Flax Fiber Prepreg Market Size (2024-2030)

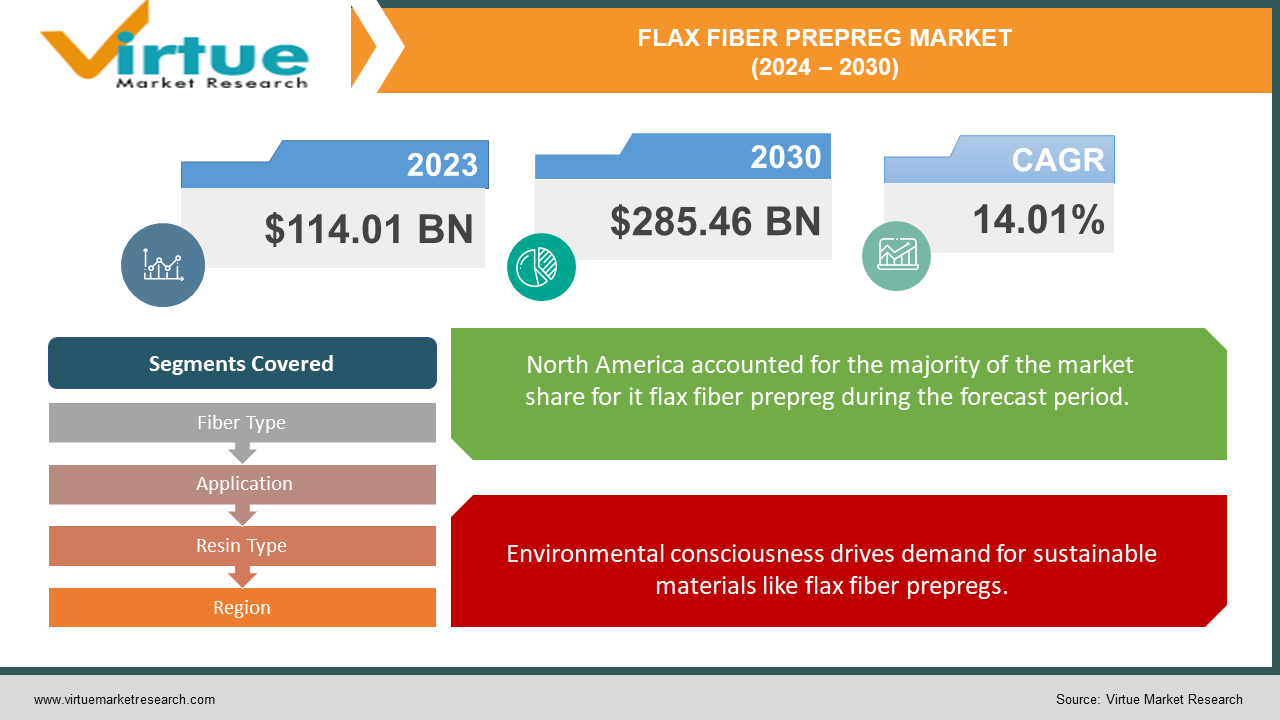

The Flax Fiber Prepreg Market was valued at USD 114.01 billion in 2023 and is projected to reach a market size of USD 285.46 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 14.01%.

The flax fiber prepreg market is emerging as a strong contender in the world of sustainable materials. This sector is fueled by the growing demand for lightweight and eco-friendly alternatives across various industries. Flax fiber prepregs offer a compelling combination of advantages: they are lighter, stronger, and have a lower environmental impact compared to traditional materials. This makes them ideal for applications in transportation, construction, sporting goods, and even consumer products.

Key Market Insights:

The flax fiber prepreg market is on the rise, driven by the growing demand for sustainable and lightweight materials. Flax fibers, the key ingredient, boast a lower carbon footprint compared to traditional materials, making them a darling of environmentally conscious industries. These eco-friendly characteristic positions flax fiber prepregs well for a future focused on sustainability.

Furthermore, flax fiber prepregs offer impressive performance. They are incredibly lightweight yet retain high strength. This translates to numerous potential applications. The transportation sector, particularly automobiles and airplanes, can significantly benefit from weight reduction achieved through flax fiber prepregs, leading to improved fuel efficiency. The construction industry is another key area, projected to experience the fastest growth at a Compound Annual Growth Rate (CAGR) of around 14%, driven by the increasing focus on sustainable building practices. Flax fiber prepregs' versatility extends beyond these traditional sectors, with potential applications even in sporting goods and consumer products.

The Flax Fiber Prepreg Market Drivers:

Environmental consciousness drives demand for sustainable materials like flax fiber prepregs.

Environmental consciousness is taking center stage, prompting industries to actively seek eco-friendly alternatives in their production processes and material choices. Flax fibers, the foundation of flax fiber prepregs, boast a significantly lower carbon footprint compared to traditional materials. This translates to a reduced environmental impact throughout the entire product lifecycle, making flax fiber prepregs a compelling choice for companies striving to minimize their ecological footprint and align themselves with sustainable practices.

The lightweight advantage of flax fiber prepregs enhances performance in transportation and sports.

Flax fibers stand out for their impressive strength-to-weight ratio. This translates to lighter yet exceptionally strong flax fiber prepregs, a characteristic highly sought after in various applications. The transportation sector, particularly in the development of fuel-efficient automobiles and airplanes, can significantly benefit from weight reduction achieved through flax fiber prepregs. Similarly, sporting goods manufacturers can leverage this advantage to create lighter, high-performance equipment that enhances athletic performance.

Construction industry embraces flax fiber prepregs for sustainable building practices.

The construction industry is witnessing a paradigm shift towards sustainable building practices, driven by growing environmental concerns and government regulations. Flax fiber prepregs are perfectly positioned to capitalize on this trend. With a projected Compound Annual Growth Rate (CAGR) of around 14%, the construction sector is rapidly embracing flax fiber prepregs as an eco-friendly alternative to traditional construction materials. This shift signifies a significant driver for the growth of the flax fiber prepreg market.

The versatility of flax fiber prepregs opens doors for innovation across various industries.

The potential applications for flax fiber prepregs extend far beyond the traditional sectors of transportation and construction. Their unique properties, characterized by a lightweight yet robust nature, make them suitable for a wide range of products. Sporting goods and consumer goods manufacturers are exploring the potential of flax fiber prepregs to create innovative and sustainable products. This versatility opens doors for further exploration and market expansion across various industries, propelling the growth of the flax fiber prepreg market.

The Flax Fiber Prepreg Market Restraints and Challenges:

The flax fibre prepreg market, while promising, faces hurdles that need to be addressed for sustained growth. A key challenge lies in the supply chain. Flax fibre, the backbone of prepregs, is vulnerable to limitations. Weather fluctuations affecting cultivation, limited land for flax growth, and volatile fibre prices can disrupt the consistent production of flax fibre prepregs. Additionally, established players like carbon fibre and fiberglass composites pose a competitive threat. These traditional materials have a longer history of use and might be more cost-effective in certain applications.

The lingering effects of the pandemic further complicate matters. Lockdowns and restrictions disrupted global supply chains, leading to delays in obtaining raw materials, transportation issues, and labour shortages, all of which can impact flax fibre prepreg production. Furthermore, the pandemic-induced economic slowdown reduced demand from key consumer industries like automotive, aerospace, and construction, which rely on flax fibre prepregs for lightweight and high-performance components. A sluggish recovery in these sectors could hinder market growth. Finally, the relative immaturity of flax fibre processing technologies contributes to higher production costs compared to traditional materials. Advancements in processing techniques are crucial to improve efficiency and make flax fibre prepregs more cost competitive. Despite these challenges, the flax fibre prepreg market holds significant potential for the future. Addressing these hurdles will pave the way for wider adoption of this sustainable and high-performing material.

The Flax Fiber Prepreg Market Opportunities:

The flax fiber prepreg market, while not without challenges, offers exciting opportunities for growth. A major opportunity lies in the rising focus on sustainability. As environmental concerns escalate, the demand for eco-friendly materials like flax fiber prepregs is expected to surge. This presents a significant chance for manufacturers to cater to industries seeking to reduce their environmental footprint and embrace sustainable practices.

Furthermore, advancements in flax fiber processing technologies hold immense potential. Research and development efforts aimed at improving these technologies can lead to increased efficiency and lower production costs. Ultimately, this could make flax fiber prepregs more competitive with traditional materials, opening doors for wider market adoption.

The potential applications for flax fiber prepregs extend beyond their traditional uses in transportation and construction. Their unique properties make them suitable for a wide range of products like sporting goods, consumer electronics, and even furniture. Exploring these new applications can unlock significant growth opportunities and propel the flax fiber prepreg market forward.

FLAX FIBER PREPREG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.01% |

|

Segments Covered |

By Fiber Type, Application, Resin Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lineo by Stora Enso, Bcomp Ltd., Cotesa GmbH, Lingrove, Composites Evolution Ltd., TFP Composites, CELC Masters of Linen, SAERTEX GmbH & Co. KG, Euro-Composites S.A., SGL Carbon SE |

Flax Fiber Prepreg Market Segmentation: By Fiber Type

-

Undirectional Flax Fiber Prepregs

-

Bidirectional Flax Fiber Prepregs

The most dominant segment in the Flax Fiber Prepreg Market (by Fiber Type) is likely Undirectional Flax Fiber Prepregs. These prepregs offer the advantage of maximized strength in a single direction, ideal for applications requiring high tensile strength. The fastest-growing segment is expected to be Bio-based Resin Prepregs. As sustainability concerns rise, these eco-friendly prepregs made with renewable resources are gaining traction, though they are still under development.

Flax Fiber Prepreg Market Segmentation: By Application

-

Transportation

-

Construction

-

Sporting Goods

-

Consumer Goods

The current dominant segment of the Flax Fiber Prepreg Market is Transportation, driven by the need for lightweight materials in automobiles, airplanes, and marine vehicles. The Construction sector is experiencing the fastest growth due to the increasing focus on sustainable building practices, making flax fiber prepregs an eco-friendly alternative.

Flax Fiber Prepreg Market Segmentation: By Resin Type

-

Epoxy Resin Prepregs

-

Bio-based Resin Prepregs

Epoxy Resin Prepregs currently dominate the flax fiber prepreg market by Resin Type due to their established performance and good adhesion. However, Bio-based Resin Prepregs are poised for the fastest growth. As sustainability concerns rise, these eco-friendly alternatives made from renewable resources are gaining traction, offering a greener solution for the future of flax fiber prepregs.

Flax Fiber Prepreg Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently reigns supreme as the largest regional market for flax fiber prepregs. This dominance stems from the well-established presence of major industries like automotive, aerospace, and sporting goods, all of which are prime users of this lightweight and high-performance material. These industries leverage flax fiber prepregs to reduce weight in vehicles and equipment, leading to improved fuel efficiency and overall performance.

Asia-Pacific region is experiencing the fastest growth in the flax fiber prepreg market. The burgeoning automotive, construction, and wind energy sectors in countries like China, Japan, and India are key drivers of this growth. As these industries prioritize lightweight and sustainable materials, flax fiber prepregs are gaining significant traction, offering a solution that aligns with their goals.

COVID-19 Impact Analysis on the Flax Fiber Prepreg Market:

The COVID-19 pandemic cast a long shadow over the flax fiber prepreg market, disrupting its growth trajectory in the short term. Lockdowns and restrictions wreaked havoc on global supply chains, causing delays in obtaining crucial raw materials like flax fibers. This, coupled with transportation bottlenecks that hampered the smooth flow of materials and finished products, led to production slowdowns and potential shortages of flax fiber prepregs. Social distancing measures and lockdowns further exacerbated the situation by creating labor shortages in manufacturing facilities, hindering production capacity. To make matters worse, the pandemic-induced economic slowdown triggered a decrease in demand from key end-user industries like automotive, aerospace, and construction. These industries are major consumers of flax fiber prepregs, and their sluggish recovery dampened market growth.

However, amidst these challenges, a silver lining emerged. The pandemic heightened awareness of environmental issues, leading to a significant shift in consumer preferences towards sustainable materials. This trend positions flax fiber prepregs favorably in the market. Their eco-friendly credentials, with a lower carbon footprint compared to traditional materials, resonate with environmentally conscious consumers and businesses alike. Additionally, as industries strive to recover and rebuild in a post-pandemic world, there's an increased emphasis on sustainable practices. This presents a golden opportunity for flax fiber prepregs to gain significant traction as a viable alternative to traditional materials with a larger environmental impact.

Latest Trends/ Developments:

The flax fiber prepreg market is buzzing with exciting new developments. A key trend is the focus on bio-based resins. While epoxy resins are currently dominant, they have a larger environmental footprint. To address this, there's a growing emphasis on developing bio-based resin alternatives derived from sustainable resources like plant oils, which aligns perfectly with the overall sustainability focus of the market.

Advancements in processing technologies are another area of progress. Research and development efforts are aimed at improving how flax fibers are processed. These advancements can lead to several benefits, including increased efficiency, reduced production costs, and ultimately, a more competitive price point for flax fiber prepregs compared to traditional materials. This could open doors for wider market adoption.

Furthermore, the potential applications for flax fiber prepregs are constantly expanding. Beyond their traditional uses in transportation and construction, there's a surge of interest in incorporating flax fiber prepregs into consumer goods like furniture components, electronic casings, and even sporting equipment.

Manufacturers are also looking towards increased automation in flax fiber processing and prepreg production. This automation can lead to higher production volumes, improved consistency, and potentially lower costs, making flax fiber prepregs even more attractive to a wider range of industries.

Finally, the concept of a circular economy, where materials are reused and recycled, is gaining traction in the flax fiber prepreg market. Research is ongoing to develop methods for recycling flax fibers from used flax fiber prepregs, further enhancing the sustainability profile of this entire material lifecycle. These trends highlight the dynamic nature of the flax fiber prepreg market, and as research and development efforts progress alongside the growing focus on sustainability, we can expect to see even more advancements and innovative applications for this eco-friendly and high-performance material.

Key Players:

-

Lineo by Stora Enso

-

Bcomp Ltd.

-

Cotesa GmbH

-

Lingrove

-

Composites Evolution Ltd.

-

TFP Composites

-

CELC Masters of Linen

-

SAERTEX GmbH & Co. KG

-

Euro-Composites S.A.

-

SGL Carbon SE

Chapter 1. Flax Fiber Prepreg Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flax Fiber Prepreg Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flax Fiber Prepreg Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flax Fiber Prepreg Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flax Fiber Prepreg Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flax Fiber Prepreg Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Undirectional Flax Fiber Prepregs

6.3 Bidirectional Flax Fiber Prepregs

6.4 Y-O-Y Growth trend Analysis By Fiber Type

6.5 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Flax Fiber Prepreg Market – By Application

7.1 Introduction/Key Findings

7.2 Transportation

7.3 Construction

7.4 Sporting Goods

7.5 Consumer Goods

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Flax Fiber Prepreg Market – By Resin Type

8.1 Introduction/Key Findings

8.2 Epoxy Resin Prepregs

8.3 Bio-based Resin Prepregs

8.4 Y-O-Y Growth trend Analysis By Resin Type

8.5 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 9. Flax Fiber Prepreg Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Fiber Type

9.1.3 By Application

9.1.4 By By Resin Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Fiber Type

9.2.3 By Application

9.2.4 By Resin Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Fiber Type

9.3.3 By Application

9.3.4 By Resin Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Fiber Type

9.4.3 By Application

9.4.4 By Resin Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Fiber Type

9.5.3 By Application

9.5.4 By Resin Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Flax Fiber Prepreg Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Lineo by Stora Enso

10.2 Bcomp Ltd.

10.3 Cotesa GmbH

10.4 Lingrove

10.5 Composites Evolution Ltd.

10.6 TFP Composites

10.7 CELC Masters of Linen

10.8 SAERTEX GmbH & Co. KG

10.9 Euro-Composites S.A.

10.10 SGL Carbon SE

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Flax Fiber Prepreg Market was valued at USD 114.01 billion in 2023 and is projected to reach a market size of USD 285.46 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 14.01%.

Surging Demand for Sustainable Materials, Lightweight Champion for Performance Enhancement, Construction Industry Embraces Sustainability, Versatility Opens Doors for Innovation.

Transportation, Construction, Sporting Goods, Consumer Goods.

North America reigns supreme as the largest market for flax fiber prepregs, driven by established automotive, aerospace, and sporting goods industries. Their focus on lightweight materials positions them as prime users of this technology.

Lineo by Stora Enso, Bcomp Ltd., Cotesa GmbH, Lingrove, Composites Evolution Ltd., TFP Composites, CELC Masters of Linen, SAERTEX GmbH & Co. KG, Euro-Composites S.A., SGL Carbon SE.