Asia-Pacific Foundry Coatings Market Size (2024-2030)

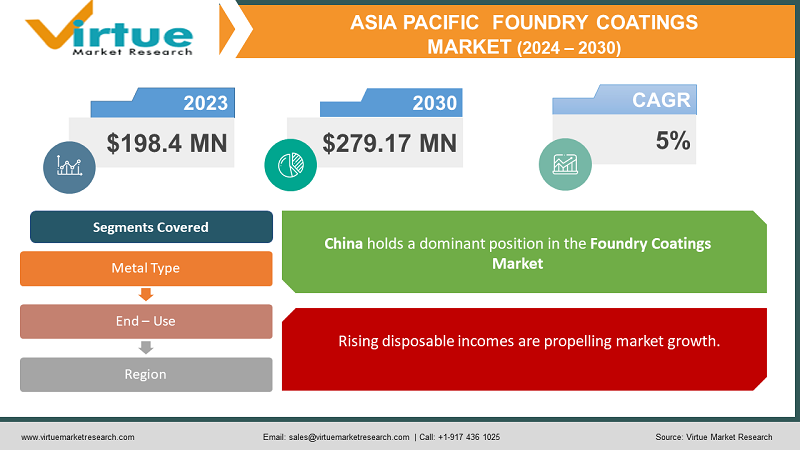

The Asia-Pacific foundry coatings market was valued at USD 198.4 million in 2023 and is projected to grow to USD 279.17 million by 2030, exhibiting a compound annual growth rate (CAGR) of 5% during 2024–2030.

Foundry coatings are specialized paint-like materials applied to molds and cores used in metal casting. They are protective suits for the molds, ensuring smooth casting surfaces, preventing defects like cracks, and enhancing the final product's quality. These coatings come in various types, each with unique properties like heat resistance, lubrication, and adherence. From car parts to building components, foundry coatings play a crucial role in shaping the metal world.

Key Market Insights:

The Asia-Pacific foundry coatings market paints a promising picture. This growth is fueled by the region's booming automotive and construction industries, both of which demand high-performance and durable coatings for their castings. Water-based coatings are gaining traction due to environmental concerns, while specialty coatings for lightweight and corrosion resistance are seeing increasing adoption. China and India remain the dominant players, driven by their large manufacturing bases and rapid infrastructure development. However, competition intensifies, with regional players emerging alongside established global giants. Navigating fluctuating raw material prices and stringent regulations adds complexity to the market. Overall, the Asia-Pacific foundry coatings market presents exciting opportunities for manufacturers who can cater to the evolving needs of the region's key industries while ensuring sustainable and compliant practices.

Asia-Pacific Foundry Coatings Market Drivers:

Growing demand for castings is driving the APAC founndry coatings market.

The need for high-quality castings is rising as the automobile, aviation, and construction sectors expand. Foundries stand tall to meet this challenge, but they don't operate alone. Foundry coatings play a crucial role in shaping the fate of these crucial components. These coatings act as invisible shields, safeguarding against scorching temperatures, corrosive environments, and demanding wear and tear. From pistons powering cars to turbine blades slicing through the air to beams holding up towering structures, foundry coatings enhance the quality, durability, and performance of castings, ensuring they function flawlessly even under immense pressure. In essence, these coatings are responsible for the smooth operation of machines and planes and the unwavering strength of buildings.

Rising disposable incomes are propelling market growth.

Rising prosperity paints a vibrant picture for the Asia-Pacific region, with bulging wallets in China and India fueling a surge in consumer goods and infrastructure development. This economic boom translates into a windfall for the foundry industry as the demand for castings, the backbone of countless products, explodes. From sleek car parts to intricate building components, castings find their way into everything we use and build. Foundry coatings ensure strength, durability, and flawless performance. As disposable incomes rise, the desire for quality consumer goods and robust infrastructure grows, creating a ripple effect that translates into booming demand for both castings and the coatings that empower them. In essence, the economic vibrancy of the region paves the way for a thriving foundry industry, where foundry coatings play a critical role in shaping the quality and longevity of the castings that bring modern life to fruition.

Rapid urbanization is accelerating the growth rate.

This is the rapid urbanization sweeping across the Asia-Pacific region, fuelled by a growing population and economic aspirations. As cities stretch outward, the demand for construction projects—bridges, skyscrapers, and more—explodes. Castings are versatile components that provide strength and structure. From intricate building facades to robust pipelines, castings aid modern construction. Foundry coatings shield these castings from the harsh realities of construction environments. These coatings act as armor, protecting against corrosion, wear and tear, and extreme temperatures, ensuring the castings maintain their strength and integrity for decades to come. As urbanization accelerates, so does the demand for both castings and the coatings that empower them. From bustling metropolises to quaint suburbs, the need for durable and safe infrastructure paves the way for a thriving foundry industry, where foundry coatings play a crucial role in shaping the very foundation of our evolving cities.

Asia-Pacific Foundry Coatings Market Challenges and Restraints:

Fluctuating raw material prices are hindering market growth.

The Asia-Pacific foundry coatings market walks a tightrope, balanced precariously on the price volatility of its raw materials. Resins, pigments, and solvents, the building blocks of these crucial coatings, are susceptible to market fluctuations, creating a ripple effect that can threaten the stability of manufacturers.

Resins, the backbone of these coatings, are particularly susceptible to swings, causing ripples that threaten manufacturers' stability. Pigments, while less impactful, can also see fluctuations, affecting the final cost of the coating and requiring adjustments in formulations or pricing strategies. Solvents, often tied to the global oil market, add another layer of uncertainty. Soaring resin prices can inflate production costs, squeeze profit margins, and potentially force manufacturers to pass on the burden to customers. Pigment price fluctuations, while less impactful, can still disrupt budgeting and necessitate reformulating coatings to maintain affordability. Solvents, often petroleum-based, are particularly sensitive to global oil price swings, adding another layer of uncertainty to the equation. To navigate this volatile landscape, manufacturers must employ strategic sourcing, adopt flexible formulations that accommodate price changes, and explore hedging strategies to mitigate risk. Ultimately, managing the impact of raw material price fluctuations is crucial for ensuring the long-term health and profitability of the Asia-Pacific foundry coatings market.

The economic slowdown in key markets is a major reason for slow growth

When the economic engine sputters in key markets like China, the tremors reach far and wide, impacting even industries seemingly distant. The Asia-Pacific foundry coatings market, heavily reliant on the demand for castings, feels these tremors acutely. A slowdown in China, the region's economic powerhouse, translates to reduced investments in construction, automotive, and other casting-intensive sectors. This ripples down, dampening the demand for the very castings that foundry coatings protect and enhance. As such, production lines slow down, construction projects stall, and consumer spending dips. The need for new castings shrinks, and with it, the demand for the coatings that ensure their quality and performance. While the impact might not be immediate, it can be significant, affecting production capacities, profitability, and even workforce stability in the foundry coatings industry. Manufacturers must stay vigilant, diversifying their customer base, exploring new applications, and weathering the storm through strategic planning and cost optimization. By adapting to the economic climate, they can ensure the Asia-Pacific foundry coatings market emerges stronger and more resilient.

Market Opportunities:

The growth of the Asia-Pacific foundry coatings market is driven by the region's industrial giants in automotive and construction, who demand high-performance, durable coatings for their castings. Eco-conscious trends propel water-based coatings, while lightweight and corrosion-resistant specialty solutions gain traction. China and India, boasting large manufacturing bases and rapid infrastructure development, remain dominant players. The market presents exciting opportunities for manufacturers who can cater to evolving industry needs, focusing on sustainability and compliance. By offering innovative, eco-friendly coatings tailored to specific applications, manufacturers can tap into the vast potential of the Asia-Pacific foundry coatings market.

ASIA-PACIFIC FOUNDRY COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Metal Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Rest of the Asia-Pacific |

|

Key Companies Profiled |

Ashland Global Holdings Inc, BASF SE, Huntsman Corporation, RPM International Inc, Wacker Chemie AG, AkzoNobel N.V., Jindal Poly Films Ltd, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd. , Petroliam Nasional Berhad (Petronas) , Shalimar Paints Ltd. |

Asia-Pacific Foundry Coatings Market Segmentation

Asia-Pacific Foundry Coatings Market Segmentation: By Metal Type:

- Iron

- Steel

- Aluminium

- Copper

- Others

Iron, especially in the form of cast iron, is the largest metal type in several sectors, including infrastructure, industrial, automotive, and construction. It is renowned for its tenacity, magnetism, and strength. Moreover, iron is ductile and malleable. One of the metal kinds with the fastest predicted growth is aluminum. Aluminum is in high demand because of its ability to withstand corrosion, be lightweight, and be recyclable. These qualities make aluminum a desirable material for use in a variety of sectors, including consumer electronics, automotive, and aerospace. Aluminum's market expansion is being propelled by its eco-friendly qualities and adaptability, which are valued by industries that still place a high priority on performance, sustainability, and fuel economy.

Asia-Pacific Foundry Coatings Market Segmentation: By End-User

- Automotive

- Construction

- Aerospace

- Agriculture

- Electronics

- Others

The Asian-Pacific foundry coatings market caters to diverse industries, but the automotive sector is the largest end-user due to its insatiable demand for high-quality castings in engine components, wheels, and countless other parts. The construction sector is the fastest-growing, fueled by the region's booming infrastructure development and its need for robust castings in building materials, pipes, and structural components. While aerospace demands high-performance coatings for critical aircraft components, agriculture utilizes them in essential machinery and equipment. Other industries, like power generation, mining, and shipbuilding, all contribute to the market's dynamism.

Asia-Pacific Foundry Coatings Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia and New Zealand

- Rest of Asia-Pacific

The Asian-Pacific foundry coatings market is a diverse landscape, with China as its largest market owing to rapid industrialization and a seemingly endless demand for castings. Besides, this area has well-established players who are involved in bulk manufacturing. These companies have a global presence, increasing revenue generation. Prominent companies in this region include Qingdao Sungraf Chemical Industry Co., Ltd., Henan Yinfeng Refractory Co., Ltd., Qingdao Henglin Machinery Coatings Co., Ltd., and Zhejiang Zhenxing Coating Technology Co., Ltd. India is the fastest-growing market, fueled by its industrial ambitions. The economy in this country has undergone significant progress. As such, investments and funding have increased. Furthermore, governmental initiatives in the form of schemes have helped with the development. Meanwhile, Japan, a mature player, focuses on high-end applications, ensuring stability in the region.

COVID-19 Impact Analysis on the Asia-Pacific Foundry Coatings Market

The COVID-19 pandemic delivered a brutal blow to the Asia-Pacific foundry coatings market, initially causing a sharp decline. Disrupted supply chains, halted production, and plummeting demand from key industries like automotive and construction sent shockwaves through the market. Economic uncertainty prevailed. People lost their jobs because of this. Moreover, most of the funding was shifted toward healthcare applications, delaying the launches. However, the impact wasn't uniform. China, with its stringent containment measures and swift economic recovery, bounced back faster. India, though hit hard, witnessed a gradual revival as infrastructure projects resumed. Southeast Asia's growth slowed but remained relatively stable. The pandemic also accelerated trends like automation and online sales, creating new opportunities for efficient and digitalized players. While some smaller foundries closed down, larger ones consolidated, leading to increased demand for high-performance coatings. As the region recovers, the focus has shifted towards cost-effectiveness, sustainability, and resilience. Manufacturers who adapt to these evolving needs and offer robust, eco-friendly solutions stand to benefit in the post-pandemic landscape.

Latest trends/Developments

The Asia-Pacific foundry coatings market pulsates with exciting trends and developments. Sustainability reigns supreme, with water-based and bio-based coatings gaining traction due to environmental concerns and regulations. Technological advancements in nanocoatings offer superior performance and lightweight properties, catering to the automotive and aerospace industries. Automation is creeping in, with robotic systems optimizing coating processes for efficiency and precision. Digitalization is transforming the market, with players exploring e-commerce platforms and AI-powered production optimization. Additionally, the emergence of regional players alongside established giants is intensifying competition. Overall, the Asia-Pacific Foundry Coatings market thrives on innovation and adaptation, poised to shape the future of metal casting in the region and beyond.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

- Ashland Global Holdings Inc

- BASF SE

- Huntsman Corporation

- RPM International Inc

- Wacker Chemie AG

- AkzoNobel N.V.

- Jindal Poly Films Ltd

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Petroliam Nasional Berhad (Petronas)

- Shalimar Paints Ltd.

Chapter 1. Asia-Pacific Foundry Coatings Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Foundry Coatings Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Foundry Coatings Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Foundry Coatings Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Foundry Coatings Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Foundry Coatings Market– By Metal Type

6.1. Introduction/Key Findings

6.2. Iron

6.3. Steel

6.4. Aluminium

6.5. Copper

6.6. Others

6.5. Y-O-Y Growth trend Analysis By Metal Type

6.6. Absolute $ Opportunity Analysis By Metal Type , 2024-2030

Chapter 7. Asia-Pacific Foundry Coatings Market– By End-User

7.1. Introduction/Key Findings

7.2. Automotive

7.3. Construction

7.4. Aerospace

7.5. Agriculture

7.6. Electronics

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End-User

7.9. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 8. Asia-Pacific Foundry Coatings Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Metal Type

8.1.3. By End-User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Foundry Coatings Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ashland Global Holdings Inc

9.2. BASF SE

9.3. Huntsman Corporation

9.4. RPM International Inc

9.5. Wacker Chemie AG

9.6. AkzoNobel N.V.

9.7. Jindal Poly Films Ltd

9.8. Kansai Paint Co., Ltd.

9.9. Nippon Paint Holdings Co., Ltd.

9.10. Petroliam Nasional Berhad (Petronas)

9.11. Shalimar Paints Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific foundry coatings market was valued at USD 198.4 million in 2023 and is projected to grow to USD 279.17 million by 2030, exhibiting a compound annual growth rate (CAGR) of 5% during 2024–2030.

Growing demand for castings, rising disposable incomes, and rapid urbanization are the reasons that are driving the market

Based on end users, the Asia-Pacific foundry coatings market is divided into four segments: automotive, construction, aerospace, and agriculture.

China is the most dominant country in the region for the foundry coatings market.

Ashland Global Holdings Inc., BASF SE, Huntsman Corporation, and Jindal Poly Films Ltd. are some of the key players