasse Ash is the fastest growing source during the forecast period. As the sugar industry embraces sustainable practices, the utilization of Sugarcane Bagasse Ash as a source for Green Silica gains momentum

Green Silica Market – By Type:

- Highly Dispersible Silica (HDS)

- Easily Dispersible Silica (EDS)

In this segment, Highly Dispersible Silica takes the lead as the largest type. Its excellent dispersion characteristics make it a versatile additive in various applications. However, Easily Dispersible Silica emerges as the fastest growing type during the forecast period. Its ease of use and compatibility with different products make it a preferred choice for industries seeking sustainable solutions.

Green Silica Market – By Application:

- Tires

- Paints & Coatings

- Industrial Rubber

- Plastic & Packaging

- Food & Beverages

- Animal Feed Ingredients

- Cosmetics

- Personal Care

- Others

Among these applications, the Tire segment holds the largest share in the market. Green Silica's incorporation in tire manufacturing improves tire performance and fuel efficiency, leading to its widespread adoption.

Meanwhile, the Paints & Coatings segment is projected to be the fastest growing application during the forecast period. As environmental regulations become more stringent, the demand for sustainable additives like Green Silica in the paints and coatings industry rises significantly.

Green Silica Market - By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Among these regions, Asia-Pacific stands out as the largest market for Green Silica. The region's rapid industrialization, coupled with increasing environmental awareness, drives the demand for sustainable solutions like Green Silica. As various industries in Asia-Pacific embrace eco-friendly practices, the adoption of Green Silica in manufacturing processes gains significant momentum, contributing to its dominant position in the market.

On the other hand, North America emerges as the fastest growing region for Green Silica during the forecast period. The region's strong emphasis on sustainability and stringent environmental regulations propels the demand for eco-friendly alternatives in multiple industries. As North American companies seek to reduce their carbon footprint and demonstrate their commitment to environmental stewardship, the demand for Green Silica witnesses substantial growth. Moreover, the rising consumer awareness about eco-friendly products further bolsters the adoption of Green Silica in various applications.

Major Key Players in the Market:

- Brisil

- Novosilgreen

- ORYZASIL

- Green Silica Group

- BSB Nanotechnology Joint Stock Company

- Yihai Kerry

- Amyris Inc

- Usher Agro Limited

- Refratechnik

- Agrilectric Power

- Wadham Energy Limited Partnership

Notable Happenings in the Global Green Silica Market in the Recent Past:

- Expansion- In May 2021, W. R. Grace and Co. stated that the expansion of their silica gel production facility in Kuantan, Malaysia, had been completed. The facility should be able to meet the growing demand from several sectors, including biofuel, purification against blocking in plastic films and bags, matting furniture, leather, and coils.

- Expansion- In November 2021, Nouryon announced that they have plans to increase the capacity of their American manufacturing facility for Levasil colloidal silica. The expansion is intended to satisfy the rising demand from the construction and packaging industries.

- Product Launch- In July 2020, Aprinnova, Inc., a joint venture with Amyris, Inc. and the industry leader in high-performance, clean beauty products announced the commercialization of plant-derived silica manufactured from sugarcane ashes. In cosmetics and personal care products, silica is frequently employed. It is often obtained through non-renewable sand dredging, which uses a lot of energy and emits a lot of carbon dioxide. As a more sustainable and effective substitute for conventional silica, the new ingredient with the brand name BiosilicaTM can be found in foundations, creams, lotions, and other products. Additionally, it provides a replacement for microplastics, which are being phased out of numerous cosmetic items.

Chapter 1. Green Silica Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Green Silica Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Green Silica Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Green Silica Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Green Silica Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Green Silica Market – By Source

6.1. Rice Husk Ash

6.2. Bamboo Leaf

6.3. Sugarcane Bagasse Ash

6.4. Corncob

6.5. Others

Chapter 7. Green Silica Market – By Type

7.1. Highly Dispersible Silica (HDS)

7.2. Easily Dispersible Silica (EDS)

Chapter 8. Green Silica Market – By Application

8.1. Tires

8.2. Paints & Coatings

8.3. Industrial Rubber

8.4. Plastic & Packaging

8.5. Food & Beverages

8.6. Animal Feed Ingredients

8.7. Cosmetics

8.8. Personal Care

8.9. Others

Chapter 9. Green Silica Market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Rest of the World

Chapter 10. Green Silica Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Brisil

10.2. Novosilgreen

10.3. ORYZASIL

10.4. Green Silica Group

10.5. BSB Nanotechnology Joint Stock Company

10.6. Yihai Kerry

10.7. Amyris Inc

10.8. Usher Agro Limited

10.9. Refratechnik

10.10. Agrilectric Power

10.11. Wadham Energy Limited Partnership

Download Sample

Choose License Type

2500

4250

5250

6900