Limecrete Flooring Market Size (2023 – 2030)

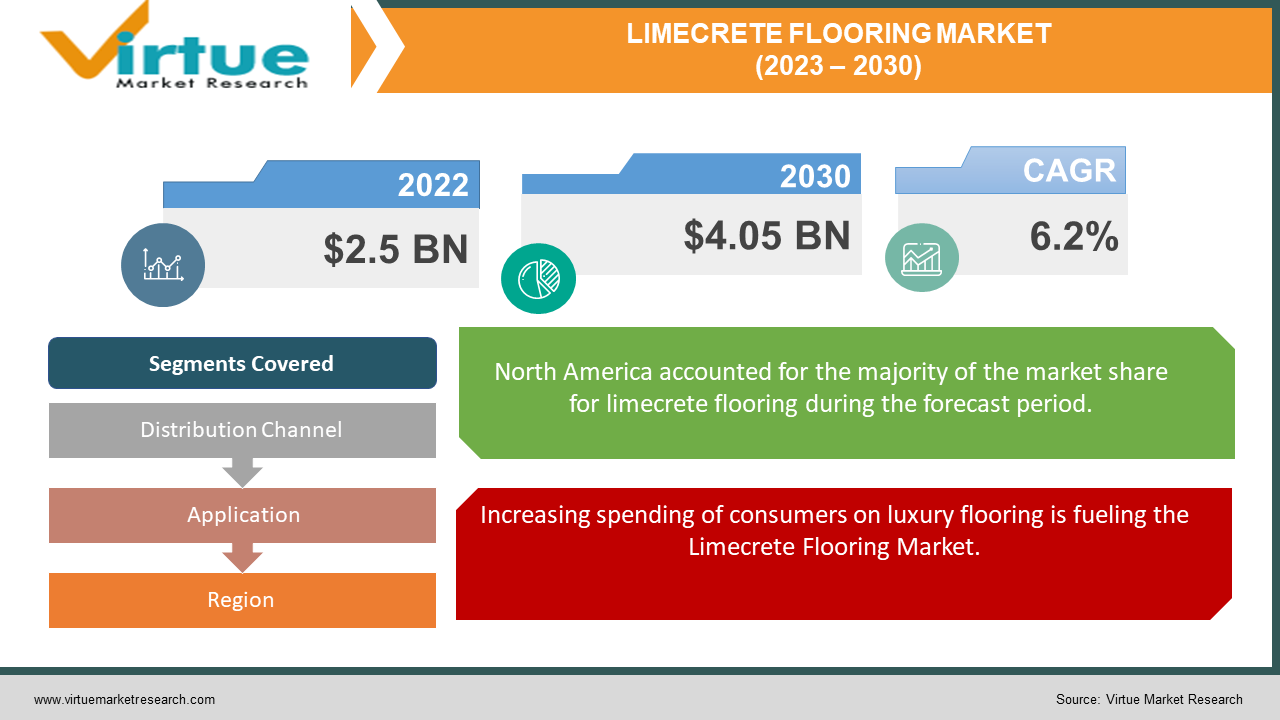

The Global Limecrete Flooring Market was valued at USD 2.5 Billion and is projected to reach a market size of USD 4.05 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.2%.

Flooring plays a crucial role in construction by providing a stable foundation for walking and serving other purposes, such as expanding the usable floor area. Additionally, flooring is essential for constructing multi-story buildings, effectively utilizing all levels to maximize the overall livable space within a structure.

The heightened emphasis on sustainability standards for eco-friendly materials is increasing the importance of green construction practices. Green buildings offer a multitude of advantages to occupants, which encompass not only a reduced burden on resources but also the creation of a healthier overall environment, among various other benefits. The limecrete flooring market has recently witnessed a surge in interest and growth due to its eco-friendly and versatile nature. Comprising lime, aggregates, and other materials, limecrete offers a unique blend of sustainability and durability. This innovative flooring solution is gaining popularity in various sectors, including residential, commercial, and institutional spaces. What sets limecrete flooring apart is its robustness and flexibility. It provides a comfortable walking surface, reducing the risk of damage from impacts, and effectively manages indoor moisture levels. As the demand for environmentally responsible and resilient construction materials continues to rise, the limecrete flooring market is well-positioned for further expansion. Limecrete's contributions to energy efficiency, indoor air quality, and overall environmental responsibility make it a flooring choice that aligns seamlessly with the evolving demands and preferences of modern construction and design practices.

Key Market Insights:

The global flooring market is characterized by intense competition, with a dominant presence of both global and regional players. Within this competitive landscape, numerous small-sized enterprises and imports from economically competitive emerging nations exert pressure on profit margins. Complicating matters further, each region exhibits distinct preferences for floor coverings, intensifying the competition.

Technological innovation takes center stage in this industry and is crucial for sustaining business growth. Companies are actively developing limecrete flooring materials that combine technology-driven designs and formats, resulting in unique and visually appealing options. For instance, laminate flooring has made significant strides in mimicking a wide range of materials, including stone, marble, and wood. These technological advancements have empowered manufacturers to craft flooring solutions with raised textures and intricate designs, enhancing their aesthetic appeal. Limecrete's contribution to energy efficiency and indoor air quality aligns with the growing emphasis on environmentally responsible building materials. Its popularity is likely to continue growing as sustainability becomes a top priority in construction. The limecrete flooring market is poised for further expansion as the demand for sustainable and resilient building materials continues to rise. It is expected to play a significant role in modern construction practices, meeting evolving needs and preferences.

Global Limecrete Flooring Market Drivers:

Increasing spending of consumers on luxury flooring is fueling the Limecrete Flooring Market.

The COVID-19 pandemic has brought about a notable shift in individuals' lifestyles, leading to substantial changes in consumer spending patterns. This evolving trend is evident in the increase in consumer spending on luxury items, driven by the savings accumulated from canceled travel expenses. Additionally, the significant amount of time spent at home has motivated many individuals to invest in enhancing and renovating their residential spaces, with a considerable portion of their budgets allocated to home upgrades. The surge in spending on flooring can be attributed to this phenomenon and is anticipated to be a key driver of market revenue growth shortly.

Rising government expenditure coupled with rapid urbanization is augmenting the growth of the limecrete flooring market

Increased government spending on infrastructure development is expected to play a pivotal role in driving the demand for limecrete flooring. The global building and construction industry is expanding rapidly due to rapid urbanization and population growth. This growth has created a heightened need for privacy and comfort, especially in noisy environments. As a result, there is a growing requirement for insulation in the flooring market because well-insulated floors contribute to improved sound environments. This increasing demand for insulation is, in turn, supporting the overall growth of the market

Demand for eco-friendly and sustainable flooring the boosting the market for limecrete flooring

Limecrete flooring has emerged as a preferred choice among builders, architects, and homeowners who are committed to environmentally responsible construction practices. The use of lime, a natural and abundant material, in limecrete significantly reduces carbon emissions compared to traditional cement-based alternatives. This sustainability factor aligns with the global push for eco-friendly building materials that reduce the environmental impact of construction projects. Limecrete flooring not only offers a greener option but also provides superior durability, comfort, and moisture regulation. As eco-conscious consumers and regulations promoting sustainable construction practices continue to rise, limecrete flooring is poised to play a pivotal role in the market.

The incessant rise of private companies in the flooring domain is propelling the upward trajectory of the Limecrete Flooring Market.

The growth of private-sector companies operating in the construction industry in countries like the UAE, India, and China is poised to stimulate increased spending on construction projects, thereby fostering the overall expansion of the flooring market. Furthermore, the adoption of user-friendly installation methods, the availability of innovative construction solutions, and the rising demand for environmentally sustainable products are all anticipated to be driving forces behind the industry's growth. Additionally, the stringent regulatory framework governing various stages of production, usage, implementation, and recycling is expected to provide a further boost to market growth.

Global Limecrete Flooring Market Restraints and Challenges:

The perception of limecrete as a somewhat specialized flooring choice may restrict its acceptance when compared to more conventional materials. Moreover, the challenges related to the availability and affordability of premium-quality limecrete materials can be particularly pronounced in regions where they are not easily procurable. Adhering to regulatory compliance and certification standards for environmentally friendly construction materials can also present obstacles for manufacturers and suppliers, demanding both time and financial resources. Additionally, the ongoing task of informing consumers and construction experts about the advantages of limecrete flooring while addressing misconceptions remains a persistent challenge.

Global Limecrete Flooring Market Opportunities:

The evolving technologies and continuous advancements in research and development have intensified competition among potential market players. Industry leaders are driving innovation and enhancing the performance of existing building materials, including Limecrete floorings. These market players have introduced cutting-edge techniques to achieve an authentic appearance in Limecrete floorings. Favorable conditions for the overall growth of the flooring industry are emerging in countries like India, China, and the UAE, characterized by robust industrial and economic development and the expansion of the private sector. Furthermore, opportunities abound in the industry due to advancements in installation techniques and innovative construction-related methods. These factors collectively contribute to the growth potential of the flooring industry throughout the forecast period.

LIMECRETE FLOORING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mike Wye & Associates Ltd., Ty-Mawr Lime Ltd, Cobalt Carbon Free, Sustainable Kitchens, The Limecrete Company, Womersley’s, Limeway Wiltshire, Organic by Design, Lime Green Products Ltd., St Astier Natural Hydraulic Limes (NHL) |

Global Limecrete Flooring Market Segmentation: By Distribution Channel

-

Distributors

-

Retailer

-

Direct Sales

-

Online Sales

In 2022, retailers, particularly retail flooring stores, including specialty outlets, held the largest market revenue share. These stores serve as the primary distribution channel not only for various flooring products but also for limecrete. Consumers often gravitate toward these retail outlets because they value the opportunity to physically examine different flooring options, assess textures, explore a variety of colors, and make informed decisions for achieving aesthetically pleasing designs in their homes and other spaces. Direct sales, on the other hand, is projected to emerge as the fastest-growing market segment, poised to capture a substantial market share throughout the forecast period

Global Limecrete Flooring Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

-

Others

In 2022, the residential application segment asserted its dominance in the market, contributing to 49.4% of the total revenue share making it the largest market in the segment. This segment encompasses various residential structures, including buildings, apartments, complexes, and small houses. Government subsidies targeted at first-time homebuyers in both developing and developed economies have played a favorable role in boosting the residential sector's growth.

Across the Asia Pacific region, developing nations have introduced a range of schemes aimed at supporting real estate sector development. Many of these schemes receive partial or full funding from governments, ultimately benefiting the demand side of the construction sector. Consequently, this is expected to drive substantial growth in the flooring industry in the years to come.

On the other hand, the commercial application segment stood out as the fastest-growing segment accounting for 43.0% of the revenue share in 2022. Commercial settings often entail high-traffic areas, necessitating durable flooring options such as resilient and wooden materials. Flooring products find extensive use in various commercial building applications, including offices, convenience stores, shopping malls, and the construction of other retail establishments. The increased construction of commercial buildings, such as drugstores, grocery stores, and big-box retailers, in recent years, is anticipated to fuel the growth of this segment in the foreseeable future.

Global Limecrete Flooring Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, the Asia Pacific region emerged as the dominant force in the market, contributing to a significant 45.5% of the total revenue share. Several factors are driving this regional dominance, including increased investments in affordable housing, the construction of smart cities, infrastructure upgrades, and tourism sector developments. These factors are expected to drive a surge in demand for various flooring products throughout the forecast period. China, in particular, stands out as a major driver of market expansion within the region. The country's growing population and the concurrent demand for new infrastructure and buildings are key drivers behind this growth. Additionally, shifting consumer preferences and a desire for enhanced designs and a wider range of product choices are further propelling the regional market's growth trajectory.

North America is the fastest-growing segment and is poised to witness increased demand for flooring products during the projection period. The region's robust construction industries in the United States and Canada, along with a growing demand for single-family homes, are expected to fuel growth prospects in the market.

COVID-19 Impact on the Global Limecrete Flooring Market:

The emergence of the COVID-19 pandemic triggered significant economic challenges for both the residential and commercial sectors. Various governments implemented stringent measures to curb the spread of the virus, resulting in a slowdown in construction output growth. This had widespread implications and created economic hardships, particularly for the flooring industry. Many projects remained incomplete due to a lack of funding, and the construction sector grappled with a series of challenges. These challenges encompassed disruptions in the supply chain, shortages of subcontractors and construction materials, and the termination of contracts as a cost-control measure. These factors collectively hindered the growth of the flooring market during the forecast period. Construction activities came to a temporary halt in numerous regions as a result of these constraints and uncertainties. The overall impact of the COVID-19 pandemic on the market was negative. But in the post-pandemic phase, as the construction, renovation, and infrastructure work has resumed back to normal and with the shifted preference of consumers towards an eco-friendlier and sustainable flooring product is projected to drive the limecrete flooring market opening up lucrative business opportunities.

Latest Trends/ Developments:

In Europe, the National Energy Efficiency Action Plans (NEEAPs) are playing a pivotal role in promoting the refurbishment of existing residential and commercial structures. Meanwhile, the U.S. flooring market has experienced consistent expansion, buoyed by robust activity in the home repair and renovation segment. This heightened emphasis on renovation has exerted additional momentum on the flooring market, particularly in the realm of sustainable flooring options.

As environmental awareness grows, limecrete flooring, with its reduced carbon footprint and minimal environmental impact, is gaining traction as a favored choice among builders and homeowners alike. As per statistics within the flooring industry, there is a notable upsurge in the adoption of sustainable flooring materials such as limecrete. Retailers are increasingly redirecting their attention towards offering biodegradable and environmentally friendly flooring products. The installation of sustainable flooring also contributes to the enhancement of a building's Leadership in Energy and Environmental Design (LEED) certification points.

The growing preference for healthier indoor environments has led to increased interest in limecrete flooring, which effectively regulates indoor moisture levels and contributes to better indoor air quality. As the construction industry continues to evolve, these trends and developments position limecrete flooring as a compelling choice that aligns with modern construction practices and consumer preferences.

Key Players:

-

Mike Wye & Associates Ltd.

-

Ty-Mawr Lime Ltd

-

Cobalt Carbon Free

-

Sustainable Kitchens

-

The Limecrete Company

-

Womersley’s

-

Limeway Wiltshire

-

Organic by Design

-

Lime Green Products Ltd.

-

St Astier Natural Hydraulic Limes (NHL)

In February 2022, Paceline Equity Partners LLC, a private equity firm that is based in the US acquired AHF Products, a manufacturer that leads in the flooring business.

In February 2022, Diverzify joined forces with Spectra Contract Flooring and ProSpectra Contract Flooring, both divisions of Shaw Industries, to create the largest independent commercial installation business on a global scale.

Chapter 1. Limecrete Flooring Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Limecrete Flooring Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Limecrete Flooring Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Limecrete Flooring Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Limecrete Flooring Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Limecrete Flooring Market– By Distribution Channel

6.1 Introduction/Key Findings

6.2 Distributors

6.3 Retailer

6.4 Direct Sales

6.5 Online Sales

6.6 Y-O-Y Growth trend Analysis By By Distribution Channel

6.7 Absolute $ Opportunity Analysis by By Distribution Channel , 2023-2030

Chapter 7. Limecrete Flooring Market– By APPLICATION

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Others

7.6 Y-O-Y Growth trend Analysis By APPLICATION

7.7 Absolute $ Opportunity Analysis By APPLICATION, 2023-2030

Chapter 8. Limecrete Flooring Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Distribution Channel

8.1.3 By APPLICATION

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Distribution Channel

8.2.3 By APPLICATION

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Distribution Channel

8.3.3 By APPLICATION

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Distribution Channel

8.4.3 By APPLICATION

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By By Distribution Channel

8.5.3 By APPLICATION

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Limecrete Flooring Market– Company Profiles – (Overview, Limecrete Flooring Market Portfolio, Financials, Strategies & Developments)

9.1 Mike Wye & Associates Ltd.

9.2 Ty-Mawr Lime Ltd

9.3 Cobalt Carbon Free

9.4 Sustainable Kitchens

9.5 The Limecrete Company

9.6 Womersley’s

9.7 Limeway Wiltshire

9.8 Organic by Design

9.9 Lime Green Products Ltd.

9.10 St Astier Natural Hydraulic Limes (NHL)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Limecrete Flooring Market was valued at USD 2.5 Billion and is projected to reach a market size of USD 4.05 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.2%.

Demand for aesthetically pleasing flooring coupled with consumer’s preference for eco-friendly and sustainable flooring material.

Based on the Distribution Channel, the Global Limecrete Flooring Market is segmented into Distributors, Retailers, Direct Sales, and Online Sales.

China is the most dominating country in the region of Asia-Pacific for the Global Limecrete Flooring Market.

Mike Wye & Associates Ltd., Ty-Mawr Lime Ltd, Cobalt Carbon Free, Sustainable Kitchens, The Limecrete Company, Womersley’s, Limeway Wiltshire, Organic by Design, Lime Green Products Ltd., St Astier Natural Hydraulic Limes (NHL).