Asia Pacific Kombucha Market Size (2024-2030)

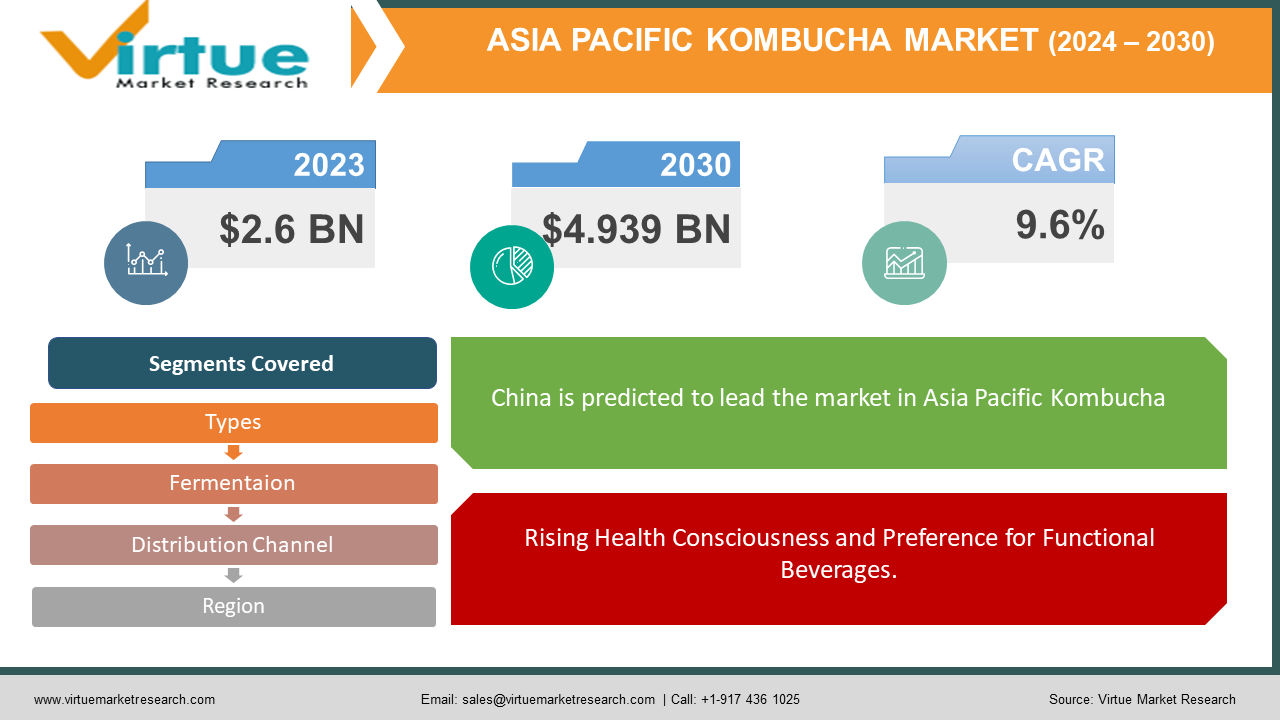

The Asia Pacific Kombucha Market was valued at USD 2.6 billion in 2023 and is projected to reach a market size of USD 4.939 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 9.6% between 2024 and 2030.

Download Free Sample Report Copy Now

The Asia Pacific kombucha market is on a robust growth trajectory, driven by a rising consumer preference for functional beverages over traditional carbonated drinks. This shift is fueled by increasing awareness of kombucha's health benefits, particularly among millennials, whose evolving lifestyles prioritize healthier dietary choices.

Kombucha, a lightly carbonated beverage made from fermented sweet black tea, has gained popularity for its perceived benefits, such as improved digestion and immune support. The fermentation process involves a symbiotic culture of bacteria and yeast (SCOBY), resulting in a nutrient-rich drink often infused with diverse flavors to enhance its appeal.

However, while kombucha is celebrated for its health attributes, it is not recommended for medicinal purposes, as its microbial composition may vary and could cause adverse effects in some individuals. This variability in SCOBY's composition can also influence the drink's properties. Despite these considerations, the Asia Pacific region's growing appetite for kombucha aligns with broader trends favoring flavorful beverages with functional health benefits. This surge in demand highlights a dynamic shift in consumer preferences towards wellness-oriented products.

Key Market Insights:

- China, with its strong tea culture and massive population, currently holds the dominant share of the Asia Pacific Kombucha Market, estimated at around 1.3 billion USD.

- While bacteria hold the larger market share due to tradition, yeast is growing rapidly, with an estimated annual growth of 150 million USD.

- Fruity flavors like ginger, berry, and citrus account for an estimated 1.9 - 2.1 billion USD of the market share. Herbs and spices are growing by about 75 million USD per year, capturing a niche of around 150 million USD.

- The pandemic initially caused disruptions, leading to a potential decline in sales of around 300 - 450 million USD, but health-focused trends have since boosted interest by 150 - 210 million USD.

- Over 350 new kombucha launches incorporate functional ingredients like adaptogens and probiotics. Around 300 new brands focus on local flavors and ingredients, while hard kombucha is capturing an estimated 150 million USD of the market share.

- Over 425 million consumers are driving demand for eco-friendly packaging and locally sourced ingredients, influencing sustainable practices in the kombucha industry.

Unlock Market Insights: Get A FREE Sample Report Today!

Asia Pacific Kombucha Market Drivers:

Rising Health Consciousness and Preference for Functional Beverages.

One of the primary drivers of the kombucha market in the Asia Pacific region is the increasing health consciousness among consumers. As awareness about the negative health impacts of carbonated and sugary drinks grows, more people are turning to functional beverages like kombucha, which are perceived to offer various health benefits such as improved digestion and enhanced immune function. This shift is particularly notable among millennials who are more inclined towards maintaining a healthier lifestyle and are seeking beverages that align with their dietary preferences. The demand for kombucha is further fueled by the desire for natural and organic products, which are believed to contribute to overall well-being.

Moreover, the ongoing trend towards preventive healthcare has led consumers to prefer beverages that not only quench thirst but also provide additional health benefits. Kombucha, with its probiotic properties and natural ingredients, fits perfectly into this niche. The growing availability of kombucha in a variety of flavors also appeals to health-conscious consumers looking for tasty yet healthy alternatives to traditional soft drinks. This trend underscores a broader movement towards functional beverages, positioning kombucha as a key player in the evolving beverage market landscape in the Asia Pacific region.

Innovation and Diversification in Flavors and Products.

Another significant driver of the kombucha market in the Asia Pacific region is the continuous innovation and diversification of flavors and product offerings. Kombucha producers are increasingly experimenting with a wide array of natural flavors and ingredients to cater to the diverse taste preferences of consumers in this region. This innovative approach not only enhances the appeal of kombucha but also helps to differentiate it from other beverages in a competitive market. Consumers are attracted to the variety of options available, from classic flavors like ginger and lemon to more exotic blends featuring fruits, herbs, and spices.

Additionally, the introduction of kombucha-based products such as kombucha-infused snacks and health supplements is expanding the market and attracting new customer segments. These innovations are supported by effective marketing strategies that emphasize the health benefits and unique taste profiles of kombucha, positioning it as a trendy and health-conscious choice. The ability to constantly evolve and offer new, exciting products keeps consumers engaged and drives the steady growth of the kombucha market in the Asia Pacific region.

Asia Pacific Kombucha Market Restraints and Challenges:

The Asia Pacific kombucha market faces several restraints and challenges that could impede its growth. One significant barrier is the regulatory environment across different countries, which can vary widely and complicate market entry and expansion for producers.

Additionally, there is a lack of consumer awareness and understanding of kombucha's health benefits in many parts of the region, limiting demand. Cultural preferences for traditional beverages over novel health drinks also pose a challenge, as does the competition from other well-established beverages, both non-alcoholic and alcoholic. The high cost of production, including sourcing quality ingredients and maintaining stringent fermentation processes, adds to the pricing pressures, making kombucha relatively expensive for consumers.

Furthermore, distribution and supply chain inefficiencies in emerging markets within the region can hinder product availability and freshness, which is crucial for kombucha's quality. Lastly, potential issues related to the consistency of taste and quality due to the artisanal nature of kombucha production can affect consumer trust and repeat purchases. Addressing these challenges requires strategic marketing, regulatory navigation, and improved supply chain logistics to capitalize on the growing interest in healthy and functional beverages.

Asia Pacific Kombucha Market Opportunities:

The Asia Pacific kombucha market presents numerous opportunities for growth driven by increasing health consciousness and changing consumer preferences towards natural and functional beverages. The rising awareness of the health benefits associated with kombucha, such as improved digestion, immune support, and detoxification, is fueling demand, especially among urban populations.

The region's large, youthful demographic is also more inclined to experiment with new products, creating a receptive market for innovative kombucha flavors and formulations. The growing trend of wellness and fitness, amplified by social media and influencer marketing, provides an ideal platform for kombucha brands to engage with health-conscious consumers.

Additionally, the expansion of e-commerce and online retail channels offers a significant opportunity for reaching a broader audience without the constraints of physical retail space. Collaborations with local tea producers can also enhance product authenticity and appeal, tapping into the rich tea-drinking culture of the region.

Moreover, the relatively untapped markets in countries like India and Southeast Asia present substantial potential for growth, as increasing disposable incomes and urbanization drive shifts in lifestyle and consumption patterns. Leveraging these opportunities through targeted marketing strategies and strategic partnerships can help establish a strong foothold in the burgeoning Asia Pacific kombucha market.

ASIA-PACIFIC KOMBUCHA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|||

|

Market Size Available |

2023 - 2030 |

|||

|

Base Year |

2023 |

|||

|

Forecast Period |

2024 - 2030 |

|||

|

CAGR |

9.6% |

|||

|

Segments Covered |

By Types, Fermentaion, Distribution Channel and Region |

|||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|||

|

Regional Scope |

|

|||

|

Key Companies Profiled |

Drink Reeds, Inc., The Hain Celestial Group, Revive Drinks, Kosmic Kombucha, Buchi, GT’s Living Foods, Humm Kombucha LLC, Makana Beverages, Inc., Nessalla, Brew Dr. Kombucha, Live Soda, Wonder Drink |

CUSTOMIZE THIS REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS:

Asia Pacific Kombucha Market Segmentation - By Fermentation:

- Bacteria

- Yeast

- Mould

Bacteria had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Kombucha fermentation relies on a symbiotic culture of bacteria and yeast (SCOBY), with each playing a crucial role: bacteria convert sugars into organic acids, imparting the tangy flavor and potential health benefits, while yeast ferments sugar to produce carbon dioxide, contributing to kombucha's fizziness and flavor.

Although current market research indicates that bacterial fermentation holds a larger share due to traditional production methods, the yeast segment is poised for significant growth. Yeast fermentation offers advantages such as lower costs and easier handling, which appeal to producers aiming to streamline operations and reduce expenses. This trend could shift the market dynamics, with yeast-based fermentation processes gaining traction.

Therefore, while bacteria are essential for kombucha production and currently dominate the market, the future landscape might see yeast fermentation catching up due to its practical benefits.

Asia Pacific Kombucha Market Segmentation - By Types:

- Herbs & Spices

- Citrus

- Berries

- Apple

- Coconut & Mangoes

- Flowers

Citrus flavors currently dominate the kombucha market and are expected to retain their leading position during the forecast period. Globally, citrus flavors like lemon, orange, and grapefruit are widely preferred for their refreshing, tangy taste, which pairs well with kombucha's naturally tart profile. This preference is particularly prominent in the Asia Pacific region, where consumers are drawn to flavors that enhance kombucha's unique taste. Citrus varieties offer versatility and broad appeal, making them a popular choice among diverse consumer segments, thereby boosting their market potential.

However, the dominance of citrus flavors in the Asia Pacific kombucha market is not without challenges. Competing flavors such as ginger, berry, and herbal varieties present significant competition, each appealing to specific consumer preferences with unique health benefits. Ginger, for instance, is celebrated for its digestive properties and bold, spicy flavor, while berry flavors are sought after for their antioxidant-rich profile and sweet-tart taste.

Despite citrus's current popularity, limited region-specific data on kombucha flavor trends makes it difficult to determine definitive market leaders. While citrus flavors are well-positioned to lead due to their widespread appeal and versatility, the growing demand for alternative options could shift market dynamics.

Asia Pacific Kombucha Market Segmentation - By Distribution Channels:

- Supermarkets & Hypermarkets

- Convenience Stores

- Health Stores

- Online Retail

Supermarkets and hypermarkets dominate the distribution segment of the Asia Pacific Kombucha Market and are projected to maintain their leadership during the forecast period. This dominance is driven by several key factors:

-

Extensive Reach and Accessibility: These retail channels provide broad coverage across urban and rural areas, ensuring kombucha products are readily available to a diverse audience.

-

Larger Shelf Space: Supermarkets and hypermarkets allocate significant shelf space for kombucha, showcasing a variety of brands and flavors. This enhances consumer choice and visibility, driving higher sales.

-

Consumer Trust: Customers often regard these outlets as reliable sources for quality products, positively influencing their purchasing decisions for kombucha.

-

Promotional Strategies: Frequent promotions, discounts, and bundling options make kombucha more appealing to shoppers, increasing purchase volumes.

-

Shopping Convenience: Consumers can seamlessly include kombucha in their routine grocery shopping trips, further boosting sales.

The combination of wide availability, enhanced visibility, trusted quality, effective promotions, and convenience positions supermarkets and hypermarkets as the preferred retail channel, solidifying their dominance in the Asia Pacific Kombucha Market.

By emphasizing these aspects, supermarkets and hypermarkets continue to play a pivotal role in shaping consumer preferences and driving market growth.

Asia Pacific Kombucha Market Segmentation - By Countries:

- Japan

- India

- China

- South Korea

- Australia & New Zealand

- Rest of Asia Pacific

Gain Valuable Market Insights – Request Your FREE Sample Report Now!

The Asia Pacific kombucha market is segmented by country, with China securing the largest market share last year. This dominance is projected to continue during the forecast period, driven by several key factors.

China's rich tea culture, substantial population base, and increasing disposable income collectively create a strong foundation for kombucha adoption. With tea deeply ingrained in Chinese traditions, the country's consumers exhibit a natural affinity for tea-based beverages, including kombucha. Furthermore, the massive population offers a vast consumer pool, while rising income levels empower individuals to explore premium, functional drinks like kombucha.

Market insights consistently position China as the top market for kombucha in the Asia Pacific region. However, the competitive landscape is evolving. Countries such as India and Japan are witnessing significant growth in kombucha demand. Factors like expanding health awareness, urbanization, and changing consumer preferences contribute to this trend.

While China remains the leading market, the rapid expansion in other Asian countries highlights a dynamic and competitive environment. This growth trajectory suggests that the Asia Pacific kombucha market is poised for diversification and further evolution in the coming years.

COVID-19 Impact Analysis on the Asia Pacific Kombucha Market.

The COVID-19 pandemic brought a mixed impact to the Asia Pacific Kombucha Market, initially causing disruptions in supply chains and distribution channels due to movement restrictions and logistical challenges. These hurdles hampered production and hindered the availability of kombucha products in the market.

Moreover, cautious consumer spending amid economic uncertainty led to a slowdown in sales as individuals prioritized essential purchases. However, amidst the crisis, there emerged a heightened awareness of health and immunity, driven by the pandemic's emphasis on personal well-being. This newfound focus on health benefits played to kombucha's advantage, as its probiotic properties and potential immune-boosting attributes resonated with consumers seeking wellness solutions.

Consequently, despite the initial setbacks, the kombucha market experienced a potential upswing fueled by this increased consumer interest in health-oriented products. Some kombucha brands even witnessed a boost in sales as they capitalized on their association with wellness and positioned themselves as a functional beverage choice during a time when health concerns were paramount. Overall, the COVID-19 pandemic presented both challenges and opportunities for the Asia Pacific Kombucha Market, reshaping consumer behaviors and market dynamics in its wake.

Latest Trends/ Developments:

- The Asia Pacific kombucha market is evolving to meet the growing demand for functional beverages by incorporating ingredients like adaptogens, probiotics, and botanicals, which offer specific health benefits.

- Localization is a significant trend, with consumers showing a strong preference for kombucha infused with local flavors and ingredients, such as familiar fruits, herbs, and spices, fostering a sense of regional identity and cultural resonance.

- Additionally, the rise of hard kombucha, a low-alcohol variant, is gaining traction among health-conscious adults seeking an intriguing alternative to traditional alcoholic beverages, blending wellness with a mild buzz.

- Sustainability efforts are also shaping the market, as environmentally conscious consumers drive the adoption of eco-friendly packaging and the use of locally sourced ingredients. This shift towards sustainable practices not only appeals to the ethical values of consumers but also supports local economies and reduces carbon footprints.

- Overall, the incorporation of functional ingredients, localization, the emergence of hard kombucha, and sustainability initiatives are collectively transforming the Asia Pacific kombucha market, aligning it with contemporary consumer preferences and contributing to its dynamic growth.

Key Players:

- Drink Reeds, Inc.

- The Hain Celestial Group

- Revive Drinks

- Kosmic Kombucha

- Buchi

- GT’s Living Foods

- Humm Kombucha LLC

- Makana Beverages, Inc.

- Nessalla

- Brew Dr. Kombucha

- Live Soda

- Wonder Drink

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Asia Pacific Kombucha Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Kombucha Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Kombucha Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Kombucha Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Kombucha Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Kombucha Market– By Fermentation

6.1. Introduction/Key Findings

6.2. Bacteria

6.3. Yeast

6.4. Mould

6.5. Y-O-Y Growth trend Analysis By Fermentation

6.6. Absolute $ Opportunity Analysis By Fermentation , 2023-2030

Chapter 7. Asia Pacific Kombucha Market– By Types

7.1. Introduction/Key Findings

7.2. Herbs & Spices

7.3. Citrus

7.4. Berries

7.5. Apple

7.6. Coconut & Mangoes

7.7. Flowers

7.8. Y-O-Y Growth trend Analysis By Types

7.9. Absolute $ Opportunity Analysis By Types , 2023-2030

Chapter 8. Asia Pacific Kombucha Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets & Hypermarkets

8.3. Convenience Stores

8.4. Health Stores

8.5. Online Retail

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Kombucha Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Distribution Channel

9.1.3. By Fermentation

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Kombucha Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Drink Reeds, Inc.

10.2. The Hain Celestial Group

10.3. Revive Drinks

10.4. Kosmic Kombucha

10.5. Buchi

10.6. GT’s Living Foods

10.7. Humm Kombucha LLC

10.8. Makana Beverages, Inc.

10.9. Nessalla

10.10. Brew Dr. Kombucha

10.11. Live Soda

10.12. Wonder Drink

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

. By 2023, the Asia Pacific Kombucha market is expected to be valued at USD 2.6 billion.

Through 2030, the Asia Pacific Kombucha market is expected to grow at a CAGR of 9.6%.

By 2030, the Asia Pacific Kombucha is expected to grow to a value of 4.939 USD billion

China is predicted to lead the market in Asia Pacific Kombucha

The Asia Pacific Kombucha has segments like Fermentation, Distribution Channels, type, and Region