Foundry Coatings Market Size (2024 – 2030)

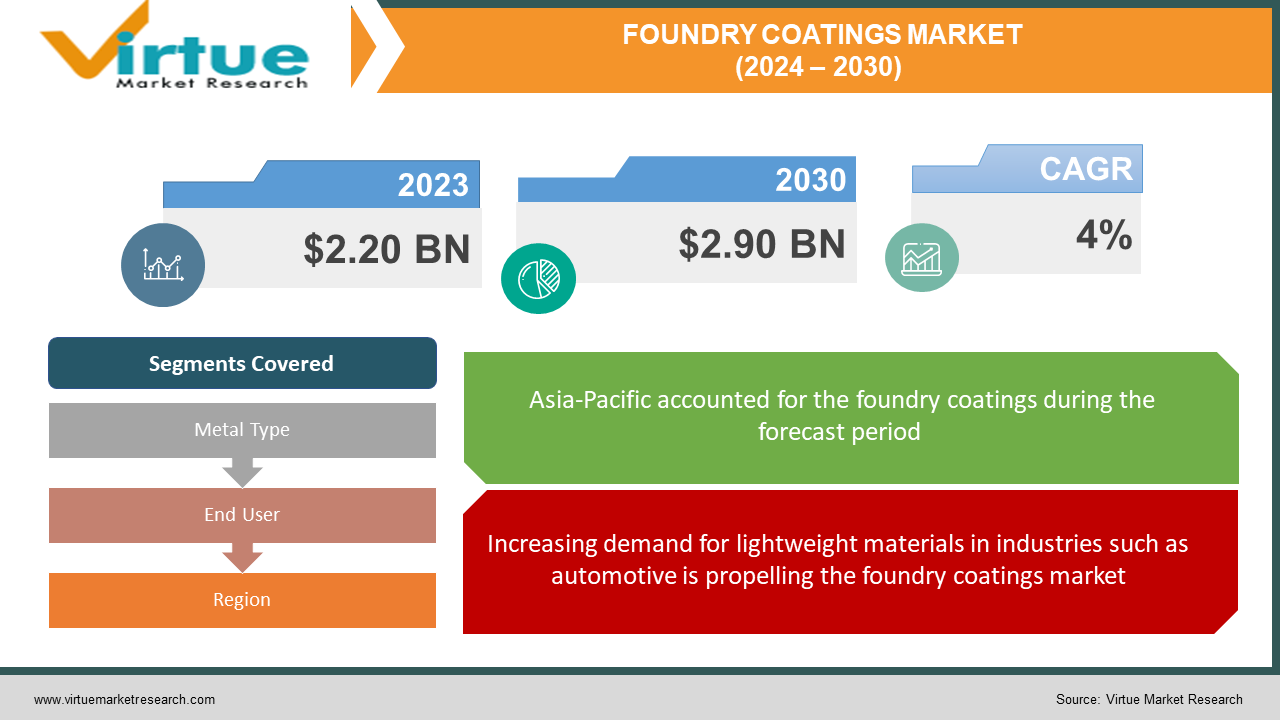

The global foundry coatings market was valued at USD 2.20 billion in 2023 and is projected to reach a market size of USD 2.90 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 4%.

In the metal casting industry, foundry coatings are chemicals specially designed to withstand high temperatures of molten metals and act as a barrier between molten metal and old surfaces. Between metal coatings and mold surfaces, foundry coatings are used to reduce or eliminate defects, metal penetration, erosion, and burn-on, and improve casting quality and surface finish. The coating is a chemical in a liquid carrier that is directly applied to the sand mold and sand core, which evaporates upon contact with molten metal, leaving a layer behind. Foundry coatings can be alcohol-based, water-based, or other. Foundry coatings are composed of refractory minerals, carriers, binders, suspending agents, and special additives. As technology advances, foundry coatings are continuously developed to improve production quality and reduce scrap and the cost of repair due to scrapped casting and defects.

Key Market Insights:

In terms of regional dynamics, Asia-Pacific continues to dominate the foundry coatings market. China and India collectively hold over 50% of the market. The region's rapid industrialization, urbanization, and infrastructure development have fueled the demand for foundry chemicals in applications ranging from automotive manufacturing to electronics. Furthermore, a major factor in the market's growth in the Asia-Pacific area is India's expanding manufacturing sector.

Resins and binders account for 48% of the market share in the product category. The market is driven by rapid industrialization and the growing automotive and construction sectors in emerging economies. The market landscape is shaped by strengthened environmental restrictions and a move towards eco-friendly foundry chemicals.

Market Drivers:

Increasing demand for lightweight materials in industries such as automotive is propelling the foundry coatings market.

The foundry coatings market is experiencing significant growth due to the increasing demand for lightweight materials in key industries like aerospace and industry machinery. As these sectors strive for improved fuel efficiency, performance, and quality, foundry coatings are being used to create lightweight and durable components. These coatings are ideal for creating lightweight components, which are vital for reducing a vehicle's weight. These chemicals help the automotive industry produce quality engine components, transmission parts, and other components.

The growing adoption of environmental regulations and green practices has boosted the demand for foundry coatings.

The rise of environmental regulation has forced industry to open up new ideas for foundry coating, leading to innovation and development. The increase in green practices has increased market demand for eco-friendly foundry coatings. People prefer eco-friendly foundry chemicals designed to reduce environmental damage and human health harm. There is an increased use of chemicals that inherently don’t harm the environment and are used in eco-friendly foundry coatings.

Expanding economic growth and infrastructure development in emerging economies utilize foundry coatings in the production of industrial machinery and components, thus augmenting growth.

The increasing growth of emerging economies in Asia-Pacific and Latin America is increasing industrial activities, thus raising demand for foundry coatings. These chemicals are vital in the production of components used in industrial machinery. The continuous growth in infrastructure development projects like the construction of roads, buildings, and bridges, particularly in emerging economies, is a major driver for the foundry coatings market. The production of metal components for these construction projects requires the use of foundry chemicals.

Market Restraints and Challenges:

Price Volatility in metals can affect the cost of foundry coatings, posing challenges for manufacturers and end-users.

One of the key challenges facing the foundry coatings market is the inherent price volatility of metals. The cost of foundry coatings is closely linked to the prices of raw materials, including metals, minerals, and chemicals. Price fluctuations for metals can have a big effect on enterprises' profitability, cost of production, and pricing policies. Manufacturers and end-users may face challenges because of this volatility. The prices fluctuate due to factors like market trends, geopolitical events, and disruptions in the supply chain. To be competitive in the market, manufacturers need strong supply chain management and hedging techniques to reduce the risk due to price volatility.

Environmental concerns lead to stricter regulations and sustainability concerns.

Because organic solvent-based coatings are hazardous and combustible, environmental concerns are posing a threat to their use. Water is the safest of the carriers. From an environmental viewpoint, the use of water-based coatings is highly recommended. The industry's chemical emissions have led to stricter environmental regulations and heightened sustainability concerns. Compliance with these regulations requires investments in cleaner technologies and practices, which can add to production costs. Additionally, consumers and businesses increasingly prioritize environmentally responsible products and suppliers, putting pressure on foundry coating manufacturers to adopt eco-friendly practices. In this market, striking a balance between the demands of environmentally friendly manufacturing and resource efficiency is a major problem that calls for creative solutions and industry-wide dedication to sustainable practices.

Market Opportunities:

The adoption of advanced technologies in the industry is creating opportunities for market expansion.

The foundry coatings market is poised to capitalize on emerging applications in various industries, like 3D printing. To expedite the manufacture of 3D metal, sand prototypes, and other essential components used in the automotive, aerospace, petrochemical, and construction industries, participants in the foundry chemicals market are implementing cutting-edge technologies. Examples of these technologies include 3D printing techniques. The expanding utilization of foundry coatings in these industries presents significant growth opportunities for manufacturers and suppliers.

Investments in research and development to develop advanced foundry coatings with enhanced properties can open new markets and applications.

Foundry coatings play a crucial role in determining the internal and external quality of the castings. In recent years, the technology of foundry coatings has seen rapid advancements, leading to an increased variety and abundance of coatings available. Several new foundry coating technologies are being developed, such as pretreatment coatings, anti-veining coatings, anti-sulfur coatings, integrated dip coatings, and non-zircon coatings, with ongoing improvements in function and performance.

FOUNDRY COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Metal Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ASK Chemicals, IVP Limited, Asahi Yukizai Corporation, SQ Group, Vesuvius, Cukurova Kimya, Hindustan Adhesive and Chemicals, General Chemical Corp., Huttenes-Albertus International, KAO Chemicals |

Foundry Coatings Market Segmentation: By Metal Type

-

Grey Iron

-

Ductile Iron

-

Aluminium

-

Steel

-

Copper

-

Zinc

In 2023, the iron foundries segment accounted for a leading market share. The demand for iron casting at foundries is higher than that of any other material because casting iron is relatively simpler compared to casting steel or other materials. Throughout the next ten years, iron foundries are expected to account for the majority of foundry chemical sales due to the high strength and low cost of iron casting, which makes it a great option for a variety of applications in a range of industries and vehicles. It is anticipated that the growing use of steel and aluminum in the production of various automotive and aerospace components will open new business prospects for foundry chemical suppliers looking to increase their sales in foundries that will be using steel and aluminum in the future.

Foundry Coatings Market Segmentation: By End User

-

Automotive

-

Aerospace

-

Electronics

-

Construction

-

Industrial Machinery

-

Agriculture

-

Others

All sectors of the global economy, including the automotive, aerospace, power generation, railway, petrochemical, medical, defense, and marine sectors, heavily rely on foundry products. Castings are necessary for almost all of these industries' essential components. Castings are used in the medical industry as well. These include essential components for scanners and computed tomography, as well as cast prostheses like hip and knee joints. Hubs for wind energy turbines, wind and wave power applications, and oil and gas industry pumps and valves are just a few of the energy-related applications that require castings.

The demand for fuel efficiency and stricter emission regulations is likely to speed up the growth of the lightweight material automobile component manufacturing industry. Aluminum has mainly replaced iron and steel as the primary materials used in making car components. The use of aluminum in automobile manufacturing provides comparable strength and durability while being lightweight. By reducing the weight of the vehicle, fuel efficiency is increased. The increase in infrastructure, construction, and development in emerging economies has paved the way for the growth of the foundry coatings market.

Foundry Coatings Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region, which includes major automotive canters like China, India, Japan, and South Korea, is anticipated to be the fastest-growing section of the foundry coatings market. Owing to the existence of significant and developing economies like China and India, the Asia-Pacific area is the leader in both the production and consumption of foundry coatings and metal castings. The expansion of the region's economy, infrastructure, industrialization, and population all contribute to the market's growth. North America, which includes the US, Canada, Mexico, and other nations, is expected to hold the largest market share due to its production and consumption of more than half of all metal castings worldwide.

An increasing number of nations are using automation in their industrial sectors as the idea of Industry 4.0 picks up steam in Europe, which includes the use of IoT and smart manufacturing techniques. Furthermore, there is an increasing awareness of sustainability in the area, which is anticipated to lead to a rise in the usage of foundry chemicals. This will decrease industry emissions and increase foundry efficiency. Germany, Italy, France, and the UK are expected to be very advantageous markets for European foundry chemical producers in the years to come.

In the United States, an increase in demand for metal castings is expected, which are used to make parts for cars and airplanes. This increase in demand presents a business opportunity for foundry coating manufacturers. During the study period of 2024–2030, it is also anticipated that there will be a rise in the use of foundry chemicals in the United States due to the increasing emphasis on eco-friendly foundry products, waste reduction from foundries, and the adoption of improved casting processes.

COVID-19 Impact Analysis on the Global Foundry Coatings Market:

Due to the COVID-19 pandemic, the foundry chemical market experienced a significant impact, resulting in slower growth. Supply chain disruptions, temporary manufacturing facility closures, and reduced end-user product demand all contributed to this. The COVID-19 epidemic also affected the foundry coatings market, as metal casting production and consumption decreased in several industries, such as automotive, aerospace, machinery, agriculture, and energy. However, the market is starting to recover as businesses resume operations and economic activity increases. To avoid future disruptions, manufacturers are prioritizing safety measures, ensuring the supply chain remains functional, and exploring automation and digitization opportunities.

Latest Trends/Developments:

The foundry coatings market is witnessing a rise in sustainable production techniques. Regulations and environmental concerns have forced manufacturers to use eco-friendly chemicals and cleaner production methods that do not harm the environment or people's health. This development is in line with the larger sustainability goals of industries like aerospace and automotive, where eco-friendly supply chains are becoming increasingly important.

The integration of digital technologies and Industry 4.0 concepts is revolutionizing foundry coating production, enhancing supply chain management, quality assurance, and production efficiency through automation, IoT devices, and data analytics. Research and development efforts are focused on creating advanced foundry coatings tailored for additive manufacturing processes, driven by the expanding market due to the rise of 3D printing and smart manufacturing.

The application of 3D printing in diverse industries like automotive, construction, robotics, aerospace, and healthcare is enabled by the development of specialized foundry coatings, allowing for the production of custom implants and lightweight parts. The evolution of foundry coatings aligns with the trend of Industry 4.0, simplifying procedures and enabling product customization to swiftly meet market demands, especially in accuracy-sensitive industries like electronics and healthcare.

Key Players:

-

ASK Chemicals

-

IVP Limited

-

Asahi Yukizai Corporation

-

SQ Group

-

Vesuvius

-

Cukurova Kimya

-

Hindustan Adhesive and Chemicals

-

General Chemical Corp.

-

Huttenes-Albertus International

-

KAO Chemicals

In February 2024, the leading foundry chemicals company ASK Chemicals announced its participation in the upcoming International Foundry Exhibition (IFEX) in Bangalore. The company will showcase its latest advancement in feeding technology, ECOCAST ONE, which is the most affordable compaction riser ever created. Additionally, ASK Chemicals will introduce newly created foundry chemicals from the recently acquired Ranjangaon, Pune, and production facility.

With effect from July 2022, Charlotte Pipe and Foundry Company has acquired Neenah Enterprises, Incorporated, which has its headquarters located in Neenah, Wisconsin. Neenah has three factories that produce industrial and building castings. Lincoln, Nebraska; Neenah, Wisconsin; and Medley, Florida, are the locations of the Neenah facility. Hooper Hardison, President and CEO of Charlotte Pipe and Foundry Company, said Charlotte Pipe's industrial know-how and sound financial standing, in our opinion, will bolster Neenah's portfolio.

Chapter 1. Foundry Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Foundry Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Foundry Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Foundry Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Foundry Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Foundry Coatings Market – By Metal Type

6.1 Introduction/Key Findings

6.2 Grey Iron

6.3 Ductile Iron

6.4 Aluminium

6.5 Steel

6.6 Copper

6.7 Zinc

6.8 Y-O-Y Growth trend Analysis By Metal Type

6.9 Absolute $ Opportunity Analysis By Metal Type, 2024-2030

Chapter 7. Foundry Coatings Market – By End User

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Electronics

7.5 Construction

7.6 Industrial Machinery

7.7 Agriculture

7.8 Others

7.9 Y-O-Y Growth trend Analysis By End User

7.10 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Foundry Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Metal Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Metal Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Metal Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Metal Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Foundry Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ASK Chemicals

9.2 IVP Limited

9.3 Asahi Yukizai Corporation

9.4 SQ Group

9.5 Vesuvius

9.6 Cukurova Kimya

9.7 Hindustan Adhesive and Chemicals

9.8 General Chemical Corp.

9.9 Huttenes-Albertus International

9.10 KAO Chemicals

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global foundry coatings market was valued at USD 2.20 billion and is projected to reach a market size of USD 2.90 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 4%.

Key drivers include the demand for lightweight materials and the growing adoption of additive manufacturing in emerging economies.

Grey iron, ductile iron, aluminum, steel, copper, zinc, and others are prominently used in the market.

AAsia-Pacific held the largest market share, estimated at 40%, in the foundry coatings market. This dominant position can be attributed to the region's robust industrialization, rapid economic growth, and diverse manufacturing sectors.

ASK Chemicals, IVP Limited, Asahi Yukizai Corporation, Vesuvius, KAO Chemicals, and Hindusthan Adhesive & Chemicals are some of the key players in the global foundry coatings market.