Paints and Coatings Market Size (2024 – 2030)

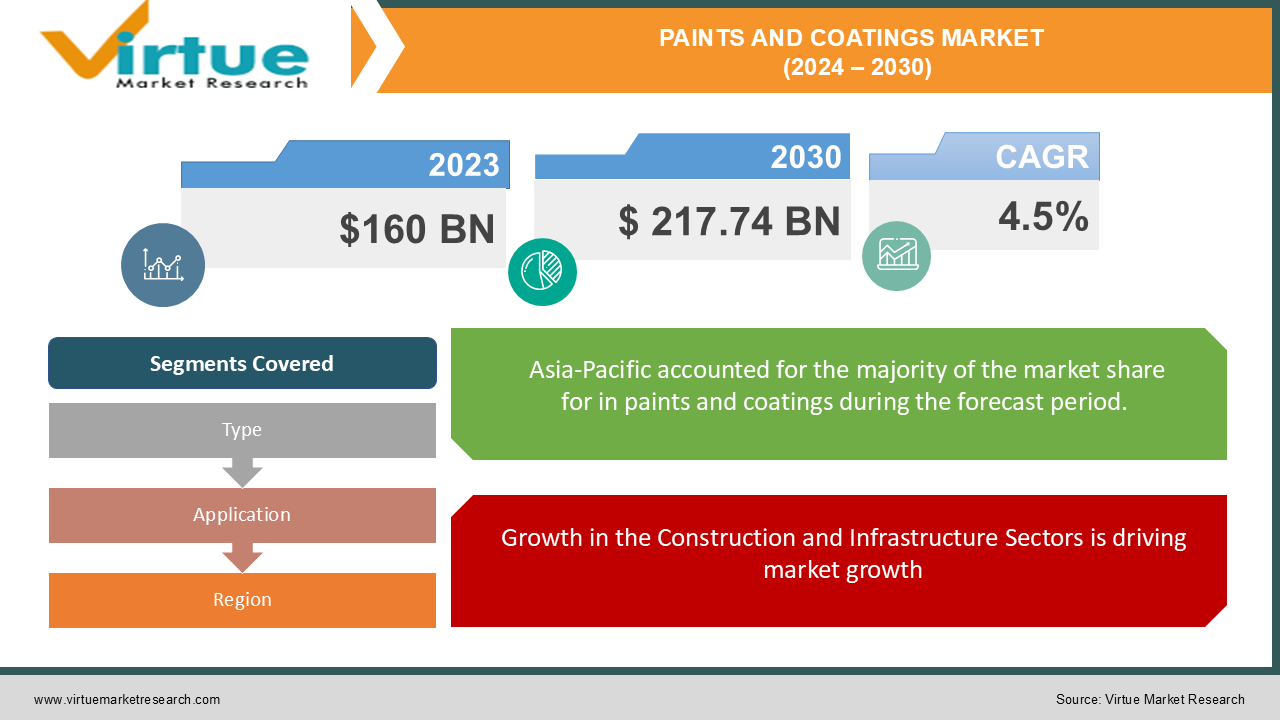

The global Paints and Coatings Market was valued at approximately USD 160 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030.By the end of the forecast period, the market is expected to reach a value of USD 217.74 billion.

The demand for paints and coatings is driven by several factors, including the growth of the construction industry, rising automotive production, and increasing awareness of environmental protection through sustainable coating solutions. Paints and coatings play a vital role in both aesthetic and protective applications across numerous industries. In construction, they are used to enhance the appearance of buildings, while also offering protective features such as weather resistance. In the automotive and industrial sectors, paints and coatings are critical for protecting vehicles, equipment, and infrastructure from corrosion and wear. Technological advancements, such as the development of waterborne coatings and powder coatings, are also driving market growth by offering eco-friendly alternatives to traditional solvent-based products.

Key Market Insights

The construction industry is one of the largest consumers of paints and coatings, particularly for architectural purposes. The rising demand for residential, commercial, and infrastructural projects in emerging economies is boosting the demand for paints and coatings. Architectural paints account for a significant portion of the overall market, driven by increasing urbanization and the need for sustainable building materials.

As environmental regulations become more stringent, there is a growing demand for sustainable coating solutions that comply with regulatory standards. This has led to the development of low-VOC, waterborne, and bio-based paints and coatings. These eco-friendly products are gaining traction in markets such as North America and Europe, where sustainability is a key focus.

Paints and coatings are widely used in the packaging industry to protect products and enhance their visual appeal. The growing demand for consumer goods and packaged food products, particularly in developing countries, is boosting the demand for packaging coatings. Additionally, the increasing trend toward recyclable and sustainable packaging materials is driving innovation in packaging coatings.

The paints and coatings market is witnessing continuous innovation in paint formulations. New technologies, such as smart coatings that offer self-healing properties and anti-microbial coatings, are being developed to meet the evolving demands of industries. These innovations are creating new opportunities for market players to differentiate their products and expand their market presence.

Global Paints and Coatings Market Drivers

Growth in the Construction and Infrastructure Sectors is driving market growth: The construction and infrastructure industries are major drivers of the global paints and coatings market. As urbanization continues to rise, particularly in developing countries, the demand for residential, commercial, and infrastructural projects is increasing. Governments around the world are investing in large-scale infrastructure projects such as roads, bridges, airports, and public transportation systems. Paints and coatings are essential for both new construction and renovation projects, as they provide aesthetic appeal, durability, and protection against environmental factors. Additionally, the increasing focus on sustainable construction practices is driving the demand for eco-friendly architectural coatings that offer low-VOC content and high energy efficiency. The growing trend toward smart cities and green buildings is further boosting the demand for advanced paint and coating solutions.

Increasing Automotive Production and Sales is driving market growth:

The automotive industry is another key driver of the paints and coatings market. Paints and coatings are crucial for protecting vehicles from corrosion, UV radiation, and environmental pollutants. With the growth of the automotive sector, particularly in emerging economies, the demand for automotive coatings is expected to rise. The increasing production of electric vehicles (EVs) and the shift toward lightweight materials in automotive manufacturing are also contributing to the demand for specialized coatings. Automotive manufacturers are increasingly focusing on improving the durability and performance of coatings to enhance the longevity and aesthetic appeal of vehicles. Additionally, advancements in coating technologies, such as the development of scratch-resistant and self-cleaning coatings, are creating new opportunities in the automotive coatings market.

Environmental Regulations and Sustainability Initiatives is driving market growth:

The global paints and coatings industry is undergoing a transformation driven by environmental regulations and sustainability initiatives. Governments and regulatory bodies in regions such as North America, Europe, and Asia-Pacific are implementing stricter regulations on VOC emissions and hazardous chemicals in paints and coatings. As a result, manufacturers are shifting toward the production of low-VOC, waterborne, and bio-based coatings that are environmentally friendly and comply with regulatory standards. The demand for sustainable coatings is further fueled by consumer preferences for eco-friendly products and corporate sustainability goals. In addition to reducing VOC content, sustainable coatings offer other benefits such as energy efficiency, recyclability, and enhanced durability. This shift toward sustainability is expected to drive the growth of green coatings in both architectural and industrial applications.

Global Paints and Coatings Market Challenges and Restraints

Fluctuations in Raw Material Prices is restricting market growth: The paints and coatings industry is highly dependent on raw materials, such as resins, pigments, solvents, and additives, many of which are derived from petroleum-based sources. Fluctuations in the prices of raw materials, particularly crude oil, can significantly impact the production costs of paints and coatings. Rising crude oil prices and supply chain disruptions can lead to increased production costs, which may be passed on to consumers in the form of higher product prices. In addition, shortages of key raw materials, such as titanium dioxide (TiO2) and specialty chemicals, can disrupt the supply of paints and coatings. Manufacturers may face challenges in maintaining consistent pricing and profitability in the face of volatile raw material markets. To mitigate these risks, companies are increasingly investing in alternative raw materials, such as bio-based resins and recycled content, to reduce their dependence on traditional petroleum-based sources.

Stringent Environmental and Regulatory Standards is restricting market growth: The paints and coatings industry is subject to stringent environmental and regulatory standards, particularly related to VOC emissions and the use of hazardous chemicals. These regulations vary by region and can impose significant compliance costs on manufacturers. For example, in the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation governs the use of chemicals in paints and coatings, while the U.S. Environmental Protection Agency (EPA) enforces strict limits on VOC emissions. Compliance with these regulations requires manufacturers to invest in research and development (R&D) to develop low-VOC and environmentally friendly formulations. While these regulations are driving the development of sustainable coatings, they also pose challenges for manufacturers in terms of cost, product performance, and consumer acceptance. The need to meet regulatory requirements without compromising on product quality or performance can be a significant challenge for companies operating in the global paints and coatings market.

Market Opportunities

The growing demand for smart and functional coatings presents a significant opportunity for the paints and coatings market. Smart coatings, which possess properties such as self-cleaning, anti-microbial, and self-healing capabilities, are gaining popularity in industries such as healthcare, automotive, and construction. These coatings offer enhanced functionality beyond traditional protective and decorative purposes, providing additional value to end-users. For example, anti-microbial coatings are increasingly being used in healthcare facilities to prevent the spread of infections, while self-cleaning coatings are being applied to building facades to reduce maintenance costs. As industries continue to prioritize efficiency, sustainability, and performance, the demand for smart coatings is expected to grow, creating new opportunities for market players to expand their product portfolios and enter new markets.

PAINTS AND COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, RPM International Inc., Axalta Coating Systems, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Jotun Group, Hempel A/S |

Paints and Coatings Market Segmentation - By Type

-

Waterborne Coatings

-

Solvent-borne Coatings

-

Powder Coatings

-

High-solids Coatings

-

Specialty Coatings

Waterborne coatings dominate the product type segment due to their low VOC content and environmentally friendly properties. These coatings are increasingly being adopted in architectural and industrial applications, driven by stringent environmental regulations and the growing demand for sustainable products.

Paints and Coatings Market Segmentation - By Application

-

Architectural Coatings

-

Automotive Coatings

-

Industrial Coatings

-

Packaging Coatings

-

Marine Coatings

-

Aerospace Coatings

Architectural coatings are the most dominant application segment, accounting for a significant share of the overall market. The growing construction industry, coupled with increasing urbanization and infrastructure development in emerging economies, is driving the demand for architectural paints and coatings.

Paints and Coatings Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Asia-Pacific region dominates the global paints and coatings market, driven by rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Southeast Asian nations. The growing construction and automotive industries in the region are major factors contributing to the demand for paints and coatings. Additionally, the rising middle-class population and increasing disposable income in the region are fueling the demand for decorative paints in residential and commercial buildings.

COVID-19 Impact Analysis on the Paints and Coatings Market

The COVID-19 pandemic had a mixed impact on the global paints and coatings market. While the construction and automotive industries experienced significant disruptions due to lockdowns, supply chain challenges, and reduced consumer spending, the market saw a resurgence in demand for protective coatings used in healthcare facilities and infrastructure maintenance. As economies recover and industrial activities resume, the demand for paints and coatings is expected to rebound, particularly in the construction, automotive, and industrial sectors. Additionally, the pandemic has accelerated the trend toward sustainability, with consumers and businesses increasingly prioritizing eco-friendly products.

Latest Trends/Developments

The paints and coatings market is witnessing several key trends, including the growing demand for eco-friendly coatings. The shift toward sustainable coatings, driven by stringent environmental regulations and consumer preferences, is leading to increased adoption of waterborne coatings, powder coatings, and bio-based coatings. Manufacturers are also investing in smart coatings that offer advanced functionalities, such as anti-microbial, self-cleaning, and self-healing properties, to meet the evolving needs of industries such as healthcare, automotive, and construction. Additionally, the adoption of digital color matching technologies is gaining momentum, allowing manufacturers to offer personalized and precise color options to consumers.

Key Players

-

AkzoNobel N.V.

-

PPG Industries, Inc.

-

The Sherwin-Williams Company

-

BASF SE

-

RPM International Inc.

-

Axalta Coating Systems

-

Kansai Paint Co., Ltd.

-

Nippon Paint Holdings Co., Ltd.

-

Jotun Group

-

Hempel A/S

Chapter 1. Paints and Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Paints and Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Paints and Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Paints and Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Paints and Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Paints and Coatings Market – By Types

6.1 Introduction/Key Findings

6.2 Waterborne Coatings

6.3 Solvent-borne Coatings

6.4 Powder Coatings

6.5 High-solids Coatings

6.6 Specialty Coatings

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Paints and Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Architectural Coatings

7.3 Automotive Coatings

7.4 Industrial Coatings

7.5 Packaging Coatings

7.6 Marine Coatings

7.7 Aerospace Coatings

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Paints and Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Paints and Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AkzoNobel N.V.

9.2 PPG Industries, Inc.

9.3 The Sherwin-Williams Company

9.4 BASF SE

9.5 RPM International Inc.

9.6 Axalta Coating Systems

9.7 Kansai Paint Co., Ltd.

9.8 Nippon Paint Holdings Co., Ltd.

9.9 Jotun Group

9.10 Hempel A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global paints and coatings market was valued at USD 160 billion in 2023 and is projected to reach USD 217.74 billion by 2030, growing at a CAGR of 4.5%.

Key drivers include the growth of the construction and automotive industries, increasing demand for eco-friendly coatings, and advancements in coating technologies.

The market is segmented by product type (waterborne, solvent-borne, powder, and specialty coatings) and by application (architectural, automotive, industrial, packaging, marine, and aerospace coatings).

Asia-Pacific is the most dominant region, driven by rapid industrialization, urbanization, and infrastructure development in emerging economies such as China and India.

Leading players include AkzoNobel, PPG Industries, Sherwin-Williams, BASF SE, and RPM International Inc.