Kombucha Market Size (2025 – 2030)

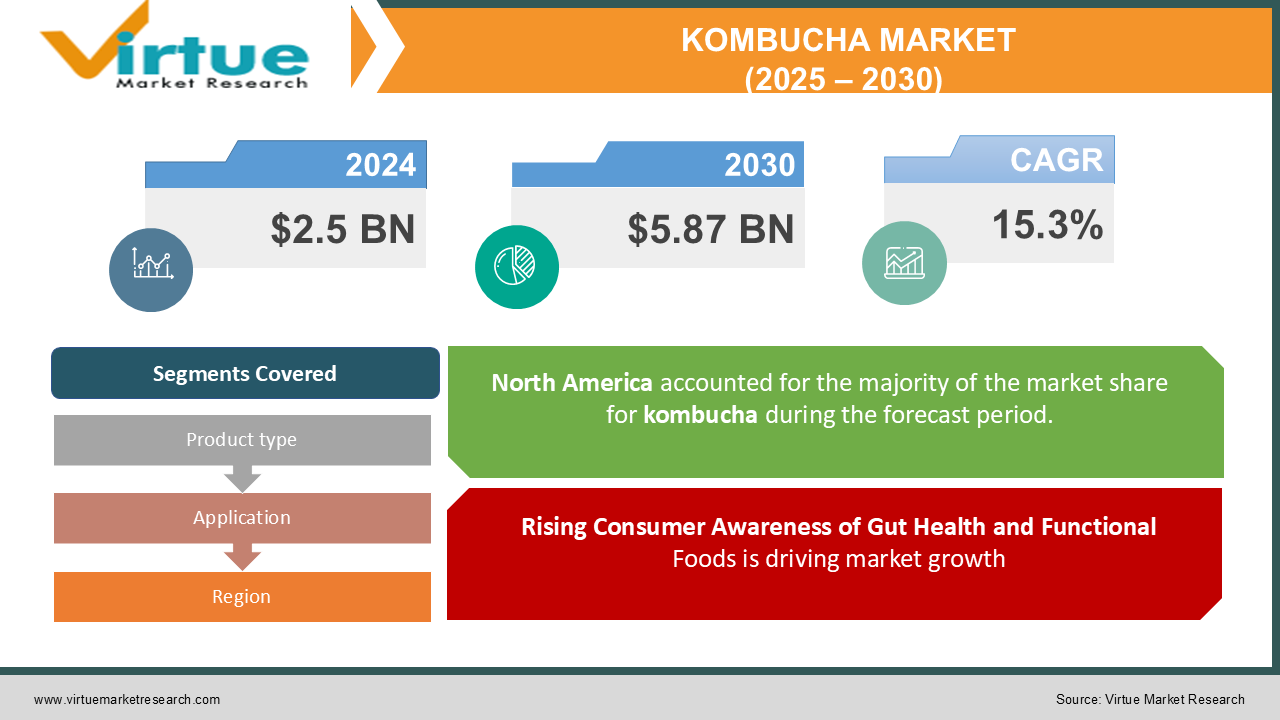

The Global Kombucha Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 15.3% from 2025 to 2030. The market is expected to reach USD 5.87 billion by 2030.

The Kombucha Market focuses on a fermented tea-based beverage known for its probiotic content, nutritional benefits, and refreshing taste. With rising consumer awareness of gut health and demand for functional beverages, kombucha has emerged as a popular choice globally. The market is further driven by innovation in flavors, packaging, and distribution channels, appealing to health-conscious and millennial consumers.

Key Market Insights

-

The rising demand for functional beverages has fueled the growth of the kombucha market, with the segment contributing to nearly 40% of the global functional drink sales in 2024.

-

Organic kombucha is gaining traction, with approximately 35% of manufacturers shifting towards USDA-certified organic production to meet consumer expectations.

-

Online retail sales of kombucha witnessed a 25% year-on-year growth in 2024, driven by convenience and an expanding digital footprint of kombucha brands.

-

Innovative packaging, including eco-friendly bottles and cans, is increasingly influencing purchase decisions, with 20% of consumers expressing sustainability as a key factor in their buying process.

-

Asia-Pacific is the fastest-growing region, with a CAGR of 17% from 2025 to 2030, supported by expanding urbanization and dietary shifts towards functional health beverages.

-

High awareness campaigns by brands, including the health benefits of probiotics, are expected to enhance consumer adoption, increasing market penetration by an additional 15% in untapped regions by 2030.

Global Kombucha Market Drivers

Rising Consumer Awareness of Gut Health and Functional Foods is driving market growth:

The growing awareness about the importance of gut health has propelled demand for probiotic-rich beverages, including kombucha. With research linking gut health to overall immunity, mental health, and digestion, consumers are increasingly prioritizing functional foods. Kombucha, being rich in probiotics and antioxidants, aligns perfectly with this trend. Furthermore, social media and influencer marketing have played a critical role in educating consumers about kombucha's health benefits. In urban regions, this beverage is often seen as a healthier alternative to carbonated drinks, contributing to its mass adoption. With consumers actively seeking products that support holistic wellness, kombucha fits as an ideal choice for the health-conscious demographic.

Innovation in Flavors and Product Diversification is driving market growth: The kombucha market has expanded significantly, owing to product innovations, particularly in flavor profiles. From traditional tea flavors to modern exotic blends like lavender-mint and turmeric-ginger, manufacturers are addressing varied consumer tastes. Additionally, the introduction of kombucha-based cocktails and zero-sugar variants caters to different lifestyle preferences. The industry has also embraced innovations in packaging, such as recyclable and compostable materials, appealing to eco-conscious buyers. These product diversification strategies not only enhance consumer experience but also allow brands to differentiate themselves in a competitive market, ensuring sustained growth.

Expansion of Distribution Channels is driving market growth: The widespread availability of kombucha across multiple retail and online channels has significantly increased its accessibility. Traditional retail avenues, such as supermarkets and health food stores, remain strongholds for the product, while e-commerce platforms have enabled brands to reach a global audience. The rise of subscription-based services for kombucha further provides convenience for regular consumers. In emerging markets, local kombucha brands are leveraging partnerships with regional distributors to penetrate new territories. These developments in distribution channels are pivotal in ensuring that kombucha reaches a broader consumer base, thus driving global market growth.

Global Kombucha Market Challenges and Restraints

High Production Costs and Scalability Issues is driving market growth: Kombucha production is a complex process requiring careful monitoring of fermentation conditions to maintain quality and safety standards. The reliance on high-quality raw materials, such as organic tea and sugar, along with adherence to strict regulatory guidelines, adds to production costs. Scaling production while ensuring consistency poses challenges, particularly for small and medium-sized enterprises (SMEs). Additionally, the perishability of kombucha increases storage and logistics costs, making it less competitive against long-shelf-life beverages. These cost challenges may deter new entrants and limit the ability of smaller players to expand their market presence.

Regulatory and Labeling Constraints is driving market growth: The kombucha industry faces stringent regulatory scrutiny across different regions, primarily due to its alcohol content, which can sometimes exceed legal limits if not carefully managed during fermentation. Governments in regions such as the U.S. and Europe have imposed strict labeling requirements to distinguish non-alcoholic kombucha from alcoholic beverages. Moreover, inconsistencies in global regulations create complexities for international trade. For brands aiming to market kombucha as a health product, claims must be substantiated with scientific evidence, which can be costly and time-consuming to achieve. These regulatory barriers may slow down market growth, particularly in regions with evolving frameworks.

Market Opportunities

The kombucha market presents significant opportunities for growth, driven by evolving consumer preferences and expanding market penetration. One of the most promising opportunities lies in targeting untapped markets, particularly in developing regions such as Africa and Latin America, where awareness of functional beverages is growing. Collaborations with local distributors and strategic marketing campaigns can aid in capturing these emerging markets. Moreover, the demand for sustainable and eco-friendly products has opened avenues for kombucha brands to emphasize their natural and organic production processes. Innovation in product offerings, such as introducing CBD-infused kombucha or functional beverages tailored for specific health benefits like weight management, also holds immense potential. Finally, partnerships with restaurants and cafes to feature kombucha as a mainstream beverage can significantly enhance consumer visibility and drive sales.

KOMBUCHA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.3% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GT’s Living Foods, KeVita Inc., Health-Ade Kombucha, Brew Dr. Kombucha, Humm Kombucha, Remedy Drinks, Revive Kombucha, The Bu Kombucha |

Kombucha Market Segmentation - By Product Type

-

Flavored Kombucha

-

Organic Kombucha

-

Non-alcoholic Kombucha

-

CBD-infused Kombucha

Flavored kombucha holds the largest market share, accounting for approximately 60% of total revenue. Consumers are drawn to its variety of options, such as fruity, herbal, and exotic blends, making it a versatile and appealing choice.

Kombucha Market Segmentation - By Application

-

Beverages

-

Functional Health Products

-

Alcoholic Cocktails

-

Dietary Supplements

The beverages segment dominates the application category, driven by kombucha’s increasing popularity as a refreshing, health-focused alternative to soft drinks and other carbonated beverages.

Kombucha Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global kombucha market, generating over 45% of total revenue. This dominance is attributed to the high consumer awareness regarding health and wellness, well-established distribution networks, and a strong presence of major kombucha brands. Additionally, the region’s emphasis on organic and natural products aligns with kombucha's unique positioning. Major cities like Los Angeles and New York are particularly influential, as they set trends in the health and beverage industries, further amplifying demand.

COVID-19 Impact Analysis on the Kombucha Market

The COVID-19 pandemic had a profound impact on consumer behaviors, sparking a significant increase in the demand for health-boosting products like kombucha. As individuals became more focused on strengthening their immunity and overall wellness, kombucha—rich in probiotics and antioxidants—emerged as a popular choice. This shift in consumer mindset helped kombucha gain considerable traction during the pandemic. While initial lockdowns and the closure of physical stores disrupted supply chains, the rise of online retail provided a vital channel for continuity in the market. Many kombucha brands reported a 30% surge in e-commerce sales during the pandemic, reflecting the growing preference for home delivery and online shopping. Additionally, the trend toward home consumption further fueled interest in DIY kombucha kits, which allowed consumers to brew their own kombucha at home and tap into the wellness trend in a more personal and cost-effective way. Post-pandemic, the focus on health and immunity is expected to remain strong, providing a long-term boost to the kombucha industry. As consumers continue to prioritize wellness and explore functional beverages, kombucha’s popularity is anticipated to sustain its upward trajectory. This ongoing health-conscious shift is not only expected to bolster existing demand but also drive innovation in the market, with brands likely to introduce new flavors, formulations, and packaging options to cater to evolving consumer preferences. The kombucha industry is well-positioned for sustained growth as it continues to align with broader wellness trends in the post-pandemic era.

Latest Trends/Developments

The kombucha market is experiencing several exciting trends, driven by consumer demand for innovation and wellness. One key development is the integration of adaptogens, CBD, and other functional ingredients, catering to niche health needs such as stress relief and enhanced focus. This shift is expanding kombucha’s appeal beyond traditional probiotic benefits to address a broader range of consumer wellness goals. Premiumization is also gaining momentum, with high-income consumers seeking kombucha featuring exotic tea blends and artisanal flavors. This trend is pushing the boundaries of kombucha offerings, making it a more sophisticated and exclusive product choice for those looking to indulge in unique, high-quality beverages. Sustainability remains a significant focus in the industry, with many kombucha brands adopting eco-friendly packaging and carbon-neutral production practices. These efforts not only align with consumer values but also help brands stand out in an increasingly environmentally conscious marketplace. Collaborative marketing campaigns, especially partnerships with fitness influencers and nutritionists, are enhancing consumer engagement and trust. These collaborations help position kombucha as a health-focused beverage choice, further solidifying its appeal to wellness-oriented consumers. Advancements in fermentation technology are also transforming the industry. Brands are leveraging new techniques to reduce production time and improve product consistency, ensuring a more reliable experience for consumers while scaling operations more efficiently. Finally, the growing trend of kombucha cocktails in bars and restaurants is a clear indicator of the beverage’s mainstream acceptance. With more consumers embracing kombucha in various settings, its versatility as both a health beverage and a trendy mixer continues to fuel its popularity across diverse demographics. These trends signal a promising future for kombucha in the global beverage market.

Key Players

-

GT’s Living Foods

-

KeVita Inc.

-

Health-Ade Kombucha

-

Brew Dr. Kombucha

-

Humm Kombucha

-

Remedy Drinks

-

Revive Kombucha

-

The Bu Kombucha

Chapter 1. Kombucha Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Kombucha Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Kombucha Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Kombucha Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Kombucha Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Kombucha Market – By Product Type

6.1 Introduction/Key Findings

6.2 Flavored Kombucha

6.3 Organic Kombucha

6.4 Non-alcoholic Kombucha

6.5 CBD-infused Kombucha

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Kombucha Market – By Application

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Functional Health Products

7.4 Alcoholic Cocktails

7.5 Dietary Supplements

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Kombucha Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Kombucha Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 GT’s Living Foods

9.2 KeVita Inc.

9.3 Health-Ade Kombucha

9.4 Brew Dr. Kombucha

9.5 Humm Kombucha

9.6 Remedy Drinks

9.7 Revive Kombucha

9.8 The Bu Kombucha

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Kombucha Market was valued at USD 2.5 billion in 2024 and is projected to reach USD 6.7 billion by 2030, growing at a CAGR of 15.3%.

Key drivers include rising consumer awareness of gut health, innovation in flavors and packaging, and the expansion of distribution channels.

The market is segmented by product (flavored, organic, CBD-infused) and application (beverages, functional health products, alcoholic cocktails).

North America is the dominant region, contributing over 45% of total revenue, supported by strong consumer demand and established distribution networks.

Leading players include GT’s Living Foods, KeVita Inc., Health-Ade Kombucha, Brew Dr. Kombucha, and Humm Kombucha.