Global Non-Human Genomics Market Size (2023 – 2030)

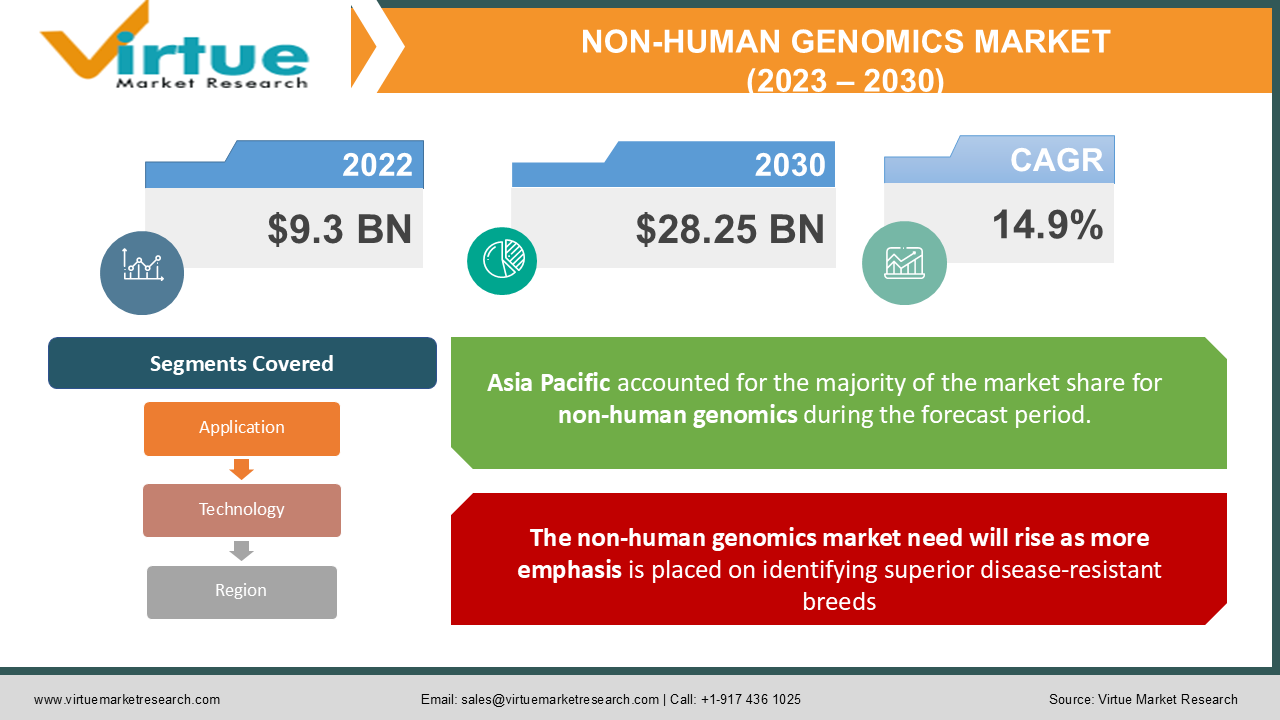

In 2022, the Global Non-Human Genomics Market was valued at USD 9.3 billion and is projected to reach a market size of USD 28.25 billion by 2030. The market is projected to grow with a CAGR of 14.9% per annum during the period of analysis (2023 - 2030).

Industry Overview

The goal of non-human genetics is to create creatures with the most desirable characteristics. Strategic breeding can be used to select features for adaption to a certain condition or disease resistance in a non-human. A genetically modified cow may be able to produce more milk and be less sensitive to common cattle diseases such as bovine respiratory disease complex, clostridial disease, and so on, increasing the total profit of cattle ranchers. As a result, this component of non-human genetics has gained widespread recognition, which is projected to drive the non-human genetics industry forward.

The industry is also predicted to develop due to a growing push to educate people about non-human genetic testing. The Veterinary Genetics Laboratory (VGL) of the UC Davis School of Veterinary Medicine, for example, has introduced an upgraded and enhanced website as well as various new assays for the veterinary community in June 2020. In addition, Embark Veterinary, Inc. announced its DNA test for purebred canines in October 2021. The kit provides purebred owners with unique, actionable health information that can be shared with a veterinarian to assist formulate diagnostic, monitoring, and treatment strategies. Such activities will lead to greater use of genetic testing for non-human health care, propelling the industry forward.

Increased use of advanced genetic technology for larger-scale production and quality breeds will also affect market growth. As a result of the aforementioned factors, the market for non-human genetics is predicted to increase considerably throughout the forecast period. The dearth of experienced experts to conduct genetics-related procedures in veterinary research, on the other hand, is likely to stifle market expansion throughout the forecast period.

Impact of Covid-19 on the Industry

The non-human genetics market is predicted to be significantly impacted by the COVID-19 pandemic. Many meat processing plants were shut down during the COVID-19 pandemic, according to a study report published in Frontiers in Veterinary Science in September 2020, putting significant strain on the poultry and pig sectors in the United States. As a result, the quantity of livestock and cattle slaughtered every day decreased, increasing the number of non-humans on farms. As a result, cattle producers were urged to slow down their breeding methods to reduce the number of non-humans on the farm. This may have resulted in greater genetic testing on-farm non-humans to minimize the growth of farm non-humans, which is fuelling market expansion.

Market Drivers

The non-human genomics market need will rise as more emphasis is placed on identifying superior disease-resistant breeds

Researchers in the field of non-human genetics have discovered features inside genes that improve non-human health, development, and capacity to absorb nutrition. These genetic advances boost output while lowering the environmental effect. Livestock and non-humans provide food security and livelihoods for about a billion people worldwide, accounting for around 40% of global agricultural production. As a result, studying non-human genetics to identify and produce disease-resistant breeds is critical for the rising population. In addition, the COVID-19 epidemic, which began in Wuhan and progressively spread throughout the world, has claimed millions of lives. The epidemic has highlighted the need for eating practices that are both safe and nutritious. As a result, non-human genetics has become a major aspect of agriculture including farming non-humans.

The non-human genomics market will benefit from increased poultry farming for meat and dairy products

In 2021, the poultry industry was worth more than USD 1.4 billion. When compared to plant-based meals, demand for higher-quality foods such as eggs, meat, and milk has increased significantly. Changes in consumption patterns, as well as population growth and urbanization, have increased demand for the chicken farming business. Because poultry non-human products are in great demand and will continue to expand, the entire market value will increase throughout the projection period.

Market Restraints

A scarcity of qualified professionals has hampered the non-human genomics

Pharmacogenomics, diagnostics, and toxicogenomics are only a few of the applications for genetic data. However, analyzing the massive amounts of data generated in genomics research is a significant difficulty. In certain circumstances, technical developments have enabled the instruments in use to give an analysis; yet, the reader's judgment remains subjective. It is vital to recruit skilled specialists to evaluate and interpret the outcomes of genome sequencing data due to the intricacies involved and the requirement for in-depth understanding in the field of genomics. However, due to a scarcity of qualified individuals, a lot of end-users are having difficulty processing genetic data.

Non-Human Genomics Market Repote Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.9% |

|

Segments Covered |

By Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Neogen Corporation (US), Genus (UK), URUS (US), EW Group (Germany), Groupe Grimaud (France), CRV Holding (Netherlands), Topigs Norsvin (Netherlands), Zoetis (US), Envigo (US), Hendix Genetics (Netherlands), Non-human Genetics (US) |

This research report on the global non-human genomics market has been segmented and sub-segmented based on Application, Technology, Geography & region.

Global Non-Human Genomics Market- By Application

- Gene Expression

- Non-human Breeding

- Genetic Trait Testing

- Genetic Disease Testing

Non-human genetics is a field of genetics that studies inheritance and gene variation in both domestic and wild non-humans. This includes gene expression, non-human breeding, and physical genetic features dependent only on inheritance, such as coat color, body structure, face form, and others. DNA testing, genetic trait testing, and genetic disease training are all done with non-humans. During the forecast period, the non-human genetics market is projected to grow due to rising demand, increased consumption of non-human proteins, and a rise in urban population, all of which drive demand for meat products around the world.

Global Non-Human Genomics Market- By Technology

- Sequencing

- PCR

- Nucleic Acid Extraction and Purification

- Microarray

- Other Technologies

Sequencing, PCR, Nucleic Acid Extraction and Purification, Microarray, and Other Technologies are the technology segments in the Genomics Market. The sequencing sector accounted for the largest revenue share of the entire Non-Human Genomics market in 2021. Sequencing technologies' characteristics, such as ultra-high throughput, scalability, and speed, enable researchers to execute a wide range of tasks, including non-human breeding, agriculture, and human genomics.

Global Non-Human Genomics Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Owing to its significant participants and growing demand for non-human protein, North America leads the non-human genetics industry. Furthermore, the rising adoption of innovative non-human genetics technology and the recognized livestock industry would boost the market's growth rate in this area.

During the projection period, the Asia Pacific market is anticipated to develop at the fastest rate. The established livestock sector, developing porcine industry, rising per capita incomes and increasing per capita expenditure on non-human care, and increasing knowledge of technologically sophisticated non-human genetic goods and services in this region are all contributing to the market's growth.

Global Non-Human Genomics Market- By Companies

-

Neogen Corporation (US)

-

Genus (UK)

-

URUS (US)

-

EW Group (Germany)

-

Groupe Grimaud (France)

-

CRV Holding (Netherlands)

-

Topigs Norsvin (Netherlands)

-

Zoetis (US), Envigo (US)

-

Hendix Genetics (Netherlands)

-

Non-human Genetics (US)

NOTABLE HAPPENINGS IN THE GLOBAL NON-HUMAN GENOMICS MARKET IN THE RECENT PAST:

- Business Partnership: - In January 2021, Genus ABS and The Bair Ranch cooperated to illustrate the impact of a cow-calf management system using sex-skewed semen and terminal genetics.

- Business Partnership: - In February 2020, to create Neogen's next generation of non-human genomic tests, the business worked with Gencove, a genetic testing company.

- Business Partnership: - In October 2020, Solidaridad and Hendrix Genetics teamed up to supply sustainable poultry in Mozambique and Zambia, Africa.

Chapter 1.Global Non-Human Genomics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Global Non-Human Genomics Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Global Non-Human Genomics Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Global Non-Human Genomics MarketEntry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Global Non-Human Genomics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Global Non-Human Genomics Market– By Application

6.1. Gene Expression

6.2. Non-human Breeding

6.3. Genetic Trait Testing

6.4. Genetic Disease Testing

Chapter 7.Global Non-Human Genomics Market– By Technology

7.1. Sequencing

7.2. PCR

7.3 Nucleic Acid Extraction and Purification

7.4. Microarray

7.5. Other Technologies

Chapter 8. Global Non-Human Genomics Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.Global Non-Human Genomics Market– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Neogen Corporation (US)

9.2. Genus (UK)

9.3. URUS (US)

9.4. EW Group (Germany)

9.5. Groupe Grimaud (France)

9.6. CRV Holding (Netherlands)

9.7. Topigs Norsvin (Netherlands)

9.8. Zoetis (US), Envigo (US)

9.9. Hendix Genetics (Netherlands)

9.10. Non-human Genetics (US)

Download Sample

Choose License Type

2500

4250

5250

6900