Whole Exome Sequencing Market Size (2025 – 2030)

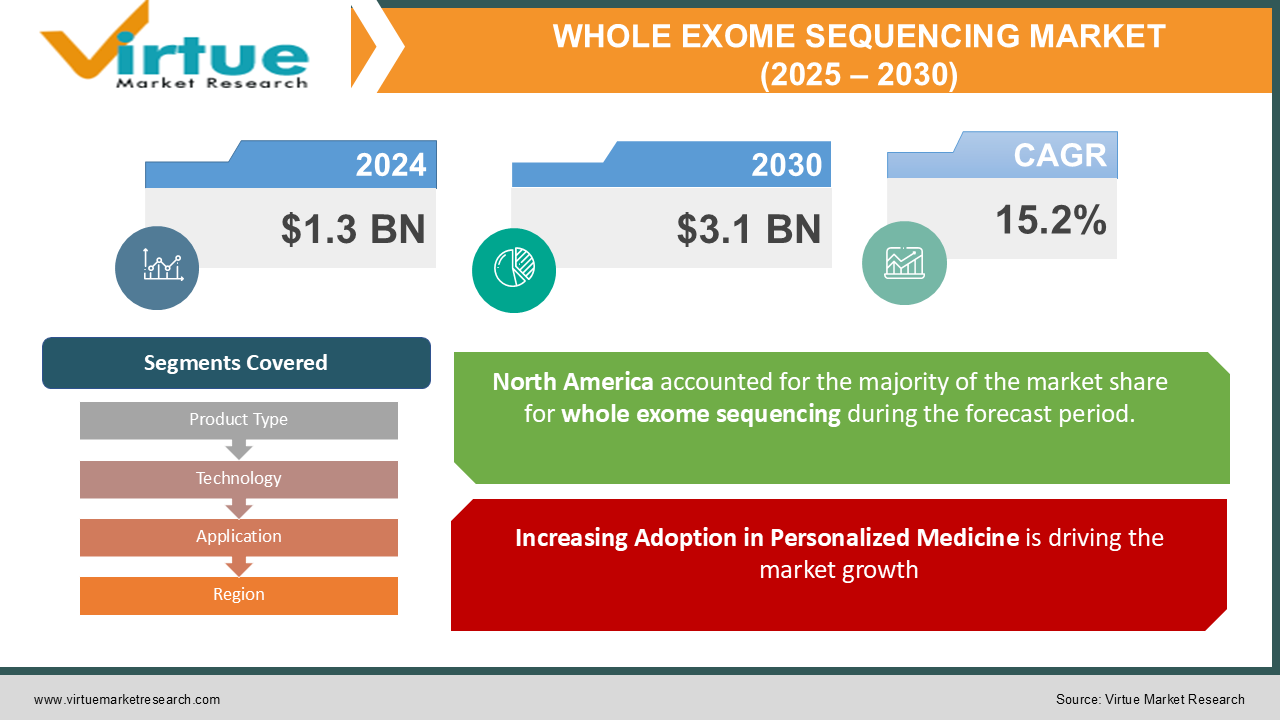

The Global Whole Exome Sequencing (WES) Market was valued at USD 1.3 billion in 2024 and is projected to reach USD 3.1 billion by 2030, growing at a CAGR of 15.2% during the forecast period (2025–2030).

Whole Exome Sequencing (WES) is an advanced genomic technique that focuses on sequencing the protein-coding regions of the genome (exons), which comprise approximately 1–2% of the entire genome.

The increasing application of WES in diagnosing genetic disorders, advancing personalized medicine, and accelerating drug discovery processes is fueling market growth. Additionally, technological advancements in sequencing methods, declining sequencing costs, and government initiatives supporting genomic research contribute significantly to the market's expansion.

Key Market Insights

Among technologies, Sequencing by Synthesis (SBS) held the largest share, due to its high accuracy and cost-effectiveness.

Increasing adoption of WES for oncology research and neurodegenerative disease studies is a key growth driver. Emerging markets in Asia-Pacific are expected to grow at the fastest CAGR of 17.5%, owing to rising investments in healthcare and genomic research. Collaborative initiatives between academia and pharmaceutical companies are enhancing innovation and clinical adoption of WES.

Global Whole Exome Sequencing Market Drivers

1. Increasing Adoption in Personalized Medicine is driving the market growth

The paradigm shift toward personalized medicine is a major driver for the WES market. By identifying individual genetic variations, WES enables tailored therapeutic strategies, improving treatment efficacy and reducing adverse effects. The growing need for precision medicine, especially in oncology and rare genetic disorders, has significantly boosted WES adoption.

For example, in oncology, WES helps identify somatic mutations, guiding targeted therapies and immunotherapies. Similarly, it plays a pivotal role in diagnosing and managing complex neurodegenerative diseases. This integration into personalized healthcare models is expected to drive long-term market growth.

2. Technological Advancements and Cost Reduction is driving the market growth

Rapid advancements in sequencing technologies have improved the efficiency, accuracy, and affordability of WES. Innovations such as next-generation sequencing (NGS) and bioinformatics tools have streamlined data analysis, reducing turnaround times.

Moreover, the declining costs of sequencing have made WES accessible to a broader audience, including research institutions and clinical laboratories in low- and middle-income countries. For instance, the cost of sequencing an exome has dropped from over USD 1,000 in 2015 to less than USD 300 in 2024, encouraging widespread adoption.

3. Growing Applications in Rare Genetic Disorders and Drug Discovery is driving the market growth

WES is increasingly being used to identify genetic mutations linked to rare disorders that traditional diagnostic methods often miss. According to studies, 85% of rare diseases are caused by genetic factors, making WES an indispensable tool for diagnosis.

In drug discovery, WES aids in identifying novel drug targets and understanding disease mechanisms, accelerating the development of effective therapies. The growing focus on rare and orphan diseases by pharmaceutical companies is further driving the demand for WES.

Global Whole Exome Sequencing Market Challenges and Restraints

1. Complex Data Interpretation and Ethical Concerns is restricting the market growth

One of the primary challenges in the WES market is the complexity of data interpretation. While WES generates a vast amount of genomic data, distinguishing clinically relevant information from incidental findings requires expertise and advanced bioinformatics tools.

Ethical concerns surrounding the potential misuse of genetic data and the incidental discovery of non-actionable mutations pose additional challenges. These factors necessitate stringent guidelines for data handling, privacy, and patient consent, which can slow down clinical adoption.

2. High Initial Investment and Operational Costs is restricting the market growth

Despite the declining costs of sequencing, setting up WES systems and laboratories requires significant capital investment. Expenses associated with sequencing platforms, bioinformatics software, and skilled personnel can be prohibitive for smaller organizations and research facilities.

Additionally, ongoing operational costs, including maintenance and data storage, further hinder market penetration in resource-constrained regions, limiting adoption to developed economies.

Market Opportunities

The global WES market is poised to benefit from the growing emphasis on genomic research and precision medicine. Governments worldwide are increasingly funding initiatives to advance genomics, creating a favorable environment for WES adoption. For instance, programs like the All of Us Research Program (USA) and the 100,000 Genomes Project (UK) aim to integrate genomics into healthcare, driving demand for sequencing technologies. The rise of cloud-based bioinformatics platforms represents another growth avenue. These platforms simplify data analysis, making WES more accessible to non-specialized users. The integration of AI and machine learning in bioinformatics is further expected to enhance the accuracy and efficiency of genomic data interpretation. Emerging markets in Asia-Pacific and Latin America offer untapped potential due to rising healthcare spending, increasing awareness of genetic testing, and expanding research infrastructure. Strategic collaborations between global and regional players can accelerate market penetration in these regions. The growing focus on developing portable sequencing devices for point-of-care applications is another promising opportunity, especially in remote and underserved areas.

WHOLE EXOME SEQUENCING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.2% |

|

Segments Covered |

By Product Type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., BGI Group, Eurofins Scientific, GENEWIZ (Azenta Life Sciences), PerkinElmer, Inc., Macrogen, Inc., QIAGEN N.V. |

Whole Exome Sequencing Market Segmentation - By Product Type

-

Kits

-

Systems

-

Services

In 2024, the services segment within the DNA sequencing market experienced significant growth, capturing a dominant 50% revenue share. This substantial market share is primarily attributed to the increasing trend of outsourcing sequencing and data analysis tasks to specialized service providers. This outsourcing model offers several advantages to researchers and clinicians, including access to cutting-edge sequencing technologies, expert technical support, and the ability to scale resources as needed. By outsourcing these complex and resource-intensive tasks, researchers can focus on their core scientific objectives, while leveraging the expertise and infrastructure of specialized service providers to ensure efficient and accurate data generation and analysis. This trend is expected to continue, further solidifying the position of the services segment within the dynamic DNA sequencing market.

Whole Exome Sequencing Market Segmentation - By Technology

-

Sequencing by Synthesis (SBS)

-

Ion Semiconductor Sequencing

-

Others

Sequencing by Synthesis (SBS) technology has emerged as the dominant force in the DNA sequencing market, capturing the largest market share. This leadership position is attributed to several key factors. SBS technology has demonstrated exceptional accuracy and reliability in determining the order of nucleotides in a DNA sequence. Furthermore, SBS platforms are highly scalable, enabling the sequencing of large volumes of genetic material efficiently. This scalability is crucial for large-scale research projects and clinical applications that require the analysis of numerous samples. Finally, advancements in SBS technology have significantly reduced sequencing costs, making it more accessible and cost-effective for a wider range of research and clinical settings. These factors collectively contribute to the dominance of SBS technology in the dynamic DNA sequencing market.

Whole Exome Sequencing Market Segmentation - By Application

-

Diagnostics

-

Drug Discovery

-

Personalized Medicine

-

Others

The diagnostics segment holds the dominant position in the genetic testing market, capturing a significant 40% revenue share. This dominance is primarily attributed to the increasing prevalence of genetic disorders across the globe. As our understanding of the genetic basis of various diseases expands, the demand for accurate and timely genetic testing is steadily rising. Furthermore, the growing emphasis on precision medicine, which aims to tailor treatment strategies to individual patients based on their unique genetic makeup, is significantly driving the demand for genetic diagnostic tools. These factors collectively contribute to the substantial market share and continued growth of the diagnostics segment within the genetic testing market.

Whole Exome Sequencing Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest market share of 45%, driven by a well-established healthcare system, extensive research funding, and the presence of major sequencing companies. The U.S. leads the regional market, supported by government initiatives such as the Cancer Moonshot Program and the expansion of precision medicine projects. Canada also contributes to regional growth with its focus on genomic research and diagnostics.

COVID-19 Impact Analysis

The COVID-19 pandemic highlighted the importance of genomic research, accelerating the adoption of WES for understanding viral mutations and developing targeted therapies. However, disruptions in supply chains and delays in non-COVID research projects temporarily impacted the market. Post-pandemic, the market is witnessing robust recovery as healthcare systems prioritize precision medicine and genomic research. Investments in genomics have surged globally, creating a favorable outlook for WES adoption in the coming years.

Latest Trends/Developments

The field of whole-exome sequencing (WES) is undergoing rapid advancements. AI and machine learning are increasingly integrated into genomic analysis, significantly improving the accuracy and efficiency of WES data interpretation. The development of compact and portable WES systems is gaining traction, enabling point-of-care diagnostics and expanding access to this technology. Beyond diagnostics, WES applications are expanding significantly, encompassing oncology, reproductive health, and forensic research. Rising investments in genomic infrastructure in emerging markets like Asia-Pacific and Latin America are driving market growth. Collaborative research initiatives between academia, pharmaceutical companies, and sequencing providers are accelerating innovation and facilitating the clinical adoption of WES. These advancements are collectively transforming WES into a powerful tool with the potential to revolutionize personalized medicine and improve healthcare outcomes

Key Players

-

Illumina, Inc.

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies, Inc.

-

F. Hoffmann-La Roche Ltd.

-

BGI Group

-

Eurofins Scientific

-

GENEWIZ (Azenta Life Sciences)

-

PerkinElmer, Inc.

-

Macrogen, Inc.

-

QIAGEN N.V.

Chapter 1. Whole Exome Sequencing (WES) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Whole Exome Sequencing (WES) Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Whole Exome Sequencing (WES) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Whole Exome Sequencing (WES) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Whole Exome Sequencing (WES) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Whole Exome Sequencing (WES) Market – By Product

6.1 Introduction/Key Findings

6.2 Kits

6.3 Systems

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Whole Exome Sequencing (WES) Market – By Technology

7.1 Introduction/Key Findings

7.2 Sequencing by Synthesis (SBS)

7.3 Ion Semiconductor Sequencing

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2025-2030

Chapter 8. Whole Exome Sequencing (WES) Market – By Application

8.1 Introduction/Key Findings

8.2 Diagnostics

8.3 Drug Discovery

8.4 Personalized Medicine

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Whole Exome Sequencing (WES) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Whole Exome Sequencing (WES) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Illumina, Inc.

10.2 Thermo Fisher Scientific, Inc.

10.3 Agilent Technologies, Inc.

10.4 F. Hoffmann-La Roche Ltd.

10.5 BGI Group

10.6 Eurofins Scientific

10.7 GENEWIZ (Azenta Life Sciences)

10.8 PerkinElmer, Inc.

10.9 Macrogen, Inc.

10.10 QIAGEN N.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 1.3 billion in 2024 and is projected to reach USD 3.1 billion by 2030, growing at a CAGR of 15.2%.

Key drivers include the growing adoption of WES in personalized medicine, advancements in sequencing technologies, and its increasing use in rare genetic disorder diagnosis.

Segments include Product Type (Kits, Systems, Services), Technology (Sequencing by Synthesis, Ion Semiconductor Sequencing), and Application (Diagnostics, Drug Discovery, Personalized Medicine).

North America dominates the market with a 45% share, supported by advanced healthcare infrastructure and extensive genomic research funding.

Major players include Illumina, Thermo Fisher Scientific, Agilent Technologies, and F. Hoffmann-La Roche.