Engineering Plastics Market Size (2024-2030)

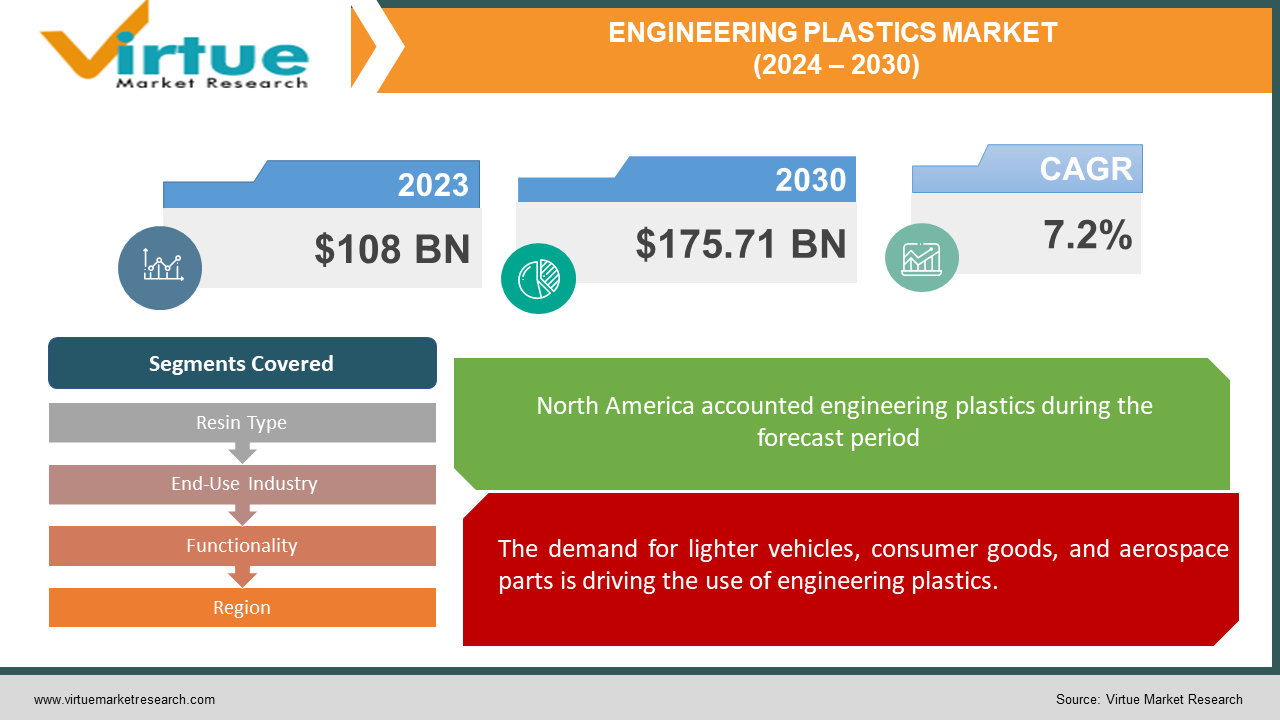

The Engineering Plastics Market was valued at USD 108 billion in 2023 and is projected to reach a market size of USD 175.71 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.2%.

The engineering plastics market is a key player in manufacturing high-performance plastics. These advanced materials boast superior strength, durability, and resistance to heat and chemicals. This translates to a wide range of applications, from lightweight and fuel-efficient car parts to electrical components and gears in industrial machinery. Even consumer appliances and packaging rely on engineering plastics. The market is driven by several factors. The growing demand for lighter vehicles and the ever-expanding electronics industry create a constant need for these versatile materials. Additionally, stricter regulations on safety and environmental protection are areas where engineering plastics excel, offering lightweight yet durable solutions.

Key Market Insights:

The engineering plastics market is a key player in innovation across various industries. These high-performance plastics boast superior strength, durability, and resistance to heat and chemicals. This translates to a wide range of applications, from lightweight and fuel-efficient car parts to electrical components and gears in industrial machinery. According to a study, high-performance plastic polymers can reduce vehicle weight by up to 50%, leading to substantial fuel savings and lower emissions in the automotive industry. 3D printing with engineering plastics is expected to grow by over 20% annually, driving innovation in product design and rapid prototyping.

The Engineering Plastics Market Drivers:

The demand for lighter vehicles, consumer goods, and aerospace parts is driving the use of engineering plastics.

A major driver is the increasing demand for lightweight materials across industries. Engineering plastics are significantly lighter than traditional materials like metals, which translates to significant advantages. In the automotive industry, lighter car parts improve fuel efficiency, while in consumer goods and aerospace, weight reduction translates to improved performance and energy savings.

The ever-expanding electronics industry relies on engineering plastics for their durability, heat resistance, and electrical insulation.

The ever-expanding electronics industry is a strong driver for engineering plastics. These advanced materials offer the perfect combination of properties – durability, heat resistance, and electrical insulation – making them ideal for various electronic components, circuit boards, and connectors. As the electronics industry continues to grow, so does the demand for these versatile engineering plastics.

Growing environmental concerns are pushing the development of sustainable engineering plastics and recycling processes.

Growing environmental consciousness is pushing the market towards sustainable solutions. This is driving research and development in bio-based engineering plastics or improved recycling processes for existing materials. Manufacturers are increasingly looking for ways to reduce the environmental impact of engineering plastics, which in turn fosters market growth for these sustainable options.

Stricter safety and environmental regulations are creating a demand for engineering plastics that meet these standards.

Stricter regulations on safety and environmental protection are also a key driver. Engineering plastics can help manufacturers comply with these regulations. For example, their lightweight nature can enhance safety in vehicles, while their durability ensures products meet longevity standards. Additionally, some engineering plastics offer properties that align with fire safety regulations, making them a preferred choice in various applications.

Ongoing advancements in material science are expected to bring new and improved engineering plastics to the market.

Continued research and development in material science is another driver. This ongoing innovation is expected to bring forth new types of engineering plastics with even better properties. This could lead to lighter, stronger, and more heat-resistant materials, further expanding their range of applications and propelling market growth.

The Engineering Plastics Market Restraints and Challenges:

The engineering plastics market isn't without its hurdles despite its promising future. A significant challenge is the higher cost compared to standard plastics. This can be a deciding factor for manufacturers, especially in sectors where price sensitivity is high. While the superior performance and durability of engineering plastics offer long-term benefits, the upfront cost can be a deterrent, particularly for less demanding applications. Another hurdle is the fluctuation in raw material prices. Engineering plastics rely on various components, and volatility in these prices can disrupt production costs and squeeze profit margins for manufacturers. This uncertainty can create hesitation and hinder market growth.

Environmental concerns regarding plastic production and disposal also cast a shadow. Although advancements are being made in sustainable engineering plastics, the plastic industry faces criticism for its environmental impact. This can lead to stricter regulations or consumer resistance, potentially impacting the market.

Finally, processing certain engineering plastics can be more challenging compared to standard plastics. They may require specialized equipment or techniques, which can inflate manufacturing costs and add complexity. This can limit their adoption in applications where simpler processing methods are preferred. Overcoming these processing challenges will be crucial for wider adoption of these advanced materials.

The Engineering Plastics Market Opportunities:

The engineering plastics market brims with possibilities for future growth and innovation. Sustainability is a key driver, with the development of bio-based or highly recyclable engineering plastics offering a chance for manufacturers to capture market share by meeting both performance and environmental needs. Advancements in the materials themselves are opening doors to entirely new applications. Lighter, stronger, and more heat-resistant plastics could revolutionize sectors like aerospace, medical devices, and construction. Furthermore, the ability to tailor engineering plastics to specific needs, such as flame retardancy or conductivity, creates valuable opportunities in niche markets with unique requirements. This focus on specialization can lead to higher-value products and a stronger market position for manufacturers. Finally, continued advancements in material science hold immense promise. The creation of entirely new types of engineering plastics with groundbreaking properties could revolutionize various industries, pushing the boundaries of what's possible with these advanced materials. The booming Asia Pacific region, with its rapidly growing automotive, electronics, and consumer goods sectors, presents a particularly exciting opportunity for manufacturers who can cater to the specific needs of this region and establish a strong presence there.

ENGINEERING PLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Resin Type, End-Use Industry, Functionality, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Covestro AG, Solvay SA, Celanese Corporation, The Dow Chemical Company, LG Chem Ltd., SABIC, Evonik Industries AG, LANXESS AG |

Engineering Plastics Market Segmentation: By Resin Type

-

Polyamides (PA)

-

Polycarbonates (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Fluoropolymers

-

Other Resins

The dominant segment by resin type is likely Styrene Copolymers (ABS and SAN), due to their affordability, good balance of properties, and ease of processing. These are commonly found in car parts, electronic casings, and toys. The fastest-growing segment is projected to be High-Performance (PA, PEEK, etc.) resins. These offer superior strength, heat resistance, and chemical resistance, making them ideal for demanding applications in automotive, aerospace, and industrial sectors. Their growth is driven by the increasing need for lightweight and high-performance materials.

Engineering Plastics Market Segmentation: By End-Use Industry

-

Automotive & Transportation

-

Electrical & Electronics

-

Industrial & Machinery

-

Packaging

-

Consumer Appliances

-

Other End-Use Industries

By End-Use Industry, the engineering plastics market is dominated by the Electrical & Electronics sector due to the widespread use of these plastics in circuit boards, connectors, and various electronic devices. The Automotive & Transportation sector is experiencing the fastest growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency. Engineering plastics play a key role in achieving this by replacing heavier metals in car parts.

Engineering Plastics Market Segmentation: By Functionality

-

High Strength & Stiffness

-

Heat & Chemical Resistance

-

Transparency & Impact Resistance

Among functionalities, High Strength & Stiffness plastics are likely the most dominant segment, finding use in demanding applications like gears, bearings, and automotive parts. However, the segment focused on Heat & Chemical Resistance is expected to see the fastest growth due to increasing demand in pipes, nonstick coatings, and other applications exposed to harsh conditions.

Engineering Plastics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: North America represents an established market with a long history in engineering plastics production and utilization. The region boasts a well-developed infrastructure and a strong focus on innovation. Manufacturers here prioritize high-performance engineering plastics with cutting-edge properties. While growth rates might not be as explosive as Asia Pacific, North America remains a crucial player due to its advanced technological capabilities and established presence in the global market. North American manufacturers are constantly pushing the boundaries of material science, developing new types of engineering plastics with even better properties.

Europe: Like North America, Europe is another established market with a strong presence in the engineering plastics sector. The region prioritizes high-performance materials and focuses on innovation. European manufacturers are known for their strict quality standards and often demand top-of-the-line engineering plastics for their products. While growth might not be as rapid as Asia Pacific, Europe remains a significant player due to its focus on advanced materials and its well-developed infrastructure.

Asia Pacific: Asia Pacific currently holds the dominant position in the engineering plastics market. It boasts the largest market share and is projected to experience the fastest growth in the coming years. This dominance is fueled by several factors. The region's booming automotive, electronics, and consumer goods industries create a massive demand for these versatile materials. Growing economies and increasing disposable incomes further contribute to the market's expansion. Manufacturers in Asia Pacific are actively seeking lightweight and durable solutions for their products, making engineering plastics a perfect fit. This region's rapid development creates a fertile ground for continued market growth.

South America: South America represents an emerging market in the engineering plastics landscape. The region is experiencing a growing demand for these advanced materials as its economies develop and industrial sectors expand. However, the overall market share for engineering plastics in South America remains relatively small compared to leaders like Asia Pacific. Nevertheless, this presents exciting future opportunities for market growth. As infrastructure improves and industries in South America mature, the demand for engineering plastics is expected to rise significantly. Manufacturers can tap into this potential by catering to the specific needs of this emerging market.

Middle East and Africa: The Middle East and Africa represent another emerging market with increasing demand for engineering plastics. Like South America, the overall market share here is still relatively small. However, with ongoing development and industrial growth, the demand for these versatile materials is expected to rise in the coming years. This presents exciting opportunities for manufacturers who can cater to the specific needs of these regions and establish a strong presence early on.

COVID-19 Impact Analysis on the Engineering Plastics Market:

The COVID-19 pandemic undeniably shook the engineering plastics market. Lockdowns and a slumping economy led to a drop in demand from key industries like automotive, electronics, and construction. Disruptions in manufacturing and supply chains further hampered production and availability of these materials. Raw material price fluctuations added another layer of uncertainty for manufacturers, squeezing profit margins. Production lines faced challenges too, with lockdowns and social distancing measures causing delays and labor shortages.

However, there were some silver linings. The pandemic surged demand for specific engineering plastics used in medical equipment like PPE kits and syringes, partially offsetting the decline in other sectors. Additionally, the heightened focus on environmental issues during the pandemic could potentially accelerate the development and adoption of sustainable engineering plastics and recycling processes.

While the initial impact was significant, the engineering plastics market is expected to recover and resume its growth trajectory. The long-term drivers like the need for lightweight materials, material innovation, and stricter regulations remain strong. The market is likely to experience a gradual recovery as economic activity picks up and end-use industries bounce back. Demand patterns might shift in the post-pandemic era, with potential growth in sectors like medical devices and sustainable infrastructure. Manufacturers are likely to focus on building more resilient supply chains and production processes to mitigate future disruptions. Overall, the COVID-19 pandemic presented a temporary challenge, but the long-term outlook for the engineering plastics market remains promising, with the potential for adaptation and innovation in a changing world.

Latest Trends/ Developments:

The engineering plastics market is buzzing with innovation and a focus on sustainability. Bio-based plastics derived from plants and improved recycling processes are minimizing reliance on fossil fuels and reducing waste. A circular economy approach is being explored, where products are designed for easy disassembly and recycling, creating a closed-loop system for these materials.

Material science advancements are leading to exciting new engineering plastics. Lighter and stronger options are ideal for weight reduction in vehicles and aerospace components. Self-healing materials can repair minor damage, extending product life and reducing maintenance. Functionally graded materials offer a combination of properties within a single plastic, tailoring performance for specific applications.

The rise of 3D printing creates new opportunities for engineering plastics. These materials can be used to create complex shapes and components with high precision, leading to innovative product designs and potential for customization. Additionally, manufacturers are increasingly tailoring their offerings to specific regional needs. This includes developing plastics that meet regional regulations and considering factors like climate and temperature variations. The booming Asia Pacific market presents a significant opportunity for manufacturers who can cater to their specific requirements. Overall, the engineering plastics market is looking bright, with a focus on sustainability, cutting-edge materials, and meeting the evolving needs of various industries and regions.

Key Players:

-

BASF SE

-

Covestro AG

-

Solvay SA

-

Celanese Corporation

-

The Dow Chemical Company

-

LG Chem Ltd.

-

SABIC

-

Evonik Industries AG

-

LANXESS AG

Chapter 1. ENGINEERING PLASTICS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ENGINEERING PLASTICS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ENGINEERING PLASTICS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ENGINEERING PLASTICS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ENGINEERING PLASTICS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ENGINEERING PLASTICS MARKET – By Resin Type

6.1 Introduction/Key Findings

6.2 Polyamides (PA)

6.3 Polycarbonates (PC)

6.4 Acrylonitrile Butadiene Styrene (ABS)

6.5 Fluoropolymers

6.6 Other Resins

6.7 Y-O-Y Growth trend Analysis By Resin Type

6.8 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 7. ENGINEERING PLASTICS MARKET – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Automotive & Transportation

7.3 Electrical & Electronics

7.4 Industrial & Machinery

7.5 Packaging

7.6 Consumer Appliances

7.7 Other End-Use Industries

7.8 Y-O-Y Growth trend Analysis By End-Use Industry

7.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. ENGINEERING PLASTICS MARKET – By Functionality

8.1 Introduction/Key Findings

8.2 High Strength & Stiffness

8.3 Heat & Chemical Resistance

8.4 Transparency & Impact Resistance

8.5 Y-O-Y Growth trend Analysis By Functionality

8.6 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 9. ENGINEERING PLASTICS MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Resin Type

9.1.3 By End-Use Industry

9.1.4 By Functionality

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Resin Type

9.2.3 By End-Use Industry

9.2.4 By Functionality

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Resin Type

9.3.3 By End-Use Industry

9.3.4 By Functionality

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Resin Type

9.4.3 By End-Use Industry

9.4.4 By Functionality

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Resin Type

9.5.3 By End-Use Industry

9.5.4 By Functionality

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. ENGINEERING PLASTICS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Covestro AG

10.3 Solvay SA

10.4 Celanese Corporation

10.5 The Dow Chemical Company

10.6 LG Chem Ltd.

10.7 SABIC

10.8 Evonik Industries AG

10.9 LANXESS AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Engineering Plastics Market was valued at USD 108 billion in 2023 and is projected to reach a market size of USD 175.71 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.2%.

Lightweighting Trend, Expanding Electronics Industry, Sustainable Material Focus, Regulation-Driven Demand, Material Innovation.

High Strength & Stiffness, Heat & Chemical Resistance, Transparency & Impact Resistance.

The engineering plastics market is dominated by Asia Pacific, boasting the biggest market share and the fastest projected growth.

BASF SE, Covestro AG, Solvay SA, Celanese Corporation, The Dow Chemical Company, LG Chem Ltd., SABIC, Evonik Industries AG, LANXESS AG.