Bentonite Market Size (2025 – 2030)

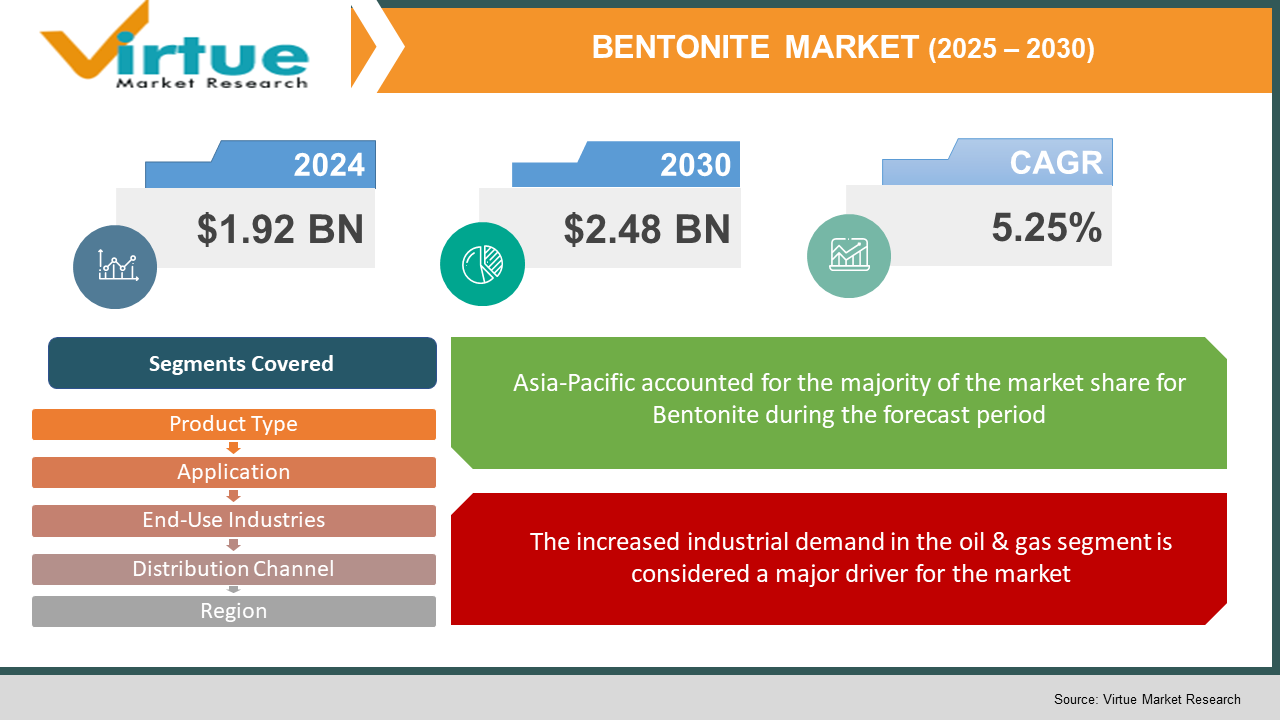

The Global Bentonite Market was valued at USD 1.92 billion and is projected to reach a market size of USD 2.48 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.25%.

Increasing need throughout many sectors, including oil and gas, building, agriculture, and environmental rehabilitation, will drive continuous expansion of the Global Bentonite Market from 2025 to 2030. Found in drill fluids, foundry sands, sealants, and medicines, bentonite is a naturally occurring clay with outstanding absorbent and binding properties that is widely used. Its use in agriculture and environmental cleanup has been increased by growing industrialization and an emphasis on sustainable methods. Further increasing worldwide market penetration are technological improvements in processing and refining bentonite, encouraging federal regulations, and growing infrastructure initiatives.

Key Market Insights:

- Emphasizing its industrial flexibility, bentonite is used in more than 60% of foundry applications and oil and gas drilling operations.

- Through better soil conditioning and water retention, more than 40% of bentonite used in agriculture now supports sustainable practices.

- Bentonite-based products for remediation and waste management have increased by 30%, due to tougher environmental laws.

- Innovations in clay processing have improved product quality, reducing production costs by nearly 15% and enhancing market competitiveness.

Bentonite Market Drivers:

The increased industrial demand in the oil & gas segment is considered a major driver for the market.

Mostly in drilling fluids, bentonite is an essential ingredient in the oil and gas industry. These fluids keep borehole walls stable, lubricate drill bits, and stop the penetration of formation fluids during drilling. Especially in unconventional reservoirs, companies are looking for more environmentally friendly and cost-effective drilling methods as mining activities accelerate worldwide. To guarantee well integrity and effective drilling operations, modern drilling methods have raised the reliance on high-quality bentonite. Recent research shows that steady growth in bentonite use in this business is linked to better drilling performance, lower non-productive time, and increased safety margins. The need for refined and specialized bentonite grades is expected to expand as the oil and gas business transitions to cleaner operations.

The recent growth of the construction and infrastructure segment is driving the growth of the bentonite market too.

Bentonite is extensively used in the building sector as a sealant, binder, and waterproofing agent in civil engineering projects. Its ideal qualities, such as great binding properties, low permeability, and high swelling capacity, make it a perfect substance for soil stabilization, foundation sealing, and addition into cement and concrete. As global infrastructure investments climb, especially in developing countries, the demand for goods that improve the safety and lifespan of buildings is also increasing. Used to manage water flow and increase ground stability, bentonite is becoming more and more common in road construction, tunneling, and foundation building projects. Strict environmental regulations that encourage sustainable building methods speed up this development even more and make bentonite a preferred material for major infrastructure projects.

Bentonite finds use in the agricultural and environmental segments, thereby driving the growth of the market.

Its natural water holding and adsorption properties in agriculture and environmental reclamation make bentonite very useful. In agriculture, it is used to improve soil quality by increasing water retention, enhancing nutrient availability, and reducing soil erosion—benefiting both crop yield and sustainability. Bentonite is used in environmental uses for the construction of landfill liners, the remediation of degraded sites, and contaminant confinement because of its capacity to create impermeable barriers. The need for bentonite in these uses is rising as the world focuses on environmental preservation and sustainable agriculture deepens. Recent market analysis indicates that mounting worries about water scarcity and soil degradation are driving higher use of bentonite as a natural, environmentally friendly solution in both agriculture and environmental management.

Bentonite is used in the pharmaceutical and cosmetic industries, acting as a major market driver.

Bentonite is highly regarded in the cosmetic and pharmaceutical businesses for its natural purifying, absorbent, and detoxifying qualities. In various cosmetic formulations as well as in topical applications and oral care goods, it serves as a binder, thickener, and stabilizer. The tendency toward natural and organic ingredients has increased bentonite demand in these sectors. Since bentonite can cleanse impurities and soothe skin, manufacturers are using it more and more in goods to improve efficiency and safety. As consumer preference changes to environmentally friendly and non-toxic goods, bentonite's pharmaceutical and cosmetic uses are growing, hence driving more market expansion.

Bentonite Market Restraints and Challenges:

The production and processing costs for this market are very high, acting as a big market challenge.

Particularly for uses in drilling fluids, construction, and pharmaceuticals, advanced processing methods are necessary to produce bentonite to meet business criteria. These procedures sometimes demand sophisticated tools and high-energy activities and comprise difficult beneficiation, drying, and chemical treatment steps. Thus, relative to other ingredients, production costs are much higher. Particularly in cost-sensitive markets where pricing is crucial, high capital expenditures for technology, labor, and energy can limit bentonite products' competitiveness. Expenses are also increased by the demand for continuous quality and the environmental regulations needed throughout processing, therefore aggravating this cost difficulty. Therefore, although bentonite offers many long-term advantages in different uses, these great starting and running costs might retard market expansion and impede production increase in developing regions.

The strict rules and regulations related to the environment and mining are a major market restraint.

Bentonite mining and processing are subject to strict environmental laws, which vary by area. To guarantee environmentally responsible mining, minimal ecological effects, and the preservation of local ecosystems, governments set strict criteria. Adherence to these rules sometimes demands thorough environmental impact assessments, use of sophisticated mitigation methods, and ongoing monitoring of garbage management and emissions. For mining firms, these regulations can slow project approvals and greatly raise operational expenses. These issues are especially demanding in areas of Europe and North America with strict environmental legislation. Rising complexity and cost of compliance could restrict the scalability of bentonite mining activities and cause supply limitations that then impact market growth and price stability.

The frequent fluctuations in the prices of the raw materials are a hindrance to the market growth.

Fluctuations in mining output, variations in transportation and energy costs, and geopolitical uncertainties all contribute to the volatility of bentonite pricing. Natural resource depletion or production interruptions could cause variations in bentonite's world supply, which could then cause price volatility. For example, changes in output from major bentonite-producing areas can influence the total market supply, while rising transportation expenses caused by fuel price increases or logistical disturbances additionally affect cost. Geopolitical conflicts in important mining districts may also create supply chain vagueness, which hinders manufacturers and end-users from reliably predicting expenses. For consumers as well as manufacturers, this volatility in raw material costs poses hazards, therefore hamstringing long-term agreements and influencing market sentiment.

The bentonite market faces tough competition from its alternatives, thereby challenging the market reach.

In some uses, synthetic ingredients or other natural clays are starting to be reasonable replacements for bentonite. At maybe reduced production expenses, these options generally have similar performance traits, including sealing, binding, or absorption capabilities. Synthetic polymers and engineered clays may provide identical advantages in sectors including foundry molding or bore fluids with better process consistency or cost efficiency. Particularly in price-sensitive industries with tight operational budgets, this tournament could damage bentonite's market share. To keep their competitiveness, bentonite producers have to constantly be creating and refining their product quality. Bentonite's value proposition is challenged by the availability of synthetic alternatives needing less thorough processing, so lowering its appeal in uses where cost-efficiency is most important.

Bentonite Market Opportunities:

The developing nations act as a great opportunity for the market to grow its operations and expand its reach.

Bentonite is presented with significant growth possibilities by fast urbanization and industrialization in areas including Africa, Latin America, and the Asia-Pacific region. Governments in these areas are progressively putting funds into contemporary infrastructure, including environmental restoration projects, extensive building projects, and sustainable agricultural techniques. For example, bentonite is a sealant and binder used in construction and civil engineering projects that is becoming progressively more in demand as urbanization is going at a fast pace in India and parts of Africa. In fledgling markets as well, government-driven efforts to improve water management systems and environmental remediation are increasing bentonite use. In addition to increasing knowledge of bentonite's ecological advantages, these elements are setting the areas for sped-up market expansion.

The recent innovations in the field of processing technologies are a major market opportunity to grow.

Reducing production expenses and improving the quality of bentonite goods depend critically on investments in new processing and refining techniques. Advanced beneficiation methods, better drying procedures, and chemical treatments, among other technological advancements, will enable lower-cost production of bentonite with greater performance properties and higher purity at last. By reducing waste in production and increasing energy efficiency, these breakthroughs also create possibilities for custom items meeting particular industry standards. Manufacturers who use these new technologies will obtain efficiencies of scale and enhanced competitiveness, thus raising adoption in several fields, including construction, environmental rehabilitation, and agriculture.

The recent shift towards sustainable farming practices has resulted in the rise of demand for bentonite.

The demand for bentonite, a natural soil conditioner, is increasing as the world turns to more environmentally friendly agricultural techniques. Its natural properties—that include improved soil fertility, better water retention, and controlled nutrient flow—make bentonite a necessary adjunct in contemporary farming. Natural materials are more and more used in sustainable agriculture methods, which center on lowering chemical inputs and improving soil health. Bentonite can increase crop yields by utilizing its effects on soil composition and moisture retention, especially in arid and semi-arid areas, according to current research findings. The agricultural industry's increasing focus on organic and environmentally friendly farming techniques is enlarging bentonite's market.

The increased preference for natural and eco-friendly products has increased the use of bentonite in these segments.

The pharmaceutical and cosmetic sectors are finding bentonite more useful as customers change their preferences toward green and organic items. Bentonite is a well-liked component in many formulations, including topical creams, detoxifying masks, and oral care products, owing to its great absorbent and purifying qualities. Driven by growing consumer knowledge and government pressure for safer, non-toxic ingredients, recent market studies have shown a constant demand for natural additives in health and beauty products. Manufacturers have a profitable opportunity in the development of specialized solutions utilizing the distinctive properties of bentonite since this sector benefits from both the organic product development trends and the continuous consumer health and well-being emphasis.

BENTONITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.25% |

|

Segments Covered |

By Product Type, application, end user industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Imerys, Thiele Kaolin Company, Attapulgite International, Bentonite Resources, Clariant, KaMin LLC, Ashapura Group, St. Gobain, Bentonite & Clay Industries, Huntsman Corporation |

Bentonite Market Segmentation:

Bentonite Market Segmentation: By Product Type

- Calcium Bentonite

- Sodium Bentonite

- Mixed Bentonite

Sodium Bentonite is the dominant segment, and mixed bentonite is the fastest-growing segment. Sodium Bentonite is the preferred option in construction and drilling on account of its high absorbency and flexibility. Mostly utilized in drilling fluids and sealants, appreciated for its great absorption capacity. Innovation in blending techniques is rapidly expanding its applications in environmental remediation and pharmaceuticals, making mixed bentonite the fastest-growing segment. Famous for its swelling and sealing qualities, calcium bentonite is frequently used in environmental applications and drilling.

Bentonite Market Segmentation: By Application

- Drilling Fluids

- Foundry Sands

- Sealants & Binders

- Pharmaceuticals

- Others

Drilling Fluids is considered the dominant segment in the market due to its large use in the oil and gas industry. It is extensively used for wellbore stability and lubrication in oil and gas drilling. Whereas the pharmaceutical segment is the fastest-growing one, the rising demand for natural ingredients and eco-friendly products is driving this growth. It is used for its absorbent and purifying qualities, including in beauty and health products.

The foundry sands are used in foundry molds as a binder due to their binding properties. Used in building and environmental contexts, sealants and binders provide waterproofing and sealing. The others segment includes special business uses and environmental restoration.

Bentonite Market Segmentation: By End-Use Industries

- Oil & Gas

- Construction

- Agriculture

- Pharmaceuticals

- Cosmetics

- Others

The oil & gas segment is the dominant one, whereas the pharmaceutical segment is the fastest-growing one. Thanks to their vast drilling operations, the oil & gas sector is the most significant consumer of bentonite. When it comes to the pharmaceutical segment, the rising emphasis on natural and organic products is driving fast development in this sector.

When it comes to civil engineering projects, construction, and infrastructure, bentonite is used in waterproofing and sealing applications. In the agriculture sector, it is used to enhance water retention and soil quality, and for the cosmetics segment, it is used due to its cleansing properties. The Others segment covers environmental restoration and specific industrial uses.

Bentonite Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

The direct sales segment is the dominant one due to its high preference for large-scale custom orders by clients. Online retail is considered the fastest-growing segment due to rapid digitalization and the ease of access.

In the distributors segment, the intermediaries have an important role in reaching the smaller customers and regional markets.

Bentonite Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Here Asia-Pacific region is considered the dominant player of the market due to high levels of industrial growth and investments in infrastructure. Whereas South America is the fastest-growing region, which is due to high economic development and industrialization.

North America stands second in this market as it has a mature market with advanced technologies. Europe, on the other hand, is characterized by strict rules and regulations regarding the environment. The MEA region is marked by an increase in infrastructural development and environmental projects.

COVID-19 Impact Analysis on the Global Bentonite Market:

Initially, the global bentonite supply chain was disturbed by the COVID-19 epidemic because of logistic difficulties and diminished mining activities, therefore, production levels suffered. Yet the crisis also sped up the use of environmentally friendly and cost-effective materials in several sectors as businesses wanted to lower operational hazards and increase supply chain resilience. In reaction, many companies increased output and broadened their supply channels, which resulted in a strong post-pandemic recovery. Furthermore, stoking demand for bentonite and thereby strengthening its long-term market potential are rising expenditures on environmental remediation projects and infrastructure during the recovery phase.

Latest Trends/ Developments:

Improvements in processing equipment are lowering energy use and waste, therefore making bentonite output more sustainable.

Specialized bentonite mixes adapted to particular uses like cosmetics and pharmaceuticals are in development by manufacturers.

Production methods are benefiting from advanced quality control and digital monitoring systems, therefore improving product consistency and reliability.

Innovations and market reach expansion are inspired by partnerships among research institutions, mining firms, and consumer industries.

Key Players:

- Imerys

- Thiele Kaolin Company

- Attapulgite International

- Bentonite Resources

- Clariant

- KaMin LLC

- Ashapura Group

- St. Gobain

- Bentonite & Clay Industries

- Huntsman Corporation

Chapter 1. Bentonite Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Bentonite Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Bentonite Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Bentonite Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Bentonite Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Bentonite Market– By Product Type

6.1 Introduction/Key Findings

6.2 Calcium Bentonite

6.3 Sodium Bentonite

6.4 Mixed Bentonite

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. Global Bentonite Market– By Application

7.1 Introduction/Key Findings

7.2 Drilling Fluids

7.3 Foundry Sands

7.4 Sealants & Binders

7.5 Pharmaceuticals

7.6 Others Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Bentonite Market– By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis Distribution Channel

8.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. Global Bentonite Market– By End-User Industry

9.1 Introduction/Key Findings

9.2 Oil & Gas

9.3 Construction

9.4 Agriculture

9.5 Pharmaceuticals

9.6 Cosmetics

9.7 Others

9.8 Y-O-Y Growth trend Analysis End-User Industry

9.9 Absolute $ Opportunity Analysis End-User Industry , 2025-2030

Chapter 10. Bentonite Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By Distribution Channel

10.1.4. By Application

10.1.5. End-User Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By Distribution Channel

10.2.4. By Application

10.2.5. End-User Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By End-User Industry

10.3.4. By Application

10.3.5. Distribution Channel

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User Industry

10.4.3. By Application

10.4.4. By Product Type

10.4.5. Distribution Channel

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Distribution Channel

10.5.3. By End-User Industry

10.5.4. By Application

10.5.5. Product Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Bentonite Market– Company Profiles – (Overview, Service Product Type Portfolio, Financials, Strategies & Developments)

11.1 Imerys

11.2 Thiele Kaolin Company

11.3 Attapulgite International

11.4 Bentonite Resources

11.5 Clariant

11.6 KaMin LLC

11.7 Ashapura Group

11.8 St. Gobain

11.9 Bentonite & Clay Industries

11.10 Huntsman Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Technical developments together with expanding uses in industry and environment propel market development. These are some of the market drivers.

The drilling fluids in the oil and gas business are considered the biggest consumer of bentonite.

High manufacturing expenses, unstable raw material costs, and legal requirements are major obstacles that are being faced by the global bentonite market.

To meet sustainability goals, firms are spending money on product customization and green processing methods.

South America is considered the fastest-growing region in this market due to rapid industrialization and spending on infrastructure.