Smartphone Music Production Software Market Size (2024 –2030)

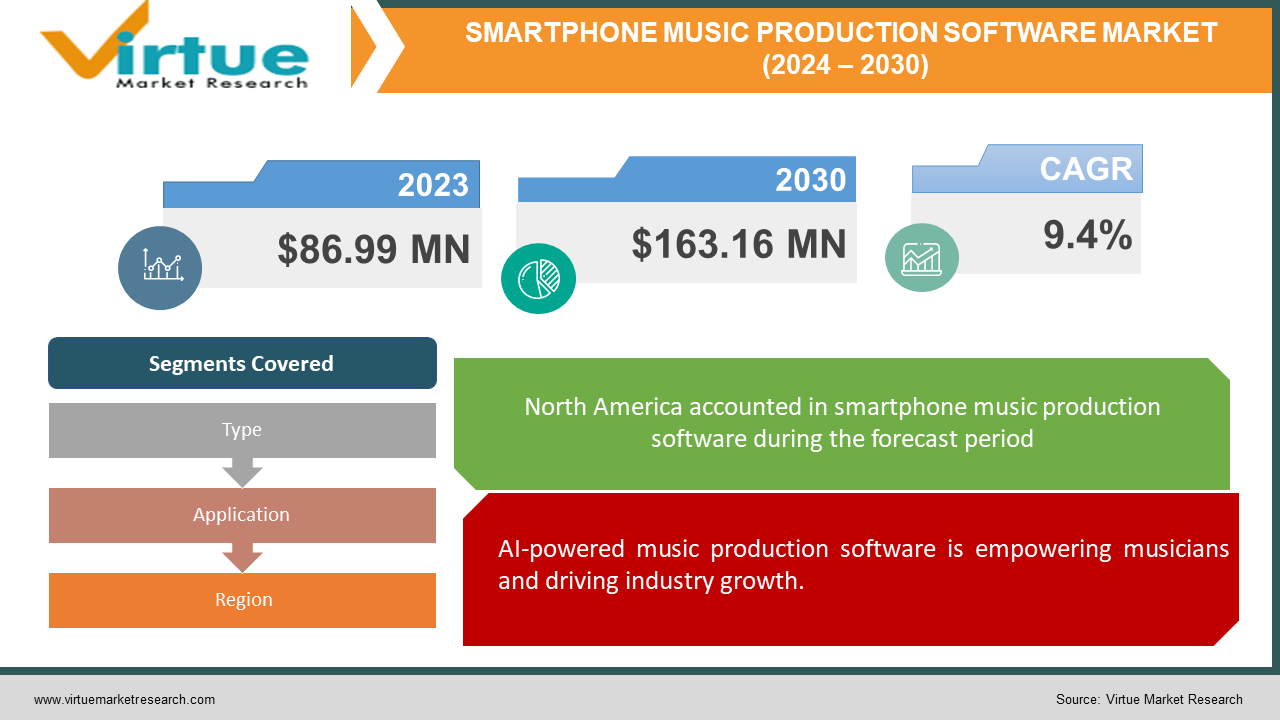

The Global Smartphone Music Production Software Market was estimated to be worth USD 86.99 million in 2023 and is projected to reach a value of USD 163.16 million by 2030, growing at a CAGR of 9.4% during the forecast period 2024-2030.

Electronic music creation, composition, and recording are done with digital audio workstation (DAW) software, sometimes referred to as music production software. This software can be used for a variety of musical tasks, such as composing music, making electronic tracks, and recording music. Because music software is digital and simple to download, the market is anticipated to expand quickly. Online tools and instructional materials are beneficial to both professional musicians and amateurs, simplifying the process of learning and producing music. Social media sites like Facebook and Twitter can help artists connect and understand their fan base. Additionally, during the forecast period, the availability of software for music production that runs on tablets, laptops, and smartphones is anticipated to propel market growth.

Key Market Insights:

Professional-grade smartphone music production applications typically retail for $10 to $30.Over 5 million people are reportedly using music production apps on iOS and Android devices worldwide.Industry estimates state that adding machine learning and artificial intelligence capabilities can improve these apps' functionality by as much as 40%.In this market segment, the top 10 music production apps generate about 75% of all downloads and income.

Global Smartphone Music Production Software Market Drivers:

AI-powered music production software is empowering musicians and driving industry growth.

Businesses in the industry are creating music production apps for smartphones with a range of features and free and paid subscription options. These apps help musicians and provide chances for small and medium-sized music businesses to expand without making large investments by utilizing artificial intelligence (AI) to improve the user experience. These apps give musicians more power by integrating AI into digital processing, learning, performance, and composition. However, certain software products' limited features and performance problems might restrict the market growth for smartphone music-creation software.

Demand for Music Production Software Will Rise as the SME Population Grows.

Large industry players are creating a range of music production apps for smartphones that let users create music effortlessly and imaginatively. Applications for creating music include AX-Edge Editor, Aerophone mini Plus, Beat Sync Maker, Piano Every Day, Aerophone GO Plus, and Aerophone Go Ensemble, all from Roland Corporation. With these tools, users can access the entire studio from the comfort of their own homes. Furthermore, there are more smartphone music-making apps available as small businesses and startups expand globally. According to Sensor Tower estimates, 64% of all mobile app downloads globally in 2020 occurred in Asia Pacific, suggesting a substantial potential for growth in this region. According to the International Finance Corporation, forty percent of SMEs are located in developing nations (IFC). Governments across the globe are putting in place particular initiatives to assist small and medium-sized enterprises (SMEs) in recognition of their role in generating employment and national revenue. To improve their understanding of the market and corporate operations, large corporations also actively interact with and invest in small businesses. All of these elements work together to fuel the market expansion of smartphone music production applications.

Smartphone Music Production Software Market Challenges and Restraints:

Software for creating music on smartphones has many advantages that support market growth. But certain problems could prevent it from growing. One issue is the cluttered app interface, which can obscure crucial functions and make it challenging for users to use. It may take some time to become proficient with all the features, which could postpone making music. The software's performance, which might not be as good as that of professional studio tools, is another drawback. Furthermore, some apps might have problems with auto-saving, which, if not used carefully, could result in the loss of work. Finally, compared to studio programs, smartphone music creation software frequently has fewer plugins, which restricts its functionality. The market expansion for smartphone music production software may be constrained by these issues.

Smartphone Music Production Software Market Opportunities:

Users of cloud-based music creation services have access to vast libraries of audio samples, mixing tools, and synthesizer presets. Users can safely store their work on the servers of platforms such as Splice, Noiiz, and Loopcloud. These services also offer royalty-free audio samples that can be used in compositions without violating copyright laws. The industry's leading developers are concentrating on creating smartphone apps for cloud-based music production that can record, edit, and even publish music videos. With the help of these apps, users can keep a lot of audio and video content on their smartphones. As an illustration, iZotope unveiled the second iteration of Spire Studio, a component of the Spire ecosystem that provides tools for collaboration, recording, and production. Additionally, the company has improved its recording equipment for iOS and Android and is giving iOS users a free six-month premium subscription. Due to the growing demand for cloud technology in music production software, the global market for smartphone music production software is anticipated to grow significantly in the upcoming years.

SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Avid Technology, Inc., Spotify Technology S.A., Roland Corporation, e-Sony Group Corporation, BandLab Technologies, Arturia Tous droits reserves, e-inMusic Brands, Native Instruments GmbH, Steinberg Media Technologies GmbH, Image Line Software |

Global Smartphone Music Production Software Market Segmentation: By Type

-

Editing

-

Mixing

-

Recording

The recording segment of the smartphone music production software market is growing at the fastest rate (45%). Although they were costly and difficult to operate, traditional recording studios and equipment were once thought to be necessities. This has changed, however, as smartphones have made it simple for people to record songs and ideas, regardless of ability level. Interest and adoption have surged due to the ease of recording on a smartphone and the accessibility of user-friendly music apps. The recording industry has also benefited from social media and streaming platforms, which have given musicians new ways to distribute their music globally without depending on conventional channels. The market for smartphone music production software is expanding quickly, with the editing segment growing at a rate of 29%. This growth is being fueled by several factors, one of which is the emphasis on personalization and customization. Professional and amateur musicians alike are constantly seeking new approaches to customize their work. With the aid of editing tools, they can perfect melodies, modify rhythms, and improve the overall sound to better reflect their creative intent. This trend has been driven by the need for more sophisticated and approachable editing apps for smartphones. DIY music production is becoming more and more popular, allowing anyone with a smartphone to become a producer and engineer and transform their ideas into professionally recorded songs. With this empowerment, music enthusiasts who did not have access to conventional production tools before have become more diverse.

Global Smartphone Music Production Software Market Segmentation: By Application

-

Music Production Companies

-

Independent Musicians

-

Home Studios (personal)

With 48% and 25% of the smartphone music production software market, respectively, independent musicians and home studios hold substantial market shares. Anyone can make music with this software, regardless of location or financial status. Because it is now available to a larger audience, including those who cannot afford a professional studio, it has democratized the process of producing music. With the help of these apps, users can creatively explore and experiment with their music. Smartphone music production software is a popular tool used by independent singers, musicians, podcasters, and voice actors to quickly record and create high-quality music anywhere. Using smartphone apps, independent musicians nowadays compose and distribute their music online. The increasing use of professional music composition software by independent producers and social media influencers is driving up demand for mobile music software.

Global Smartphone Music Production Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With a 55% market share, North America commands the biggest portion of the global music industry. With an average of four hours spent on mobile devices and 3.7 hours spent watching TV each day, Americans are spending more time using apps on their phones than watching live TV. Digitalization, new business models, and heightened competition from foreign companies—especially American ones—have all had a substantial impact on the music industry in Europe. For the music industry to grow and develop, there needs to be strategic coordination at all levels. With a predicted growth rate of 32%, Asia Pacific is predicted to have the fastest growth in the music market. Many Asian nations have more people using smartphones than desktop computers. This is especially true in South Korea, Singapore, Taiwan, Hong Kong, Australia, and Japan. Additionally, people in these nations use their mobile devices for extended periods every day. This presents opportunities for music production software providers to interact with their clientele by providing intuitive mobile applications.

COVID-19 Impact on the Global Smartphone Music Production Software Market:

The COVID-19 pandemic caused a lot of businesses to close, which made it difficult for artists to continue their regular jobs. In an attempt to adapt, musicians started using live streaming services, social media, and smartphone music production apps to stay in touch with their fans and look into new revenue streams. Due to people spending more time online, the pandemic also caused a spike in the download of mobile apps. The demand for software companies that offer subscription-based apps has increased, and these companies are predicted to continue growing. The growing significance of technology during and after the pandemic is reflected in the U.S. Bureau of Labor Statistics prediction of a notable increase in demand for software engineers.

Latest Trend/Development:

To satisfy consumer demand for user-friendly interfaces, software companies are concentrating on enhancing user experiences. They are making investments in interactive features, instructional videos, and user-friendly interfaces to accommodate users with different levels of musical ability. Companies are also making sure that their software is compatible with a variety of hardware and operating systems, so users can enjoy a seamless experience on any device. Apple Music Classical, a new streaming service geared toward fans of classical music, was just announced by the company. With the help of this service's streamlined search tool, users can quickly peruse the biggest collection of classical music in the world. ZenTracker, an audio recording app that lets users record, edit, and upload tracks to the Roland cloud, was introduced by Roland Corporation. On Android and iOS devices, the app can be downloaded for free; however, users who have a paid subscription to Roland Cloud can access additional features than those who cannot.

Key Players:

-

Avid Technology, Inc.

-

Spotify Technology S.A.

-

Roland Corporation

-

e-Sony Group Corporation

-

BandLab Technologies

-

Arturia Tous droits reserves

-

e-inMusic Brands

-

Native Instruments GmbH

-

Steinberg Media Technologies GmbH

-

Image Line Software

Market News:

-

Reactional Music is a music distribution network and personalization engine that aims to speed up music customization for video games. In April 2023, Amanotes spearheaded a new fundraising round for the company. Similar to "skins" and other in-game purchases, the platform specializes in fusing music with games, enabling users to customize their characters and gameplay with their favorite tunes.

-

Qualcomm Technologies Inc. unveiled the Snapdragon 7 series mobile platform in March 2023, providing a modern, high-end experience. This platform seeks to provide the most cutting-edge solutions possible to meet the demands of the industry and consumers on a broad scale.

Chapter 1. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – By Application

6.1 Introduction/Key Findings

6.2 Music Production Companies

6.3 Independent Musicians

6.4 Home Studios (personal)

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – By Type

7.1 Introduction/Key Findings

7.2 Editing

7.3 Mixing

7.4 Recording

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. SMARTPHONE MUSIC PRODUCTION SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Avid Technology, Inc.

9.2 Spotify Technology S.A.

9.3 Roland Corporation

9.4 e-Sony Group Corporation

9.5 BandLab Technologies

9.6 Arturia Tous droits reserves

9.7 e-inMusic Brands

9.8 Native Instruments GmbH

9.9 Steinberg Media Technologies GmbH

9.10 Image Line Software

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smartphone Music Production Software Market was estimated to be worth USD 86.99 million in 2023 and is projected to reach a value of USD 163.16 million by 2030, growing at a CAGR of 9.4% during the forecast period 2024-2030.

Musicians are empowered by AI-powered music production software, which is fostering industry expansion The growing SME Population to increased demand for Music Production Software are the factors driving the Global Smartphone Music Production Software Market

Limited App Features and Poor App Performance Will Limit Market Growth.

Editing type is the fastest growing in the Global Smartphone Music Production Software Market.

Asia-Pacific region is the fastest growing in the Global Smartphone Music Production Software Market.