DNA Sequencing Market Size (2025 – 2030)

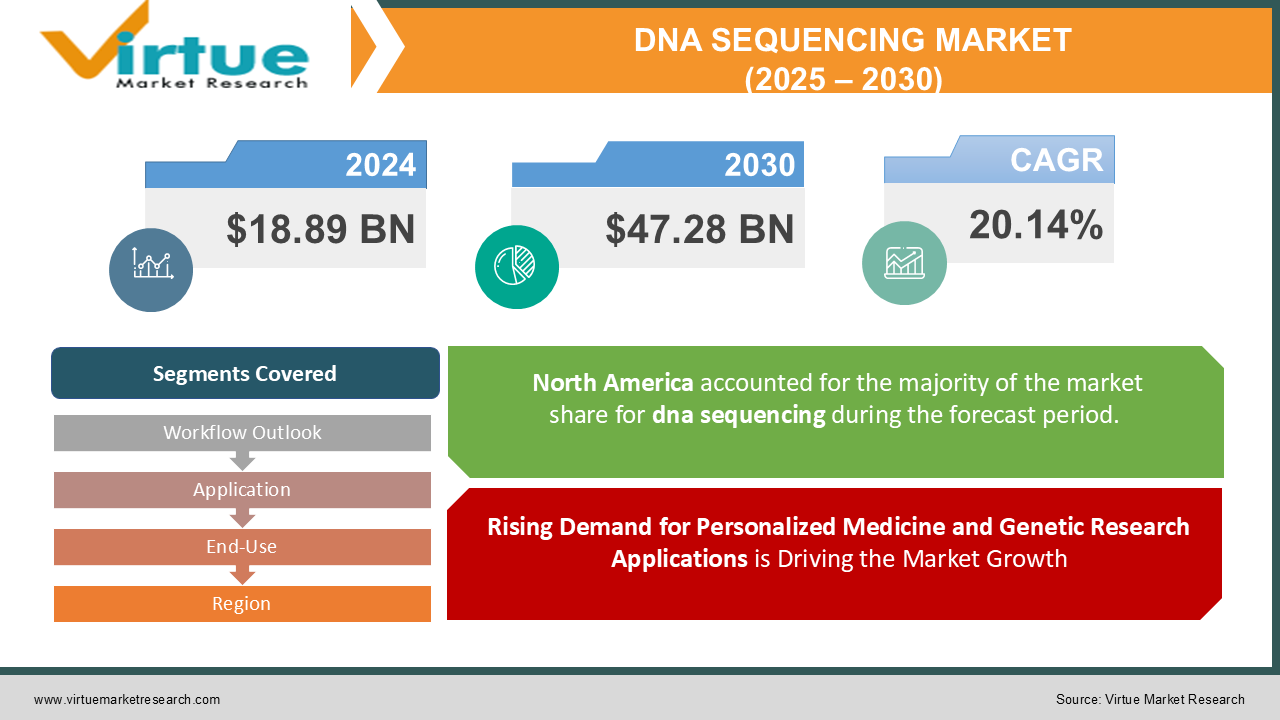

The Global DNA Sequencing Market was valued at USD 18.89 billion in 2024 and is projected to reach a market size of USD 47.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.14%.

The utilization of Next-Generation and Whole-Genome Sequencing technologies in clinical diagnosis applications is broadening the scope of DNA sequencing. These developments are anticipated to contribute to market growth over the forecast period.

The continuous evolution of sequencing technologies has revolutionized the field of genomics and has a widespread impact across the healthcare industry. One key aspect of technological advancement is the substantial improvement in sequencing speed. NGS platforms, such as those developed by Illumina, have dramatically increased the pace at which genetic information can be decoded. These platforms employ parallel processing, enabling the simultaneous analysis of multiple DNA fragments. This acceleration in speed has far-reaching implications, allowing researchers & clinicians to process large volumes of genomic data more efficiently than ever. For instance, in March 2023, Illumina Inc. unveiled its Connected Insights cloud-based software designed to facilitate tertiary analysis for clinical NGS data. Such initiatives are expected to boost market growth in the coming years.

Key Market Insights:

-

Based on product & service, the consumables segment led the market for the largest revenue share of 49.12% in 2023. The growing accessibility of reagents and kits designed for various library construction stages, including DNA fragmentation, adapter ligation, and quality control, is a key factor in expanding market share. Many of these tools are characterized by simplified and streamlined workflows, pre-prepared components, and compatibility with low-input and formalin-fixed specimens.

-

The third-generation sequencing segment is projected to witness the fastest CAGR over the forecast period. This technology overcomes the problems of second-generation sequencing as it includes easy sample preparation without the need for PCR amplification which reduces the time and cost required for sequencing. Moreover, this technology can generate long reads exceeding numerous kilobases for the resolution of assembly issues, as well as repetitive sites of complex genomes.

Market Drivers:

Rising Demand for Personalized Medicine and Genetic Research Applications is Driving the Market Growth

The increasing focus on personalized medicine is driving the demand for DNA sequencing. Physicians and researchers are leveraging genomic data to develop targeted therapies for various diseases, including cancer and rare genetic disorders. Advances in precision medicine allow for customized treatments based on a patient’s genetic makeup, improving efficacy and reducing side effects. Additionally, pharmaceutical companies are using DNA sequencing to accelerate drug discovery and optimize clinical trials. This growing adoption in medical and research fields is significantly boosting market growth.

Technological Advancements Leading to Faster and Cost-Effective Sequencing

Rapid technological innovations have made DNA sequencing faster, more accurate, and more affordable. Next-generation sequencing (NGS) and third-generation sequencing methods are continuously improving throughput and reducing costs. Automation, AI-driven analytics, and cloud computing are further enhancing data processing and interpretation. These advancements are making DNA sequencing more accessible to smaller research labs and clinical settings. As costs decline and efficiency improves, more industries are integrating DNA sequencing into their operations, fueling market expansion.

Increasing Applications of DNA Sequencing in Agriculture and Forensics

Beyond healthcare, DNA sequencing is transforming agriculture, environmental studies, and forensic sciences. In agriculture, sequencing is used for crop improvement, disease resistance, and livestock breeding programs. Forensic labs utilize DNA sequencing for criminal investigations, ancestry tracking, and missing person cases. Conservation efforts also benefit from sequencing by analyzing endangered species’ genetic diversity. The expansion of sequencing applications across diverse industries is driving demand for sequencing technologies and services.

Rising Government Funding and Investments in Genomic Research

Governments and private organizations are heavily investing in genomic research to advance healthcare and biotechnology. National genome projects, precision medicine initiatives, and funding for rare disease studies are supporting the growth of the DNA sequencing market. Many countries are establishing sequencing centers and providing grants to accelerate research in genomics and bioinformatics. These financial investments are fostering innovation, expanding sequencing capabilities, and making genomic technologies more widely available.

DNA Sequencing Market Restraints and Challenges:

High Costs, Data Privacy, and Regulatory Barriers Restrict DNA Sequencing Growth

The DNA sequencing market faces several restraints and challenges despite its rapid growth. High costs associated with sequencing technologies, especially for whole-genome sequencing, limit accessibility for smaller research institutions and developing regions. Additionally, data storage, processing, and interpretation pose significant hurdles due to the vast amount of genetic information generated, requiring advanced bioinformatics tools and expertise. Ethical and privacy concerns regarding genetic data sharing and potential misuse also hinder widespread adoption. Regulatory complexities and compliance requirements vary across regions, creating challenges for companies operating in multiple markets. The shortage of skilled professionals in genomics and bioinformatics further slows the pace of research and clinical adoption. Moreover, sequencing errors, contamination risks, and challenges in analyzing complex genomes impact the accuracy and reliability of results. Addressing these challenges is crucial for unlocking the full potential of DNA sequencing in healthcare, agriculture, and biotechnology.

DNA Sequencing Market Opportunities:

The DNA sequencing market presents significant opportunities driven by advancements in precision medicine, personalized healthcare, and biotechnology. The increasing adoption of sequencing in disease diagnosis, drug discovery, and gene therapy is expanding its clinical applications. Growing investments in genomic research, government initiatives, and national genome projects are fueling market expansion. Additionally, the rise of direct-to-consumer genetic testing is creating new commercial opportunities. Emerging markets and developing regions offer untapped potential as sequencing costs decline and accessibility improves. Furthermore, innovations in AI, bioinformatics, and cloud computing are enhancing data analysis, making sequencing more efficient and scalable for diverse industries

DNA SEQUENCING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.14% |

|

Segments Covered |

By Workflow Outlook, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific, Inc, Agilent Technology, Illumina, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Macrogen, Inc., PerkinElmer Genomics, PacBio, BGI, Bio-Rad Laboratories, Inc., Myriad Genetics, PierianDx, Partek Incorporated, Eurofins Scientific |

DNA Sequencing Market Segmentation: By Workflow Outlook

-

Pre-Sequencing

-

Sequencing

-

Data Analysis

Sequencing is dominant in the DNA sequencing market, as it is the core step in decoding genetic information. The advancement of next-generation sequencing (NGS) and third-generation sequencing technologies has significantly improved sequencing speed, accuracy, and cost-effectiveness.

Data Analysis is fastest-growing due to the increasing volume of genetic data generated from sequencing. The demand for bioinformatics tools, AI-driven analytics, and cloud-based solutions is rising to interpret complex genomic information efficiently. As sequencing applications expand into precision medicine, agriculture, and forensic science, the need for advanced data analysis solutions continues to grow rapidly.

DNA Sequencing Market Segmentation: By Application

-

Oncology

-

Reproductive Health

-

Clinical Investigation

-

Agri genomics & Forensics

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Consumer Genomics

-

Others

Oncology is the dominant sub-segment in the DNA sequencing market due to its critical role in cancer diagnosis, treatment, and research. Next-generation sequencing (NGS) helps identify genetic mutations, enabling targeted therapies and personalized treatment plans

Consumer Genomics is the fastest-growing sub-segment, driven by the rising demand for direct-to-consumer (DTC) genetic testing. Companies like 23andMe and AncestryDNA are making genetic insights more accessible, fueling market expansion.

DNA Sequencing Market Segmentation: By End-Use

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceuticals & Biotechnology companies

-

Other users

Academic Research is the dominant sub-segment in the DNA sequencing market, as universities and research institutions are the primary users of sequencing technologies. Researchers use DNA sequencing for genomics, evolutionary biology, and disease research, contributing to scientific advancements.

Hospitals & Clinics is the fastest-growing sub-segment due to the increasing clinical adoption of DNA sequencing for diagnostics and personalized medicine. Sequencing is becoming essential in detecting genetic disorders, guiding cancer treatments, and improving patient outcomes. As healthcare providers integrate genomic testing into routine medical practice, the demand for sequencing solutions in hospitals and clinics is expected to surge rapidly.

DNA Sequencing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the DNA sequencing market, contributing approximately 40% of the global market share. The United States, in particular, drives this dominance due to its robust healthcare infrastructure, government funding for genomics, and the presence of leading sequencing companies.

Asia-Pacific is the fastest-growing region in the DNA sequencing market, with an estimated market share of around 30%. The rapid adoption of sequencing technologies in countries like China and India, coupled with increased investments in healthcare and research, is fueling the region's growth. The expanding focus on personalized medicine, genomics research, and improving healthcare infrastructure in Asia-Pacific is expected to continue driving the demand for DNA sequencing services and solutions.

COVID-19 Impact Analysis on the Global DNA Sequencing Market:

During the COVID-19 pandemic, the DNA sequencing market encountered slight negative growth in the initial stage. The worldwide lockdowns, supply chain disruptions, resource reduction in the manufacturing, and other restrictions led to the negative expansion of the market in the early 2020.

However, being the first pandemic of the post genomic-era, launches of various genomic projects to understand the SARS-CoV-2 mechanism for the diagnosis and drug discovery led to the wide implementation of genomics technologies including DNA sequencing. Such initiatives increased the usage of DNA sequencing products and services in late 2020, which helped boost market growth. In 2021, the market grew substantially, returned to pre-pandemic levels in 2022, and is expected to grow continuously over the coming years.

Latest Trends/ Developments:

Recent developments in the DNA sequencing market highlight advances in next-generation and third-generation sequencing technologies. These methods are making sequencing faster, more accurate, and more affordable, broadening access for research and healthcare providers. The integration of artificial intelligence is also enhancing data analysis, enabling deeper insights into genetic information.

The market is expanding in fields like oncology, agriculture, and forensics, with DNA sequencing enabling personalized medicine and cancer treatments. Direct-to-consumer genetic testing is also gaining popularity, offering insights into health and ancestry. Increased investments in genomics research are driving innovations in drug discovery and disease diagnosis, while DNA sequencing is helping improve crop and livestock breeding. As technology advances, the market is expected to grow across multiple industries.

Key Players:

-

Thermo Fisher Scientific, Inc

-

Agilent Technology

-

Illumina, Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Macrogen, Inc.

-

PerkinElmer Genomics

-

PacBio

-

BGI

-

Bio-Rad Laboratories, Inc.

-

Myriad Genetics

-

PierianDx

-

Partek Incorporated

-

Eurofins Scientific

Chapter 1. DNA Sequencing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DNA Sequencing Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DNA Sequencing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DNA Sequencing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DNA Sequencing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DNA Sequencing Market – By Workflow Outlook

6.1 Introduction/Key Findings

6.2 Pre-Sequencing

6.3 Sequencing

6.4 Data Analysis

6.5 Y-O-Y Growth trend Analysis By Workflow Outlook

6.6 Absolute $ Opportunity Analysis By Workflow Outlook, 2025-2030

Chapter 7. DNA Sequencing Market – By Application

7.1 Introduction/Key Findings

7.2 Oncology

7.3 Reproductive Health

7.4 Clinical Investigation

7.5 Agri genomics & Forensics

7.6 HLA Typing/Immune System Monitoring

7.7 Metagenomics, Epidemiology & Drug Development

7.8 Consumer Genomics

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. DNA Sequencing Market – By End-Use

8.1 Introduction/Key Findings

8.2 Academic Research

8.3 Clinical Research

8.4 Hospitals & Clinics

8.5 Pharmaceuticals & Biotechnology companies

8.6 Other users

8.7 Y-O-Y Growth trend Analysis By End-Use

8.8 Absolute $ Opportunity Analysis By End-Use, 2025-2030

Chapter 9. DNA Sequencing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Workflow Outlook

9.1.3 By Application

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Workflow Outlook

9.2.3 By Application

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Workflow Outlook

9.3.3 By Application

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Workflow Outlook

9.4.3 By Application

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Workflow Outlook

9.5.3 By Application

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. DNA Sequencing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific, Inc

10.2 Agilent Technology

10.3 Illumina, Inc.

10.4 QIAGEN

10.5 F. Hoffmann-La Roche Ltd.

10.6 Macrogen, Inc.

10.7 PerkinElmer Genomics

10.8 PacBio

10.9 BGI

10.10 Bio-Rad Laboratories, Inc.

10.11 Myriad Genetics

10.12 PierianDx

10.13 Partek Incorporated

10.14 Eurofins Scientific

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global DNA Sequencing Market was valued at USD 18.89 billion in 2024 and is projected to reach a market size of USD 47.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.14%.

The global DNA sequencing market is driven by advancements in technology, reducing costs, and increasing adoption of personalized medicine. Additionally, growing research investments and rising demand for genetic testing in healthcare and agriculture contribute to market growth.

By end-user, the Global DNA Sequencing market is segmented into Academic Research, Clinical Research, Hospitals and clinics, Pharmaceuticals and Biotechnology Companies and other users.

North America is the most dominant region for the Global DNA Sequencing Market.

Thermo Fisher Scientific, Inc, Agilent Technology, Illumina, Inc. and QIAGEN are the leading players of Global DNA Sequencing market.