Force Sensors Market Size (2025-2030)

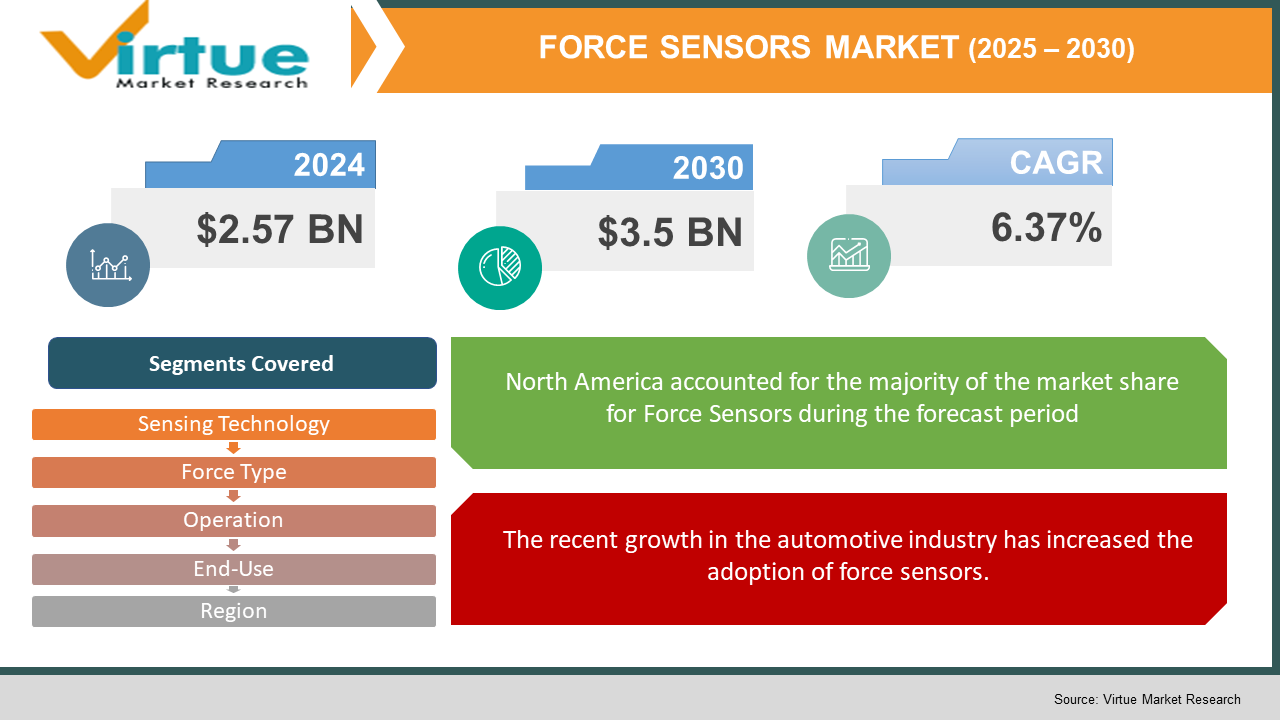

The Global Force Sensors Market was valued at USD 2.57 billion in 2024 and is projected to reach a market size of USD 3.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.37%.

From 2025 to 2030, the worldwide force sensors market is expected to expand strongly. The demand for force sensors is increasing greatly. This development is credited to the growing use of industrial automation, sensor technology improvements, and the increasing use of force sensors in different applications including industrial robots, medical equipment, and smart infrastructure, highlighting their crucial function in improving efficiency and accuracy across sectors, and the expanding use of force sensors in many sectors.

Key Market Insights:

- Including strain gauge, piezoelectric, and capacitive sensors, the force sensors market spans many different technologies, each meeting particular application needs.

- Advanced systems like robotics, medical equipment, and consumer electronics are progressively including force sensors to improve user experience and functionality.

- Industrialization, technology, and economic circumstances all affect local force sensor adoption and growth rates, which differ from one another.

- Manufacturing procedures and supply lines have been changed by world events pandemics as well as economic fluctuations that have therefore affected the use and production of force sensors.

- With a forecast for the robot sensor market to be worth $5 billion by 2032, the substantial expansion and activity in this industry are underlined.

- Reflecting the increasing use of sensor technologies in many sectors, the worldwide sensors market covering applications including smart infrastructure is expected to grow annually by 6.37 percent from 2025 to 2030.

Force Sensors Market Drivers:

The recent advancements in the field of industrial automation are considered an important market driver, helping the global force sensors market to expand.

The need for accurate force measurement has risen drastically with the integration of mechanical technologies in manufacturing and industrial operations. Monitoring and controlling machine operations, guaranteeing product quality, and increasing operational efficiency all rely on force sensors. For example, force sensors in automated assembly lines identify changes in applied forces and enable real-time adjustments to keep uniformity and avoid equipment damage. Modern industry relies on systems that can rapidly react to changing circumstances thanks to their capacity to convert physical inputs into electrical signals.

The recent growth in the automotive industry has increased the adoption of force sensors.

Emphasis on safety and performance in the automotive industry has resulted in the broad acceptance of force sensors in many uses. Force sensors in airbag systems detect impacts and calculate the correct deployment timing, therefore improving passenger safety. In the same way, these sensors track the force used in braking systems to maximize vehicle stability and braking efficiency. Accurate force measurement is very critical to avoid accidents and lower deaths and to depend on for the development of vehicle safety systems including Automatic Emergency Braking (AEB). Recent developments have increased the efficiency of AEB systems at higher speeds, thereby highlighting the crucial role of force sensors in automotive safety innovations.

Technological innovation in healthcare devices is also a key market driver leading to market growth.

The use of sophisticated medical devices with force sensors in the healthcare sector has vastly improved surgical accuracy and patient care. Force sensors give surgeons tactile information in minimally invasive operations, therefore enhancing precision and lowering tissue damage hazards. Recovery devices also depend on sensors that track muscle strength and progress in patients, therefore aiding custom therapy plans. The sensors' capacity to provide reliably under different environmental circumstances guarantees their usefulness in different medical uses, therefore enhancing patient results.

The rise in the demand for electronics has also increased the demand for force sensors.

The explosion in popularity of tablets, smartphones, and other touch-sensitive devices has raised demand for force sensors. Pressure-sensitive touchscreens, made possible by these sensors, improve user interaction using which devices can distinguish between several levels of touch pressure. This ability enhances the general user experience by enabling things like different line thicknesses in digital drawing applications and pressure-sensitive typing. Driving innovation and market growth in the consumer electronics sector, the continuous miniaturization of force sensors has made it possible to integrate them into compact consumer electronics without compromising performance.

Force Sensors Market Restraints and Challenges:

The high levels of production costs are a major challenge faced by many industries which particularly affects the SMEs.

Especially difficult for small and medium-sized firms (SMEs), producing high-precision force sensors calls for significant financial outlay. The production process calls for sophisticated technologies and high-quality materials to guarantee precision and dependability, hence raising expenses. Small businesses occasionally find these costs difficult given their restricted funds and means. Moreover, the integration of predictive maintenance sensors, which can improve force sensors' effectiveness, offers extra monetary costs that several small and medium-sized enterprises find hard to justify. Their competitive edge and capacity for invention inside the force sensors sector might suffer under this financial difficulty.

The technical limitations faced by the force sensors affect its performance thereby affecting the global force sensors market.

Signal drift and temperature sensitivity, two problems that can negatively influence the performance of force sensors, are both present in such sensors. Signal drift, driven by elements including environmental pollution, vibrations, or extreme temperature variations, results in imprecise measurements over time. Varied sensor readings under different thermal environments, therefore aggravating accuracy, could be a result of temperature sensitivity. Dealing with these technical difficulties calls for the deployment of temperature compensation circuits and materials with lower temperature coefficients together with other strategies of compensation. On the other hand, these remedies can raise the sophistication and cost of sensor design and production, therefore presenting further obstacles to market expansion.

The competition faced by the market is intense and poses a great challenge for the market to sustain.

Many suppliers define the market for force sensors, therefore raising rivalry. As businesses seek to provide more affordable goods to entice consumers, this competitive environment frequently leads to price wars. As a result, reduced margins of profits make it difficult for businesses to grow their activities or fund research and development. Ultimately impeding the general development of the market, this setting can inhibit innovation and discourage fresh participants.

Rules and regulations act as a huge market challenge, hindering the growth of the market.

Particularly for uses in industries such as automotive, healthcare, and aerospace, adherence to strict industry norms and rules is vital in the force sensors market. Compliance of sensors guarantees they are safe, reliable, and interoperable. Meeting such demanding criteria, on the other hand, can raise the difficulty and price of sensor design and implementation. Particularly challenging for small businesses with restricted means, manufacturers have to spend on quality assurance measures, certification processes, and specialized testing equipment. The rules here may slow market innovation and impede entry.

Force Sensors Market Opportunities:

The rapid evolution of the robotics field acts as an opportunity for the market to expand its operations.

Force sensors are essential for improving accuracy and machine-human interaction in the fast-changing robotics industry. Robots can identify and react to physical forces thanks to these sensors, so enabling delicate operations like assembling tiny pieces or safely interacting with people.

The recent development of smart infrastructure presents a great opportunity for the market to grow further.

By enabling constant structural health monitoring, the incorporation of force sensors into smart buildings and infrastructure helps to reduce maintenance costs and enhance safety. These sensors supply real-time data by sensing changes in stress, load, and pressure, therefore helping to avert structural breakdowns.

The advancements in the wearable technologies have helped the market to expand its reach.

The popularity of wearable devices for monitoring health and fitness has driven the need for small and effective force sensors. Wearable technologies use force sensors known as stretch sensors to monitor body posture and activity. For instance, motion capture gloves with stretch sensors supply precise tracking free of the problems of drift or occlusion identified in lots of different sensor kinds.

The developing countries present a great opportunity for the market to tap into these areas and grow its presence.

Investment in industrialization and technical adoption of developing areas offers the force sensors sector major growth chances. The need for sensors to improve safety and productivity rises as these areas update their industrial infrastructure. The projected increase in the overall sensors market suggests a growing trend in sensor utilization across many uses including in developing economies.

FORCE SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.37% |

|

Segments Covered |

By sensing technology, force type, operation, end use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., TE Connectivity Limited, ATI Industrial Automation Inc., FUTEK Advanced Sensor Technology Inc., Sensata Technologies Inc., Tekscan Inc., Kistler Group, Omega Engineering Inc., Lorenz Messtechnik GmbH, Spectris Public Limited Company. |

Force Sensors Market Segmentation:

Force Sensors Market Segmentation: By Sensing Technology

- Strain Gauge

- Load Cell

- Force Sensitive Resistors

- Others

Load Cells are the dominant segment and piezoelectric sensors are the fastest-growing segment. Mainly in weighing systems and industrial automation, load cells are extremely commonly used across several sectors because of their accuracy and dependability in measuring force. Their great sensitivity and dynamic response, which make them great for robotics, medical devices, and consumer electronics, are driving piezoelectric sensor sales. Their ability to precisely assess dynamic vibrations and forces has resulted in growing acceptance in these blossoming industries.

The deformation of a material is what the strain gauge uses to quantify force. Found in touch interfaces, Force Sensitive Resistors (FSRs) change resistance depending upon applied force. The others segment Features optical force sensors.

Force Sensors Market Segmentation: By Force Type

- Compression

- Tension

- Compression and Tension

The compression and tension segment is both the dominant and the fastest-growing segment. Sensors able to measure both compression and tension forces are flexible, hence appropriate for a wide spectrum of uses, so increasing their adoption. They are more versatile, so they fit in a wider set of uses. Their growing acceptance in many sectors is being powered by this flexibility.

Compression measures the force that compresses the sensor and the tension measures the forces that pull the sensors.

Force Sensors Market Segmentation: By Operation

- Analog

- Digital

The analog segment is the dominant one and the digital segment is the fastest-growing one. Their simplicity and direct relationship between force and output signal have historically made analog force sensors popular in many uses. Able to seamlessly integrate with contemporary digital systems, digital force sensors are becoming popular because they provide several benefits including increased data processing power and better precision. Applications needing accurate force measurements and real-time data analysis benefit especially from this integration.

Force Sensors Market Segmentation: By End-Use

- Automotive

- Locomotive

- Manufacturing

- Mining

- Aerospace and Defense

- Construction

- Healthcare

- Others

The automotive segment is both the dominant segment and the fastest-growing too. This is due to the increased integration of force sensors with the vehicles that enhance safety and performance.

The locomotive is used in trains that monitor load, in manufacturing it is used to control the process. In mining, it is used to monitor the force and to ensure safety. In the defense segment, it is important for testing and monitoring.in construction, it is used to enhance safety by monitoring the machinery. It is integrated with the devices to measure the force when it comes to the healthcare sector and the others segment includes the energy sector and other consumer electronics.

Force Sensors Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Here, North America is the leader of the market with the highest market share followed by Europe and Asia-Pacific which is also the fastest-growing region. In North America, there is a very high demand for force sensors and the Asia-Pacific region is seeing rapid growth and industrialization making it the fastest-growing region. South America and MEA are the emerging regions in this market.

COVID-19 Impact Analysis on the Global Force Sensors Market:

The coronavirus epidemic upset worldwide supply networks, causing a temporary drop in demand for force sensors as well as their production. The epidemic, on the other hand, also sped up the use of automation and contactless technologies, therefore growing the call for force sensors in consumer electronics, industrial automation, and medical devices. As businesses restart operations and invest in advanced technology, post-pandemic recovery has even more fortified market expansion.

Latest Trends/ Developments:

Integrating force sensors more and more with Internet of Things (IoT) systems enables real-time data monitoring and predictive maintenance.

Continuous miniaturization of force sensors is broadening their use in medical equipment and small consumer electronics.

The development of smart force sensors with self-diagnostic features is improving performance and system reliability.

The increasing use of force sensors in robotics is raising accuracy and safety in service and industrial robots.

Key Players:

- Honeywell International Inc.

- TE Connectivity Limited

- ATI Industrial Automation Inc.

- FUTEK Advanced Sensor Technology Inc.

- Sensata Technologies Inc.

- Tekscan Inc.

- Kistler Group

- Omega Engineering Inc.

- Lorenz Messtechnik GmbH

- Spectris Public Limited Company

Chapter 1. Force Sensors Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Force Sensors Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Force Sensors Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Force Sensors Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Force Sensors Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Force Sensors Market– By Sensing Technology

6.1 Introduction/Key Findings

6.2 Strain Gauge

6.3 Load Cell

6.4 Force Sensitive Resistors

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Sensing Technology

6.7 Absolute $ Opportunity Analysis By Sensing Technology , 2025-2030

Chapter 7. Global Force Sensors Market– By Force Type

7.1 Introduction/Key Findings

7.2 Compression

7.3 Tension

7.4 Compression and Tension

7.5 Y-O-Y Growth trend Analysis By Force Type

7.6 Absolute $ Opportunity Analysis By Force Type , 2025-2030

Chapter 8. Global Force Sensors Market– By Operation

8.1 Introduction/Key Findings

8.2 Analog

8.3 Digital

8.4 Y-O-Y Growth trend Analysis Operation

8.5 Absolute $ Opportunity Analysis Operation , 2025-2030

Chapter 9. Global Force Sensors Market– By End-Use

9.1 Introduction/Key Findings

9.2 Automotive

9.3 Locomotive

9.4 Manufacturing

9.5 Mining

9.6 Aerospace and Defense

9.7 Construction

9.8 Healthcare

9.9 Others

9.10 Y-O-Y Growth trend Analysis End-Use

9.11 Absolute $ Opportunity Analysis End-Use , 2025-2030

Chapter 10. Force Sensors Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Sensing Technology

10.1.3. By Operation

10.1.4. By Force Type

10.1.5. End-Use

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Sensing Technology

10.2.3. By Operation

10.2.4. By Force Type

10.2.5. End-Use

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Sensing Technology

10.3.3. By End-Use

10.3.4. By Force Type

10.3.5. Operation

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-Use

10.4.3. By Force Type

10.4.4. By Sensing Technology

10.4.5. Operation

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Operation

10.5.3. By End-Use

10.5.4. By Force Type

10.5.5. Sensing Technology

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Force Sensors Market– Company Profiles – (Overview, Service End-Use Sensing Technology Portfolio, Financials, Strategies & Developments)

11.1 Honeywell International Inc.

11.2 TE Connectivity Limited

11.3 ATI Industrial Automation Inc.

11.4 FUTEK Advanced Sensor Technology Inc.

11.5 Sensata Technologies Inc.

11.6 Tekscan Inc.

11.7 Kistler Group

11.8 Omega Engineering Inc.

11.9 Lorenz Messtechnik GmbH

11.10 Spectris Public Limited Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Growing at a compound annual growth rate (CAGR) of 6.37% over the expected period, the worldwide force sensor market was estimated to be about $2.57 billion in 2024 and should reach roughly $3.5 billion by 2030.

The rising use of automation in manufacturing procedures calls for exact force measurement driving the need for force sensors. Integration of force sensors in vehicles for applications such as braking systems or airbag deployment raises performance and safety. The creation of medical gadgets including force sensing technology enhances surgical accuracy and patient care. In consumer electronics, enhanced user interfaces made possible by force sensors underpin the rise of touch-sensitive devices such as tablets and smartphones.

Advanced industrial automation and a robust automotive industry help to drive North America's largest share of the worldwide force sensor market. Also, major markets are Europe, which benefits from a strong manufacturing base, and the Asia-Pacific region, which is going through fast industrialization and technological adoption.

Manufacturing high-precision force sensors is expensive, therefore it might be a handicap for small businesses. These products could be very useful in a range of applications if the cost is justified. Technical limits including signal drift and temperature sensitivity can compromise sensor performance, therefore impeding market expansion. Several players cause price wars and lower profit margins, which impede market growth by challenging it. Compliance with strict industry rules and requirements raises the complexity and expense of sensor development and deployment.

The key players in the market are - Honeywell International Inc., TE Connectivity Limited, ATI Industrial Automation Inc., FUTEK Advanced Sensor Technology Inc., Sensata Technologies Inc., Tekscan Inc., Kistler Group, Omega Engineering Inc., Lorenz Messtechnik GmbH, Spectris Public Limited Company.