Genomics Market Size (2025 – 2030)

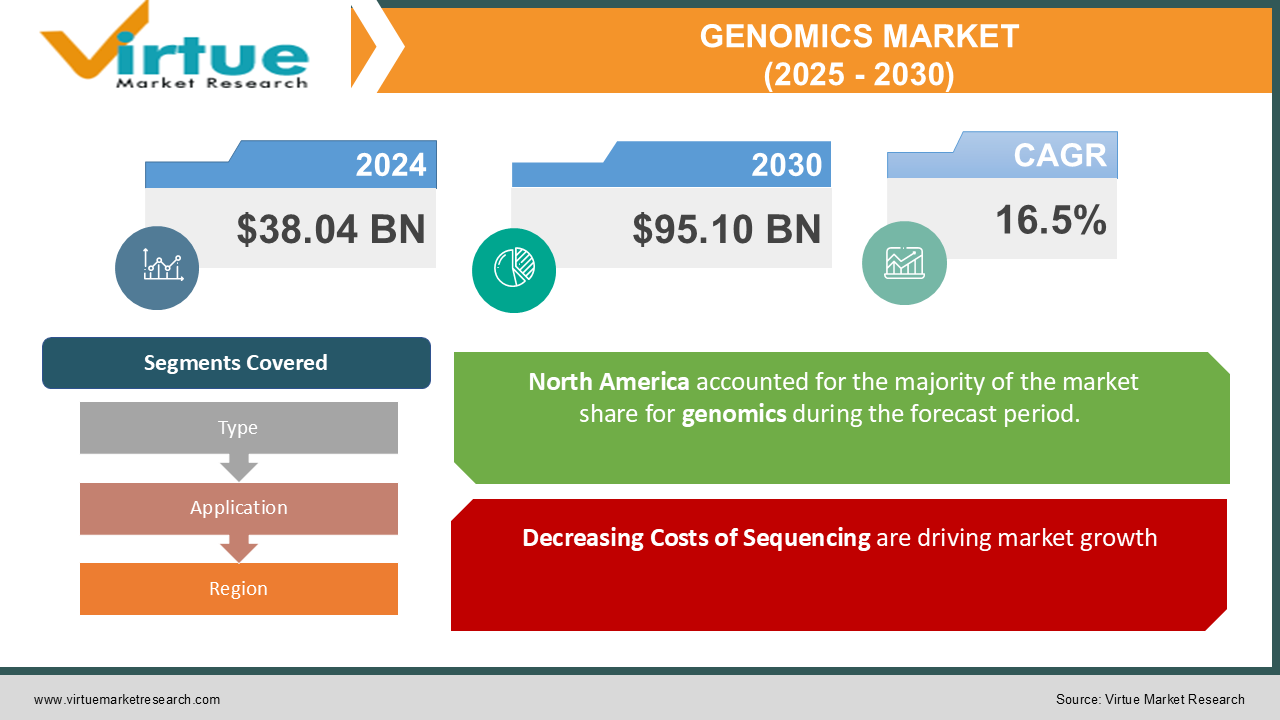

The Global Genomics Market was valued at USD 38.04 billion in 2024 and will grow at a CAGR of 16.5% from 2025 to 2030. The market is expected to reach USD 95.10 billion by 2030.

The Genomics Market encompasses all the products and services related to the study, analysis, and manipulation of genes and genomes. This includes technologies for DNA sequencing, gene editing (CRISPR), gene therapy, and bioinformatics tools to analyze the vast amount of genetic data. It's a rapidly growing field with applications in personalized medicine, drug discovery, agriculture, and forensics.

Key Market Insights:

-

North America currently holds the largest market share, exceeding 45% in 2022 (Precedence Research). This is attributed to factors like favorable government policies, high research activity, and the presence of major players like Illumina and Thermo Fisher Scientific.

-

Asia Pacific is expected to witness the fastest growth rate due to increasing healthcare spending, rising awareness of genomics, and a growing number of startups in the region.

-

Products hold a dominant market share (around 71%) due to advancements in technologies like Next-Generation Sequencing (NGS).

Global Genomics Market Drivers:

Decreasing Costs of Sequencing are driving market growth:

The dramatic plummet in DNA sequencing costs, fueled by technological advancements, has democratized access to this powerful tool. No longer confined to elite research labs, cheaper sequencing empowers a wider range of players. Research institutions can delve deeper into complex diseases, hospitals can personalize treatment plans, and even individuals can explore their genetic makeup. This accessibility unlocks a treasure trove of possibilities. In personalized medicine, doctors can tailor therapies to a patient's unique genetic profile, potentially leading to more effective treatments with fewer side effects. Drug discovery can be revolutionized by identifying genetic targets for new medications, accelerating the development process. The ripple effects extend beyond healthcare. Agriculture can benefit from the creation of crops with improved yield, disease resistance, and nutritional value, based on genetic insights. As sequencing costs continue to shrink, the true potential of genomics will undoubtedly unfold, ushering in a new era of innovation across various sectors.

Growing Demand for Personalized Medicine is driving market growth:

Personalized medicine represents a paradigm shift from a "one-size-fits-all" approach to healthcare. By leveraging the power of genomics, doctors can unlock the secrets of an individual's genetic code. This information provides a roadmap for disease susceptibility, potential drug interactions, and even personalized treatment options. Genomics plays a critical role in identifying variations within genes that are linked to specific diseases. With this knowledge, doctors can design targeted treatment plans that exploit a patient's unique vulnerabilities. Imagine a future where a cancer diagnosis isn't just about the stage or type, but incorporates a patient's genetic makeup to identify the most effective drug combination with minimal side effects. This personalized approach has the potential to revolutionize healthcare, leading to better outcomes, improved patient quality of life, and a reduction in ineffective or harmful treatments. However, it's important to remember that genomics is still a young science, and deciphering the complex interplay of genes and environment remains an ongoing challenge. Nevertheless, the potential for personalized medicine is undeniable, and as our understanding of the genome continues to grow, we can expect even more precise and effective treatments tailored to each individual.

The rise in Chronic Diseases is driving market growth:

Chronic diseases like cancer, diabetes, and heart disease cast a long shadow over global health, with their prevalence steadily climbing. But genomics offers a glimmer of hope in this fight. By delving into the genetic code, researchers are unlocking the secrets behind these complex illnesses. This newfound understanding of the genetic basis of chronic diseases empowers them to develop a multi-pronged attack strategy. Firstly, more accurate diagnostic tools can be created, allowing for earlier detection and intervention when the disease is most treatable. This can significantly improve patient outcomes and potentially save lives. Secondly, genomics paves the way for preventive strategies. By identifying individuals with a genetic predisposition to certain chronic diseases, preventive measures can be implemented, such as lifestyle changes or targeted medications. This proactive approach could significantly lessen the future burden of chronic diseases on healthcare systems. Finally, with a deeper understanding of the genetic factors involved, researchers can develop more effective treatments. This could involve personalized therapies tailored to an individual's unique genetic makeup, leading to more targeted and successful interventions with fewer side effects. By unraveling the genetic code of chronic diseases, genomics holds the promise of a healthier future, potentially mitigating the global burden of these debilitating illnesses.

Global Genomics Market challenges and restraints:

Ethical Concerns is a significant hurdle for Genomics:

As genomics delves into the intricate world of our genes, it unearths a wealth of highly personal information. This exciting discovery comes hand-in-hand with significant privacy concerns. Safeguarding this sensitive data is paramount. Security breaches could expose an individual's genetic makeup to unauthorized parties, potentially leading to discrimination or misuse of the information. Furthermore, questions arise regarding data ownership. Who controls this genetic information? Can it be used for unintended purposes by insurance companies or employers? The ethical considerations surrounding gene editing add another layer of complexity. The possibility of engineering future generations with desirable traits often referred to as "designer babies", raises serious questions about social equity and the potential manipulation of human life. Moreover, the potential misuse of this powerful technology for malicious purposes necessitates careful consideration and strong regulations. To ensure the responsible and ethical use of genomics, robust data security measures, clear ownership rights, and open discussions about the ethical implications of gene editing are crucial.

The regulatory landscape is throwing a curveball at the Genomics market:

The breakneck pace of innovation in genomics presents a challenge for regulators. Existing regulations often resemble a patchwork quilt, struggling to keep pace with the constant advancements. This regulatory lag creates a grey area, potentially hindering ethical practices and jeopardizing data privacy. Clear and consistent regulations are urgently needed to ensure the responsible use of this powerful technology. Firstly, robust regulations are essential to safeguard data privacy. They should define clear guidelines for data collection, storage, and access, protecting individuals from unauthorized use or exploitation of their genetic information. Secondly, ethical practices require clear frameworks. Regulations should address concerns surrounding gene editing, ensuring its use adheres to ethical principles and prevents misuse for discriminatory purposes. Finally, responsible clinical applications necessitate well-defined regulatory pathways. Clear guidelines for clinical trials involving genomics will ensure patient safety and pave the way for the safe integration of genomics into mainstream healthcare. By addressing the regulatory gap, we can harness the potential of genomics while mitigating potential risks, ensuring its ethical and responsible application for the benefit of society.

Market Opportunities:

The genomics market presents a treasure trove of opportunities across various sectors. Personalized medicine stands as a frontrunner, with genomics enabling the development of tailored treatment plans based on an individual's unique genetic makeup. This could lead to more effective therapies with fewer side effects, revolutionizing cancer treatment, organ transplantation compatibility, and management of chronic diseases like diabetes. Beyond healthcare, advancements in gene editing unlock possibilities in agriculture. Engineering crops with improved yield, disease resistance, and enhanced nutritional value can address global food security concerns. Furthermore, genomics has the potential to revolutionize forensics by enabling more accurate identification of suspects and victims in criminal investigations. Additionally, the environmental sector can benefit from genomics by aiding in bioremediation efforts and developing strategies to combat climate change

GENOMICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), QIAGEN N.V. (Germany), Agilent Technologies, Inc. (US), BGI (China), Pacific Biosciences of California, Inc. (US), Oxford Nanopore Technologies plc (UK), Illumina, Inc. (US) |

Genomics Market Segmentation - By Type

-

Products

-

Services

Currently, Products hold the dominant market share in the Genomics Market, exceeding Services. This is driven by the continuous advancements in powerful technologies like Next-Generation Sequencing (NGS) machines, which have become instrumental in various genomic analyses. Additionally, the development of gene editing tools like CRISPR-Cas9 and sophisticated bioinformatics software for data analysis have fueled the demand for these products. While Services are growing due to the increasing need for specialized expertise in areas like data analysis and genetic testing, readily available and powerful products remain the backbone of this market.

Genomics Market Segmentation - By Application

-

Diagnostics

-

Drug Discovery and Development

Diagnostics currently holds the leading position in the Genomics Market compared to Drug Discovery and Development. This is driven by the rise of personalized medicine and the focus on early disease detection. Genomics allows doctors to identify genetic predispositions to diseases like cancer, Alzheimer's, and heart disease. Early detection empowers them to intervene with preventative measures or targeted therapies, potentially leading to better patient outcomes and reduced healthcare costs. While Drug Discovery and Development holds immense promise for the future, Diagnostics offers a more immediate and impactful application of genomics technology, making it the current frontrunner.

Genomics Market Segmentation - Regional Analysis

-

North America

-

Asia

-

Europe

-

South America

-

Middle East and Africa

North America currently reigns supreme in the Genomics Market, holding the largest market share and exceeding 45% in 2024. This dominance can be attributed to several factors, including favorable government policies that support research and development, a strong presence of major players in the field like Illumina and Thermo Fisher Scientific, and a well-established research infrastructure. However, Asia Pacific is projected to be the fastest-growing region due to factors like increasing healthcare spending, rising awareness of genomics and its potential, and a burgeoning number of startups in the region.

COVID-19 Impact Analysis on the Global Genomics Market

The COVID-19 pandemic delivered a double-edged sword to the Genomics Market. Initially, research efforts shifted towards understanding the virus, leading to a surge in demand for genomic sequencing technologies and bioinformatics expertise. This accelerated the development of diagnostic tools and potential treatments. However, routine genomic procedures faced delays due to resource allocation towards COVID-19. The pandemic also highlighted the importance of global collaboration and data sharing, fostering international research efforts. Looking ahead, the learnings from COVID-19 are expected to bolster the field. Increased government funding for genomics research and growing public awareness of its potential are likely to propel market growth. Additionally, the development of rapid diagnostic tools and personalized medicine approaches spurred by the pandemic can be adapted for other diseases, leading to a lasting positive impact on the Genomics Market.

Latest trends/Developments

The Genomics Market is brimming with exciting developments. One key trend is the plummeting cost of DNA sequencing, democratizing access for research institutions, hospitals, and even individuals. This unlocks a treasure trove of possibilities in personalized medicine. Doctors can tailor treatment plans based on a patient's unique genetic makeup, potentially leading to more effective therapies with fewer side effects. Another hot area is the rise of single-cell genomics, allowing scientists to analyze the genetic makeup of individual cells within a tissue sample. This unveils hidden cellular diversity and promises a deeper understanding of complex diseases like cancer. Additionally, CRISPR-Cas9 gene editing technology is undergoing continuous refinement, offering immense potential for treating genetic disorders and developing novel therapies. However, ethical considerations surrounding gene editing and data privacy concerns remain paramount. Robust regulations and open discussions are crucial to ensure the responsible use of this powerful technology. The market is also witnessing a surge in collaborations between pharmaceutical companies and genomics startups, accelerating drug discovery and development. As artificial intelligence (AI) integrates with genomics, researchers can analyze massive datasets more efficiently, leading to groundbreaking discoveries. Overall, the Genomics Market is at a tipping point, poised to revolutionize healthcare, agriculture, and various other fields as these exciting trends continue to unfold.

Key Players:

-

Illumina, Inc. (US)

-

Thermo Fisher Scientific, Inc. (US)

-

F. Hoffmann-La Roche Ltd. (Switzerland)

-

Danaher Corporation (US)

-

QIAGEN N.V. (Germany)

-

Agilent Technologies, Inc. (US)

-

BGI (China)

-

Pacific Biosciences of California, Inc. (US)

-

Oxford Nanopore Technologies plc (UK)

-

Illumina, Inc. (US)

Chapter 1. Genomics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Genomics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Genomics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Genomics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Genomics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Genomics Market – By Type

6.1 Introduction/Key Findings

6.2 Products

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Genomics Market – By Application

7.1 Introduction/Key Findings

7.2 Diagnostics

7.3 Drug Discovery and Development

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Genomics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Genomics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Illumina, Inc. (US)

9.2 Thermo Fisher Scientific, Inc. (US)

9.3 F. Hoffmann-La Roche Ltd. (Switzerland)

9.4 Danaher Corporation (US)

9.5 QIAGEN N.V. (Germany)

9.6 Agilent Technologies, Inc. (US)

9.7 BGI (China)

9.8 Pacific Biosciences of California, Inc. (US)

9.9 Oxford Nanopore Technologies plc (UK)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Genomics Market was valued at USD 38.04 billion in 2024 and will grow at a CAGR of 16.5% from 2025 to 2030. The market is expected to reach USD 95.10 billion by 2030.

The decreasing Cost of Sequencing, Growing Demand for Personalized Medicine, and Rise in Chronic Diseases are the reasons that are driving the market.

Based on Application it is divided into two segments – Diagnostics, Drug Discovery, and Development.

North America is the most dominant region for the luxury vehicle Market.

Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), QIAGEN N.V. (Germany).