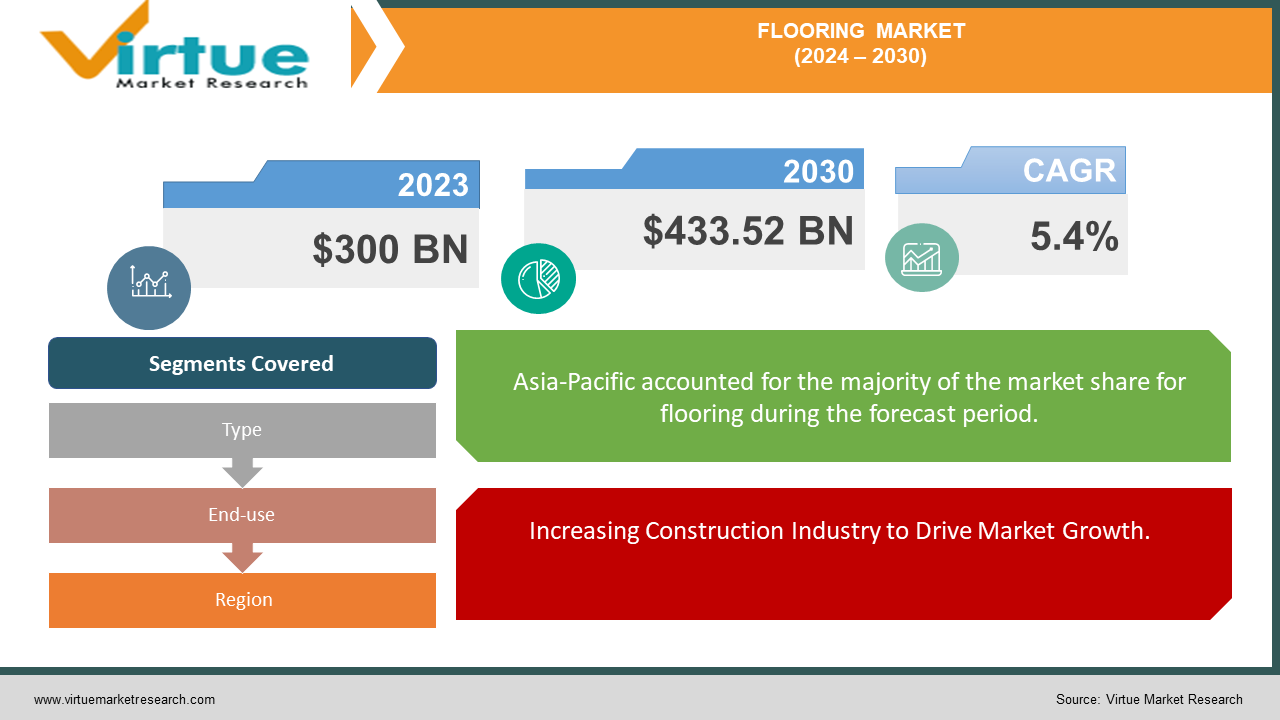

Flooring Market Size (2024 – 2030)

The Flooring Market was valued at USD 300 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 433.52 billion by 2030, growing at a CAGR of 5.4%.

Flooring serves as a finishing material applied atop a floor or subfloor to create a walking surface. These materials possess characteristics such as scratch resistance, dent resistance, moisture resistance, and ease of maintenance. Commonly utilized options include ceramic tiles, vinyl tiles, carpets, and laminates, as they offer a smooth, clean, durable, and aesthetically pleasing surface. The advantages of these products make them popular choices for both new construction and renovation projects in residential and commercial buildings. The expansion of new construction projects and the rising demand for residential spaces, commercial facilities, and healthcare environments are expected to fuel market growth.

Key Market Insights:

The growing demand for aesthetically pleasing, high-quality, and durable flooring solutions, coupled with evolving consumer preferences in floor design, has been driving the flooring industry's expansion in recent years. The growth is also fueled by the proliferation of office spaces and work environments, enhancements in consumer lifestyles, and rapid urbanization. Additionally, the swift pace of infrastructure development in response to increasing populations in developing nations further supports the growth of the flooring sector.

Flooring Market Drivers:

Increasing Construction Industry to Drive Market Growth.

The escalating global population is driving the need for both residential and non-residential construction projects. As of early 2023, the global population surpassed eight billion and is anticipated to double by the end of 2050. This population growth and urban expansion have created significant opportunities for the construction industry. Consequently, there is an increased demand for materials such as tiles, carpets, rugs, and hardwood floors due to their extensive use in construction. These materials are selected based on their specific applications. For example, hardwood floors are preferred in residential settings due to their durability, longevity, and aesthetic appeal.

In emerging economies like China, India, and other ASEAN nations, there has been notable improvement in living standards and housing affordability. Over recent decades, these developments have significantly boosted the demand for contemporary surface coverings, including carpets and rugs. Enhanced consumer spending and the potential of regional construction markets are expected to stimulate new infrastructure and construction projects in the forecast period.

Furthermore, developing nations in the Asia-Pacific region, which account for approximately 60% of the global population, are implementing measures to offer affordable housing. For

instance, the Indian government has launched the Pradhan Mantri Awas Yojana (Urban) and the Pradhan Mantri Awas Yojana (Rural) to provide affordable housing solutions for low-income populations in urban and rural areas, respectively.

Flooring Market Restraints and Challenges:

High Raw Material Prices to Limit Market Growth.

Variations in raw material prices may constrain market growth by influencing manufacturers' profitability. Key raw materials such as vinyl, fibers, fiber composites, and resins are essential for producing surface-covering products. An increase in the prices of these materials leads to higher production costs, which, in turn, elevates the cost of finished products. Consequently, the rising prices of both raw materials and end products can adversely affect the demand for flooring solutions.

Additionally, fluctuations in the prices and diminishing availability of petroleum-based raw materials, which are crucial for manufacturing specific products like vinyl flooring, are expected to impact market expansion. For example, carpets and rugs are produced using raw materials derived from crude oil, such as polyester, nylon, latex, synthetic backing materials, and various dyes and chemicals. Therefore, instability in crude oil prices is likely to hinder market growth.

Flooring Market Opportunities:

Manufacturing of Sustainable Products to create Opportunities in the market.

Sustainable products made from recycled materials are gaining traction in the market. For example, the demand for natural and recycled carpets has grown due to their cost-effectiveness and the support of green manufacturing initiatives promoted by various governments in the U.S. and the U.K. Additionally, advancements in technology allow companies to develop innovative processes and systems for recycling product waste. Utilizing waste materials in production not only enhances companies' profitability but also contributes positively to environmental sustainability. Furthermore, the increasing consumer preference for sustainable products is expected to drive higher demand for these eco-friendly options among end-users.

FLOORING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mohawk Industries, Inc., Armstrong World Industries Inc. (AHF, LLC), Berkshire Hathaway, Inc. (Shaw Industries Group, Inc.) , Gerflor Group, Tarkett S.A., Ceramiche Atlas Concorde SpA , Mannington Mills Inc., Porcelanosa Group, Kajaria Ceramics Limited , Canadian Flooring |

Flooring Market Segmentation: By Type

-

Non-Resilient

-

Resilient

-

carpets & rugs

The non-resilient segment held the largest share of the flooring market, with ceramic tiles being the predominant category. Ceramic tiles feature a protective layer on their surface, rendering them resistant to staining and water damage. They offer a hard surface that is easy to maintain, allergen-free, and durable, which contributes to their widespread use in residential settings. Laminate flooring, known for its cost-effectiveness, mimics the appearance of stone and wood floors. The growth in this segment is driven by the increasing demand for easy-to-install flooring options.

Within the resilient segment, vinyl flooring is expected to drive market growth due to its moisture resistance and durability. Luxury vinyl tiles are particularly favored in both residential and commercial environments. In the carpets and rugs segment, tufted carpets dominate. These carpets are commonly used for wall-to-wall installations and are well-suited for areas with heavy furniture.

Flooring Market Segmentation: By End-use

-

Residential

-

Non-residential

The residential segment leads the global flooring market, with its growth driven by increasing consumer disposable income and a growing population. The rising trend of renovation projects aimed at enhancing the aesthetic appeal of properties is anticipated to further stimulate demand for flooring products within the residential sector. Consequently, the expanding number of residential buildings is expected to propel the growth of the flooring market.

On the other hand, the non-residential segment is projected to experience a higher compound annual growth rate (CAGR) from 2023 to 2030, due to the burgeoning demand for commercial infrastructure such as hospitals, offices, and educational institutions. Additionally, the growing preference for seamless flooring solutions, including polished concrete, epoxy, and polyurethane, in commercial and industrial environments is set to drive market expansion.

Flooring Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is projected to capture the largest revenue share in the global flooring market during the forecast period, with the highest compound annual growth rate (CAGR) anticipated throughout the same period. This growth is attributed to a young, expanding population and a thriving housing and construction sector, where flooring plays a crucial role. Initiatives like India’s Pradhan Mantri Awas Yojana-Urban, which addresses urban housing shortages, are expected to positively impact the construction industry, thereby driving demand for flooring. Additionally, the rising interest in customizable flooring options is expected to further fuel market revenue growth in the region.

In Europe, the flooring market is expected to experience a moderate revenue CAGR over the forecast period. The increasing demand for sustainable products, including flooring materials, is anticipated to boost market revenue. High-income countries in the region are expected to generate significant sales volumes for premium luxury flooring, contributing to the region's revenue growth.

In North America, the market is projected to achieve a moderate revenue CAGR during the forecast period. The strong presence of key market players in the region is expected to drive revenue growth. The rising demand for flooring solutions in the education and commercial sectors is enhancing adoption rates in North America. Moreover, increased government investment in recyclable and sustainable flooring materials is expected to support market revenue growth in the region.

COVID-19 Pandemic: Impact Analysis

The novel coronavirus swiftly spread across numerous countries and regions, profoundly affecting people's lives and the broader community. What started as a public health crisis soon escalated into a substantial threat to global trade, the economy, and financial systems. The COVID-19 pandemic led to significant disruptions in the production of many flooring components due to widespread lockdowns. Initially, the economic downturn resulted in reduced investment in both residential and non-residential construction projects. However, with the rollout of various vaccines, the severity of the pandemic has notably diminished. By mid-2022, the number of COVID-19 cases had decreased significantly, allowing flooring manufacturing companies to fully resume operations. Over two years since the pandemic's onset, many companies have demonstrated considerable signs of recovery.

Latest Trends/ Developments:

May 2023 – Shaw Industries announced its plans to integrate advanced solar technology at its carpet tile manufacturing facility. By leveraging renewable energy, Shaw Industries is proactively contributing to environmental protection and striving for a cleaner future for upcoming generations.

Key Players:

These are top 10 players in the Flooring Market :-

-

Mohawk Industries, Inc.

-

Armstrong World Industries Inc. (AHF, LLC)

-

Berkshire Hathaway, Inc. (Shaw Industries Group, Inc.)

-

Gerflor Group

-

Tarkett S.A.

-

Ceramiche Atlas Concorde SpA

-

Mannington Mills Inc.

-

Porcelanosa Group

-

Kajaria Ceramics Limited

-

Canadian Flooring

Chapter 1. Flooring Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flooring Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flooring Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flooring Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flooring Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flooring Market – By Types

6.1 Introduction/Key Findings

6.2 Non-Resilient

6.3 Resilient

6.4 carpets & rugs

6.5 Y-O-Y Growth trend Analysis By Types

6.6 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Flooring Market – By End-use

7.1 Introduction/Key Findings

7.2 Residential

7.3 Non-residential

7.4 Y-O-Y Growth trend Analysis By End-use

7.5 Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 8. Flooring Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By End-use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By End-use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By End-use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By End-use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By End-use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flooring Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mohawk Industries, Inc.

9.2 Armstrong World Industries Inc. (AHF, LLC)

9.3 Berkshire Hathaway, Inc. (Shaw Industries Group, Inc.)

9.4 Gerflor Group

9.5 Tarkett S.A.

9.6 Ceramiche Atlas Concorde SpA

9.7 Mannington Mills Inc.

9.8 Porcelanosa Group

9.9 Kajaria Ceramics Limited

9.10 Canadian Flooring

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing demand for aesthetically pleasing, high-quality, and durable flooring solutions, coupled with evolving consumer preferences in floor design, has been driving the flooring industry's expansion in recent years.

The top players operating in the Flooring Market are - Mohawk Industries, Inc., Armstrong World Industries Inc. (AHF, LLC), Berkshire Hathaway, Inc. (Shaw Industries Group, Inc.), Gerflor Group, Tarkett S.A., Ceramiche Atlas Concorde SpA, Mannington Mills Inc., Porcelanosa Group, Kajaria Ceramics Limited and Canadian Flooring.

The COVID-19 pandemic led to significant disruptions in the production of many flooring components due to widespread lockdowns. Initially, the economic downturn resulted in reduced investment in both residential and non-residential construction projects.

May 2023 – Shaw Industries announced its plans to integrate advanced solar technology at its carpet tile manufacturing facility. This initiative underscores the company's dedication to sustainability and reducing its carbon footprint. By leveraging renewable energy, Shaw Industries is proactively contributing to environmental protection and striving for a cleaner future for upcoming generations.

In Europe, the flooring market is expected to experience a moderate revenue CAGR over the forecast period.