Frozen Bakery Products Market Size (2024 – 2030)

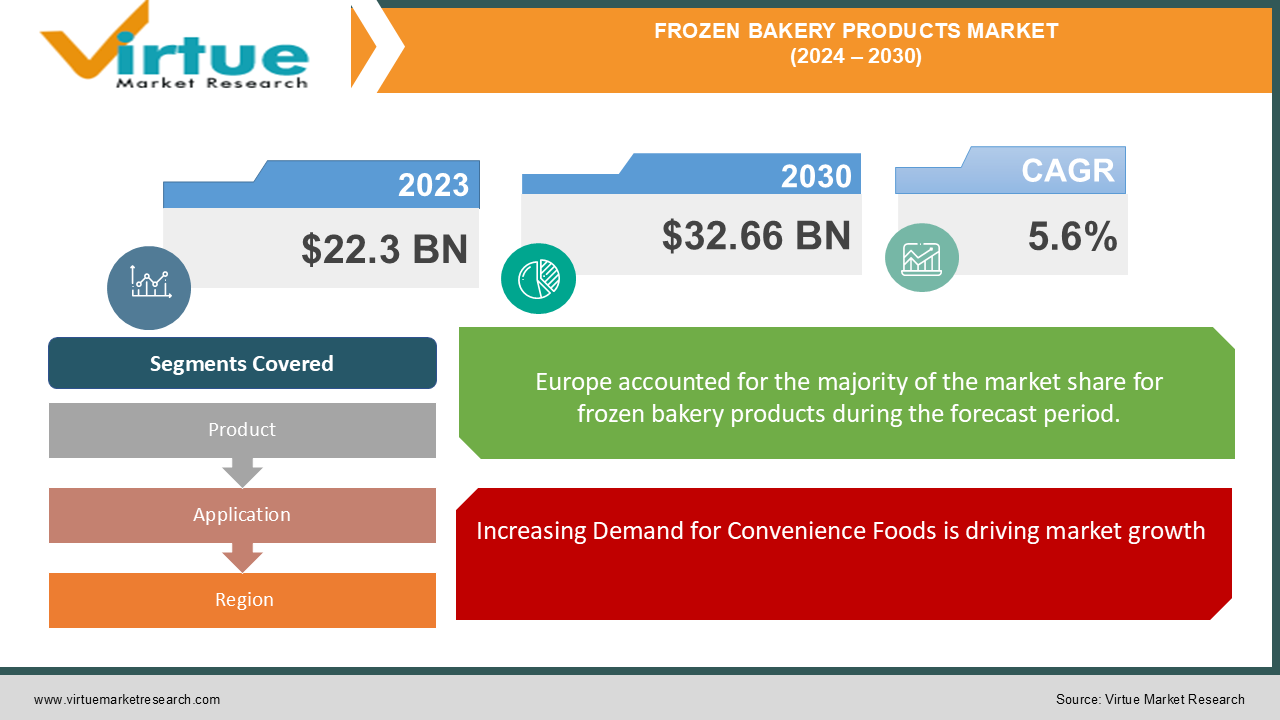

The Global Frozen Bakery Products Market was valued at USD 22.3 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to reach USD 32.66 billion by 2030.

The Frozen Bakery Products Market includes various baked goods that are frozen to extend their shelf life and ensure they retain freshness until consumption. The market is driven by the growing demand for convenience foods, urbanization, and the increasing trend of on-the-go lifestyles. Products like frozen bread, cakes, pastries, and pizza crusts are witnessing high demand across both developed and developing regions.

Key Market Insights

The global shift towards ready-to-eat food products has significantly boosted the demand for frozen bakery products, making them a staple in many households and foodservice outlets.

Europe dominates the frozen bakery products market, primarily due to high consumption rates and the presence of major manufacturers in the region. Asia-Pacific is projected to be the fastest-growing region, driven by rising disposable incomes, urbanization, and the increasing westernization of diets.

The growing popularity of artisanal and premium frozen bakery products is influencing the market, with consumers’ increasingly seeking high-quality and diverse product offerings.

Health-conscious consumers are pushing manufacturers to introduce healthier frozen bakery products, such as those with whole grains, low sugar, and gluten-free options.

Global Frozen Bakery Products Market Drivers

Increasing Demand for Convenience Foods is driving market growth: The rising pace of life, particularly in urban areas, has significantly increased the demand for convenience foods, including frozen bakery products. Consumers are looking for quick meal solutions that do not compromise on taste or quality, making frozen bakery products a popular choice. The growing working population, coupled with the trend of nuclear families, has further fueled this demand. Frozen bakery products offer the convenience of long shelf life and ease of preparation, catering to the needs of modern consumers who have less time to cook from scratch. This trend is expected to continue driving market growth in the coming years, as more consumers opt for ready-to-eat and easy-to-prepare food options.

Growth of the Foodservice Industry is driving market growth: The expansion of the foodservice industry, including cafes, restaurants, and quick-service restaurants (QSRs), is a major driver of the frozen bakery products market. These establishments rely heavily on frozen bakery products to ensure consistency, reduce preparation time, and manage inventory efficiently. The convenience of having ready-to-bake or ready-to-thaw products allows foodservice operators to serve a variety of bakery items with minimal effort. Additionally, the growing trend of eating out and the increasing popularity of bakery cafés and fast-food chains are further boosting the demand for frozen bakery products. As the foodservice industry continues to grow, particularly in emerging markets, the demand for frozen bakery products is expected to rise accordingly.

Innovations in Product Offerings is driving market growth: Manufacturers in the frozen bakery products market are continuously innovating to meet changing consumer preferences and to differentiate their products in a competitive market. This includes the introduction of new flavors, healthier options such as gluten-free and low-sugar products, and premium offerings that cater to the demand for artisanal bakery items. The development of innovative freezing techniques that maintain the quality and freshness of bakery products has also played a significant role in driving market growth. As consumers become more adventurous in their food choices and increasingly seek out unique and high-quality products, the market for frozen bakery products is expected to expand further.

Global Frozen Bakery Products Market Challenges and Restraints

Health Concerns and Changing Consumer Preferences is restricting market growth: One of the major challenges facing the frozen bakery products market is the growing health consciousness among consumers. With increasing awareness of the health risks associated with high sugar, fat, and preservative content, many consumers are shifting away from traditional frozen bakery products. This trend is particularly pronounced among millennials and younger consumers, who are more likely to seek out healthier food options. In response, manufacturers are under pressure to reformulate their products to include healthier ingredients and to offer alternatives such as whole grain, low-sugar, and gluten-free options. However, this shift can be challenging, as it requires significant investment in research and development, as well as potential changes in production processes.

Supply Chain Disruptions and Fluctuating Raw Material Prices is restricting market growth: The frozen bakery products market is also facing challenges related to supply chain disruptions and the volatility of raw material prices. The supply chain for frozen bakery products is complex, involving multiple stages from the sourcing of raw materials to production, freezing, and distribution. Any disruption at any stage of the supply chain, whether due to natural disasters, geopolitical tensions, or pandemics, can have a significant impact on the availability and cost of frozen bakery products. Additionally, fluctuations in the prices of key raw materials such as flour, sugar, and butter can affect profit margins and force manufacturers to pass on the increased costs to consumers, potentially reducing demand.

Market Opportunities

The frozen bakery products market presents significant opportunities for growth, particularly in emerging markets where rising incomes and urbanization are driving demand for convenient food options. As more consumers in developing regions adopt Western-style diets, the demand for frozen bakery products is expected to increase. Furthermore, the growing trend of health and wellness presents an opportunity for manufacturers to innovate and develop healthier frozen bakery products, such as those with whole grains, reduced sugar, and gluten-free options. The increasing popularity of premium and artisanal bakery products also offers an opportunity for manufacturers to differentiate their offerings and tap into the growing demand for high-quality, indulgent food experiences. Additionally, the expansion of online retail channels and advancements in freezing and packaging technologies present further opportunities for market growth.

FROZEN BAKERY PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Grupo Bimbo S.A.B. de C.V., Aryzta AG, Rich Products Corporation, General Mills Inc., Europastry S.A., Conagra Brands Inc., Lantmännen Unibake International, Vandemoortele NV, Dawn Food Products, Inc., Associated British Foods plc |

Frozen Bakery Products Market Segmentation - By Product

-

Frozen Bread

-

Frozen Cakes & Pastries

-

Frozen Pizza Crusts

-

Frozen Cookies

-

Others

Frozen Bread dominates the market due to its widespread use in households and the foodservice industry. The convenience of having ready-to-bake or ready-to-thaw bread, coupled with its longer shelf life compared to fresh bread, makes it a preferred choice for consumers. Additionally, the rising demand for different types of bread, including whole grain and artisanal varieties, further strengthens the dominance of this segment in the frozen bakery products market.

Frozen Bakery Products Market Segmentation - By Application

-

Foodservice Industry

-

Retail

-

Household

The Foodservice Industry is the most dominant application segment, driven by the increasing reliance on frozen bakery products by restaurants, cafes, and quick-service restaurants. These establishments benefit from the consistency, ease of preparation, and inventory management advantages offered by frozen bakery products, allowing them to offer a wide variety of baked goods with minimal preparation time.

Frozen Bakery Products Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Europe is the dominant region in the global frozen bakery products market, primarily due to the high consumption of bakery products and the presence of key manufacturers in the region. Countries such as France, Germany, and the UK have a strong tradition of consuming bakery products, and the demand for frozen options continues to grow due to the convenience they offer. Additionally, the region's well-established foodservice industry and the increasing trend of home baking during the COVID-19 pandemic have further boosted the market for frozen bakery products.

COVID-19 Impact Analysis on the Frozen Bakery Products Market

The COVID-19 pandemic had a mixed impact on the frozen bakery products market. Initially, the market experienced disruptions due to supply chain challenges and the closure of foodservice establishments, which are major consumers of frozen bakery products. However, the pandemic also led to a significant increase in demand for frozen foods, including bakery products, as consumers sought convenient and long-lasting food options during lockdowns. The shift towards home baking and the rise in online grocery shopping further boosted sales of frozen bakery products. As the foodservice industry gradually recovers and consumer habits normalize, the frozen bakery products market is expected to continue growing, with an increased focus on convenience, health, and premium product offerings.

Latest Trends/Developments

The frozen bakery products market is witnessing several key trends and developments. One of the most notable trends is the growing demand for premium and artisanal frozen bakery products, as consumers increasingly seek high-quality and indulgent food experiences. This trend is driving manufacturers to innovate and introduce new products that offer unique flavors, textures, and ingredients. Additionally, the health and wellness trend continues to shape the market, with an increasing number of consumers seeking healthier frozen bakery options, such as whole grain, low-sugar, and gluten-free products. The rise of online grocery shopping and the expansion of e-commerce platforms are also having a significant impact on the market, making frozen bakery products more accessible to a wider range of consumers. Furthermore, advancements in freezing and packaging technologies are improving the quality and shelf life of frozen bakery products, enhancing their appeal to consumers and driving market growth.

Key Players

-

Grupo Bimbo S.A.B. de C.V.

-

Aryzta AG

-

Rich Products Corporation

-

General Mills Inc.

-

Europastry S.A.

-

Conagra Brands Inc.

-

Lantmännen Unibake International

-

Vandemoortele NV

-

Dawn Food Products, Inc.

-

Associated British Foods plc

Chapter 1. Frozen Bakery Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Frozen Bakery Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Frozen Bakery Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Frozen Bakery Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Frozen Bakery Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Frozen Bakery Products Market – By Product

6.1 Introduction/Key Findings

6.2 Frozen Bread

6.3 Frozen Cakes & Pastries

6.4 Frozen Pizza Crusts

6.5 Frozen Cookies

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Frozen Bakery Products Market – By Application

7.1 Introduction/Key Findings

7.2 Foodservice Industry

7.3 Retail

7.4 Household

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Frozen Bakery Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Frozen Bakery Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Grupo Bimbo S.A.B. de C.V.

9.2 Aryzta AG

9.3 Rich Products Corporation

9.4 General Mills Inc.

9.5 Europastry S.A.

9.6 Conagra Brands Inc.

9.7 Lantmännen Unibake International

9.8 Vandemoortele NV

9.9 Dawn Food Products, Inc.

9.10 Associated British Foods plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Frozen Bakery Products Market was valued at USD 22.3 billion in 2023 and is projected to reach USD 32.66 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030.

The key drivers of the Frozen Bakery Products Market include the increasing demand for convenience foods, the expansion of the foodservice industry, and innovations in product offerings, such as healthier and premium frozen bakery products.

The Global Frozen Bakery Products Market is segmented by Product into Frozen Bread, Frozen Cakes & Pastries, Frozen Pizza Crusts, Frozen Cookies, and Others. By Application, the market is segmented into Foodservice Industry, Retail, and Household.

Europe is the most dominant region in the Global Frozen Bakery Products Market, primarily due to high consumption rates of bakery products and the presence of key manufacturers in the region.

Leading players in the Global Frozen Bakery Products Market include Grupo Bimbo S.A.B. de C.V., Aryzta AG, Rich Products Corporation, General Mills Inc., Europastry S.A., Conagra Brands Inc., Lantmännen Unibake International, Vandemoortele NV, Dawn Food Products, Inc., and Associated British Foods plc.