Fluoropolymers Market Size (2025 – 2030)

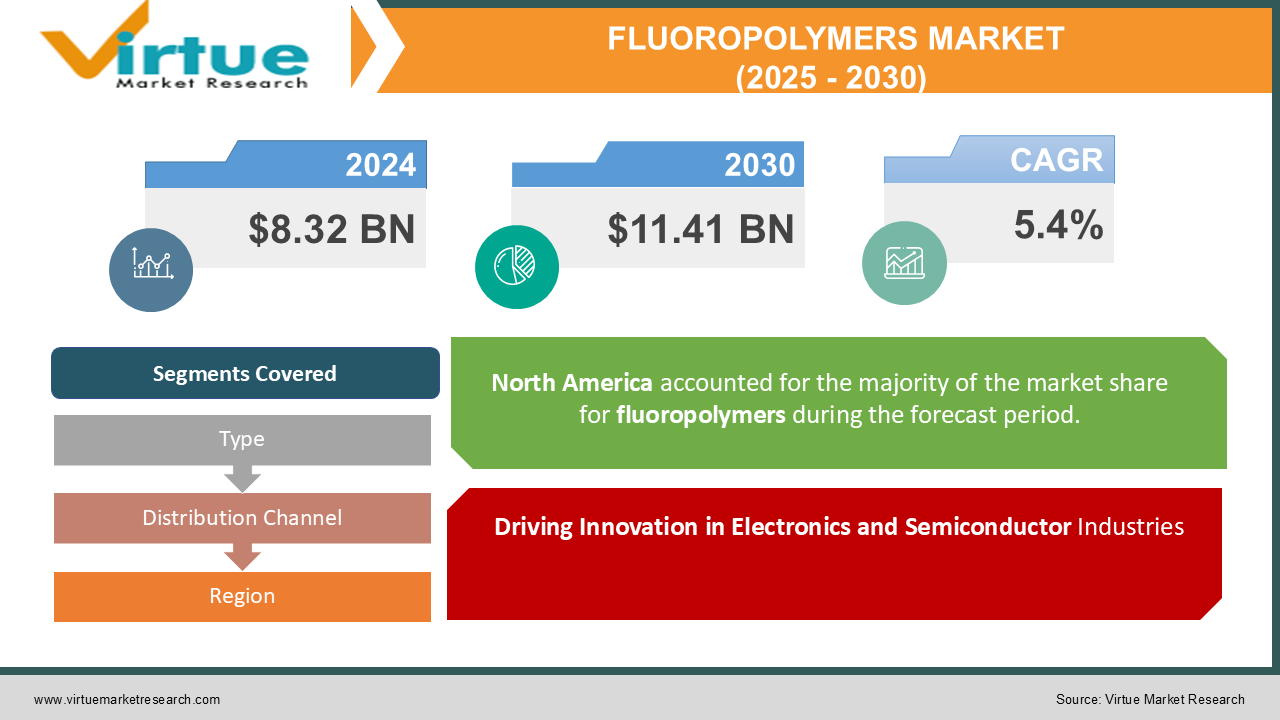

The Fluoropolymers Market was valued at USD 8.32 Billion in 2024 and is projected to reach a market size of USD 11.41 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.4%.

The fluoropolymers market is an essential segment of the global materials industry, characterized by its versatility, resilience, and applicability across a range of industrial sectors. Known for their superior chemical resistance, thermal stability, and exceptional mechanical properties, fluoropolymers have established themselves as indispensable materials in industries like automotive, electronics, construction, healthcare, and chemical processing. These polymers, derived from fluorocarbon-based molecules, exhibit unique properties such as low friction, non-reactivity, and excellent insulating capabilities, making them highly sought after in applications requiring durability and performance under extreme conditions. Fluoropolymers such as polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), and polyvinylidene fluoride (PVDF) dominate the market, each serving distinct applications with unique specifications. The rapid growth of sectors like electric vehicles (EVs), renewable energy, and advanced electronics is significantly boosting the demand for fluoropolymers. For instance, in the EV industry, these materials are widely used for battery components, wiring insulation, and sealing solutions due to their exceptional thermal and chemical properties.

Key Market Insights:

-

Global demand for fluoropolymers reached approximately 875,000 metric tons.

-

The fluoropolymer market's global valuation was estimated at $9.2 billion.

-

Approximately 40,000 tons of fluoropolymers were used in the renewable energy sector.

-

The industrial processing sector utilized 25% of the total fluoropolymer production globally.

-

Over 85% of the PVDF produced globally was used in lithium-ion battery manufacturing.

-

The aerospace and defense sector used approximately 10,000 tons of fluoropolymers.

Market Drivers:

Fluoropolymers: Driving Innovation in Electronics and Semiconductor Industries

The electronics and semiconductor industries have become a cornerstone for the fluoropolymer market's growth. Their exceptional properties, including thermal stability, electrical insulation, and chemical resistance, make fluoropolymers a critical component in modern electronic devices. The rise in consumer electronics and advancements in semiconductor technology have significantly boosted demand. Innovations like miniaturization, faster processors, and 5G technology have driven manufacturers to adopt high-performance materials. Additionally, fluoropolymers' use in protective coatings for printed circuit boards and connectors ensures longevity and reliability in harsh environments. The growing application of PVDF in lithium-ion batteries, used extensively in electric vehicles and grid storage solutions, further emphasizes their relevance in the electronics sector.

Expansion of the Renewable Energy Sector

The rapid transition toward renewable energy sources, such as solar and wind power, has provided a substantial boost to the fluoropolymer market. These materials play a crucial role in improving the durability and efficiency of renewable energy systems. PVDF, in particular, has become indispensable in solar photovoltaic modules due to its resistance to UV degradation and harsh weather conditions. Moreover, the rise in offshore wind power installations has led to increased adoption of fluoropolymer coatings and insulation materials, which enhance the performance of turbines and related components. This alignment with global sustainability goals positions fluoropolymers as essential in driving cleaner energy solutions.

Market Restraints and Challenges:

The fluoropolymers market faces several restraints and challenges that hinder its growth, despite the promising applications and market dynamics. One of the foremost challenges is the high cost of production associated with fluoropolymers. These materials involve complex manufacturing processes, often requiring specialized equipment and stringent quality control measures. The reliance on expensive raw materials like fluorine further adds to the cost, making fluoropolymers less accessible for price-sensitive industries. Additionally, the energy-intensive nature of their production process raises concerns about sustainability and increases operational expenses, particularly as industries shift toward more eco-friendly practices. Environmental and regulatory pressures also present significant challenges. Governments and regulatory bodies worldwide are implementing stricter environmental guidelines to reduce the use of substances that may contribute to ecological harm. Certain fluoropolymers, particularly those with per- and polyfluoroalkyl substances (PFAS), have faced scrutiny due to their persistence in the environment and potential health risks. This has led to restrictions on their usage in some regions, impacting manufacturers and prompting industries to seek alternative materials. Developing eco-friendly or biodegradable fluoropolymer substitutes involves considerable investment in research and development, delaying widespread adoption and innovation. Market players also contend with supply chain disruptions and price volatility of raw materials. The fluoropolymer supply chain is heavily reliant on limited sources of fluorine and other specialty chemicals, leaving it vulnerable to geopolitical tensions, natural disasters, and trade restrictions. This dependency can lead to periodic shortages or fluctuations in raw material prices, impacting production schedules and profit margins for manufacturers. Additionally, the competition from alternative materials and technologies presents a challenge to the market's expansion. Materials like silicone, thermoplastics, and other polymers often serve as cost-effective substitutes in specific applications, particularly where the unique properties of fluoropolymers are not essential. These alternatives offer comparable performance at a lower cost, making them appealing for budget-conscious industries. Finally, the technological complexity of handling and processing fluoropolymers poses a challenge, particularly for small- and medium-sized enterprises (SMEs). These companies may lack the expertise or resources to incorporate fluoropolymer-based solutions into their products, limiting market penetration in emerging economies and niche sectors.

Market Opportunities:

While the fluoropolymers market faces its share of challenges, it also holds numerous opportunities for growth and expansion. One of the most promising avenues lies in the development of sustainable and eco-friendly fluoropolymer solutions. As environmental concerns gain traction globally, manufacturers are increasingly investing in greener production technologies and materials. Innovations such as water-based coatings, fluoropolymer recycling systems, and reduced reliance on harmful additives are gaining momentum, allowing companies to align their offerings with environmental regulations and consumer preferences. The healthcare industry represents another significant growth opportunity. The demand for high-performance materials in medical devices and healthcare applications is rising due to advancements in diagnostics, treatment, and patient care. Fluoropolymers’ biocompatibility, resistance to chemicals, and ability to maintain performance under sterilization conditions make them ideal for medical tubing, implants, and drug delivery systems. With aging populations and increased healthcare spending worldwide, the medical sector is poised to become a major driver for fluoropolymers. Renewable energy projects, particularly solar and wind power installations, are expanding rapidly, creating substantial opportunities for fluoropolymer applications. PVDF, widely used in solar panels for its UV and weather resistance, is expected to see continued growth as countries invest in green energy infrastructure. Similarly, the wind power sector offers opportunities for anti-corrosion coatings and insulation materials, particularly in offshore environments where harsh conditions demand high-performance solutions. The automotive industry's shift toward electrification and lightweighting is another fertile ground for fluoropolymers. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) increasingly rely on high-performance materials for battery components, wiring insulation, and sealing solutions. Fluoropolymers' properties align perfectly with the automotive sector's needs, ensuring their continued adoption as the industry evolves. The expansion of emerging markets, particularly in Asia-Pacific, Africa, and Latin America, also presents significant opportunities. These regions are witnessing increased industrialization, infrastructure development, and consumer spending, driving demand for high-quality materials. Companies that establish local production facilities and distribution networks in these regions are well-positioned to capitalize on the rising demand.

FLUOROPOLYMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chemours Company, 3M Company, Solvay SA, Daikin Industries, Ltd., AGC Chemicals, Arkema Group, Dongyue Group Limited, Gujarat Fluorochemicals Limited, Kureha Corporation, Halo Polymer OJSC |

Fluoropolymers Market Segmentation: by Type

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated Ethylene Propylene (FEP)

-

Perfluoro alkoxy Alkanes (PFA)

-

Polyvinylidene Fluoride (PVDF)

-

Ethylene Tetrafluoroethylene (ETFE)

-

Polyvinyl Fluoride (PVF)

-

Other Specialized Fluoropolymers

Most Dominant Type: PTFE continues to dominate the market, accounting for the highest share due to its widespread use in industrial applications, including non-stick coatings, seals, and gaskets.

Fastest-Growing Type: PVDF is the fastest-growing type, driven by its increasing use in lithium-ion batteries, solar panels, and water filtration membranes.

Fluoropolymers Market Segmentation: by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Channels

Most Dominant Channel: Direct sales remain dominant as manufacturers prefer direct engagement with industrial clients for custom solutions.

Fastest-Growing Channel: Online channels are gaining traction due to the increasing digitalization of procurement processes, providing convenience and transparency to buyers.

Fluoropolymers Market Segmentation: by Regional Analysis

-

Asia-Pacific

-

Europe

-

North America

-

Latin America

-

Middle East and Africa

Most Dominant Region: Asia-Pacific leads the market due to its robust industrial base, particularly in electronics, automotive, and construction.

Fastest-Growing Region: North America is the fastest-growing region, fueled by advancements in renewable energy, healthcare, and EV adoption.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the fluoropolymers market. While supply chain disruptions and reduced industrial activities posed challenges, certain segments, such as healthcare and electronics, witnessed increased demand. Fluoropolymers found heightened relevance in medical applications, including personal protective equipment (PPE), ventilator components, and medical tubing. At the same time, the pandemic accelerated trends like digitalization and renewable energy adoption, indirectly boosting the demand for high-performance materials. However, the market faced setbacks in construction and automotive sectors during the early phases of the pandemic, as these industries experienced significant slowdowns.

Latest Trends and Developments:

The fluoropolymers market is experiencing a wave of innovation, with sustainability and advanced applications taking center stage. Manufacturers are focusing on developing low-emission and recyclable fluoropolymers to align with global environmental goals. The integration of fluoropolymers in emerging technologies, such as 5G telecommunications and advanced batteries, is redefining their role in modern industries. Moreover, smart coatings and surface treatments using fluoropolymer technology are gaining traction, offering self-cleaning and anti-microbial properties for diverse applications. In construction, ETFE membranes are becoming a preferred choice for sustainable architecture, while PVDF films dominate the solar energy sector.

Key Players

-

Chemours Company

-

3M Company

-

Solvay SA

-

Daikin Industries, Ltd.

-

AGC Chemicals

-

Arkema Group

-

Dongyue Group Limited

-

Gujarat Fluorochemicals Limited

-

Kureha Corporation

-

Halo Polymer OJSC

Chapter 1. Fluoropolymers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fluoropolymers Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fluoropolymers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fluoropolymers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fluoropolymers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fluoropolymers Market – By Type

6.1 Introduction/Key Findings

6.2 Polytetrafluoroethylene (PTFE)

6.3 Fluorinated Ethylene Propylene (FEP)

6.4 Perfluoro alkoxy Alkanes (PFA)

6.5 Polyvinylidene Fluoride (PVDF)

6.6 Ethylene Tetrafluoroethylene (ETFE)

6.7 Polyvinyl Fluoride (PVF)

6.8 Other Specialized Fluoropolymers

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Fluoropolymers Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Channels

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Fluoropolymers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fluoropolymers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Chemours Company

9.2 3M Company

9.3 Solvay SA

9.4 Daikin Industries, Ltd.

9.5 AGC Chemicals

9.6 Arkema Group

9.7 Dongyue Group Limited

9.8 Gujarat Fluorochemicals Limited

9.9 Kureha Corporation

9.10 Halo Polymer OJSC

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Key factors driving the growth of the fluoropolymers market include rising demand in renewable energy, automotive electrification, and healthcare applications; superior material properties like chemical resistance; increasing adoption in advanced technologies like 5G and lithium-ion batteries; and sustainability innovations.

Main concerns about the fluoropolymers market include environmental issues due to non-biodegradability, stringent regulatory restrictions on fluorinated compounds, high production costs, challenges in recycling, and increasing competition from eco-friendly alternatives in industries emphasizing sustainability and green material adoption.

Chemours Company, 3M Company, Solvay SA, Daikin Industries, Ltd., AGC Chemicals, Arkema Group.

Asia Pacific currently holds the largest market share, estimated around 35%.

North America has shown significant room for growth in specific segments.