Asia Pacific Frozen Bakery Products Market Size (2023-2030)

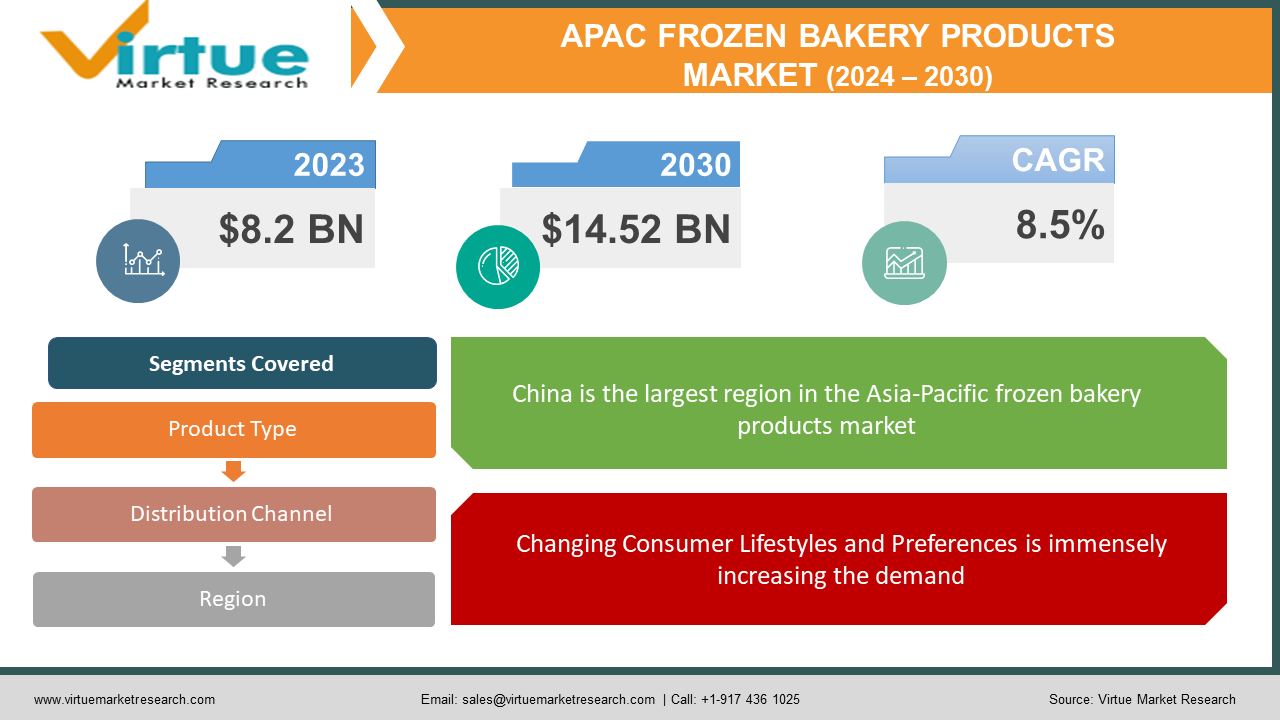

The Asia Pacific Frozen Bakery Products Market was valued at USD 8.2 Billion in 2023 and is projected to reach a market size of USD 14.52 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.5%.

The Asia Pacific frozen bakery products market is a rapidly growing sector within the global food industry, characterized by a wide range of frozen baked goods such as bread, pastries, cakes, and pizzas. This market is primarily driven by changing consumer lifestyles, urbanization, and increasing demand for convenient and ready-to-eat food options. The region's diverse culinary preferences and the adoption of Western-style baked goods have contributed to the market's expansion. Key factors influencing market growth include rising disposable incomes, a growing middle-class population, and the expansion of retail chains. Advancements in freezing technology and an emphasis on product innovation to meet evolving consumer tastes are contributing to the dynamic nature of this industry. The Asia Pacific frozen bakery products market is expected to continue its robust growth in the coming years, driven by evolving consumer preferences and the convenience these products offer.

Key Market Insights:

The shelf life of bakery products primarily hinges on the initiation of staling due to microbial spoilage, which involves a range of physicochemical alterations, including changes in taste and aroma, increased crumb hardness, crumb opacity, and starch crystallization. Other factors influencing shelf life encompass issues like crystallization, grittiness, and the degradation of flavors and odors due to moisture migration. The surging demand for frozen bakery items in the Asia-Pacific region can be attributed to recent developments in the food and beverage industry, improved economic conditions, and a growing preference for ready-to-eat food products.

As of 2023, the Bread and bakery Products market has yielded a revenue of approximately US$744.60 billion, with an expected annual growth rate of 7.32% forecasted for the 2023-2028 period. Volume-wise, the Bread & Bakery Products market is projected to reach 588.10 billion kilograms by 2028, showing a 5.3% volume growth in 2024.

Asia Pacific Frozen Bakery Products Market Drivers:

Changing Consumer Lifestyles and Preferences is immensely increasing the demand for frozen bakery products in the Asia Pacific region.

The shift in consumer lifestyles, especially in urban areas, has led to an increased demand for convenient and ready-to-eat food options. Busy schedules and dual-income households have made consumers more inclined to choose bakery products that offer quick and easy meal solutions. Furthermore, the growing preference for Western-style baked goods, such as bread, pastries, and cakes, has contributed to the market's growth. Consumers are seeking a wider variety of bakery products, including healthier options, artisanal goods, and those with unique flavors and ingredients, driving innovation and diversification in the market.

The growth of the Asia-Pacific frozen bakery products market is also being propelled by economic expansion and the increased disposable incomes of individuals in the region.

Improved economic conditions in many Asia-Pacific countries, coupled with the expansion of the middle-class population, have boosted the purchasing power of consumers. This has led to an increase in discretionary spending on bakery products. As people have more disposable income, they are more likely to indulge in baked goods, including premium and specialty items. The bakery market has capitalized on this trend by offering a range of products to cater to different income segments, from affordable everyday bread to high-end pastries and cakes, further fueling market growth.

Asia Pacific Frozen Bakery Products Market Restraints and Challenges:

Supply Chain Disruptions could pose a huge negative impact on the Asia Pacific Frozen Bakery Products Market.

The bakery industry heavily relies on a complex and extensive supply chain involving the procurement of raw materials, transportation, and distribution. Supply chain disruptions can result from various factors such as natural disasters, global events, and transportation issues. These disruptions can lead to delays in the production and delivery of bakery products, affecting their shelf life and quality. Maintaining a reliable and efficient supply chain is crucial to ensuring product availability and freshness, which is a key challenge for the industry.

Health and Dietary Concerns rising among consumers might pose challenges for this market.

There is a growing emphasis on health and nutrition worldwide, and consumers are increasingly looking for healthier, more nutritious food options. The bakery products market faces the challenge of adapting to changing consumer preferences, which often prioritize products with lower levels of sugar, salt, and unhealthy fats. Meeting these demands for healthier baked goods without compromising taste and texture can be a challenge. Addressing dietary restrictions and preferences, such as gluten-free or vegan options, poses additional complexities for the industry.

Asia Pacific Frozen Bakery Products Market Opportunities:

The Asia Pacific frozen bakery products market presents substantial opportunities for growth, driven by changing consumer lifestyles, a burgeoning middle-class population, and an increasing preference for convenient, ready-to-eat options. Key opportunities include expanding product portfolios to cater to diverse regional tastes, investing in advanced freezing technologies for improved product quality and shelf life, and tapping into burgeoning e-commerce platforms for wider distribution. The rising demand for healthier and more sustainable baked goods, as well as the potential for market expansion in emerging economies, positions the region as a promising arena for frozen bakery product manufacturers to thrive and innovate.

ASIA PACIFIC FROZEN BAKERY PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, India, South Korea, Australia and New Zealand, Rest of Asia- Pacific |

|

Key Companies Profiled |

Nestlé S.A., General Mills Inc., Conagra Brands Inc., McCain Foods Ltd., Grupo Bimbo , CJ Group, Rich Products Corporation, Dawn Foods , Lantmannen Unibake, Ajinomoti Co. Inc. |

Asia Pacific Frozen Bakery Products Market Segmentation: By Product Type:

- Bread

- Pastry

- Cakes and desserts

- Pizza crusts

- Biscuits

- Others

Bread is the largest segment in the Asia Pacific Frozen Bakery Products Market holding a market share of 58%. This is because bread is a staple food item consumed widely across various cultures in the Asia-Pacific region. It offers versatility and convenience, making it a popular choice among consumers for daily consumption and in various meal settings. With the demand for ready-to-eat and quick meal solutions on the rise, frozen bread products, including varieties like baguettes, rolls, and sliced bread, cater to convenience-seeking consumers, contributing significantly to the size of this segment. The longer shelf life and preservation of taste and texture through freezing technology make frozen bread an attractive choice for both residential and commercial users in the region. The fastest-growing segment in the frozen bakery products market by product type is Cakes and desserts anticipated to grow at a CAGR of 18.7%, due to changing consumer preferences and an increasing demand for premium, indulgent baked goods. Cakes and desserts cater to a wide range of occasions, including celebrations and special events, and the convenience of frozen options allows consumers to enjoy high-quality, professionally crafted sweets at home.

Asia Pacific Frozen Bakery Products Market Segmentation: By Distribution Channel:

- Supermarkets and hypermarkets

- Convenience stores

- Online retail

- Foodservice providers

- Specialty stores

- Others

The largest segment by distribution channel in the frozen bakery products market is typically Supermarkets and hypermarkets holding a revenue share of 61%. This is because supermarkets and hypermarkets have an extensive reach, offering a wide variety of frozen bakery products to a broad consumer base. These retail channels provide a one-stop shopping experience for customers, allowing them to conveniently access and purchase frozen bakery items along with other groceries. The online retail segment is the fastest-growing distribution channel in the frozen bakery products market growing at a rate of 19.3%. This growth can be attributed to the increasing prevalence of e-commerce platforms and changing consumer shopping habits, especially in the wake of the COVID-19 pandemic. Online retail offers the convenience of ordering frozen bakery products from the comfort of one's home, with a wide variety of choices and often competitive pricing. The desire for contactless shopping experiences and the expansion of delivery services have boosted the appeal of online retail, making it a rapidly expanding channel for accessing frozen bakery goods.

Asia Pacific Frozen Bakery Products Market Segmentation: Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia and New Zealand

- Rest of Asia- Pacific

China is the largest region in the Asia-Pacific frozen bakery products market having a share of 36%. This dominance is attributed to China's vast population and rapid urbanization, leading to increased consumer demand for convenient and ready-to-eat food options. A growing middle-class population with rising disposable incomes has fueled the demand for a wide variety of frozen bakery products in the country. China's robust food industry infrastructure and its status as a global manufacturing hub have also contributed to its leading position in the market. India is the fastest-growing region in the frozen bakery products market within the Asia-Pacific growing at a CAHR of 17%. This growth is driven by several factors, including a rapidly expanding population, increasing urbanization, changing consumer lifestyles with a preference for convenient food options, and a rising middle-class segment with higher disposable incomes. The trend of Western-style bakery products gaining popularity and the growing demand for ready-to-eat and frozen foods in India contribute to the robust growth of the market in the country.

COVID-19 Impact Analysis on the Asia Pacific Frozen Bakery Products Market:

The COVID-19 pandemic had a notable impact on the Asia Pacific frozen bakery products market. While the initial lockdowns and disruptions in the food service sector caused a temporary decline in demand, the market rebounded as consumers shifted towards home consumption and sought long-lasting, convenient food options. The pandemic underscored the importance of product innovation, online sales channels, and robust supply chain management to ensure product availability and safety. Increased focus on hygiene and the demand for value-added frozen bakery products, such as par-baked goods, has driven market growth. The long-term impact has been a heightened awareness of food safety and a lasting preference for frozen bakery products as a reliable and convenient food choice.

Latest Trends/ Developments:

One prominent trend in the frozen bakery products market is the growing demand for healthier and clean-label options. Consumers in the Asia-Pacific region, as in many other parts of the world, are increasingly looking for frozen bakery products that contain fewer artificial additives, and lower levels of sugar, salt, and unhealthy fats. This trend has led to the development of products that offer better nutritional profiles and cleaner ingredient labels, appealing to health-conscious consumers.

A notable development in the market is the increasing focus on sustainable packaging solutions for frozen bakery products. With rising environmental concerns, manufacturers are exploring eco-friendly packaging materials and designs that reduce the ecological footprint of their products. This development aligns with the global push towards sustainability and reflects the industry's commitment to minimizing its impact on the environment, which is becoming an important factor in consumers' purchasing decisions.

Individual Quick Frozen (IQF) technology is a significant development in the frozen bakery products market, enabling the preservation of product quality and taste. This technology involves freezing each item separately, preventing them from sticking together, which maintains the individual integrity of baked goods like pastries, bread, and pizza. IQF technology helps extend shelf life while preserving the products' freshness and texture, making them convenient for consumers. It has become a game-changer in the industry as it enables manufacturers to offer high-quality, portion-controlled frozen bakery products, meeting the evolving demands for convenience and ensuring that consumers can enjoy freshly baked tastes at their convenience.

Key Players:

- Nestlé S.A.

- General Mills Inc.

- Conagra Brands Inc.

- McCain Foods Ltd.

- Grupo Bimbo

- CJ Group

- Rich Products Corporation

- Dawn Foods

- Lantmannen Unibake

- Ajinomoti Co. Inc.

In Aug 2021, General Mills Inc. introduced six new additions to its frozen bakery product line under the Pillsbury brand, aiming to rebound from the pandemic losses. Among these, Pillsbury Monkey Bread stands out, featuring pre-cut dough kits accompanied by a delectable, sweet cinnamon sauce pouch.

Chapter 1. Asia Pacific Frozen Bakery Products Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Frozen Bakery Products Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Frozen Bakery Products Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Frozen Bakery Products Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Frozen Bakery Products Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Frozen Bakery Products Market – By Product Type

6.1. Introduction/Key Findings

6.2. Bread

6.3. Pastry

6.4. Cakes and desserts

6.5. Pizza crusts

6.6. Biscuits

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Asia Pacific Frozen Bakery Products Market – By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Specialty Stores

7.4. Online Retail

7.5. Foodservice providers

7.6. Convenience stores

7.7. Others

7.7. Y-O-Y Growth trend Analysis Distribution Channel

7.9. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Frozen Bakery Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Frozen Bakery Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé S.A.

10.2. General Mills Inc.

10.3. Conagra Brands Inc.

10.4. McCain Foods Ltd.

10.5. Grupo Bimbo

10.6. CJ Group

10.7. Rich Products Corporation

10.8. Dawn Foods

10.9. Lantmannen Unibake

10.10. Ajinomoti Co. Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia Pacific Frozen Bakery Products Market was valued at USD 8.2 Billion in 2023 and is projected to reach a market size of USD 14.52 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.5%.

Changing Consumer Lifestyles and Preferences Economic expansion and the increased disposable incomes of individuals in the region are drivers of the Asia Pacific Frozen Bakery Products market.

Based on product type, the Asia Pacific Frozen Bakery Products Market is segmented into Bread, Pastry, Cakes and desserts, Pizza crusts, Biscuits, and Others

China is the most dominant region for the Asia Pacific Frozen Bakery Products Market.

Nestlé S.A., General Mills Inc., Conagra Brands Inc., McCain Foods Ltd., and Grupo Bimbo are a few of the key players operating in the Asia Pacific Frozen Bakery Products Market.